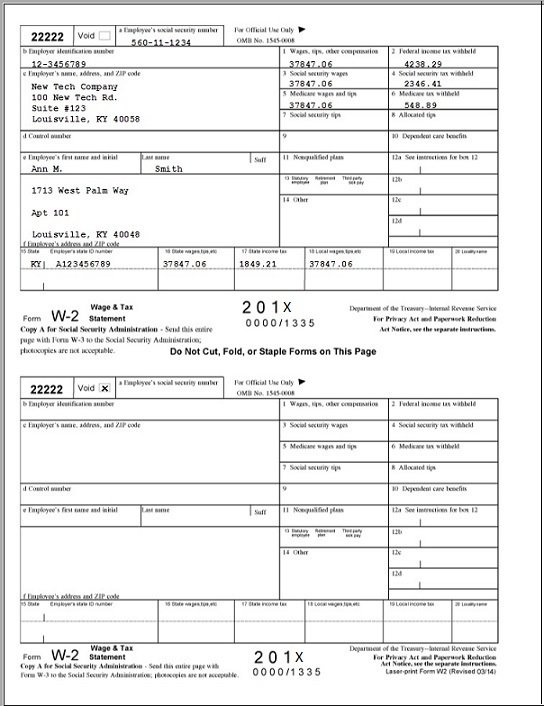

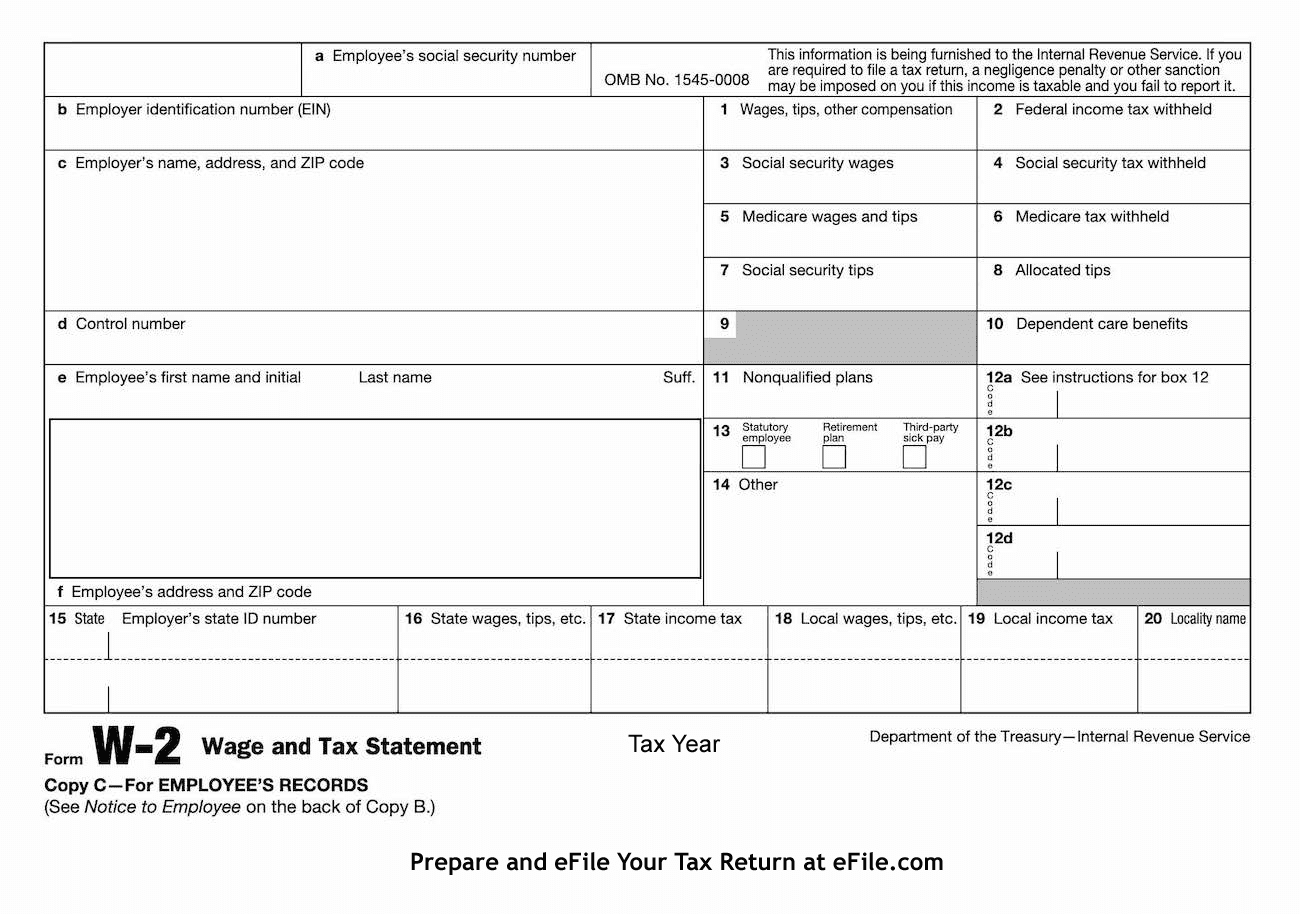

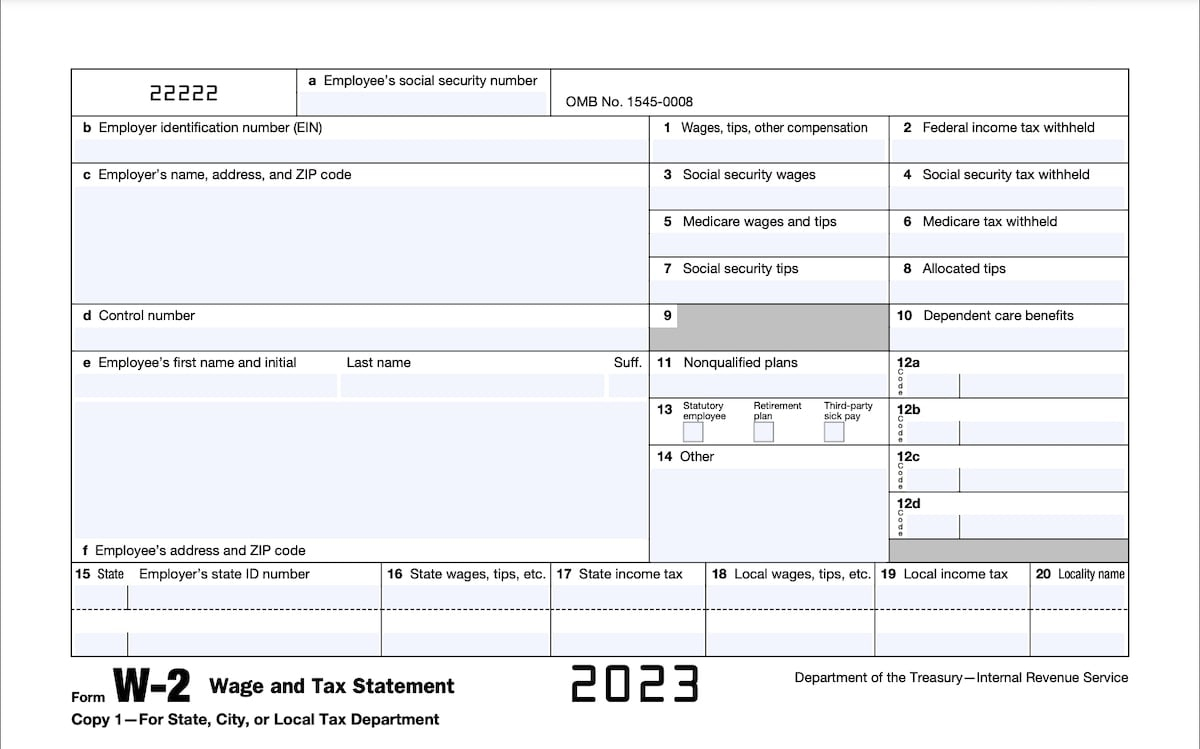

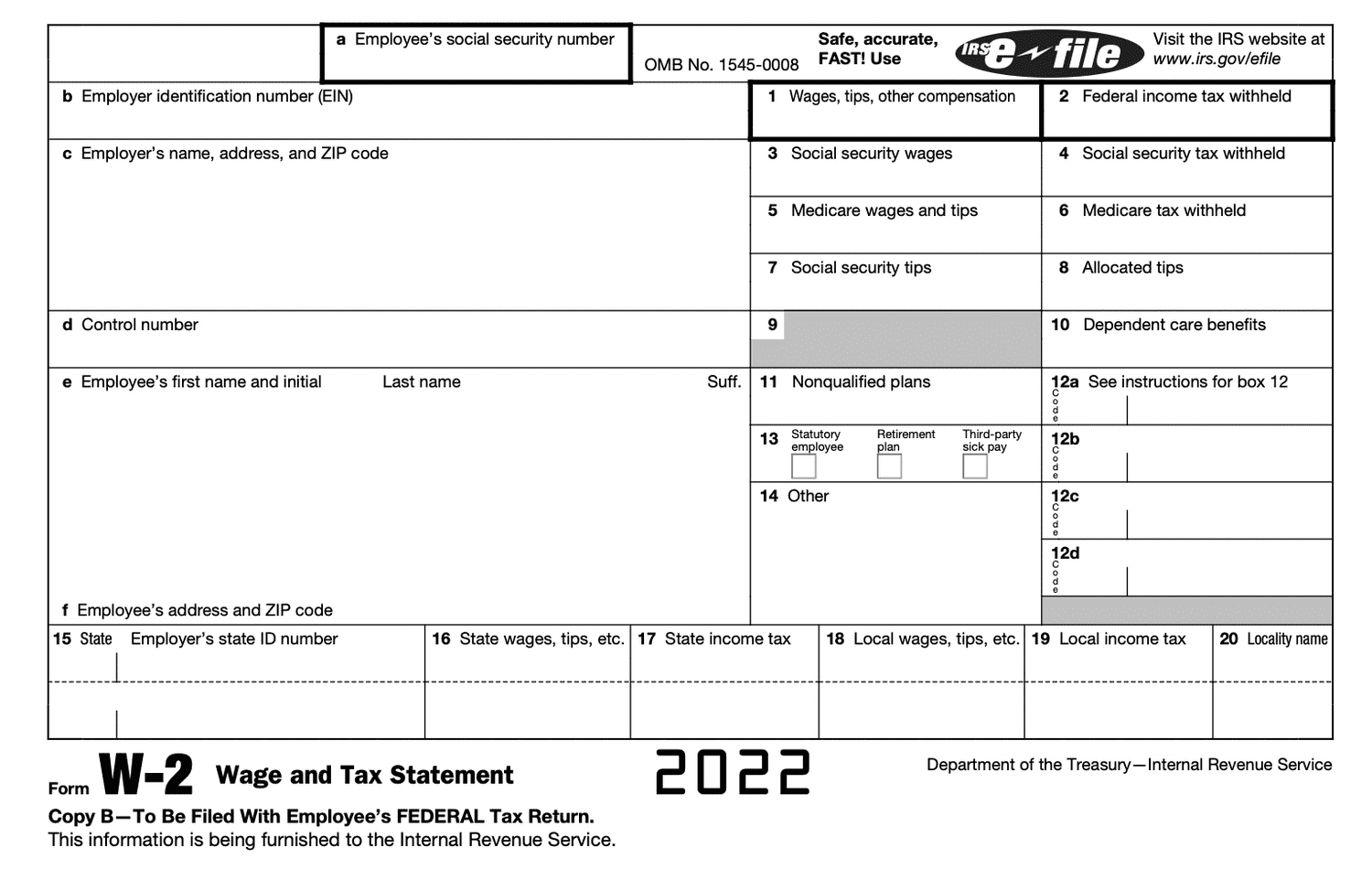

Company W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unveiling the Magic of Your Company W2!

Are you ready to unlock the secrets hidden within your company W2? Get ready to dive into the enchanting world of your W2 form and discover the wonders it holds! Your W2 is not just a piece of paper with numbers and codes on it; it is a magic portal that reveals your financial journey throughout the year. Let’s peel back the curtain and explore the magic of your company W2 together!

Let’s Dive into the Enchantment of Your Company W2!

As you gaze upon your company W2 for the first time, you may feel a sense of wonder and curiosity. Each number and code on the form tells a story about your income, taxes withheld, and other financial details. It’s like a map that guides you through your financial landscape, showing you where you’ve been and where you’re headed. Take a deep breath and allow yourself to be swept away by the enchantment of your W2.

One of the most magical aspects of your company W2 is its ability to help you understand your tax obligations. By examining the numbers on your W2, you can calculate how much you owe in taxes or how much of a refund you can expect. It’s like solving a puzzle that unlocks the treasure trove of your financial well-being. So don’t be afraid to dig deep and unravel the mysteries of your W2 – the more you understand it, the more empowered you will feel.

Discover the Wondrous World of Your Company W2 Form!

Your company W2 is more than just a document – it’s a window into your financial health and well-being. By taking the time to explore and understand your W2, you can make informed decisions about your finances and plan for the future with confidence. So grab your magnifying glass and embark on a journey of discovery through the wondrous world of your company W2 form. Who knows what magical insights and revelations await you!

In conclusion, don’t underestimate the magic that lies within your company W2. It may seem like just another piece of paperwork, but it holds the key to understanding your financial story and unlocking your financial potential. So embrace the enchantment of your W2, and let it guide you towards a brighter and more prosperous future. Happy exploring!

Below are some images related to Company W2 Form

company w2 form, ford motor company w2 former employee, genuine parts company w2 former employee, how do employers get w2 forms, how do i get a w2 from my employer, , Company W2 Form.

company w2 form, ford motor company w2 former employee, genuine parts company w2 former employee, how do employers get w2 forms, how do i get a w2 from my employer, , Company W2 Form.