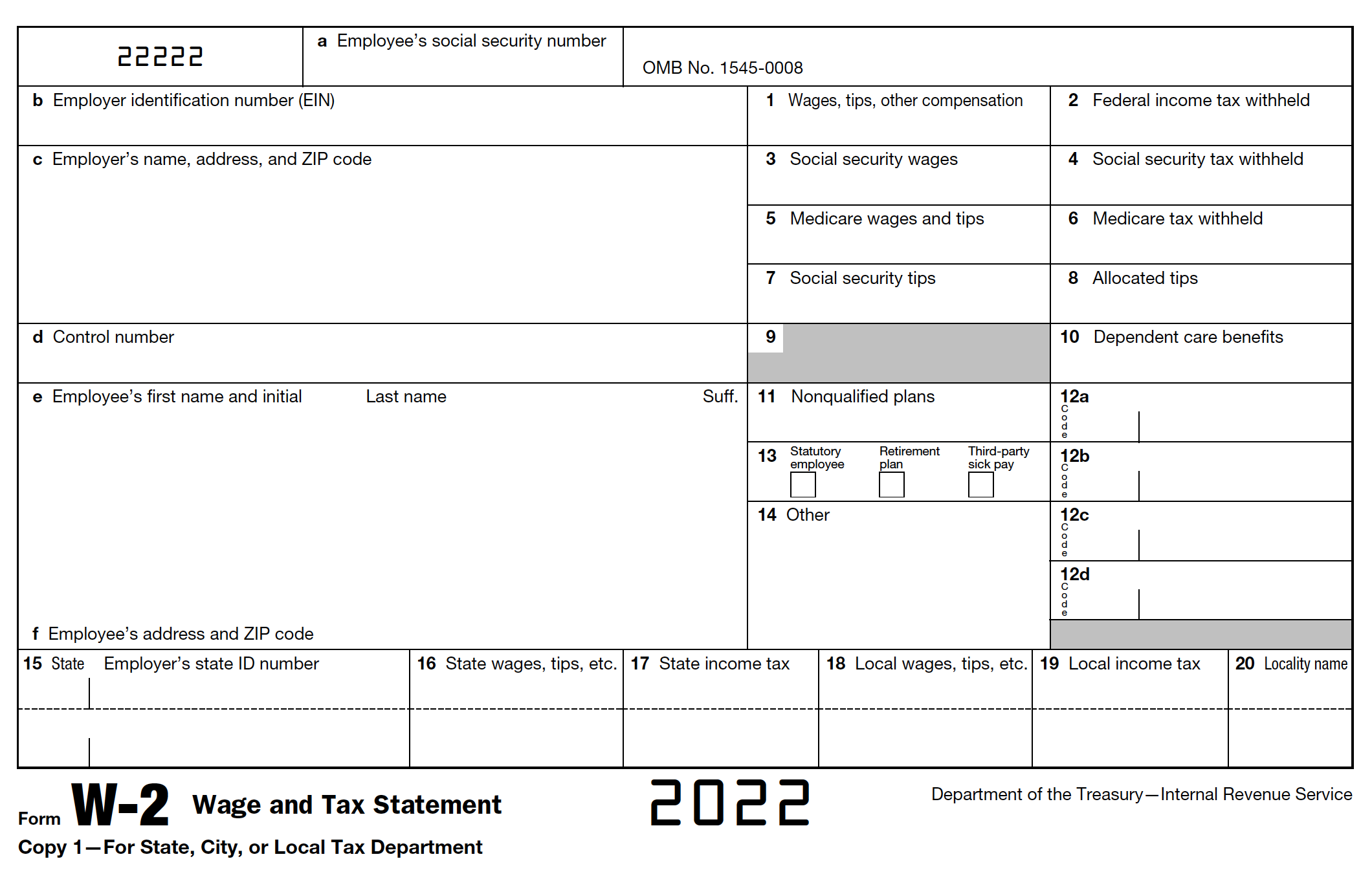

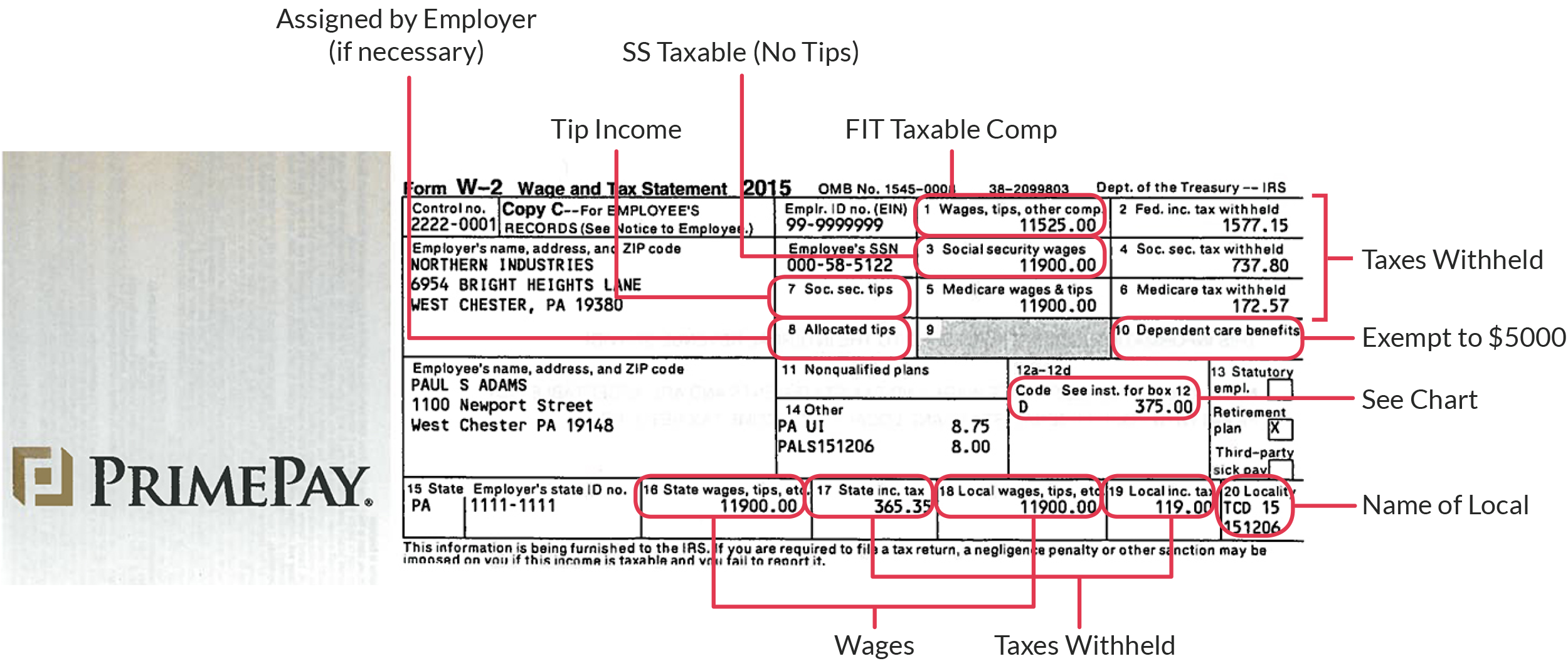

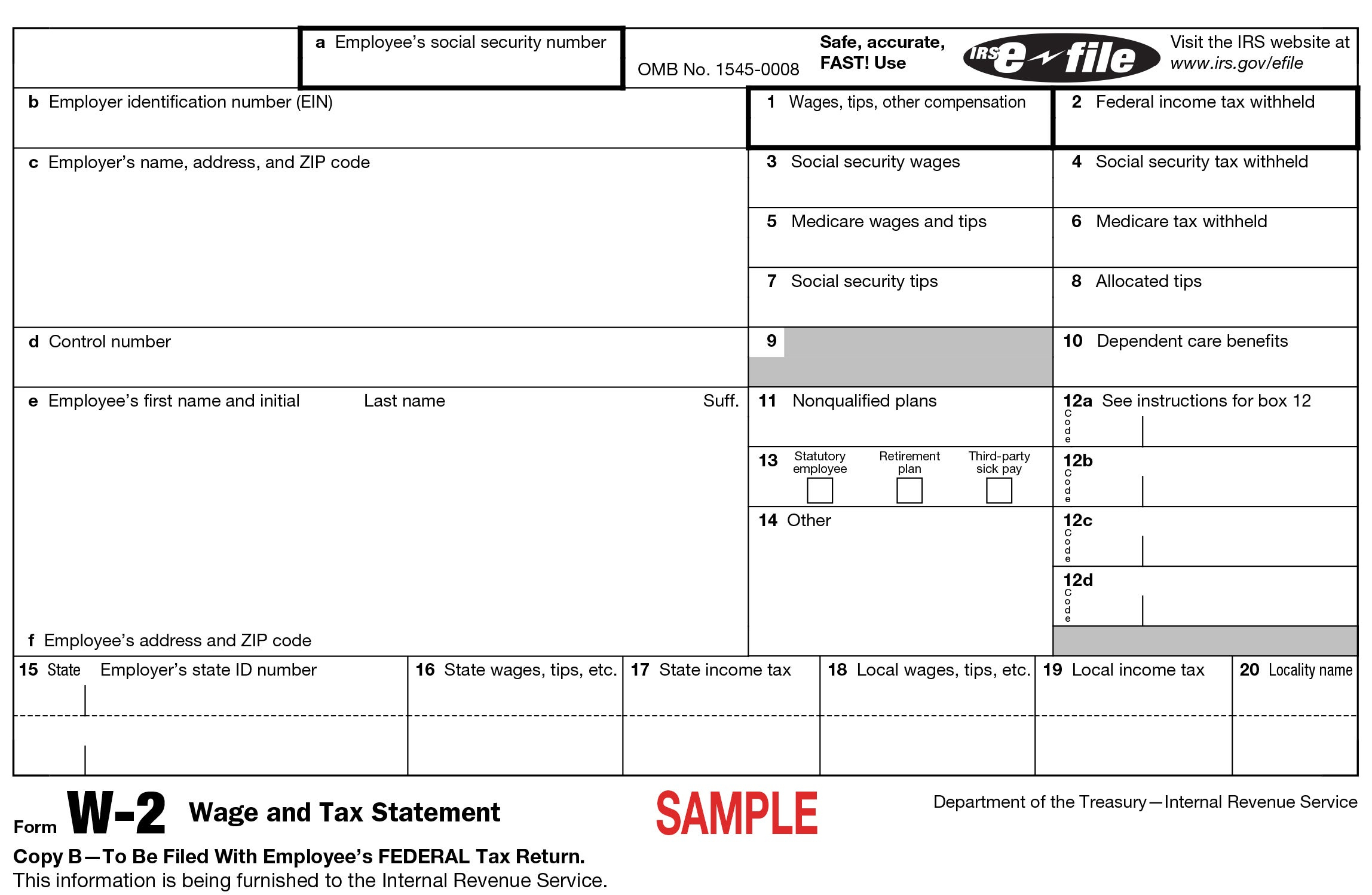

Box 14 On W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

The Curious Case of Box 14 on Your W2 Form

Have you ever looked at your W2 form and wondered what all those boxes mean? One of the most mysterious boxes on that form is Box 14. It seems to hold some sort of secret code that only the tax gods can decipher. But fear not, dear reader, for we are here to unravel the mystery of Box 14 and shed some light on its enigmatic contents.

Demystifying the Enigmatic Box 14: What Does It Mean?

Box 14 on your W2 form is like the hidden treasure chest of your tax documents. It can contain a variety of different codes and numbers that may seem confusing at first glance. However, once you understand the meaning behind these codes, you’ll be able to unlock a wealth of information about your tax situation. From union dues to educational assistance, Box 14 can provide valuable insights into your financial life.

So, what exactly can you find in Box 14? Some common codes you may encounter include things like health insurance premiums paid by your employer, contributions to a retirement plan, or even reimbursements for business expenses. Each code represents a different type of benefit or payment that could impact your tax return in one way or another. By taking the time to understand what each code means, you can ensure that you’re accurately reporting your income and deductions come tax time.

In conclusion, Box 14 on your W2 form may seem like a mysterious puzzle at first, but with a little bit of investigation, you can crack the code and make sense of its contents. By familiarizing yourself with the various codes and understanding what they mean, you’ll be better equipped to handle your taxes and make the most of any potential deductions or benefits. So, the next time you receive your W2 form, don’t be intimidated by Box 14 – embrace the challenge and let your tax-savvy skills shine!

Below are some images related to Box 14 On W2 Form

box 14 on w2 form, box 14 on w2 form pre tax, explain box 14 on w2 form, instruction for box 14 on w2 form, what do i put for box 14 on w2, , Box 14 On W2 Form.

box 14 on w2 form, box 14 on w2 form pre tax, explain box 14 on w2 form, instruction for box 14 on w2 form, what do i put for box 14 on w2, , Box 14 On W2 Form.