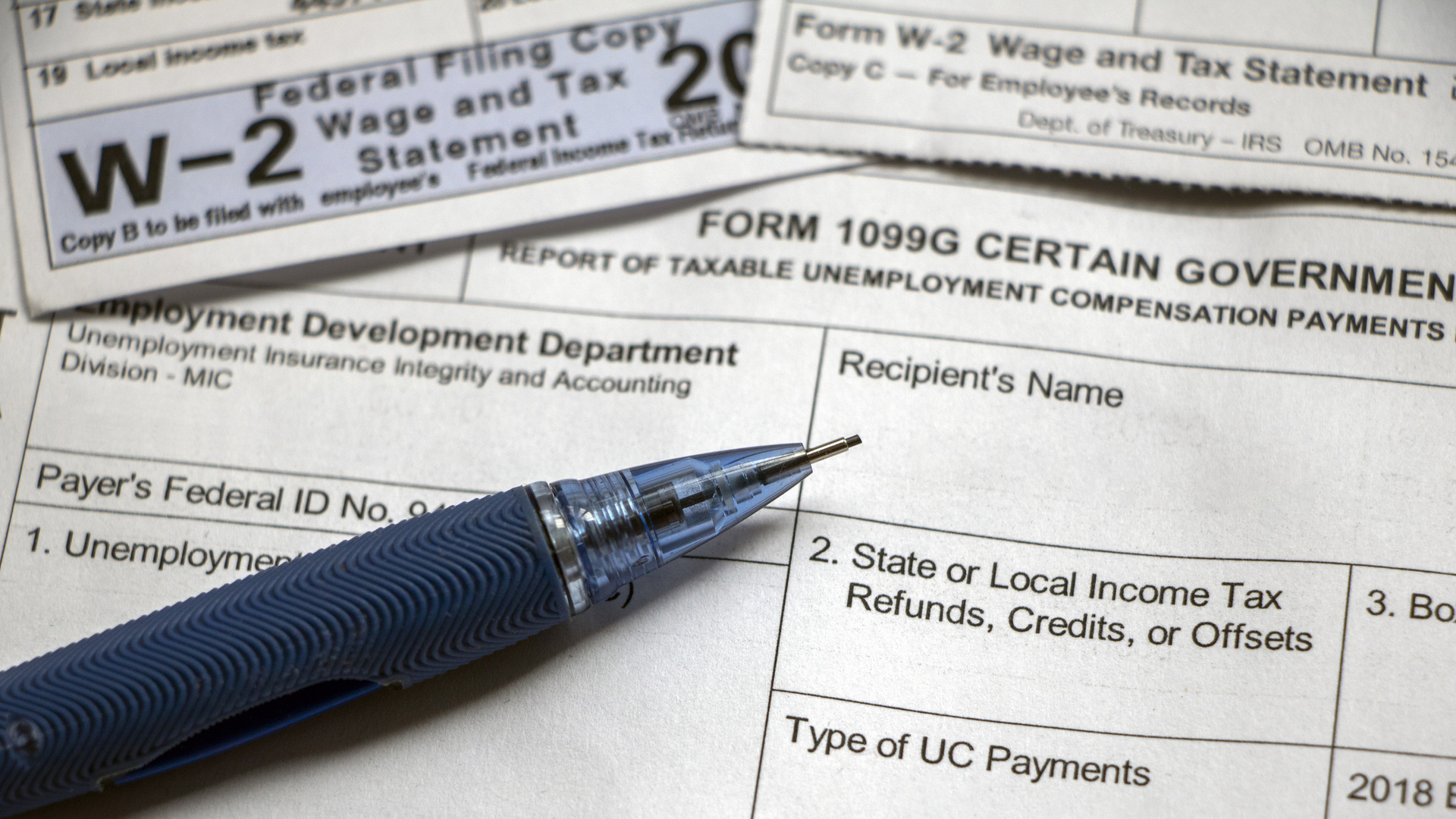

What If I Lost My W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Lost Your W2? No Problem!

So you’ve realized you’ve misplaced your W2 form – don’t worry, you’re not alone! It’s a common mistake that can happen to anyone. But before you start stressing out, take a deep breath and know that there are solutions available to help you retrieve a copy of your W2. With a little bit of patience and some simple steps, you’ll have your W2 in hand in no time!

Stay Calm – Solutions Await!

The first thing you should do if you’ve lost your W2 is to reach out to your employer. They are required by law to provide you with a copy of your W2 if you request it. Make sure to provide them with your correct contact information so they can send it to you promptly. If you’ve changed jobs or employers within the past year, make sure to reach out to all of them to ensure you have all the necessary forms.

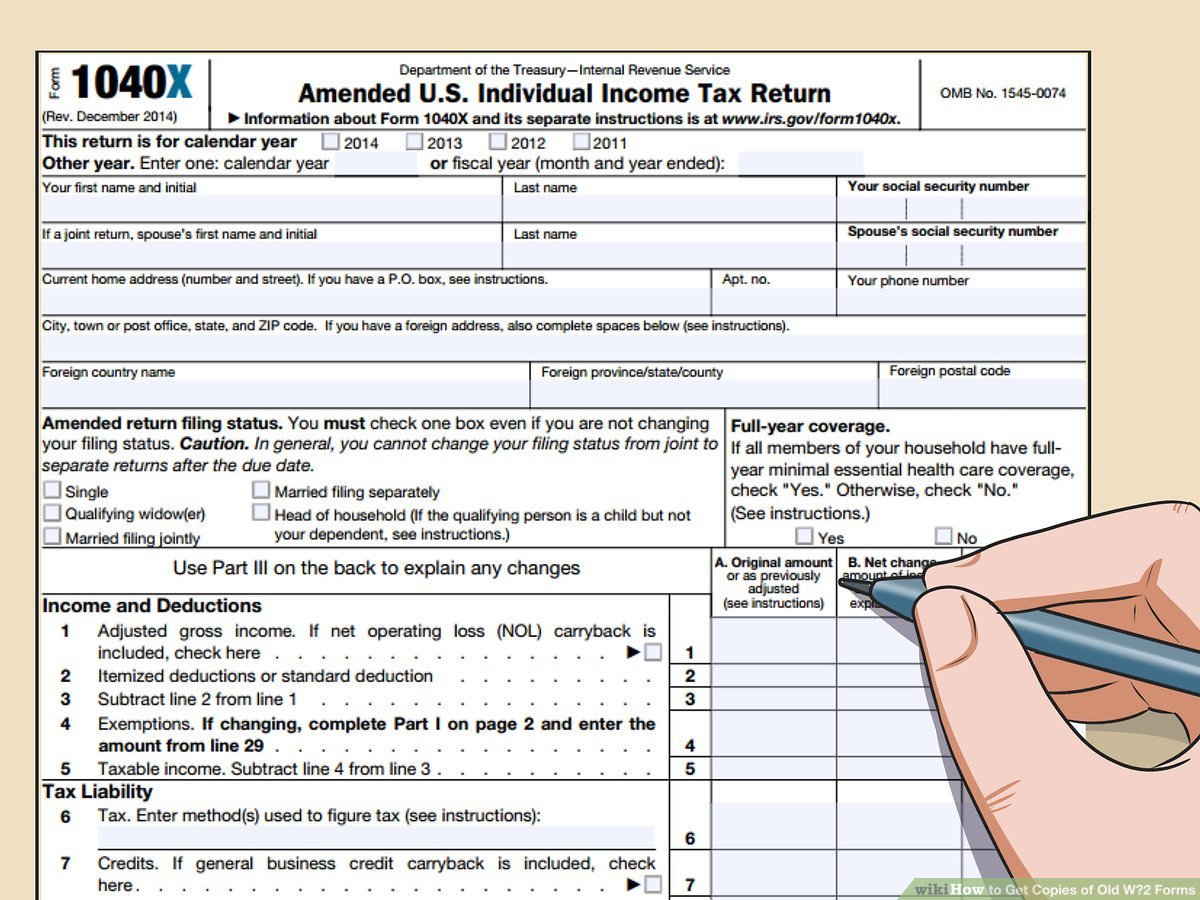

If you’re unable to get a copy of your W2 from your employer, you can also contact the IRS for assistance. They have a database of your tax information and can provide you with a copy of your W2 if needed. You may need to fill out Form 4506-T, Request for Transcript of Tax Return, to request a copy of your W2 from the IRS. It may take some time to receive it, so make sure to start the process as soon as possible.

Another option for retrieving your lost W2 is to use an online tax preparation service. Many of these services have the capability to retrieve your tax information directly from the IRS, making it easy to access your W2 without having to wait for physical copies to be mailed to you. Just make sure to use a reputable and secure service to protect your personal information.

Conclusion

Losing your W2 may seem like a daunting situation, but it’s important to stay calm and know that there are solutions available to help you get a copy of your tax form. Whether you reach out to your employer, contact the IRS, or use an online tax preparation service, there are ways to retrieve your W2 in a timely manner. So don’t panic – take a deep breath, follow the necessary steps, and you’ll have your W2 in hand before you know it!

Below are some images related to What If I Lost My W2 Form

what happens if i lost my w2, what happens if i lost my w2 form, what happens if you lost a w2 form, what if i forgot to file one of my w2 forms, what if i lose my w-2 form, , What If I Lost My W2 Form.

what happens if i lost my w2, what happens if i lost my w2 form, what happens if you lost a w2 form, what if i forgot to file one of my w2 forms, what if i lose my w-2 form, , What If I Lost My W2 Form.