Florida W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Navigating the Florida W2 Form: A Bright Adventure

Ah, Florida – the Sunshine State! Known for its beautiful beaches, warm weather, and vibrant culture, Florida is a place where residents can truly bask in the sunshine. However, when it comes to navigating the Florida W2 form, things can get a bit cloudy. Fear not, dear reader, for we are here to guide you through the process with a smile on our faces and a skip in our step.

Florida’s Finest: Understanding the W2 Form

The Florida W2 form is a crucial document that outlines an employee’s earnings and tax withholdings for the year. This form is essential for filing your taxes accurately and ensuring that you receive any refunds or credits you may be entitled to. It includes information such as your total wages, federal and state tax withholdings, and any other deductions or benefits you may have received. Understanding each section of the W2 form is key to making sure your taxes are done right.

One important aspect of the Florida W2 form is the state-specific information it contains. Florida does not have a state income tax, so you won’t see any state income tax withholdings on your W2 form. This can be a pleasant surprise for many residents, as it means more money in your pocket come tax time. However, it’s still important to review your W2 form carefully to ensure that all the information is correct and that you haven’t missed any potential tax deductions or credits.

When it comes to deciphering your Florida W2 form, it’s important to pay attention to the details. Make sure that your name, Social Security number, and other personal information are correct. Double-check your total wages, federal tax withholdings, and any other deductions to ensure that everything adds up. If you have any questions or notice any discrepancies on your W2 form, don’t hesitate to reach out to your employer or a tax professional for assistance. By taking the time to understand and review your Florida W2 form, you can ensure a smooth and stress-free tax season.

Basking in Sunshine: Tips for Navigating Florida’s W2 Form

Navigating the Florida W2 form may seem like a daunting task, but with a little sunshine and some helpful tips, you’ll be on your way to tax success in no time. One tip is to keep all your tax documents organized throughout the year, so you’re not scrambling to find them come tax season. This can help you easily reference information and ensure that you don’t miss any important details.

Another tip for navigating the Florida W2 form is to familiarize yourself with any tax credits or deductions you may be eligible for. While Florida may not have a state income tax, there are still federal tax benefits you may qualify for, such as the Earned Income Tax Credit or the Child Tax Credit. By understanding these credits and deductions, you can maximize your tax refund and keep more money in your pocket.

Lastly, don’t be afraid to ask for help if you need it. Tax laws can be complex, and it’s okay to seek assistance from a tax professional or your employer if you have any questions about your Florida W2 form. Remember, it’s better to ask for help and ensure accuracy than to make a mistake that could cost you money in the long run. With a positive attitude and a willingness to learn, you can confidently navigate the Florida W2 form and conquer tax season like a true Floridian.

In conclusion, navigating the Florida W2 form may seem like a challenge, but with a little bit of sunshine and some helpful tips, you can tackle it with ease. By understanding the key components of the W2 form and staying organized with your tax documents, you can ensure a smooth and stress-free tax season. Remember to review your W2 form carefully, take advantage of any tax credits or deductions available to you, and don’t hesitate to ask for help if you need it. With a cheerful attitude and a willingness to learn, you’ll be shining bright like the Sunshine State’s finest in no time.

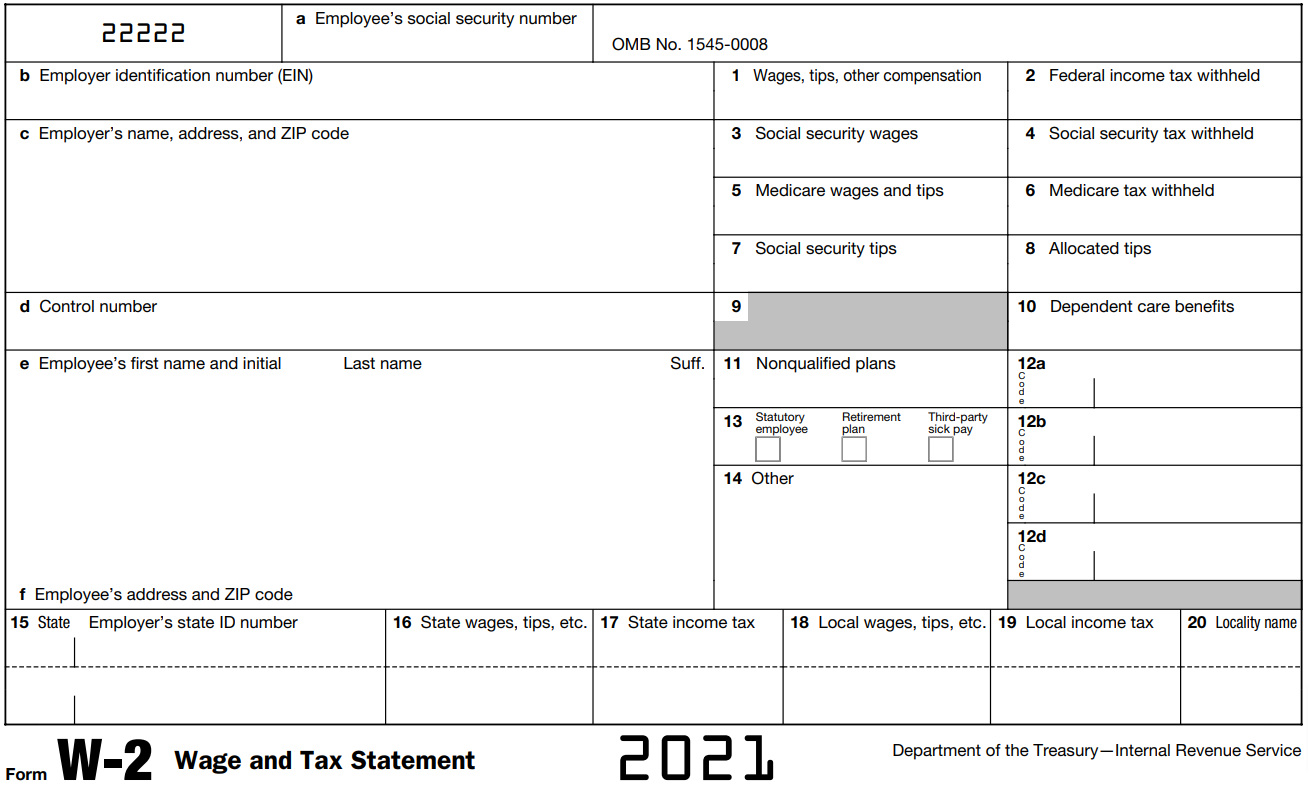

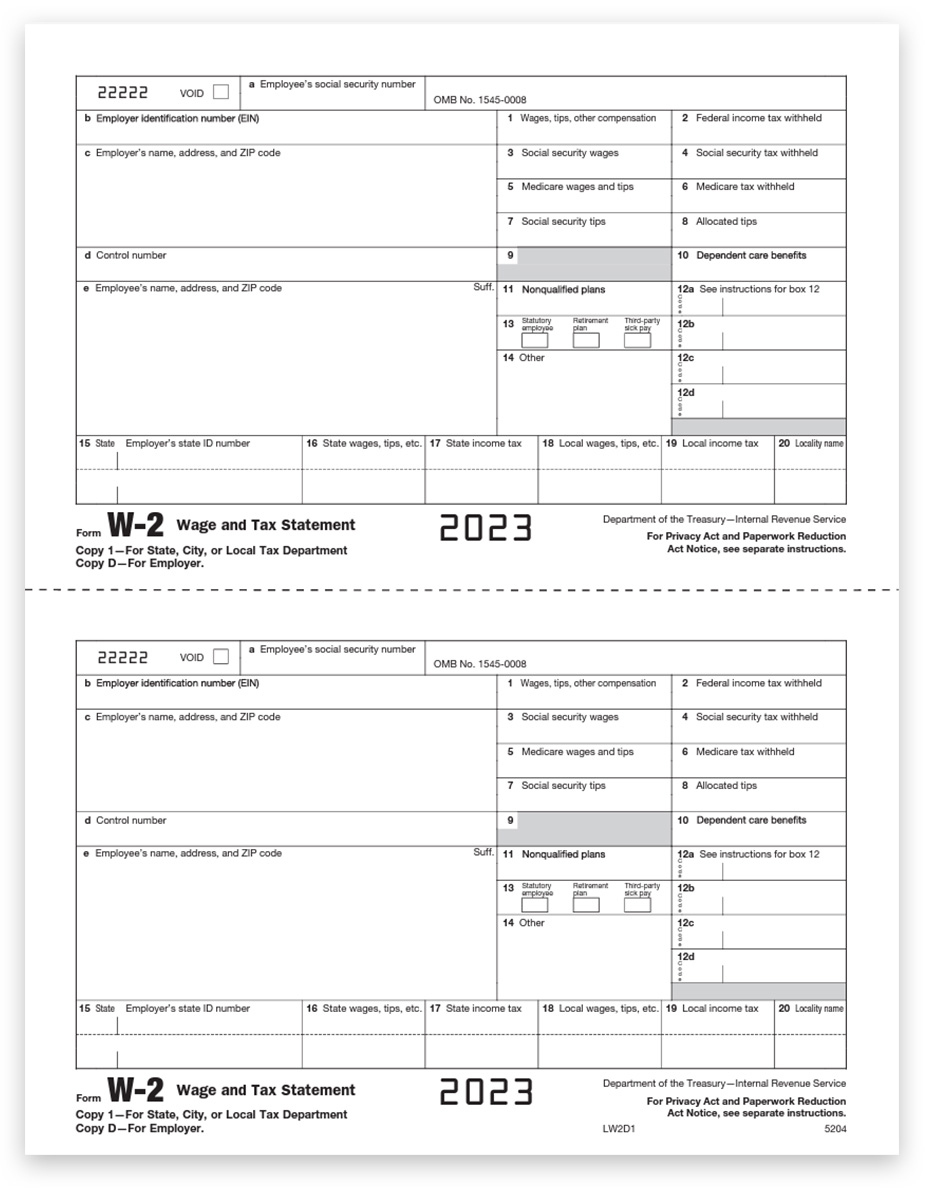

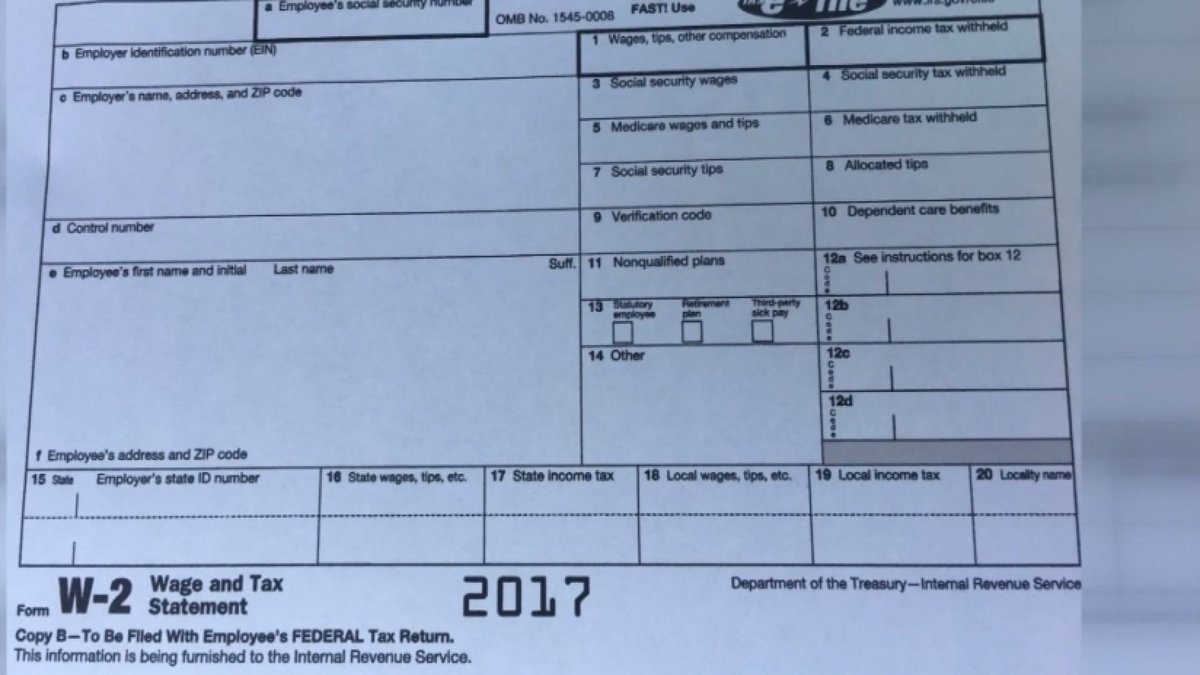

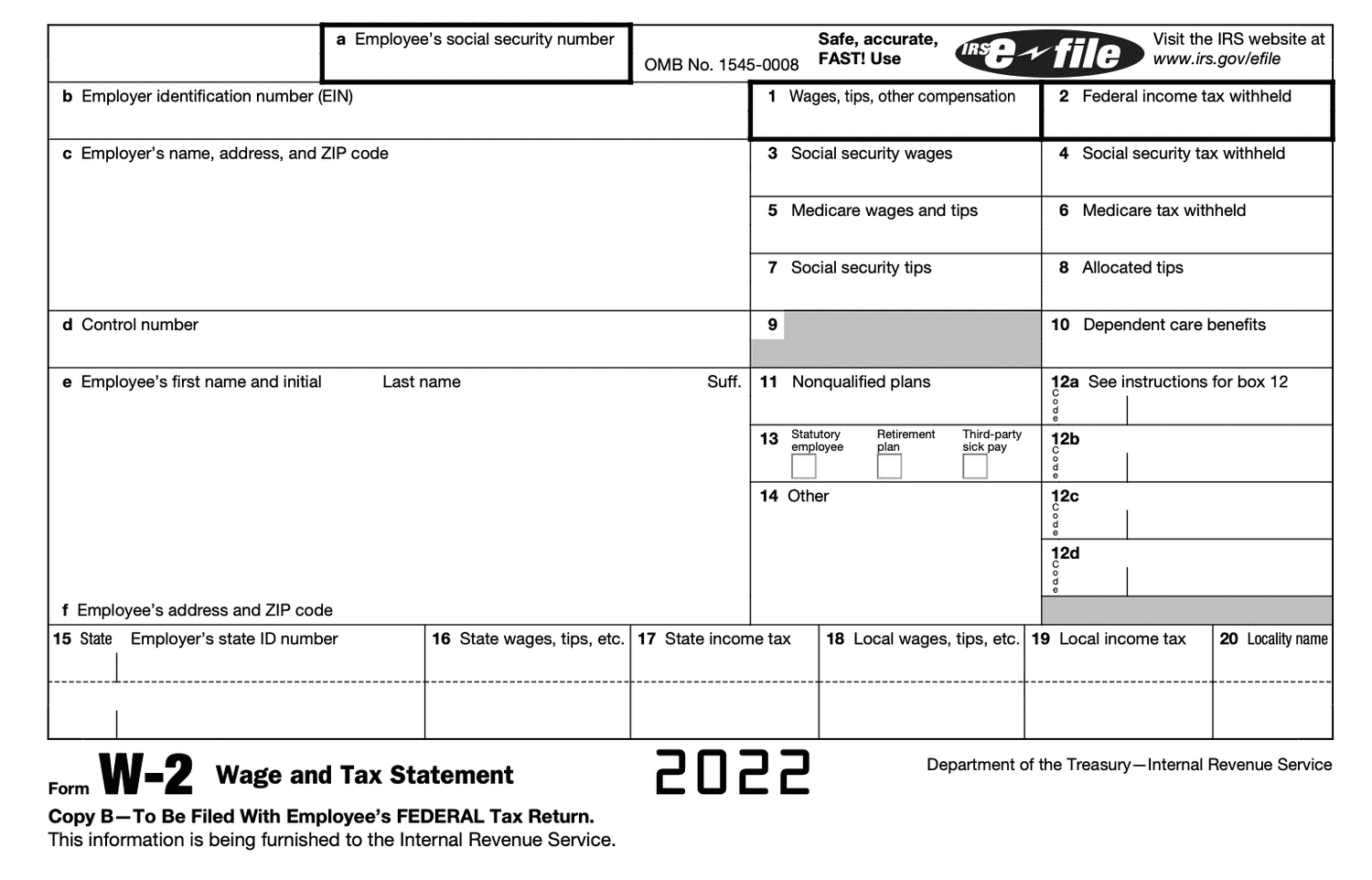

Below are some images related to Florida W2 Form

fl w2 form, florida w2 example, florida w2 form, florida w2 form 2022, florida w2 form 2023, , Florida W2 Form.

fl w2 form, florida w2 example, florida w2 form, florida w2 form 2022, florida w2 form 2023, , Florida W2 Form.