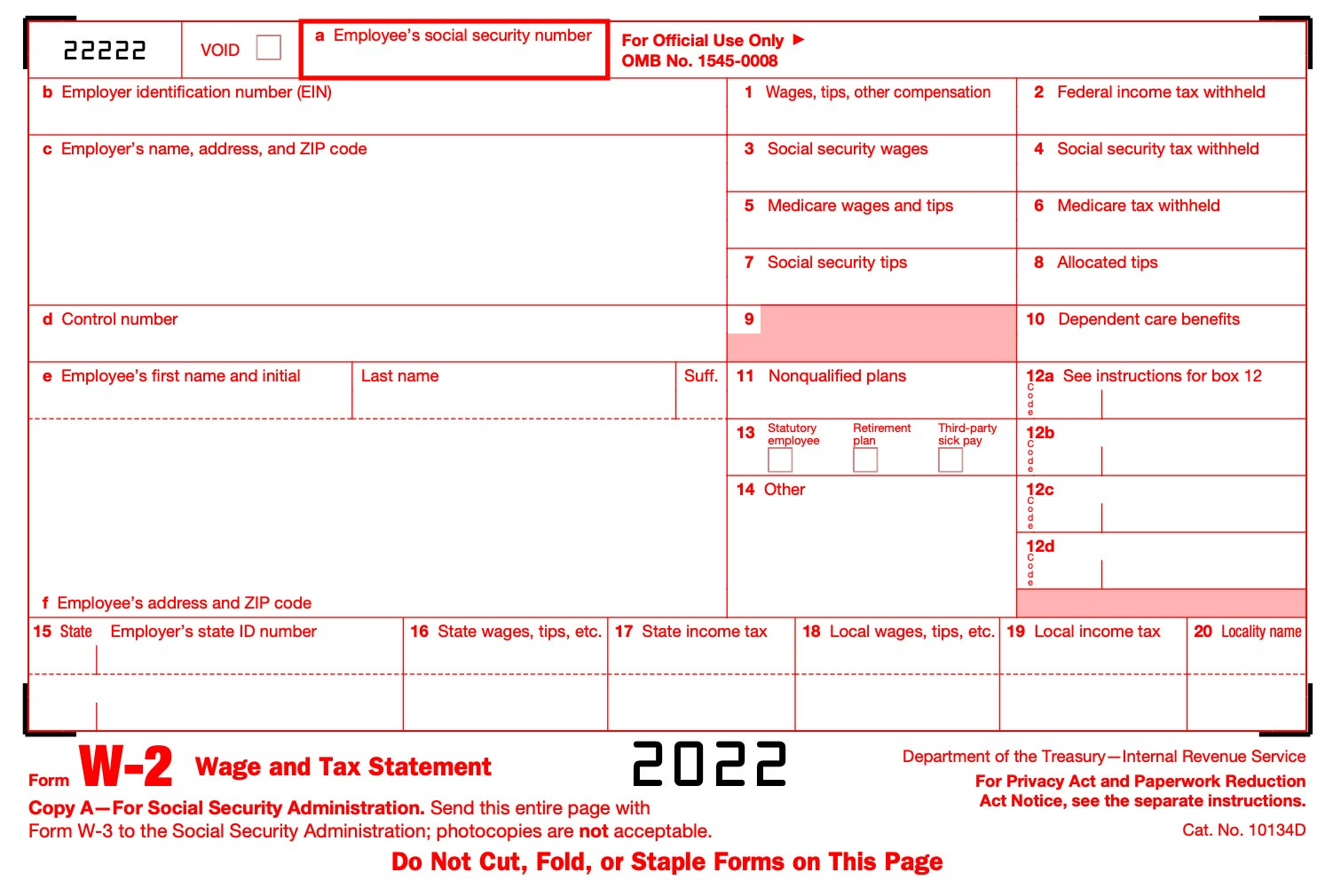

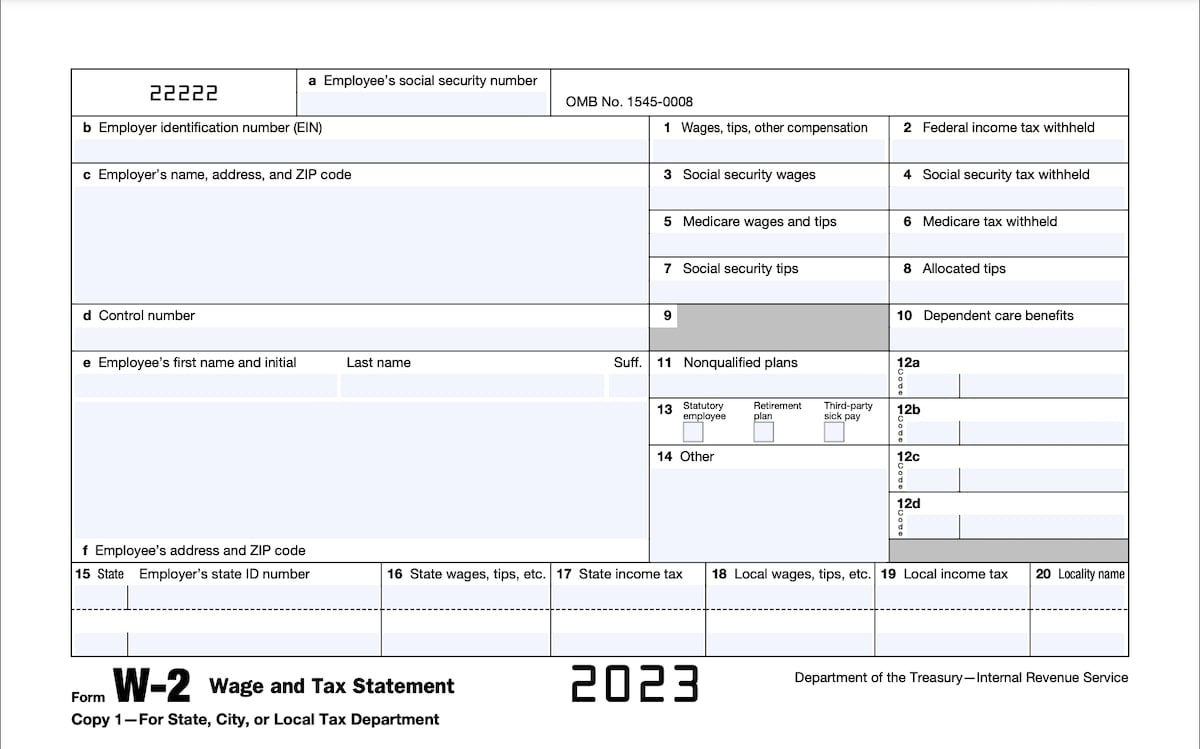

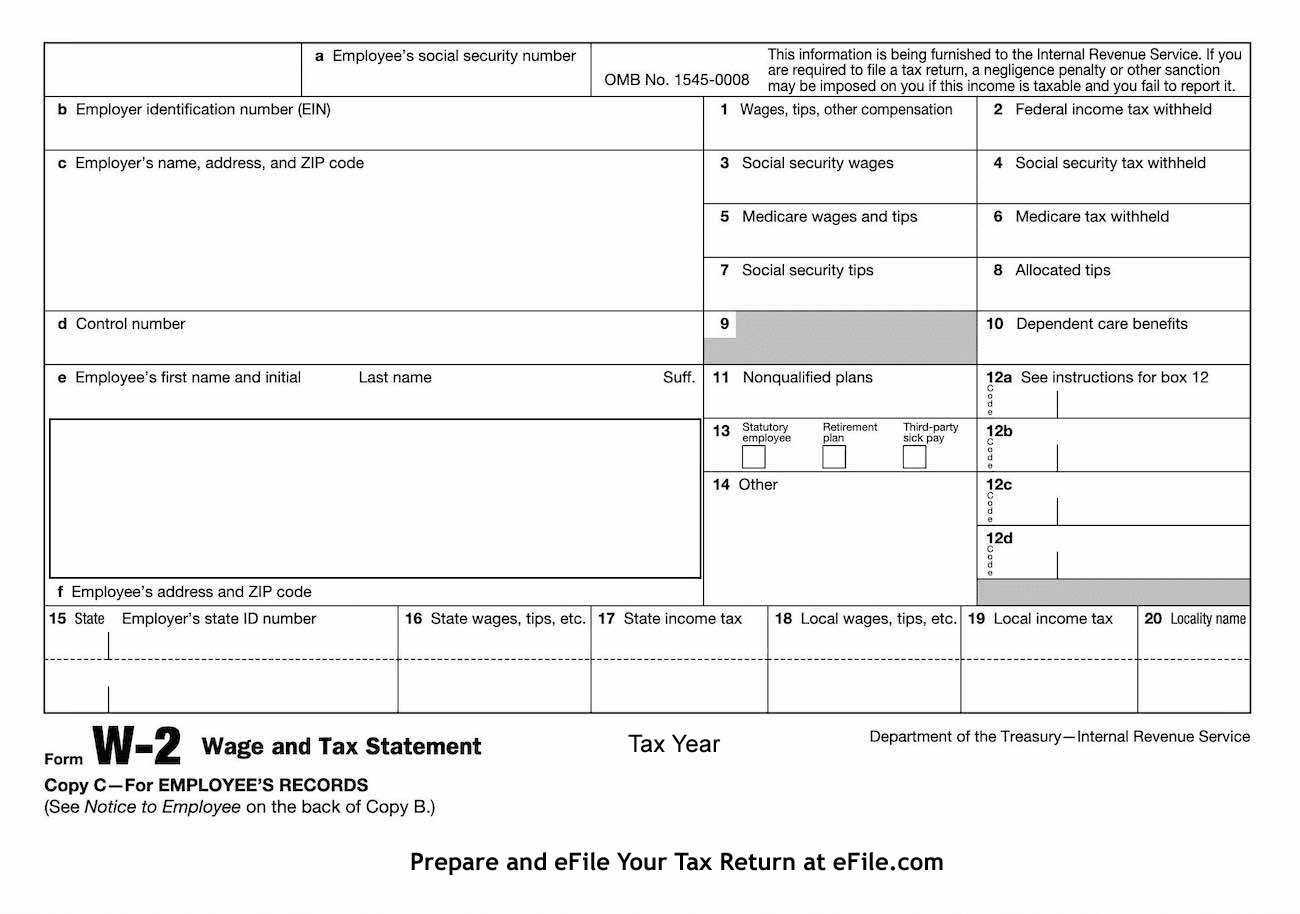

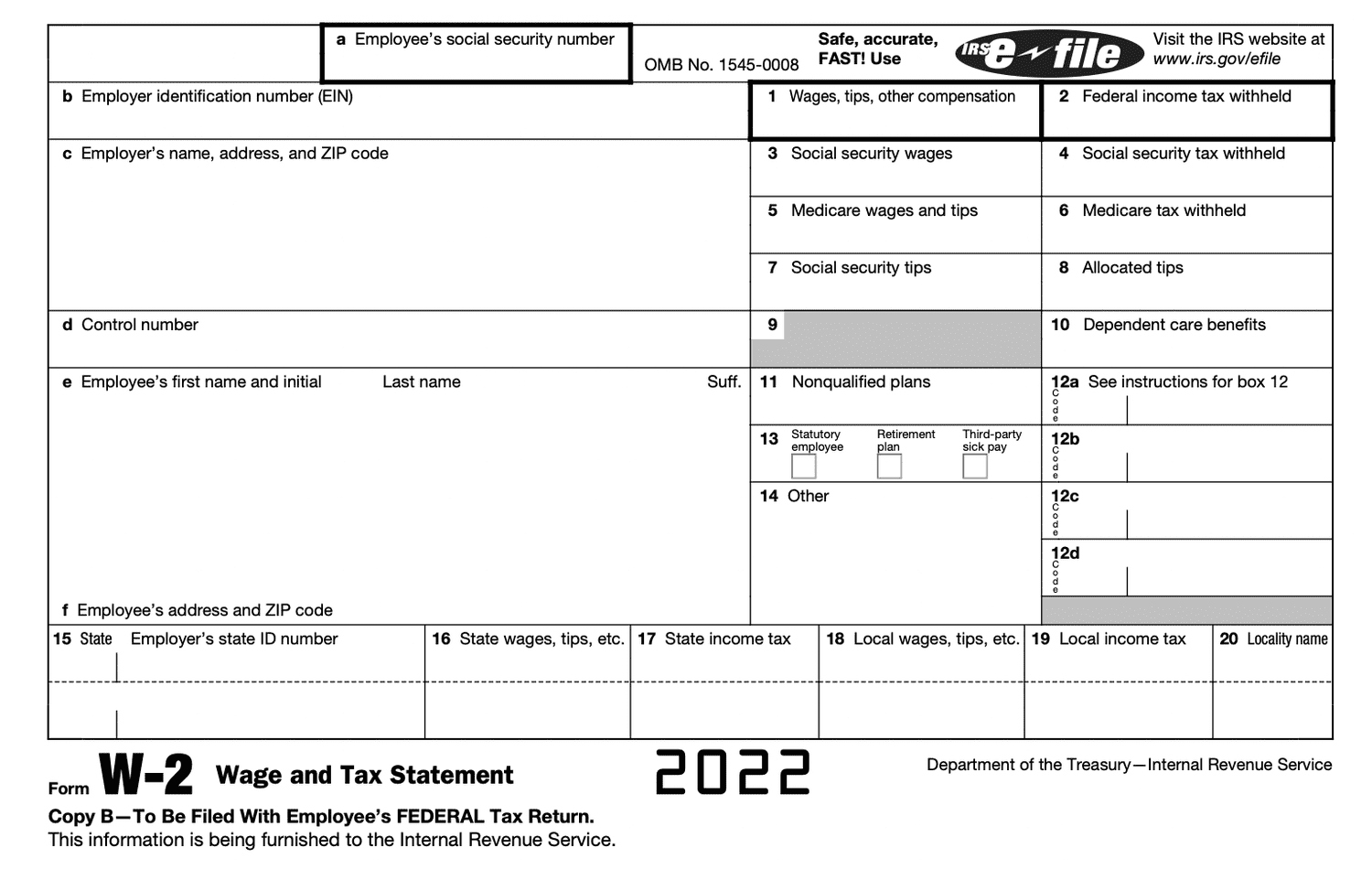

Who Sends W2 Forms – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unmasking the W2 Wizard: Who’s Behind Your Tax Forms?

Have you ever received your W2 forms in the mail and wondered who the mysterious senders behind them are? The W2 Wizard is like a silent hero, delivering important tax documents that help you file your taxes accurately and on time. But have you ever stopped to think about who these senders are and how they play a vital role in your financial well-being? Let’s peel back the curtain and uncover the identity of the W2 Wizard!

As you eagerly tear open the envelope containing your W2 forms, you might notice the name of your employer printed at the top. Your employer is the main sender of your W2 forms, providing you with crucial information about your earnings and taxes withheld throughout the year. They play a crucial role in ensuring that you have the necessary documentation to file your taxes correctly and claim any refunds or deductions you may be entitled to. So, the next time you receive your W2 forms, remember to give a nod of appreciation to your employer for their part in helping you navigate the tax season smoothly.

In some cases, you may receive multiple W2 forms from different employers if you have worked for more than one company in a tax year. Each employer will send you a separate W2 form detailing your earnings and tax information specific to the time you were employed with them. This can add a layer of complexity to your tax filing process, but it’s essential to ensure that you report all sources of income accurately. So, when you’re puzzling over your stack of W2 forms, remember that each sender has played a unique role in shaping your financial story for the year.

Dive into the Mystery of Your W2 Senders: Let’s Investigate!

Now that we’ve uncovered the identity of the W2 Wizard as your employer, let’s dive deeper into the mystery of your W2 senders. Beyond your primary employer, you may also receive W2 forms from other sources of income, such as freelance work, investments, or retirement accounts. These additional senders provide valuable information about your total income and help you piece together the puzzle of your financial picture for the year.

As you sift through your stack of W2 forms, take note of the different senders and the roles they play in your financial life. Whether it’s a side gig, rental income, or investment dividends, each sender contributes to your overall financial health and should be accounted for when filing your taxes. By understanding the diverse sources of your income, you can better manage your finances and make informed decisions about your tax strategy.

In the world of taxes, the W2 Wizard may seem like a mysterious figure, but with a bit of investigation, you can unravel the complexities of your tax forms and gain a better understanding of your financial situation. So, the next time you receive your W2 forms, take a moment to appreciate the senders behind them and the valuable information they provide. By embracing the mystery of the W2 Wizard, you can navigate tax season with confidence and clarity.

In conclusion, the W2 Wizard may be a mysterious figure in your tax journey, but by unmasking the senders behind your tax forms, you can gain a deeper appreciation for the role they play in shaping your financial story. From your primary employer to additional sources of income, each sender provides valuable information that helps you file your taxes accurately and maximize your financial outcomes. So, the next time you receive your W2 forms, remember to thank the senders who have contributed to your financial well-being and embrace the mystery of the W2 Wizard with curiosity and gratitude.

Below are some images related to Who Sends W2 Forms

who prepares w2 forms, who sends out w-2 forms, who sends w2 forms, who sends your w2 forms, , Who Sends W2 Forms.

who prepares w2 forms, who sends out w-2 forms, who sends w2 forms, who sends your w2 forms, , Who Sends W2 Forms.