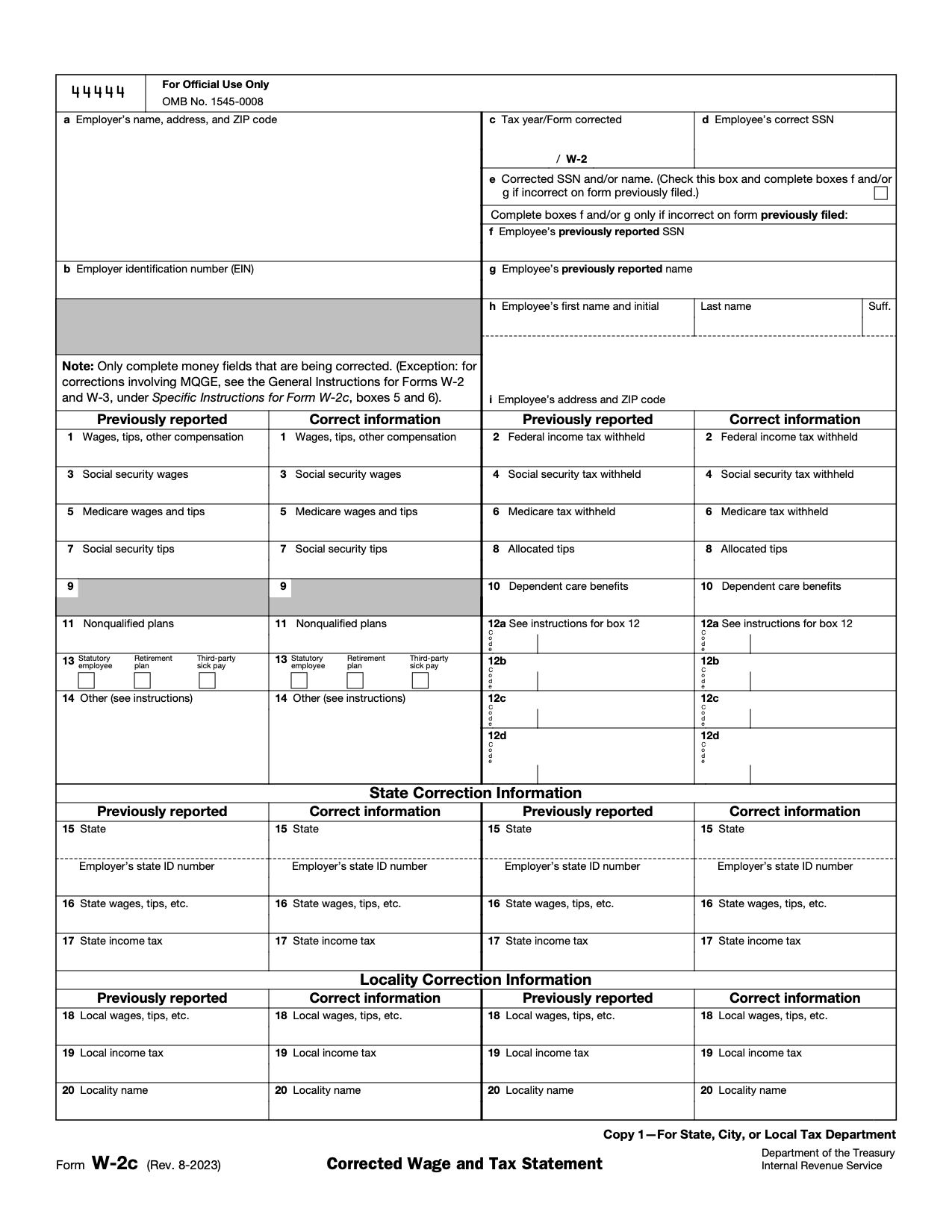

How To Correct W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

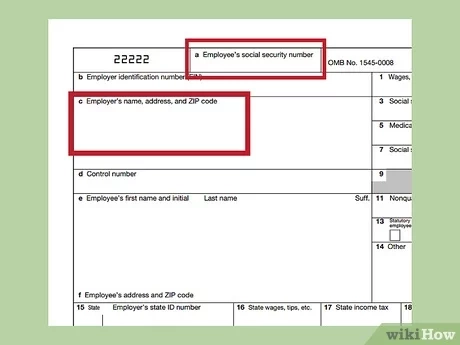

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Don’t Let W2 Worries Ruin Your Day!

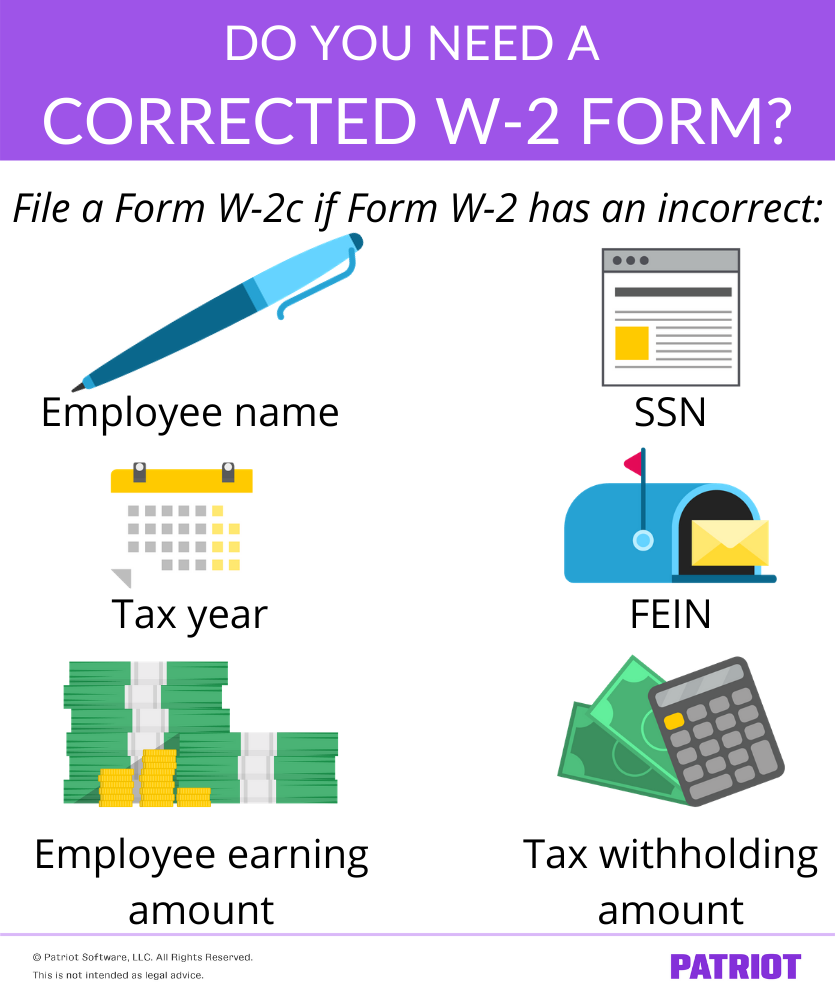

Are you feeling stressed out because your W2 form is incorrect? Don’t let those pesky W2 woes ruin your day! It’s completely normal to encounter errors on your W2 form, but the good news is that fixing them is easier than you think. With a positive attitude and a little bit of guidance, you can correct your W2 form with ease and get back to enjoying your day worry-free. So, let’s roll up our sleeves and tackle those W2 woes head-on!

The Ultimate Guide to Fixing Your W2 Woes

If you’ve discovered errors on your W2 form, don’t panic! The first step to correcting your W2 woes is to carefully review the information on the form. Look for any discrepancies in your personal information, income, taxes withheld, or any other relevant details. Once you’ve identified the errors, it’s time to take action. Reach out to your employer’s human resources or payroll department to inform them of the mistakes and request a correction. Keep in mind that mistakes can happen, and your employer will likely be more than willing to help you rectify the situation.

After notifying your employer of the errors on your W2 form, it’s important to follow up to ensure that the corrections are made in a timely manner. Stay in communication with your employer to track the progress of the correction process and make sure that the revised W2 form is sent to you promptly. Once you receive the corrected W2 form, review it carefully to verify that all the errors have been fixed. If you notice any lingering mistakes, don’t hesitate to reach out to your employer again for further assistance. Remember, your peace of mind is worth the effort of ensuring that your W2 form is accurate and error-free.

In conclusion, don’t let W2 worries get you down! By following the steps outlined in this guide, you can easily correct any errors on your W2 form and alleviate any stress or anxiety you may be feeling. Remember, mistakes happen, but it’s how we handle them that truly matters. With a positive attitude and a proactive approach, you can fix your W2 woes with ease and get back to focusing on the things that truly matter in your life. So take a deep breath, stay calm, and tackle those W2 troubles head-on – you’ve got this!

Below are some images related to How To Correct W2 Form

how to change w2 form, how to correct w2 form, how to get a corrected w2, how to w2 form, what do you do if you get a corrected w2, , How To Correct W2 Form.

how to change w2 form, how to correct w2 form, how to get a corrected w2, how to w2 form, what do you do if you get a corrected w2, , How To Correct W2 Form.