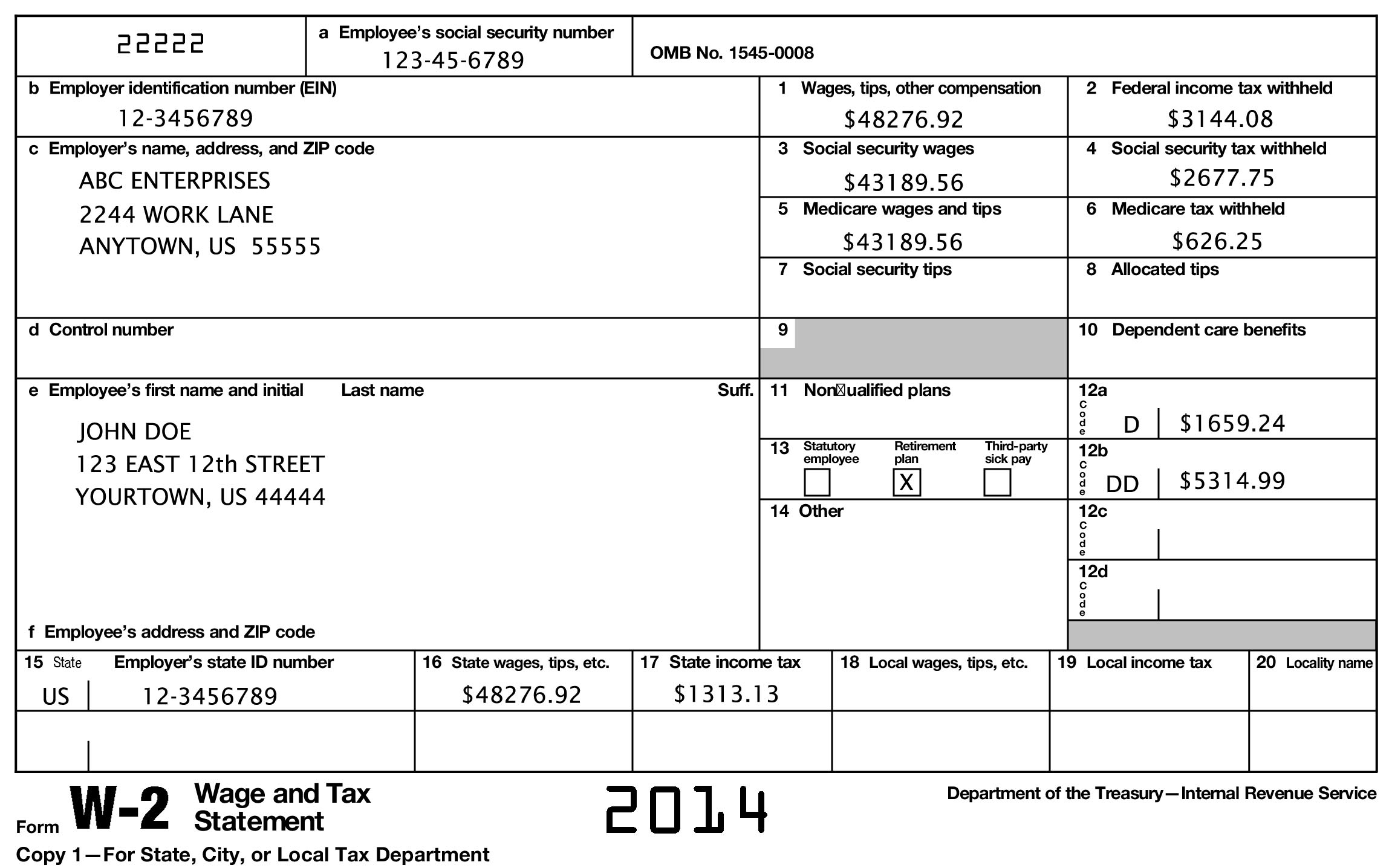

Form W2 Code Dd – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unwrapping the Mystery of Form W2 Code Dd

Have you ever received your W-2 form and felt puzzled by the various codes and numbers on it? One code that often leaves people scratching their heads is Code Dd. It may sound like some cryptic code from a spy movie, but fear not! We are here to decode this enigma and help you understand what it means.

Decoding the Enigma: Form W2 Code Dd

So, what exactly does Code Dd on your Form W-2 mean? Well, this code represents the cost of employer-sponsored health coverage. If you see Code Dd on your form, it means that your employer has provided you with health insurance benefits, and the amount listed next to it shows the value of those benefits. This information is important for tax purposes as it helps the IRS determine if your employer-provided health coverage is considered affordable under the Affordable Care Act.

But why is this information important? Understanding the value of your employer-sponsored health coverage can impact your tax liability. In some cases, if the cost of your health coverage is deemed unaffordable according to IRS standards, you may be eligible for premium tax credits or other tax benefits. So, knowing what Code Dd represents on your W-2 form can help you make informed decisions when filing your taxes.

Unlocking the Secrets of Form W2 Code Dd

Now that you know the meaning behind Code Dd on your W-2 form, you can better navigate the sometimes confusing world of tax forms. Remember, understanding the information provided on your W-2 form is crucial for accurately reporting your income and deductions to the IRS. So, the next time you receive your W-2 form and see Code Dd staring back at you, don’t panic! You now have the knowledge to unlock the secrets of this mysterious code and confidently complete your tax return.

In conclusion, Form W-2 Code Dd may seem like a mystery at first, but with a little explanation, it becomes much clearer. By understanding that it represents the cost of employer-sponsored health coverage, you can ensure that you are accurately reporting this information on your tax return. So, the next time tax season rolls around, you can confidently decipher the enigma of Code Dd and file your taxes with ease.

Below are some images related to Form W2 Code Dd

![Form W-2 Box 12 Codes | Codes And Explanations [Chart] pertaining to Form W2 Code Dd](https://ezambiablog.com/wp-content/uploads/2024/02/form-w-2-box-12-codes-codes-and-explanations-chart-pertaining-to-form-w2-code-dd.jpg)

dd w2 code, form w-2 code dd shows, form w2 code dd, w-2 form line 12a code dd, w2 code dd requirement, , Form W2 Code Dd.

dd w2 code, form w-2 code dd shows, form w2 code dd, w-2 form line 12a code dd, w2 code dd requirement, , Form W2 Code Dd.