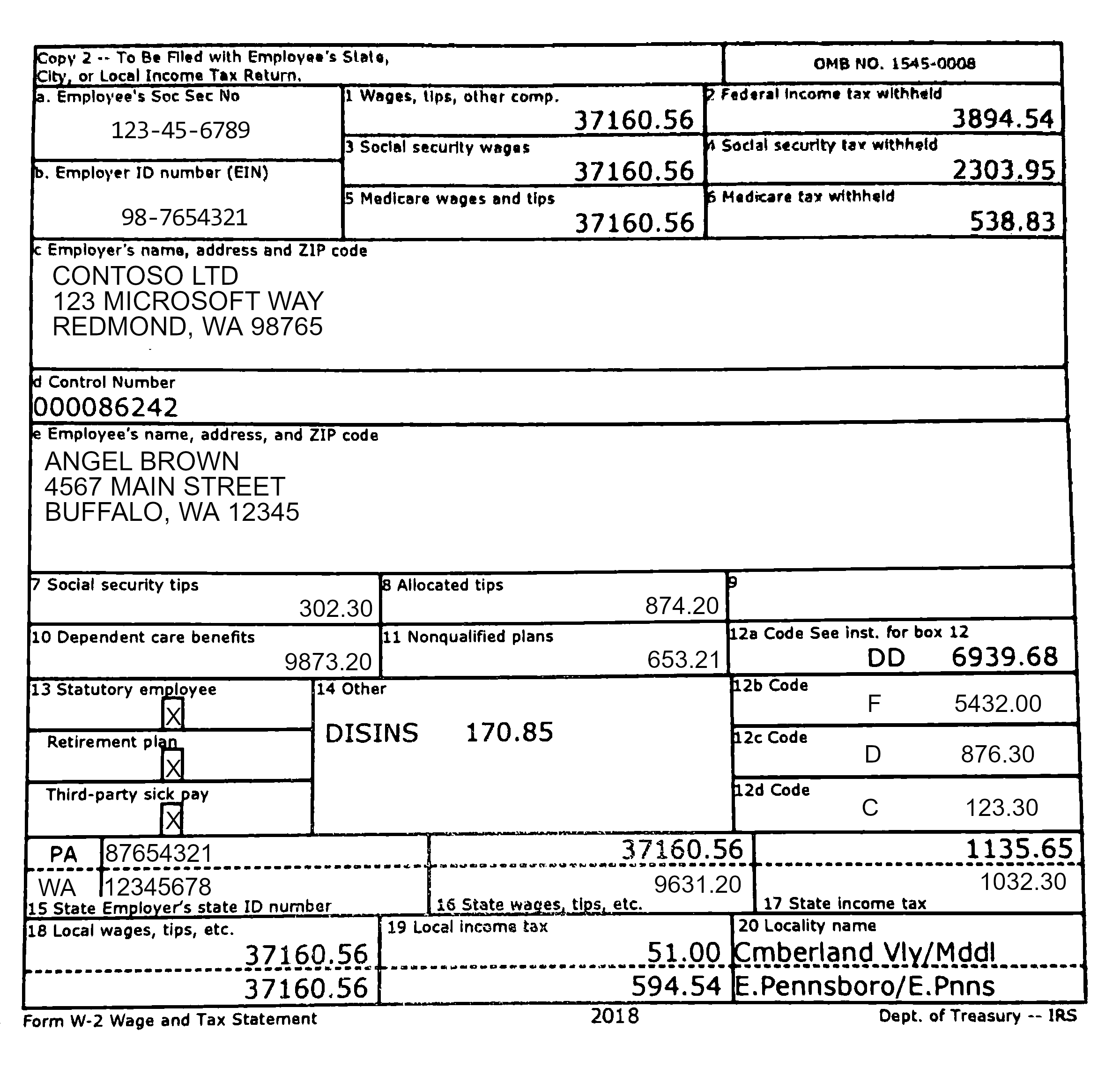

W2 Form 12b DD – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Delving into the Enchantment of W2 Form 12b DD!

Have you ever received your W2 form and come across the mysterious box labeled 12b DD? If so, you may be wondering what exactly this entails and how it affects your tax situation. Fear not, for we are here to unravel the magic of W2 Form 12b DD for you! This small box may seem insignificant at first glance, but it holds the key to some valuable information that could impact your bottom line.

W2 Form 12b DD refers to the cost of employer-sponsored health coverage that is reported on your W2 form. This cost reflects the amount that your employer has contributed towards your health insurance premiums throughout the year. Understanding this number is crucial, as it can have implications on your tax liabilities and deductions. By delving into the details of W2 Form 12b DD, you can unlock valuable insights into your overall financial picture.

In essence, W2 Form 12b DD serves as a window into the benefits provided by your employer in the form of health insurance coverage. This information is important for both employees and employers, as it helps to track the value of the health benefits being provided. By taking the time to understand the magic of W2 Form 12b DD, you can gain a better grasp of your overall compensation package and make informed decisions when it comes to tax planning and financial management.

Unlocking the Secrets of W2 Form 12b DD Magic!

As you unwrap the magic of W2 Form 12b DD, you may discover that this seemingly mundane box holds the key to a wealth of information about your employer-provided health benefits. By taking a closer look at this number, you can gain insights into the true value of the health coverage you receive and how it impacts your tax situation. Armed with this knowledge, you can make more informed decisions when it comes to managing your finances and planning for the future.

One of the secrets of W2 Form 12b DD is that it can impact your tax liability in certain situations. Depending on the value of the health coverage provided by your employer, you may be subject to additional taxes or deductions. By understanding how this number is calculated and what it represents, you can better prepare for tax season and ensure that you are taking full advantage of any available deductions or credits. Unlocking the secrets of W2 Form 12b DD can help you navigate the complexities of the tax code with confidence.

In conclusion, W2 Form 12b DD may seem like a small piece of information on your tax form, but it holds the power to reveal important details about your employer-provided health benefits. By delving into the enchantment of W2 Form 12b DD, you can gain a better understanding of your overall compensation package and how it impacts your tax situation. So, next time you receive your W2 form, be sure to pay special attention to this magical box and unlock the secrets it holds for a brighter financial future!

Below are some images related to W2 Form 12b Dd

![Form W-2 Box 12 Codes | Codes And Explanations [Chart] within W2 Form 12B Dd](https://ezambiablog.com/wp-content/uploads/2024/02/form-w-2-box-12-codes-codes-and-explanations-chart-within-w2-form-12b-dd.jpg)

w-2 form box 12b dd, w2 form 12b code dd, w2 form 12b d, w2 form 12b dd, w2 form box 12b code dd, , W2 Form 12b Dd.

w-2 form box 12b dd, w2 form 12b code dd, w2 form 12b d, w2 form 12b dd, w2 form box 12b code dd, , W2 Form 12b Dd.