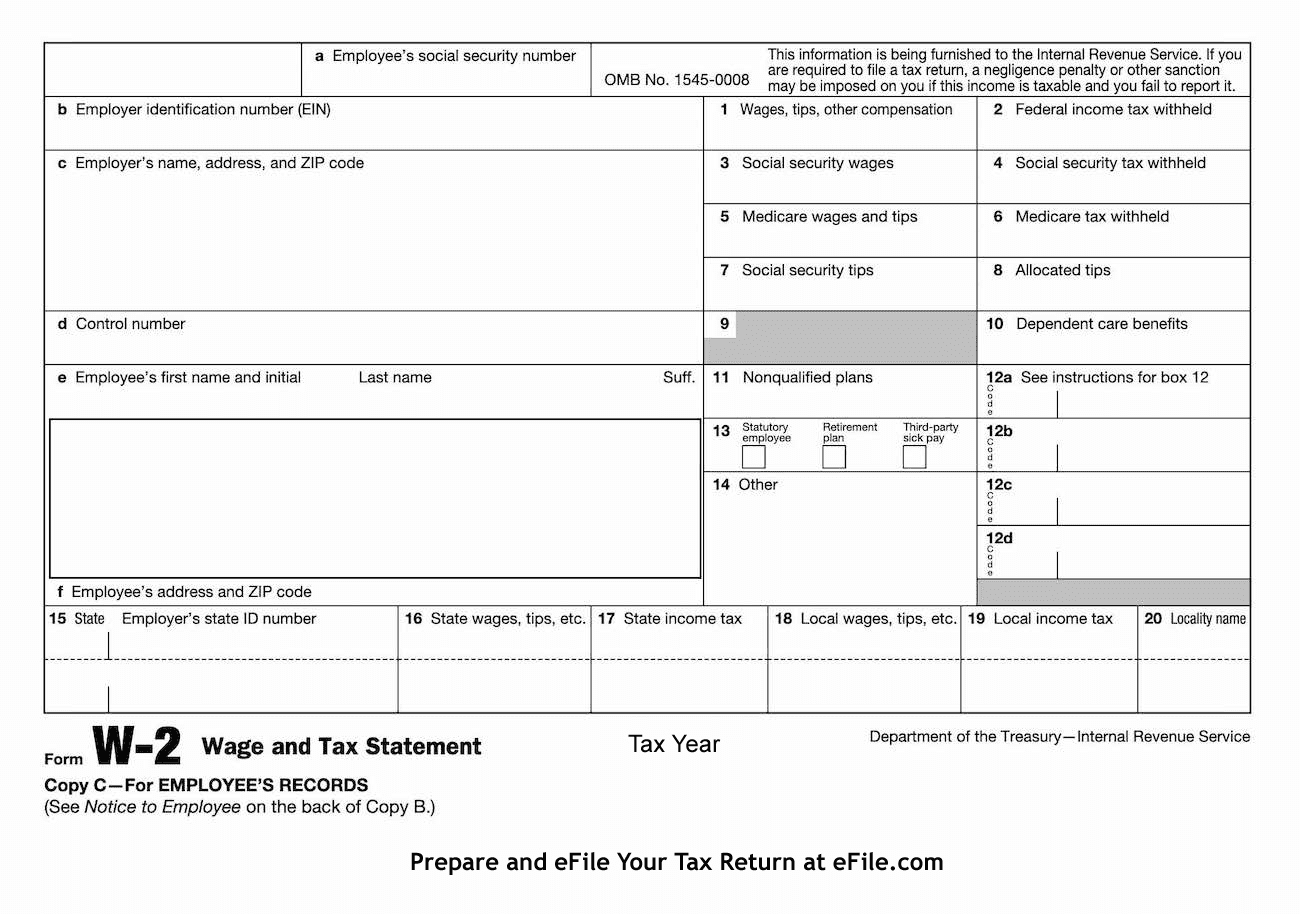

JCP W2 Former Employee – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Proudly Part of the JCP Family: Former Employee Shares W2 Tips!

Are you a proud member of the JCP family? If so, you may already know that tax season is upon us, and navigating your W2 form can sometimes be a bit confusing. But fear not, because we have an insider here to share some tips and secrets to help you breeze through tax season like a pro!

Join the JCP Family: Insider W2 Tips!

One of the best tips for handling your W2 form as a current or former JCP employee is to ensure that all your information is accurate. Double-check that your name, social security number, and address are all correct before you file your taxes. Any errors could lead to delays in processing your return or even potential penalties from the IRS.

Additionally, make sure to keep track of any deductions you may be eligible for as a JCP employee. This could include expenses related to uniforms, work-related travel, or continuing education. By taking advantage of these deductions, you can potentially lower your tax liability and keep more money in your pocket.

Lastly, don’t forget to file your taxes on time! Missing the deadline could result in penalties and interest charges, so be sure to submit your return by the due date. If you need more time, consider filing for an extension to avoid any unnecessary fees.

Ex-JCP Employee Shares Tax Secrets!

Former JCP employees have a wealth of knowledge when it comes to navigating tax season, and one of the best secrets they have to share is the importance of keeping all your tax documents organized. From your W2 form to any additional income statements, make sure to keep everything in one place to make filing your taxes a breeze.

Another tip from ex-JCP employees is to consider consulting with a tax professional if you have any questions or concerns about your taxes. They can help you maximize your deductions, minimize your tax liability, and ensure that you are fully compliant with all tax laws and regulations.

Lastly, don’t forget to take advantage of any tax credits you may be eligible for as a former JCP employee. This could include credits for education expenses, retirement savings, or even energy-efficient home improvements. By exploring all your options, you can potentially save even more money on your taxes this year.

In conclusion, being a part of the JCP family comes with its own set of perks and responsibilities when it comes to taxes. By following these insider tips and secrets from former employees, you can navigate tax season with confidence and ease. So go ahead, gather your documents, consult with a professional if needed, and make the most of your tax return this year!

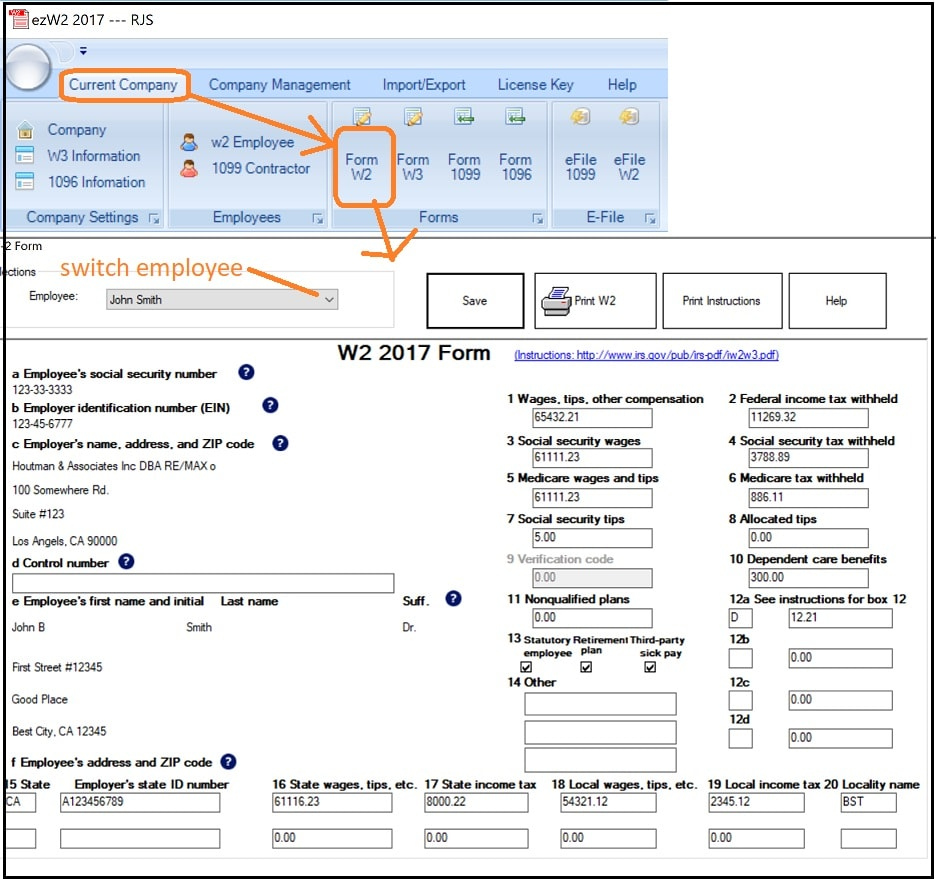

Below are some images related to Jcp W2 Former Employee

![Jcpenney Kiosk [Human Resources] - Jcpassociates with regard to Jcp W2 Former Employee](https://ezambiablog.com/wp-content/uploads/2024/02/jcpenney-kiosk-human-resources-jcpassociates-with-regard-to-jcp-w2-former-employee.jpg)

how can i get my w2 from former employer, how do i get my w2 from my old employer, how do i get my w2 from past employers, how do i get my w2 from walmart as a former employee, jcp w2 former employee, , Jcp W2 Former Employee.

how can i get my w2 from former employer, how do i get my w2 from my old employer, how do i get my w2 from past employers, how do i get my w2 from walmart as a former employee, jcp w2 former employee, , Jcp W2 Former Employee.