How To Understand W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

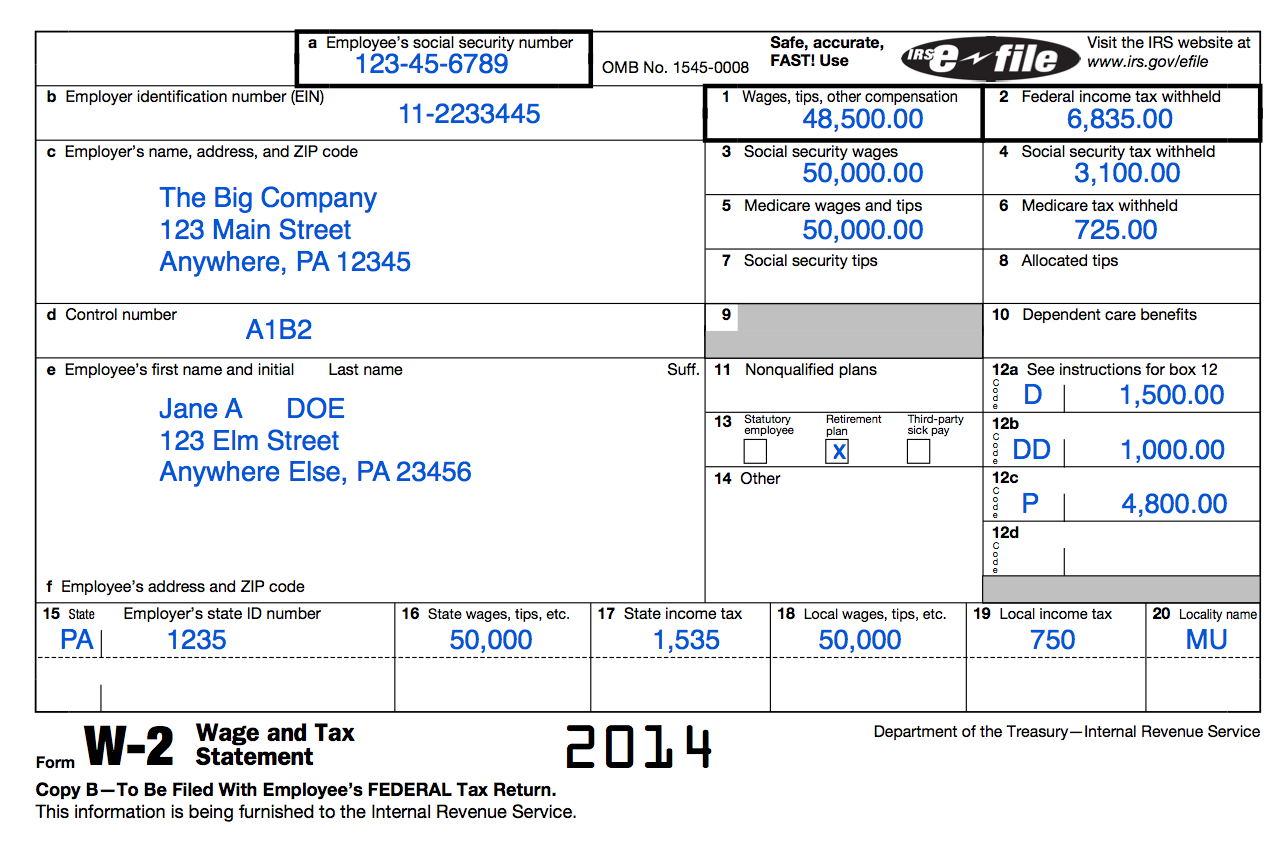

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

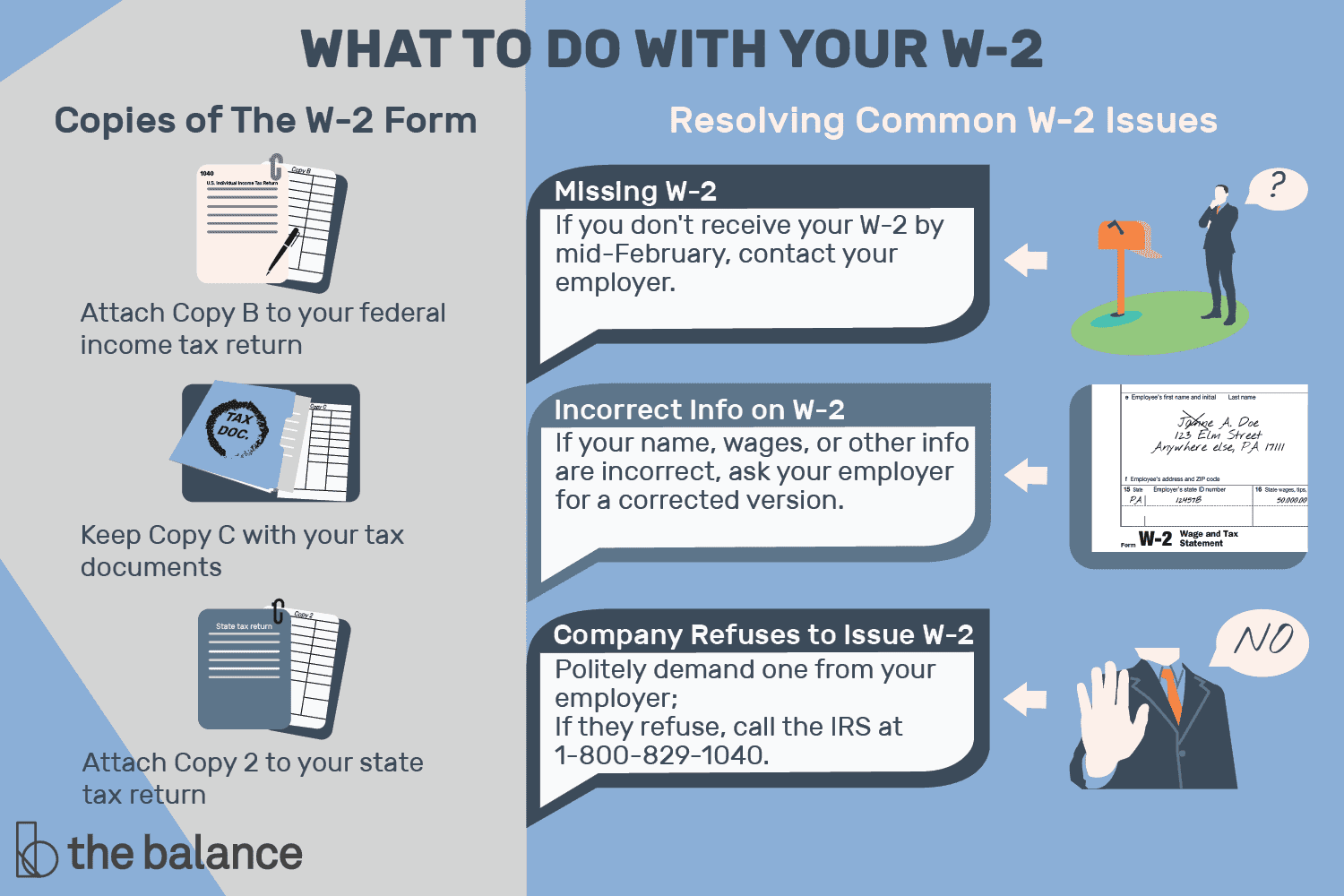

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unraveling the Mysteries of Your W2 Form!

Are you ready to unlock the secrets of your W2 form? It may seem like a daunting task, but fear not – with a little guidance, you can crack the code and master your W2 form like a pro! This important document contains valuable information about your earnings and taxes, so it’s essential to understand what it all means. Let’s dive in and demystify the world of W2 forms together!

Decode, Understand, and Take Control!

The first step to mastering your W2 form is to decode the various boxes and numbers that it contains. Each section of the form provides crucial details about your income, taxes withheld, and other important information. Take the time to carefully review each box and understand what it means for your financial situation. By deciphering the codes on your W2 form, you can gain valuable insights into your earnings and tax obligations.

Once you have decoded the information on your W2 form, it’s time to understand how it impacts your overall financial picture. By analyzing the numbers and figures on the form, you can gain a clearer understanding of your income, tax liability, and potential deductions. This knowledge can help you make informed decisions about your finances and plan for the future. Take control of your financial destiny by mastering your W2 form and using it to your advantage.

Conclusion

In conclusion, mastering your W2 form is a key step in taking control of your financial well-being. By unraveling the mysteries of this important document, you can gain valuable insights into your earnings, taxes, and overall financial situation. Take the time to decode, understand, and take control of your W2 form – it’s a small but essential step towards financial empowerment. With a little effort and know-how, you can become a W2 form master in no time!

Below are some images related to How To Understand W2 Form

how to find w2 form, how to interpret w-2 form, how to read w2 form, how to understand w2, how to understand w2 form, , How To Understand W2 Form.

how to find w2 form, how to interpret w-2 form, how to read w2 form, how to understand w2, how to understand w2 form, , How To Understand W2 Form.