What Is Form W2 – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

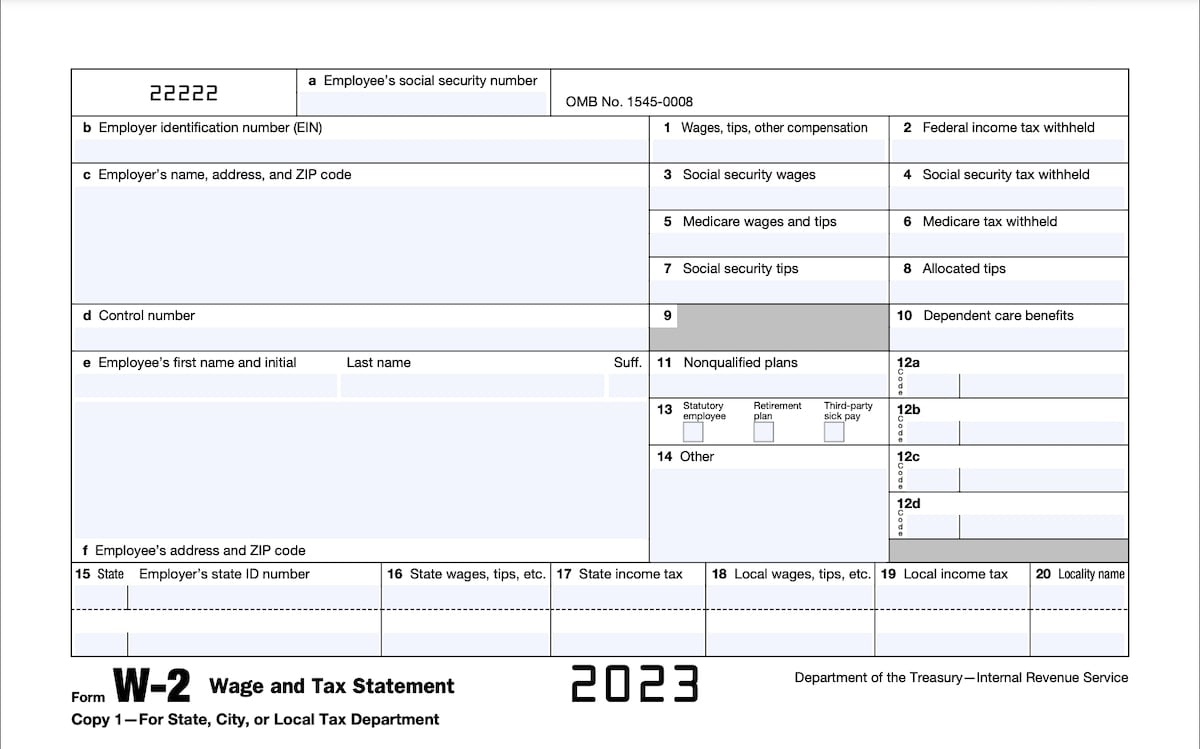

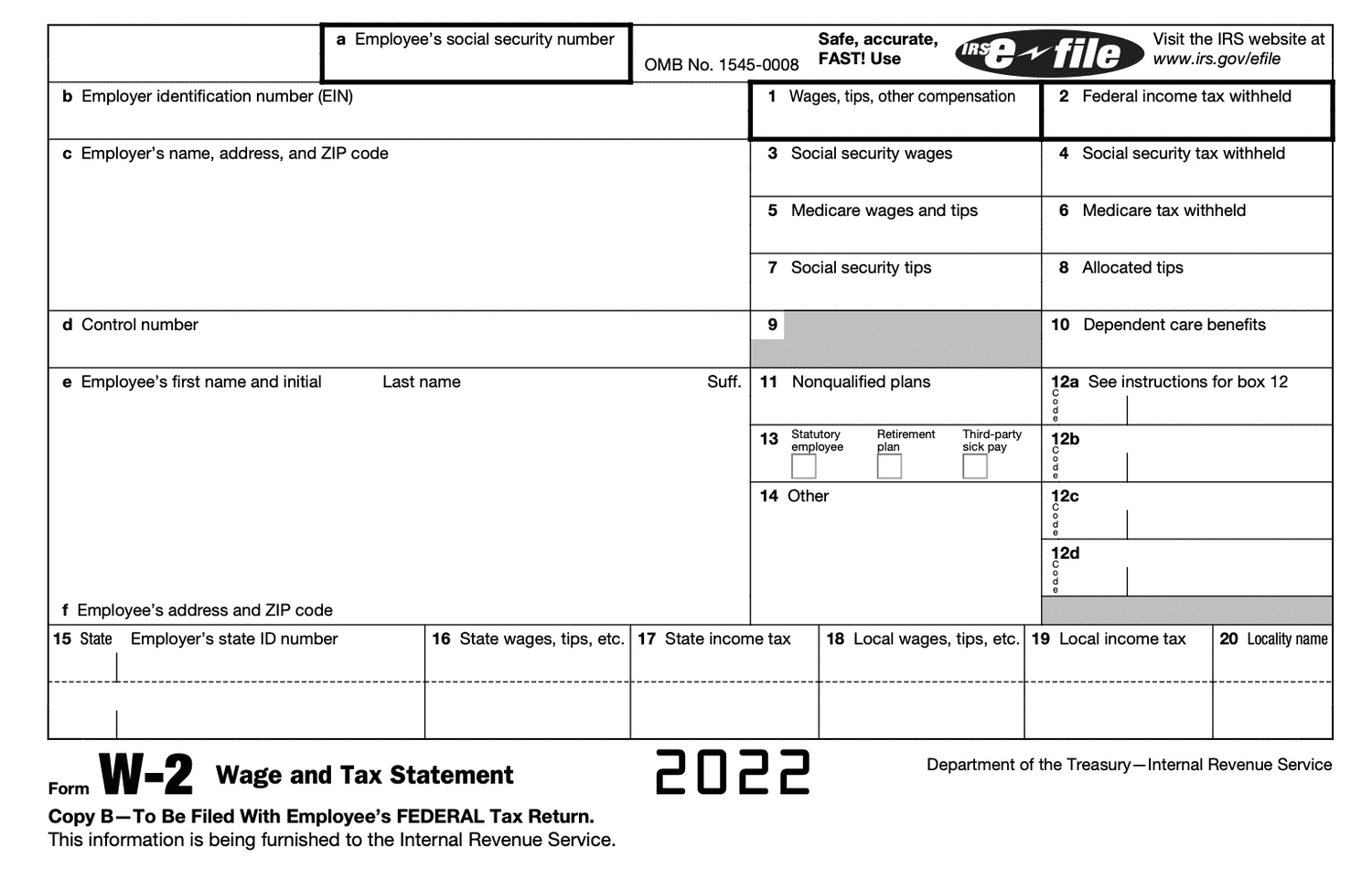

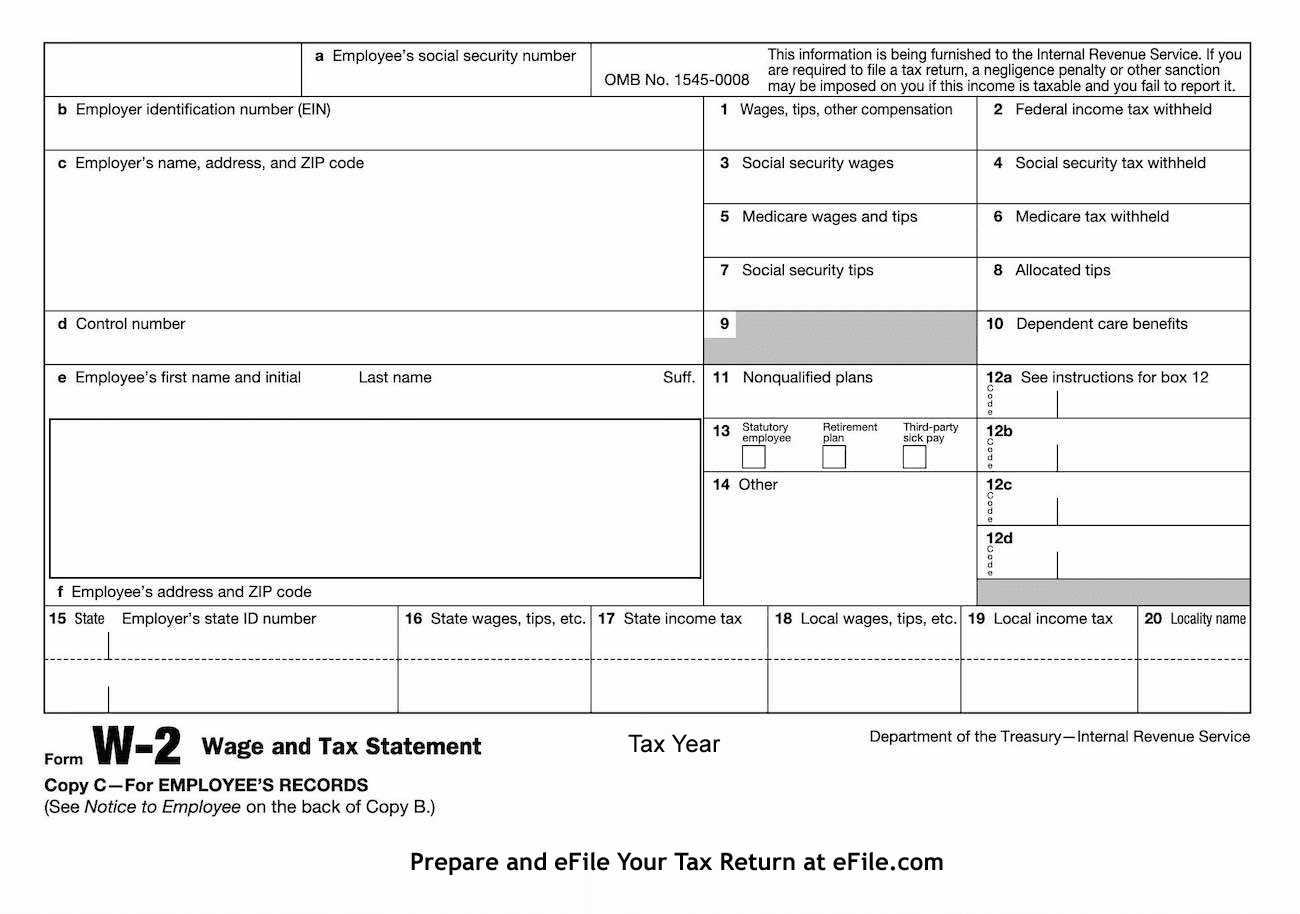

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unraveling the Mystery of Form W2

Navigating tax forms can often feel like solving a complex puzzle, with acronyms and numbers that seem to speak a language of their own. One such form that can leave many scratching their heads is the infamous Form W2. Fear not, for we are here to unravel the mystery of this enigmatic document and help you make sense of it all.

Cracking the Code: Form W2 Explained

Form W2 is a crucial document that is issued by employers to their employees each year. It provides a summary of the employee’s earnings and taxes withheld throughout the year. The form includes essential information such as wages, tips, bonuses, and other compensation, as well as deductions for taxes, retirement contributions, and benefits. Understanding the various boxes and codes on Form W2 can help you accurately report your income and file your taxes correctly.

One of the key sections of Form W2 is Box 1, which shows your total taxable wages for the year. This includes not only your regular wages but also any bonuses, commissions, and other forms of compensation. Box 2, on the other hand, displays the total federal income tax that was withheld from your paychecks during the year. Boxes 3 and 4 show your total wages subject to Social Security and Medicare taxes, respectively. By carefully reviewing each box and understanding its significance, you can ensure that you are accurately reporting your income and deductions on your tax return.

Demystifying the Enigma of Form W2

Form W2 also includes important information about any fringe benefits you may have received from your employer, such as health insurance, retirement contributions, and other perks. These benefits are often reported in Box 12 with specific codes that correspond to different types of benefits. Additionally, Form W2 provides valuable information about any state and local taxes that may have been withheld from your paychecks throughout the year. By thoroughly reviewing your Form W2 and understanding all the information it contains, you can make tax season a little less daunting and ensure that you are fulfilling your tax obligations accurately and efficiently.

In conclusion, Form W2 may seem like a daunting document at first glance, but with a little patience and understanding, you can unravel its mysteries and use it to your advantage. By familiarizing yourself with the various boxes and codes on Form W2, you can ensure that you are accurately reporting your income, deductions, and tax withholdings when filing your tax return. So fear not the enigma of Form W2, for with a little guidance, you can conquer this tax form and emerge victorious come tax season.

Below are some images related to What Is Form W2

what is a w2c form used for, what is form w2, what is form w2 and w3, what is form w2 used for, what is form w2c, , What Is Form W2.

what is a w2c form used for, what is form w2, what is form w2 and w3, what is form w2 used for, what is form w2c, , What Is Form W2.