W2 Form 12c – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unlocking the Magic of W2 Form 12c: Your Ticket to Tax Bliss!

Are you ready to uncover the secrets of the elusive W2 Form 12c? This mystical form holds the key to unlocking a world of tax bliss and financial freedom. By understanding the power of W2 Form 12c, you can wave goodbye to your tax troubles and step into a realm of clarity and confidence. So grab your wand (or calculator) and let’s dive into the enchanting world of W2 Form 12c!

Unveiling the Mysteries of W2 Form 12c

W2 Form 12c may seem like a mere piece of paper, but it holds the potential to transform your tax filing experience. This magical form contains important information about adjustments to your taxable income, such as contributions to retirement accounts or health savings plans. By decoding the information on W2 Form 12c, you can ensure that you are taking full advantage of any tax deductions or credits available to you. Say goodbye to confusion and hello to tax savings!

But wait, there’s more! W2 Form 12c can also help you better understand your overall financial picture. By analyzing the adjustments on this form, you can gain insight into your spending habits, savings goals, and overall financial health. Armed with this knowledge, you can make more informed decisions about your money and set yourself up for long-term success. So don’t let W2 Form 12c gather dust in a drawer – unleash its power and watch your financial future sparkle!

Let Your Tax Troubles Vanish with W2 Form 12c!

Tax season can be a stressful time for many people, but with W2 Form 12c in hand, you can navigate the process with ease and confidence. This magical form acts as your guide through the maze of tax laws and regulations, helping you maximize your refunds and minimize your liabilities. By embracing the power of W2 Form 12c, you can transform tax season from a dreaded chore into a joyous celebration of financial empowerment.

So don’t let fear and uncertainty hold you back – harness the magic of W2 Form 12c and watch as your tax troubles vanish into thin air. With a little bit of knowledge and a touch of wizardry, you can unlock the secrets of this powerful form and embark on a journey to tax bliss. So grab your wand (or calculator) and let’s make this tax season one to remember!

In conclusion, W2 Form 12c is not just a piece of paper – it’s your ticket to tax bliss and financial freedom. By unraveling the mysteries of this form and harnessing its power, you can transform your tax filing experience and set yourself up for success. So embrace the magic of W2 Form 12c, unleash its potential, and watch as your financial dreams become a reality. Tax season may never be the same again – and that’s a truly enchanting thought!

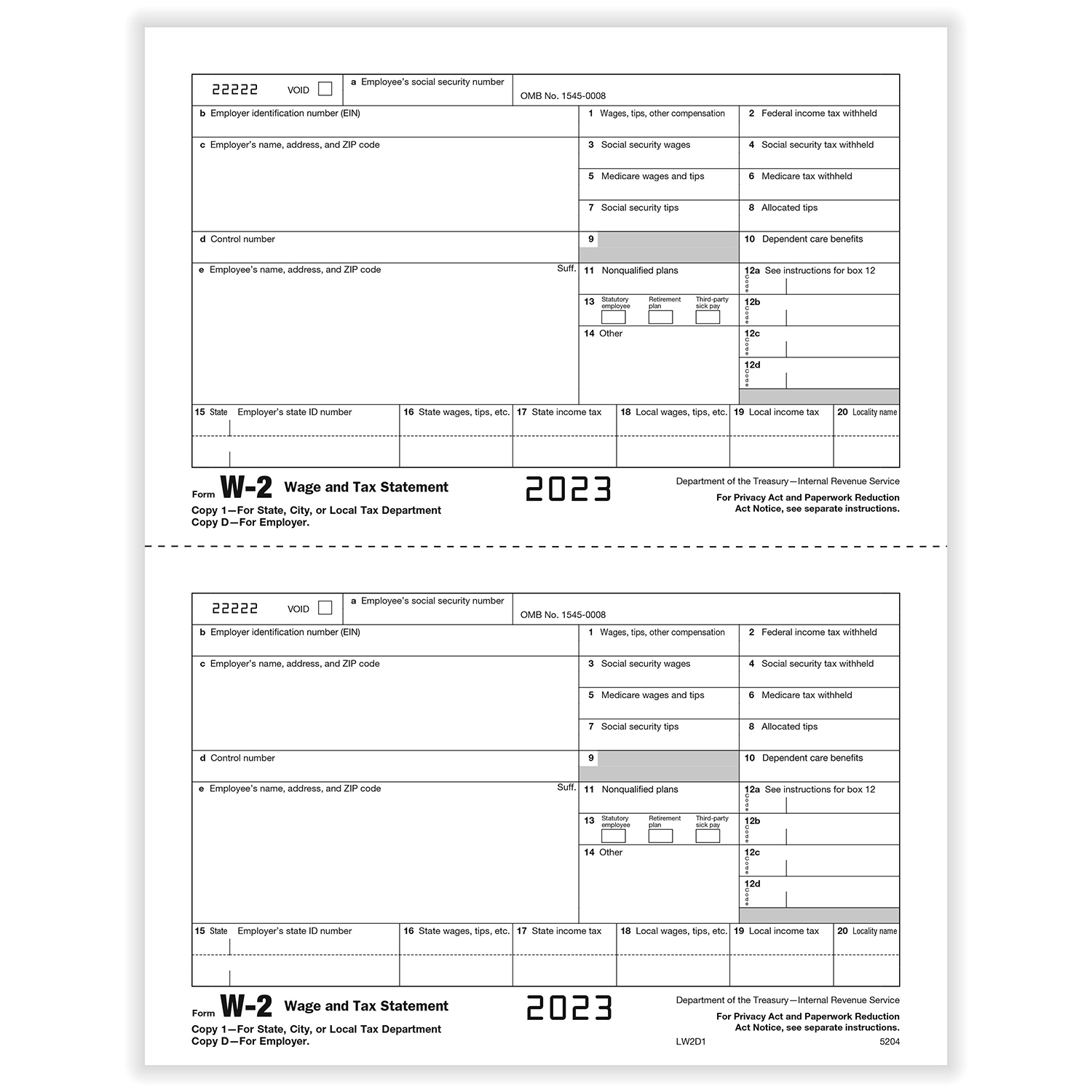

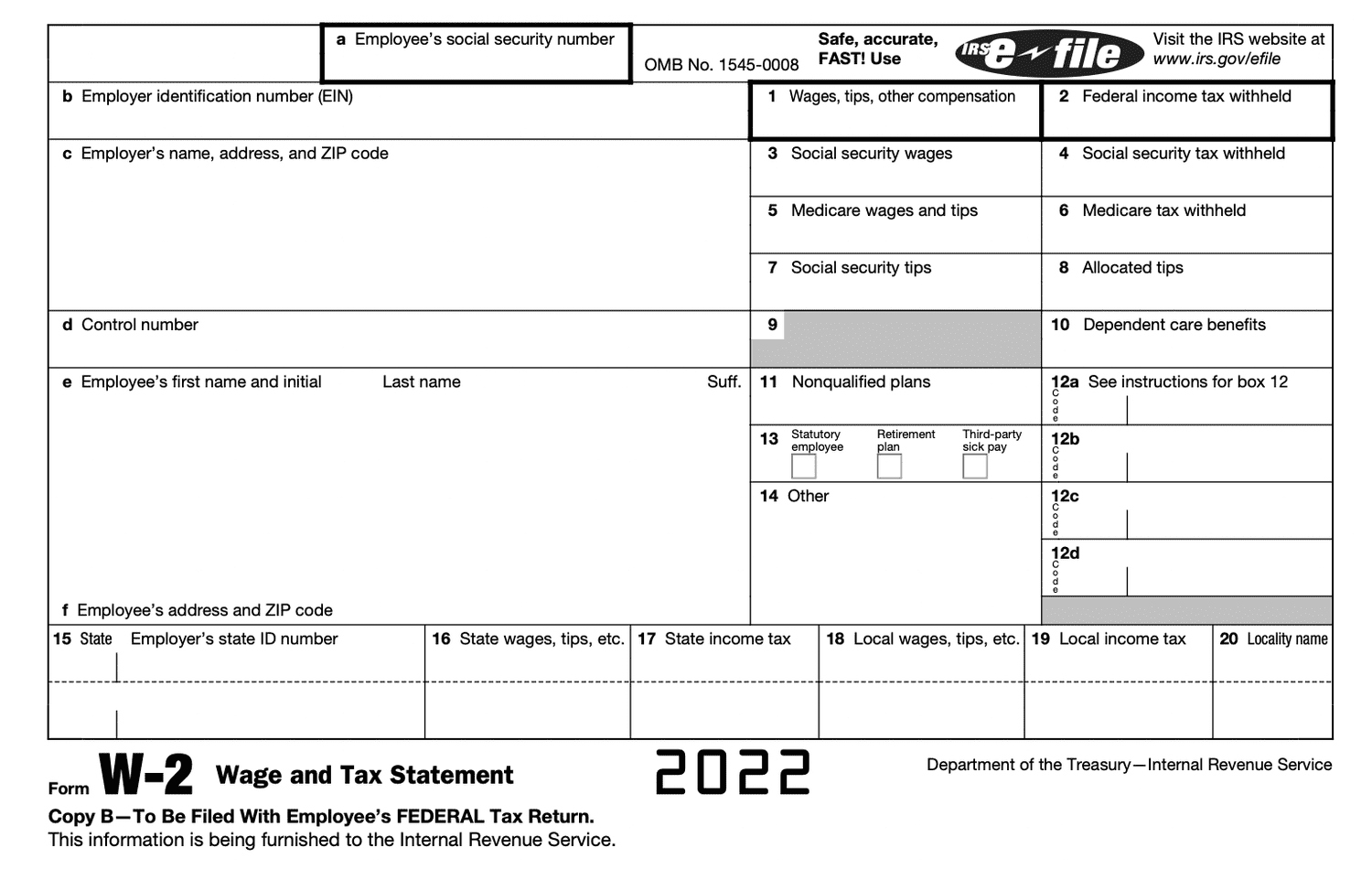

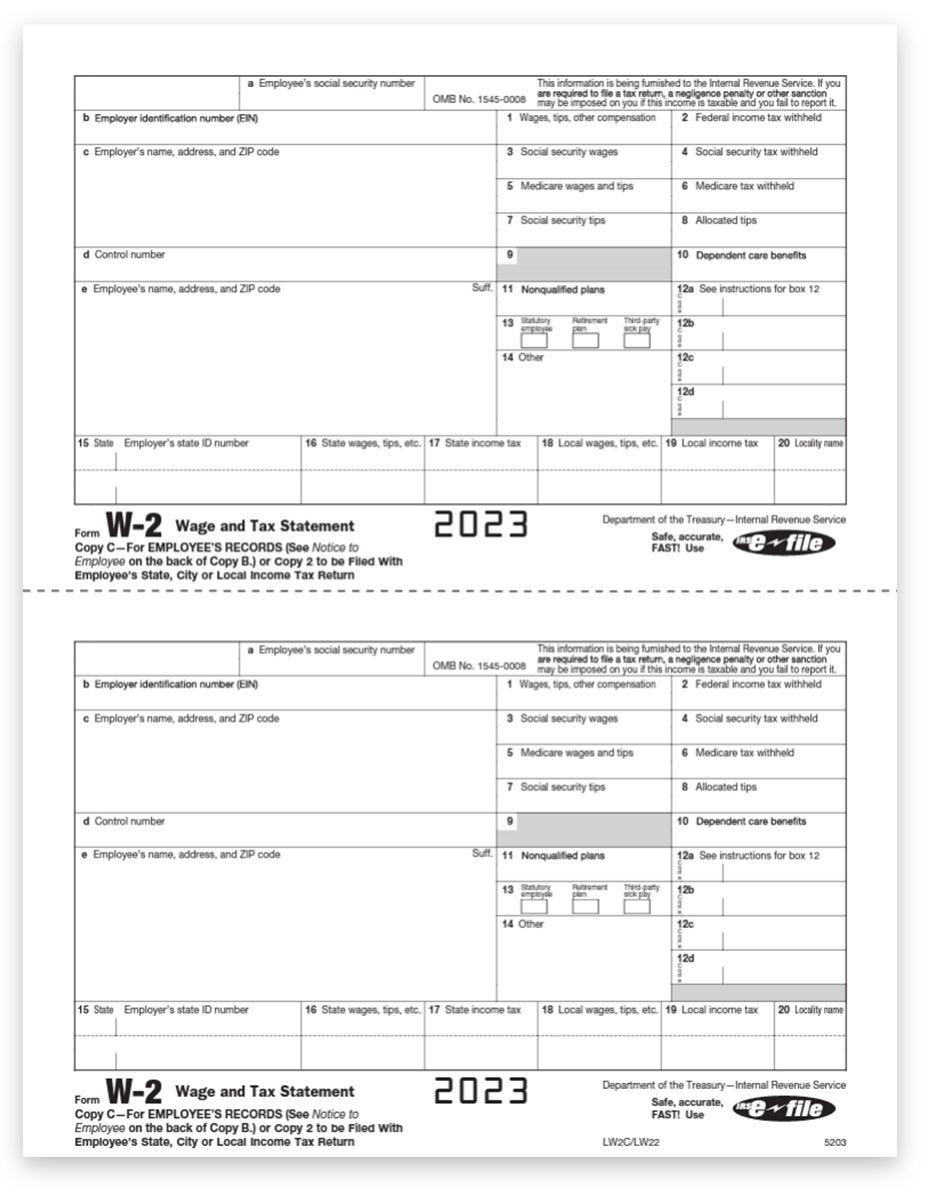

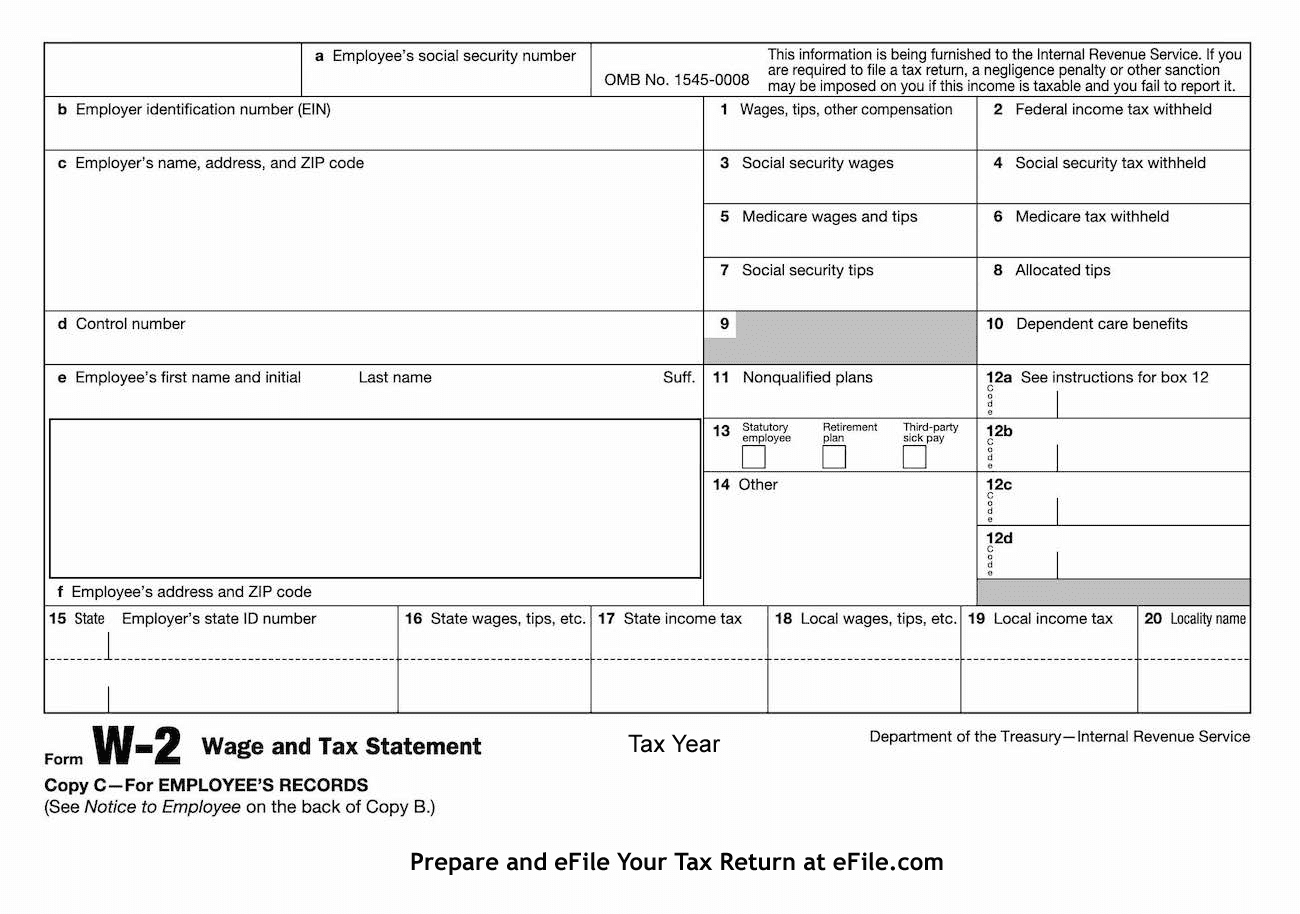

Below are some images related to W2 Form 12c

w2 12c code, w2 form 12a 12b 12c, w2 form 12c, w2 form 12c box, w2 form 12c code w, , W2 Form 12c.

w2 12c code, w2 form 12a 12b 12c, w2 form 12c, w2 form 12c box, w2 form 12c code w, , W2 Form 12c.