Corrected W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Rejoice in Accuracy: Corrected W2 Form Delight!

There’s nothing quite like the feeling of receiving a corrected W2 form that finally sets the record straight. Say goodbye to the stress and confusion that may have come with an incorrect form, and hello to the peace of mind that comes with knowing your taxes are in order. Take a deep breath and rejoice in the accuracy of your corrected W2 form – it’s time to celebrate happy days ahead!

No more second-guessing or wondering if the numbers on your W2 form are correct. With a corrected form in hand, you can confidently move forward with filing your taxes and tackling any financial planning with ease. Embrace the sense of relief that comes with having the correct information at your fingertips, and enjoy the smooth sailing that lies ahead as you navigate your updated W2 form with confidence and clarity.

Smooth Sailing: Navigating Your Updated W2 Form with Ease!

Now that you have your corrected W2 form in hand, it’s time to sail smoothly through the process of reviewing and understanding the information it contains. Take a moment to carefully examine each section, ensuring that all details are accurate and up-to-date. If you have any questions or concerns about the form, don’t hesitate to reach out to your employer or a tax professional for guidance.

As you navigate your updated W2 form, take note of any changes or discrepancies from the original document. Make sure to update any tax filing information accordingly, and keep a copy of the corrected form for your records. With everything in order, you can confidently move forward with filing your taxes and enjoying peace of mind knowing that your financial matters are in good hands.

Conclusion

Receiving a corrected W2 form can bring a sense of relief and joy, knowing that your tax information is accurate and up-to-date. Embrace the opportunity to navigate your updated form with ease, taking the time to review and understand the information it contains. With the correct details in hand, you can confidently move forward with your tax filing process and enjoy the happy days that lie ahead. Cheers to accuracy and smooth sailing with your corrected W2 form!

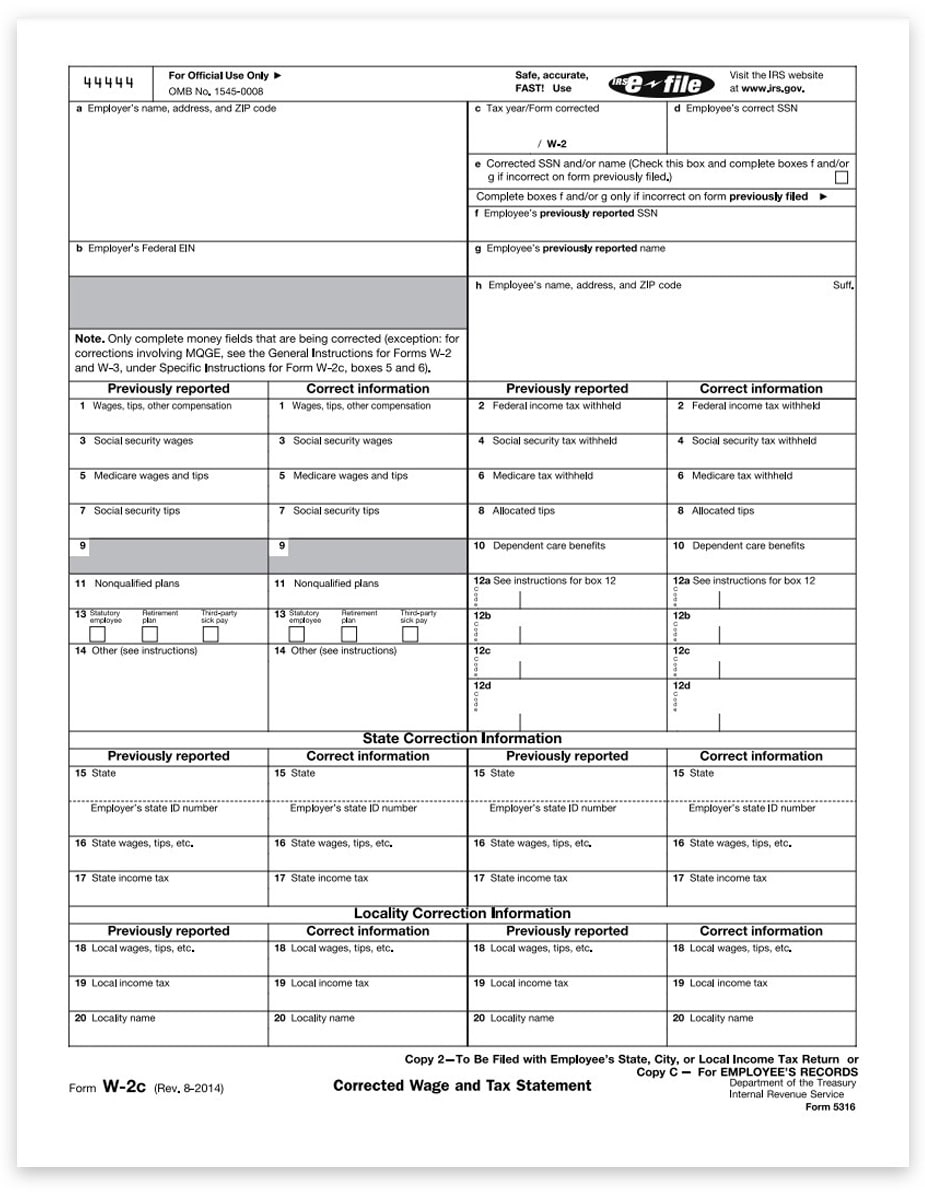

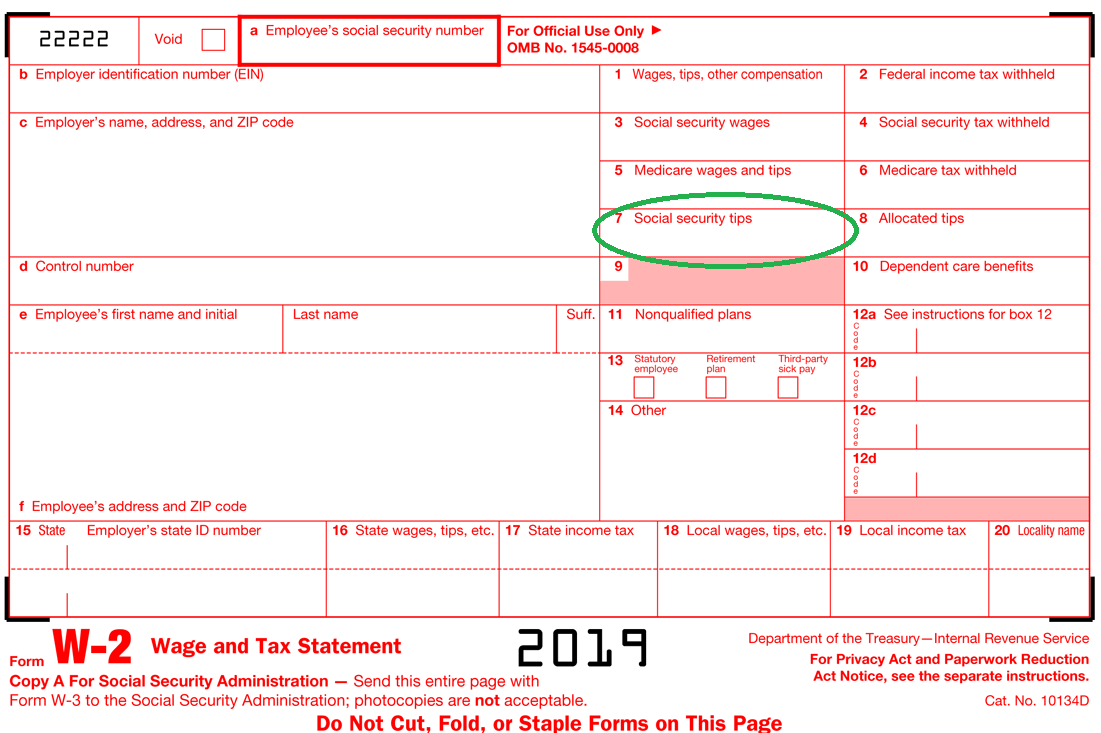

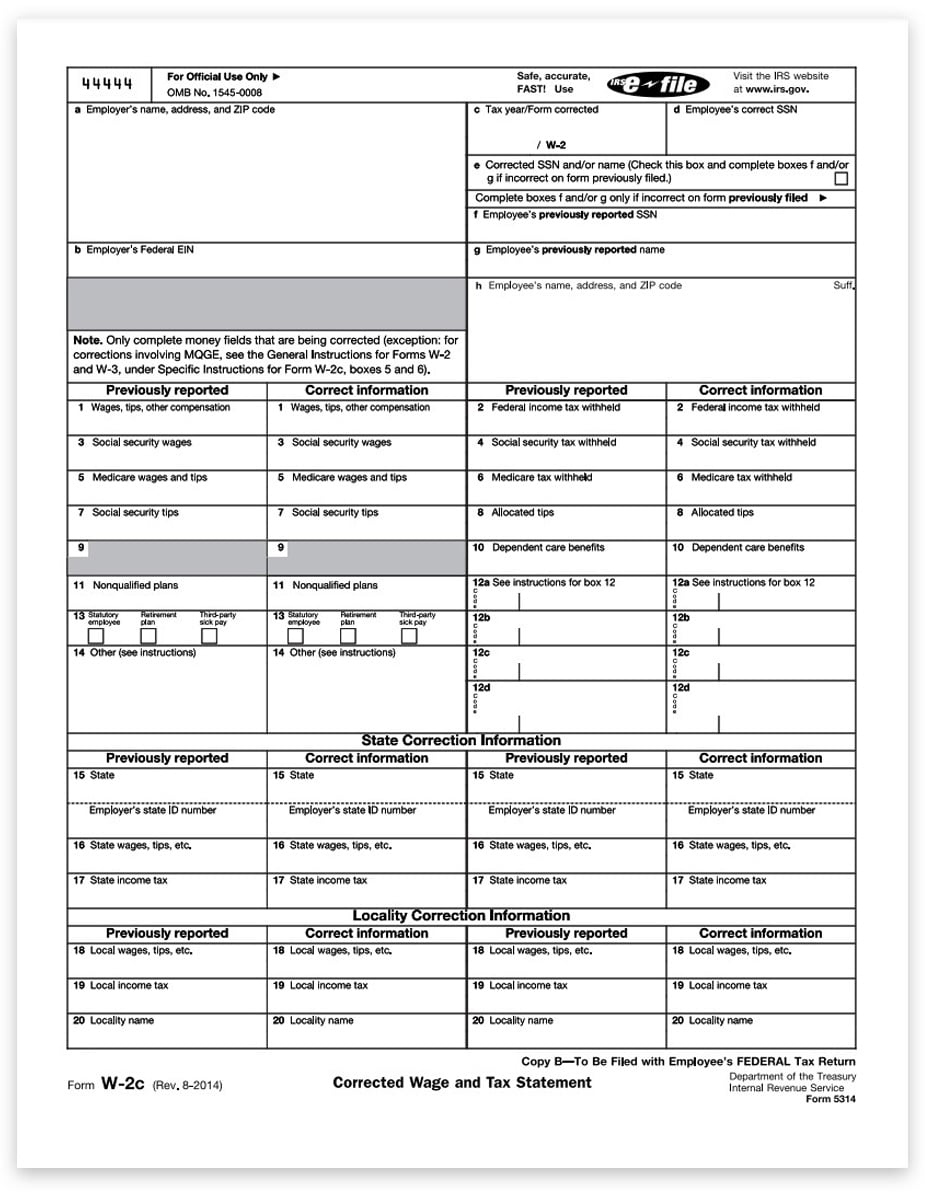

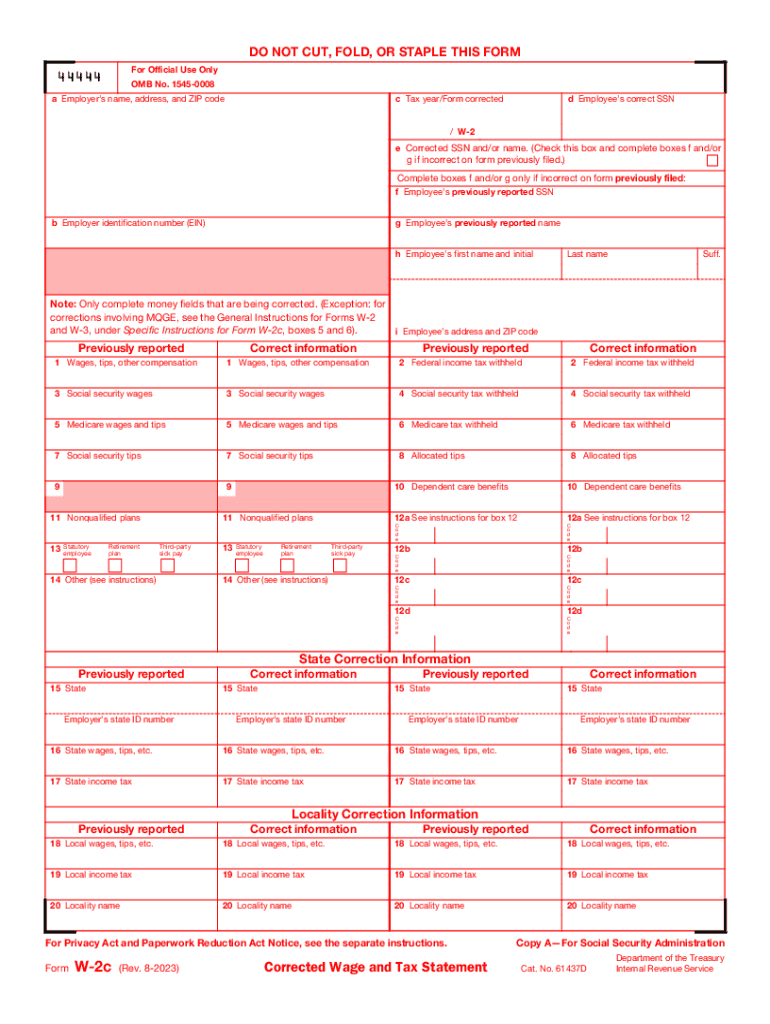

Below are some images related to Corrected W2 Form

corrected w2 example, corrected w2 form, corrected w2 form 2023, what do you do if you get a corrected w2, what is a corrected w2, , Corrected W2 Form.

corrected w2 example, corrected w2 form, corrected w2 form 2023, what do you do if you get a corrected w2, what is a corrected w2, , Corrected W2 Form.