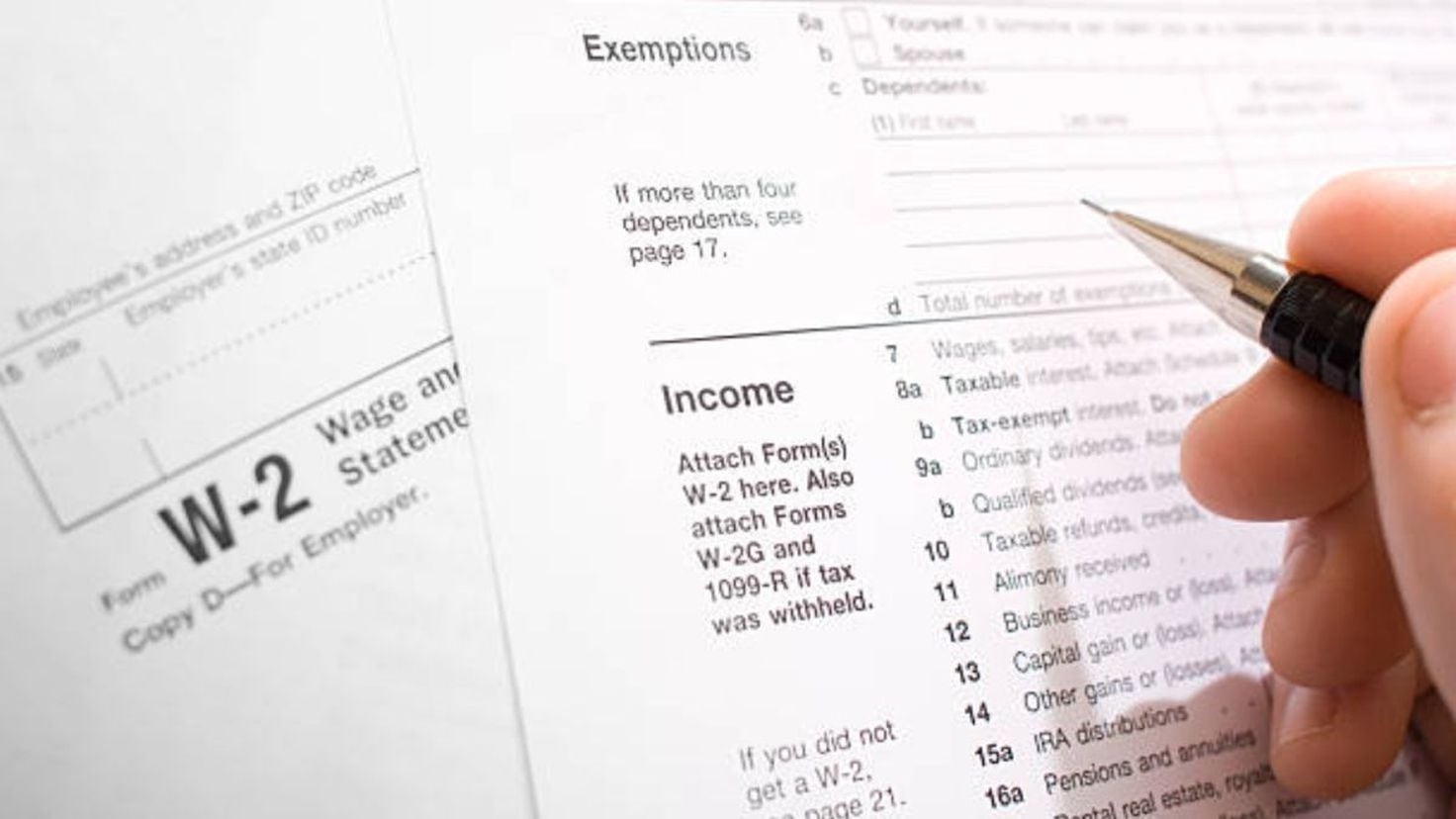

Did Not Receive W2 From Former Employer – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Lost Your W2? Don’t Panic – Here’s How to Get it Back!

So, you’ve realized that it’s tax season and you can’t seem to locate your W2 form. Don’t worry, you’re not alone! Many people find themselves in the same predicament every year. The good news is that retrieving your missing tax form is easier than you think. With a few simple steps, you’ll have your W2 in hand and be well on your way to filing your taxes stress-free.

Keep Calm and Retrieve Your Missing Tax Form with Ease

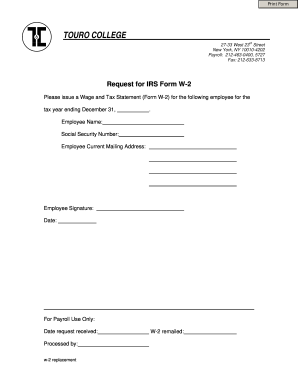

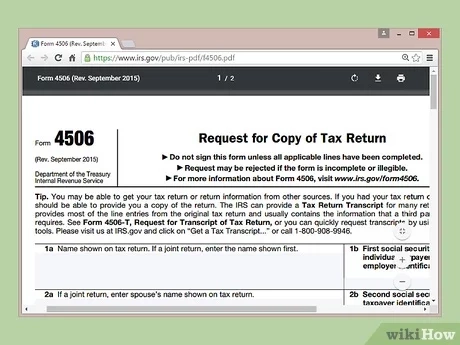

The first step in getting your missing W2 is to reach out to your employer. They are required by law to provide you with a copy of your W2 if you request it. If you no longer work for the company or are unable to get in touch with them, you can contact the Internal Revenue Service (IRS) for assistance. The IRS can help you obtain the information needed to file your taxes correctly, even if you don’t have your W2 in hand.

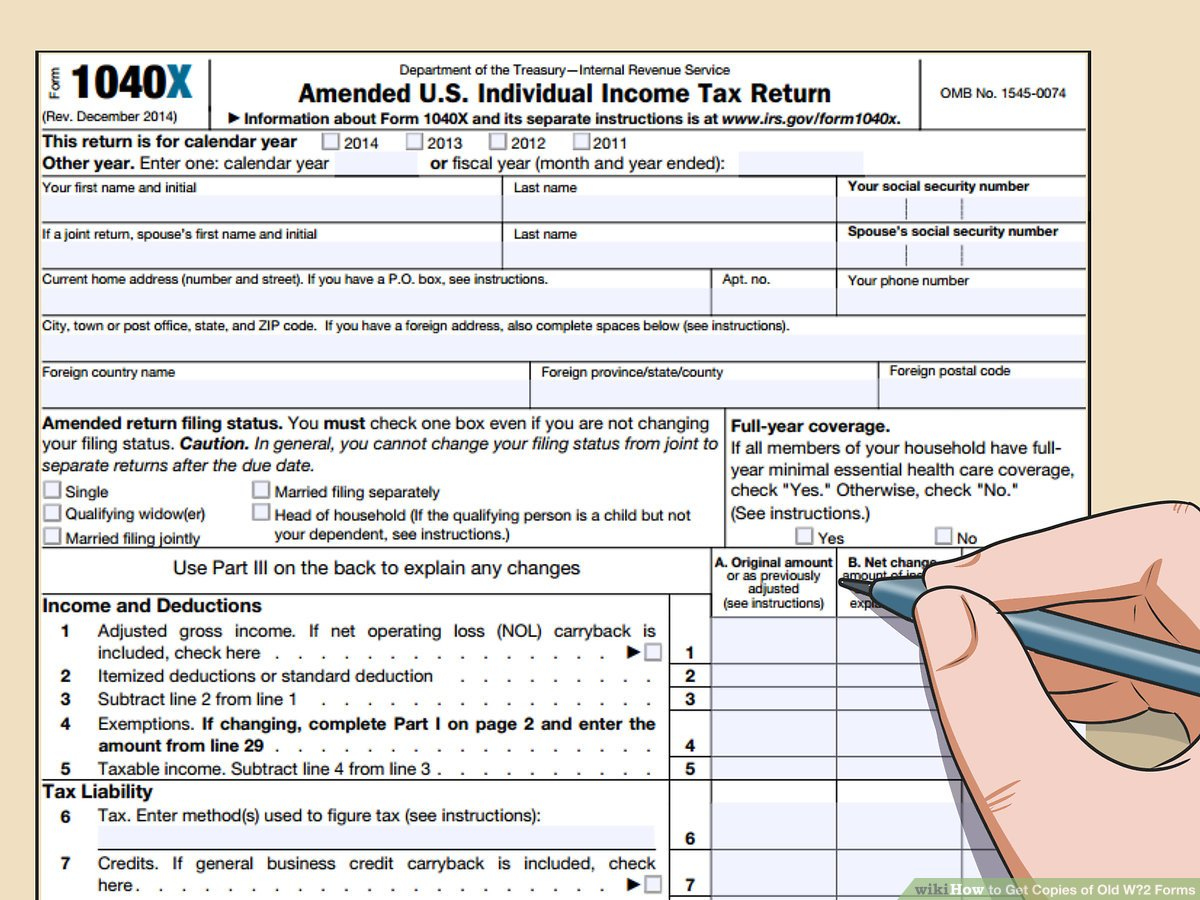

If all else fails, you can always use Form 4852 as a last resort. This form allows you to estimate your income and tax withholding information when you don’t have your W2. While it’s not the ideal situation, it is a viable option to ensure that you meet the tax deadline. Remember, it’s important to file your taxes on time, even if you’re missing your W2. Failure to do so can result in penalties and interest on any taxes owed.

In conclusion, losing your W2 is not the end of the world. With a little perseverance and the right resources, you can easily retrieve your missing tax form and file your taxes without any added stress. Remember to stay calm, reach out to your employer or the IRS for assistance, and use Form 4852 if necessary. Before you know it, you’ll have your taxes filed and be one step closer to a refund or at least knowing where you stand financially. Happy filing!

Below are some images related to Did Not Receive W2 From Former Employer

can you get w2 from previous employer, can’t get w2 from old employer, did not receive w2 from employer, did not receive w2 from former employer, did not receive w2 from previous employer, , Did Not Receive W2 From Former Employer.

can you get w2 from previous employer, can’t get w2 from old employer, did not receive w2 from employer, did not receive w2 from former employer, did not receive w2 from previous employer, , Did Not Receive W2 From Former Employer.