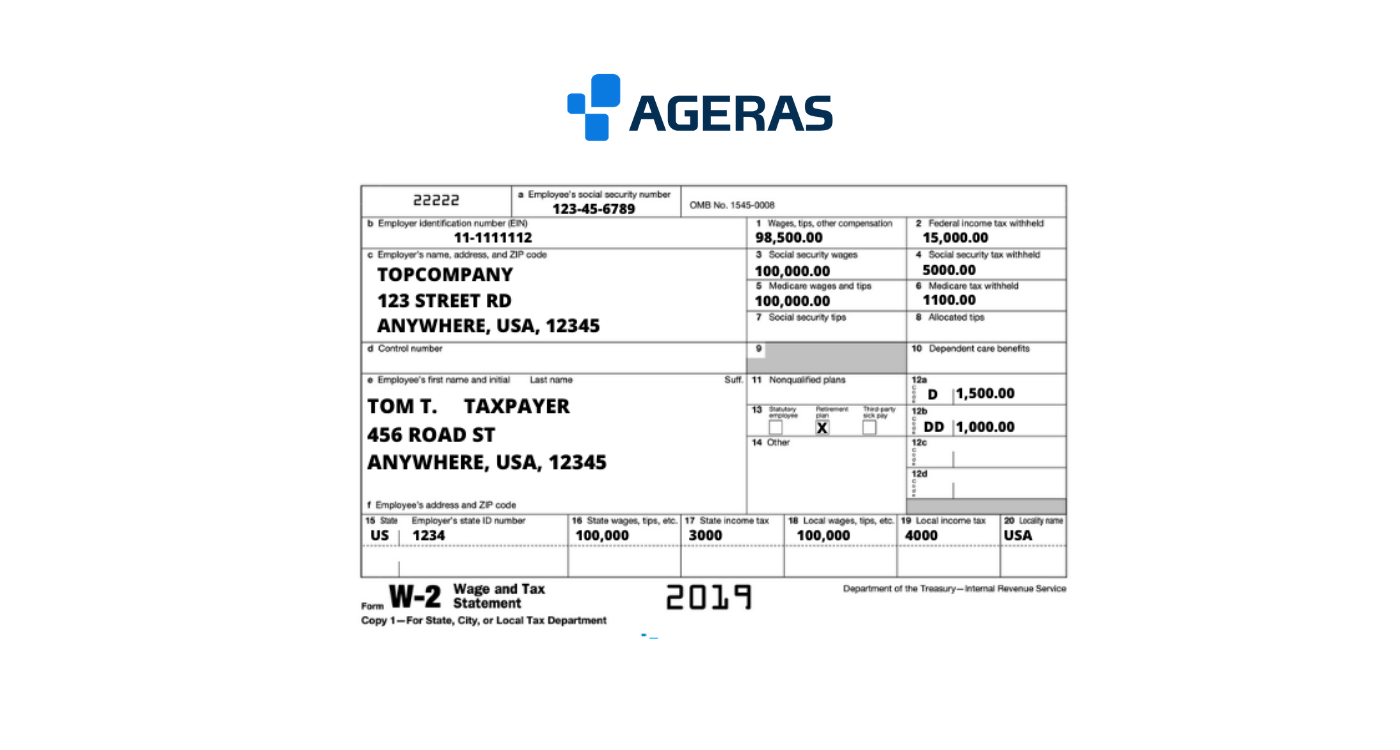

W2 Form Sample – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unlock the Magic of W2 Forms: A Sample to Simplify Your Taxes!

Are you ready to demystify the world of W2 forms and take control of your taxes? Look no further – we’re here to guide you through the process with a sample that will make everything crystal clear! Whether you’re a first-time filer or a seasoned tax pro, our easy-to-follow guide will help you unlock the magic of W2 forms and breeze through tax season like a true wizard.

Discover the Wizardry of W2 Forms!

If the thought of tackling your W2 forms has you feeling overwhelmed, don’t worry – you’re not alone! W2 forms can seem like a daunting puzzle at first, but once you understand the basics, you’ll be well on your way to mastering your taxes like a pro. From deciphering your employer’s information to understanding your income and deductions, our sample guide will walk you through each section step by step, making the process as simple as waving a wand.

Ready to dive into the world of W2 forms and unlock their hidden secrets? Our sample guide will break down each box on your form, explaining what information goes where and why it matters for your taxes. With our easy-to-follow instructions, you’ll be able to confidently fill out your W2 form and ensure that you’re reporting your income accurately. Say goodbye to tax season stress and hello to a newfound sense of confidence in your financial wizardry!

Unravel the Mystery with Our Easy Sample Guide!

As you work your way through our sample guide, you’ll begin to see the magic of W2 forms unfold before your eyes. Each section will make more sense, and you’ll start to feel like a tax-filing pro in no time. From understanding your taxable income to calculating your withholdings, our guide will empower you to take control of your finances and maximize your tax return. So grab your favorite wand (or pen) and let’s get started on simplifying your taxes!

In conclusion, don’t let the thought of tackling your W2 forms send you into a panic – with our sample guide, you’ll be well-equipped to handle your taxes with ease. By breaking down each section and providing clear explanations, we aim to demystify the process and help you unlock the magic of W2 forms. So wave goodbye to tax season stress and hello to a newfound sense of empowerment in your financial journey. Let’s make tax season a breeze together!

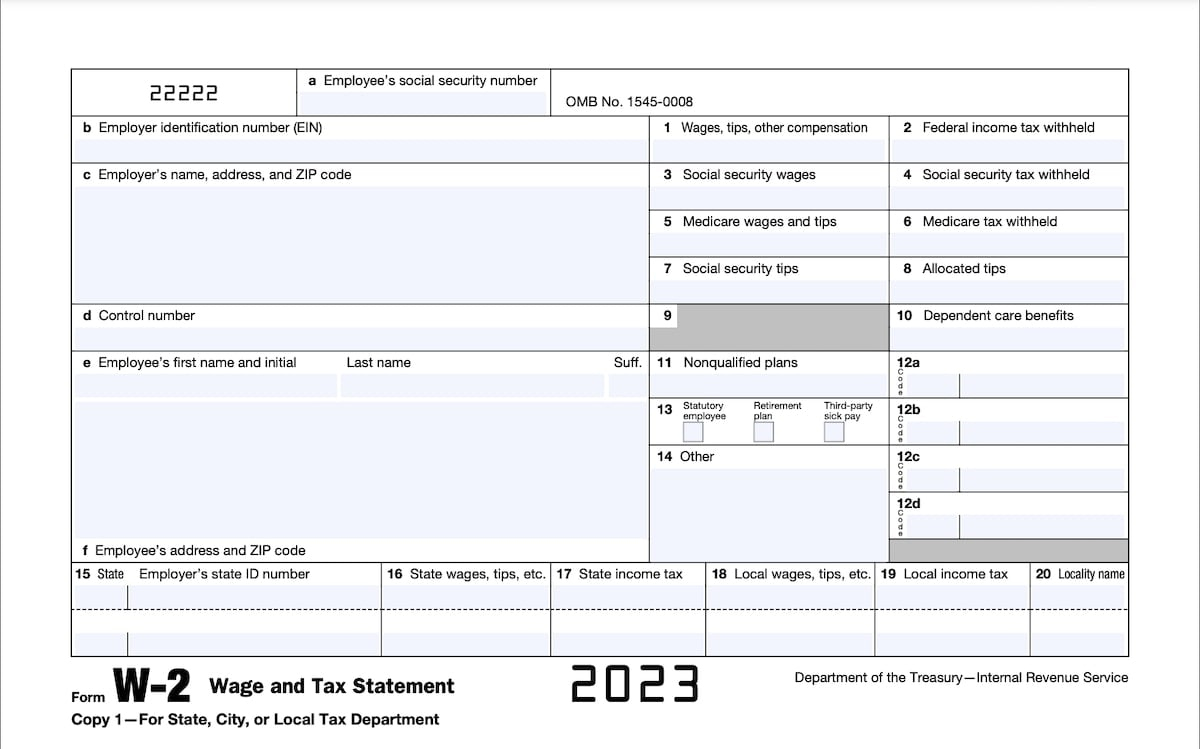

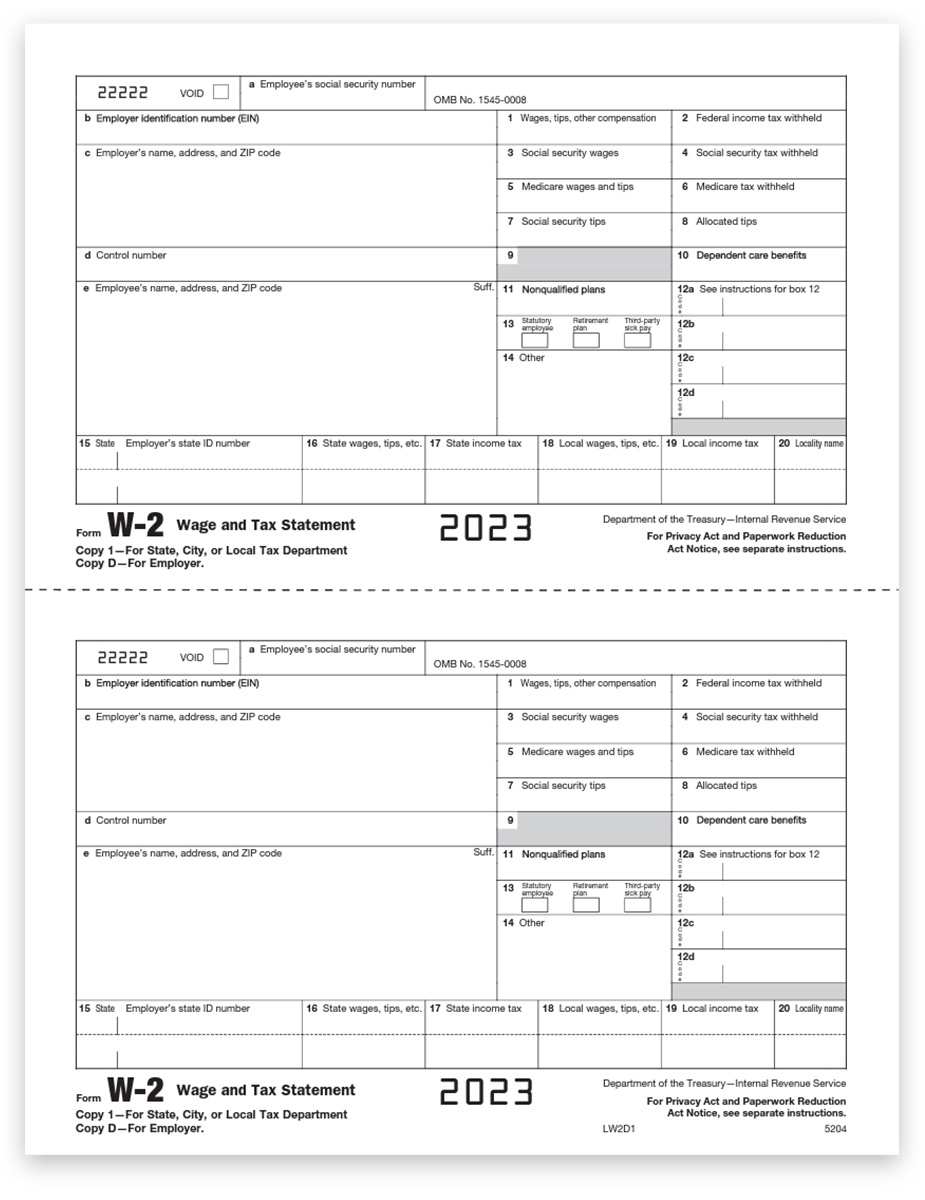

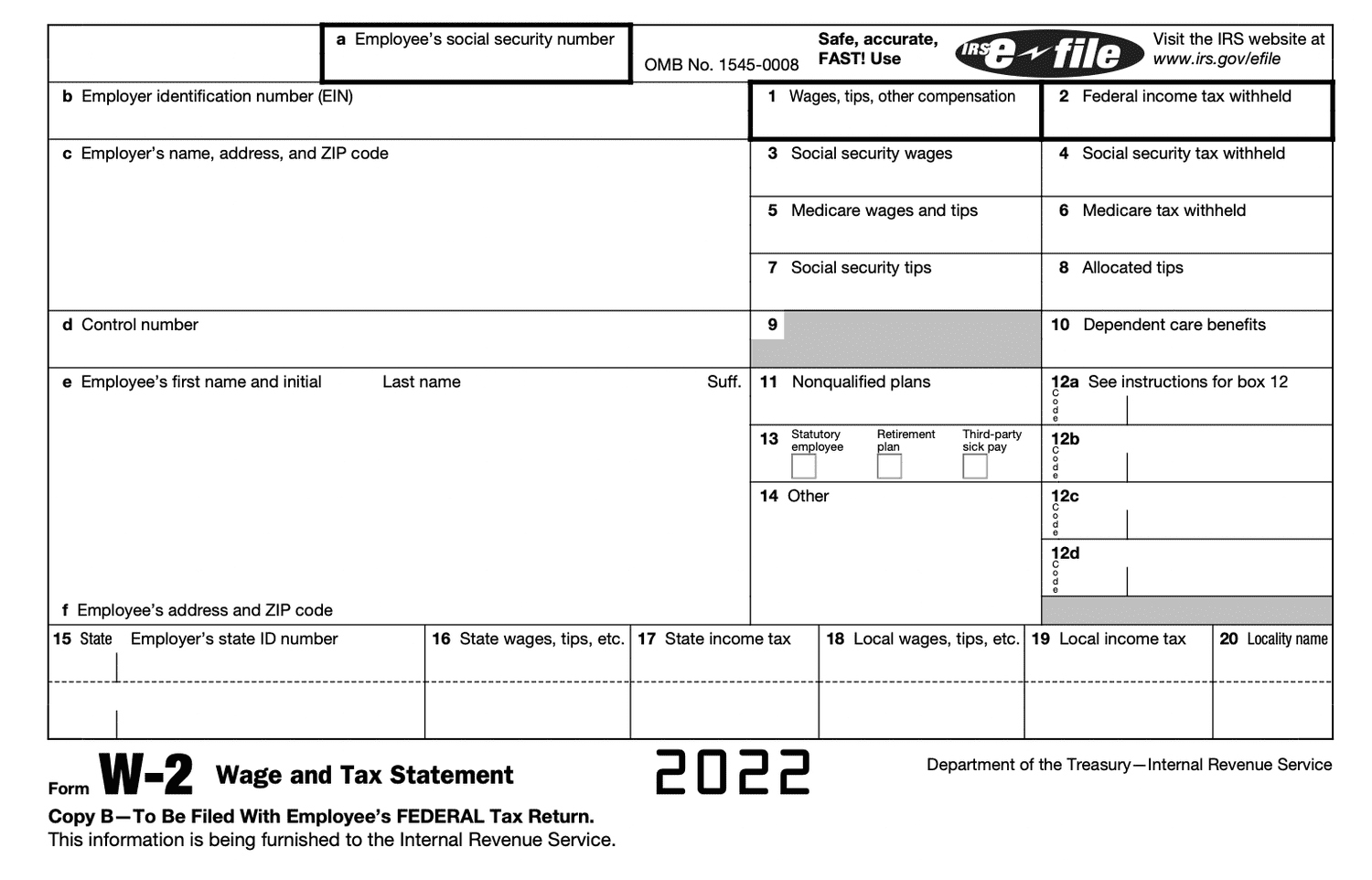

Below are some images related to W2 Form Sample

w2 form example 2022, w2 form sample, w2 form sample 2022, w2 form sample 2023, w2 form sample filled-out, , W2 Form Sample.

w2 form example 2022, w2 form sample, w2 form sample 2022, w2 form sample 2023, w2 form sample filled-out, , W2 Form Sample.