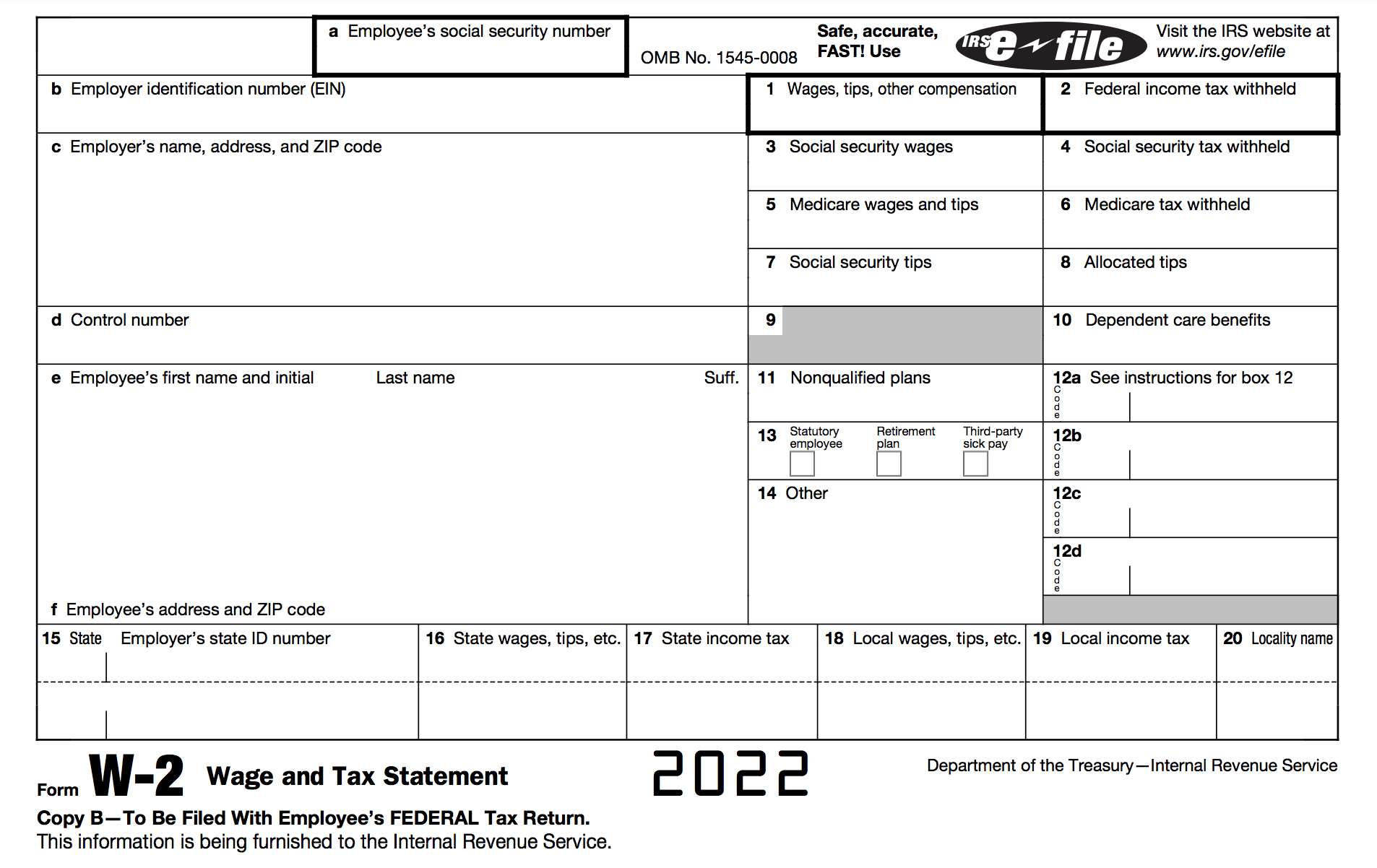

Filling Out W2 Forms – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Mastering the Art of W2s: Your Complete Guide!

Are you ready to become a W2 wizard? Learning the ins and outs of W2s can seem daunting at first, but with the right guidance, you’ll be navigating those forms like a pro in no time. In this complete guide, we’ll walk you through everything you need to know to confidently tackle your W2s with ease. From understanding the basics to mastering the details, you’ll be well on your way to W2 success!

Unleash Your W2 Wizardry: Everything You Need to Know!

First things first, let’s break down the basics of what a W2 actually is. Your W2 is a crucial document that outlines your annual earnings and taxes withheld by your employer. It’s essential for filing your taxes accurately and ensuring you’re not leaving any money on the table. Understanding the different boxes on your W2, from wages to deductions, will give you a clear picture of your financial standing for the year.

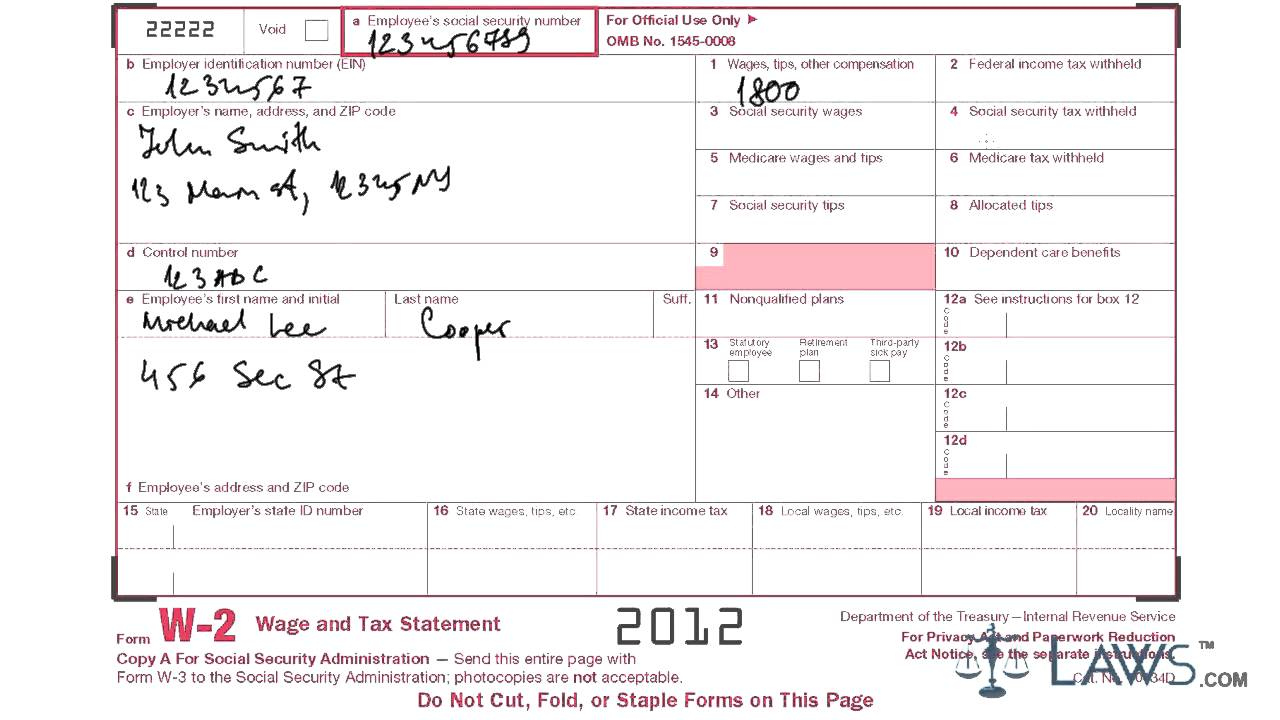

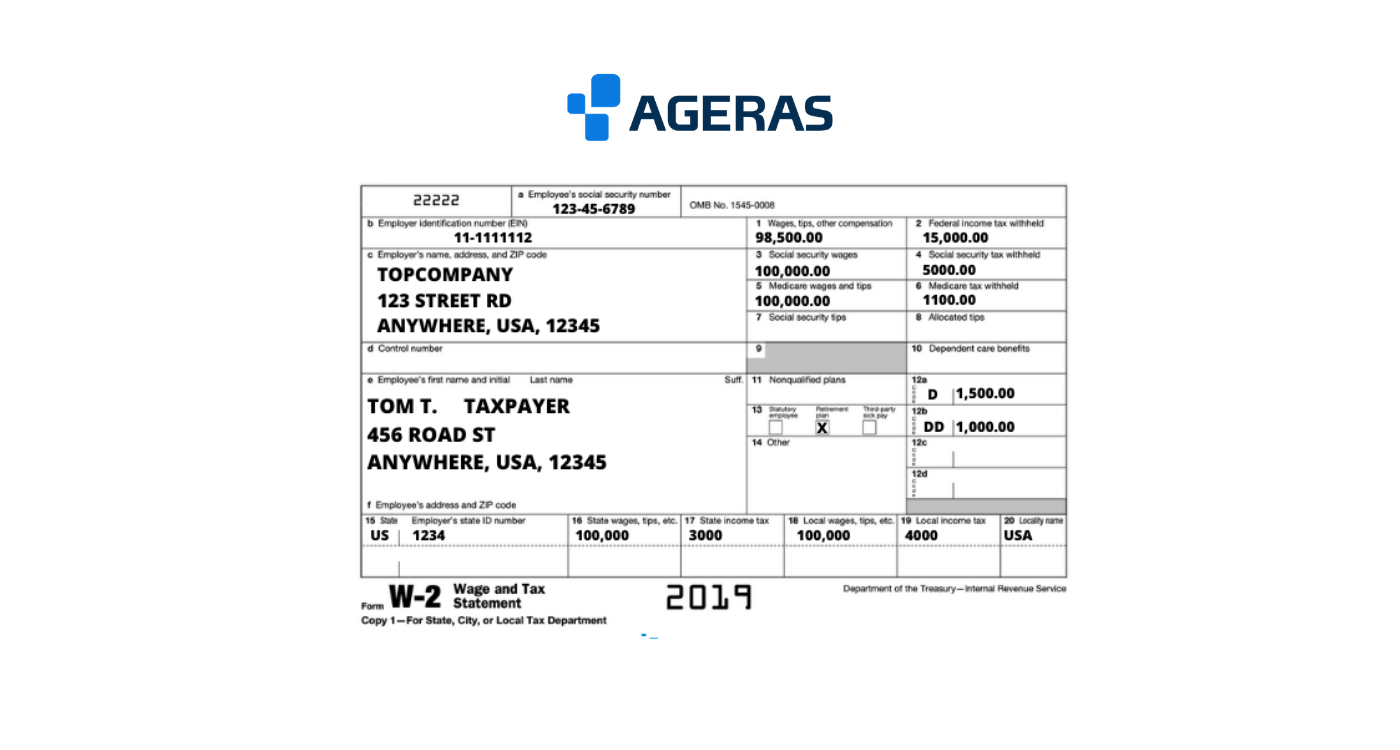

Next, let’s dive into some key tips for maximizing your W2 potential. Make sure to double-check all the information on your W2 for accuracy, including your name, Social Security number, and income details. Keep all your W2s organized in a safe place for future reference, as they will come in handy when it’s time to file your taxes. And don’t forget to take advantage of any tax deductions or credits you may be eligible for based on your W2 information.

Dive Into the World of W2s: A Step-by-Step Guide for Success!

Now that you’ve mastered the basics, let’s take a step-by-step approach to conquering your W2s. Start by carefully reviewing each box on your W2 to ensure you understand what each one represents. Calculate your total income and deductions to get a clear picture of your tax situation. Use online resources or seek advice from a tax professional if you have any questions or need further clarification.

As you dive deeper into the world of W2s, don’t be afraid to ask for help if you need it. Reach out to your employer or HR department if you have any concerns about your W2 or if you spot any discrepancies. Remember, mastering the art of W2s takes time and practice, so be patient with yourself as you navigate this important financial document. With the right knowledge and a positive attitude, you’ll soon be a W2 wizard in your own right!

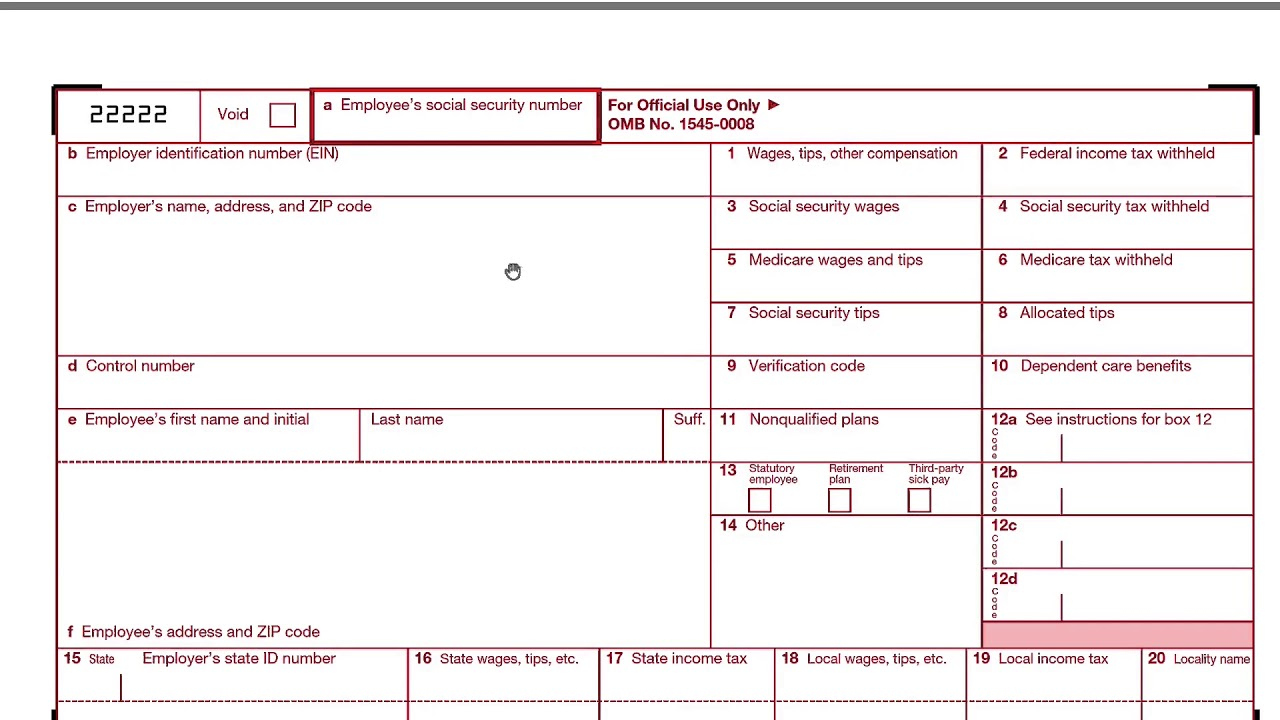

Below are some images related to Filling Out W2 Forms

can you fill out w2 online, fill in w-2 forms, fill out w2 online free, filling out w-2 form when married, filling out w2 form married, , Filling Out W2 Forms.

can you fill out w2 online, fill in w-2 forms, fill out w2 online free, filling out w-2 form when married, filling out w2 form married, , Filling Out W2 Forms.