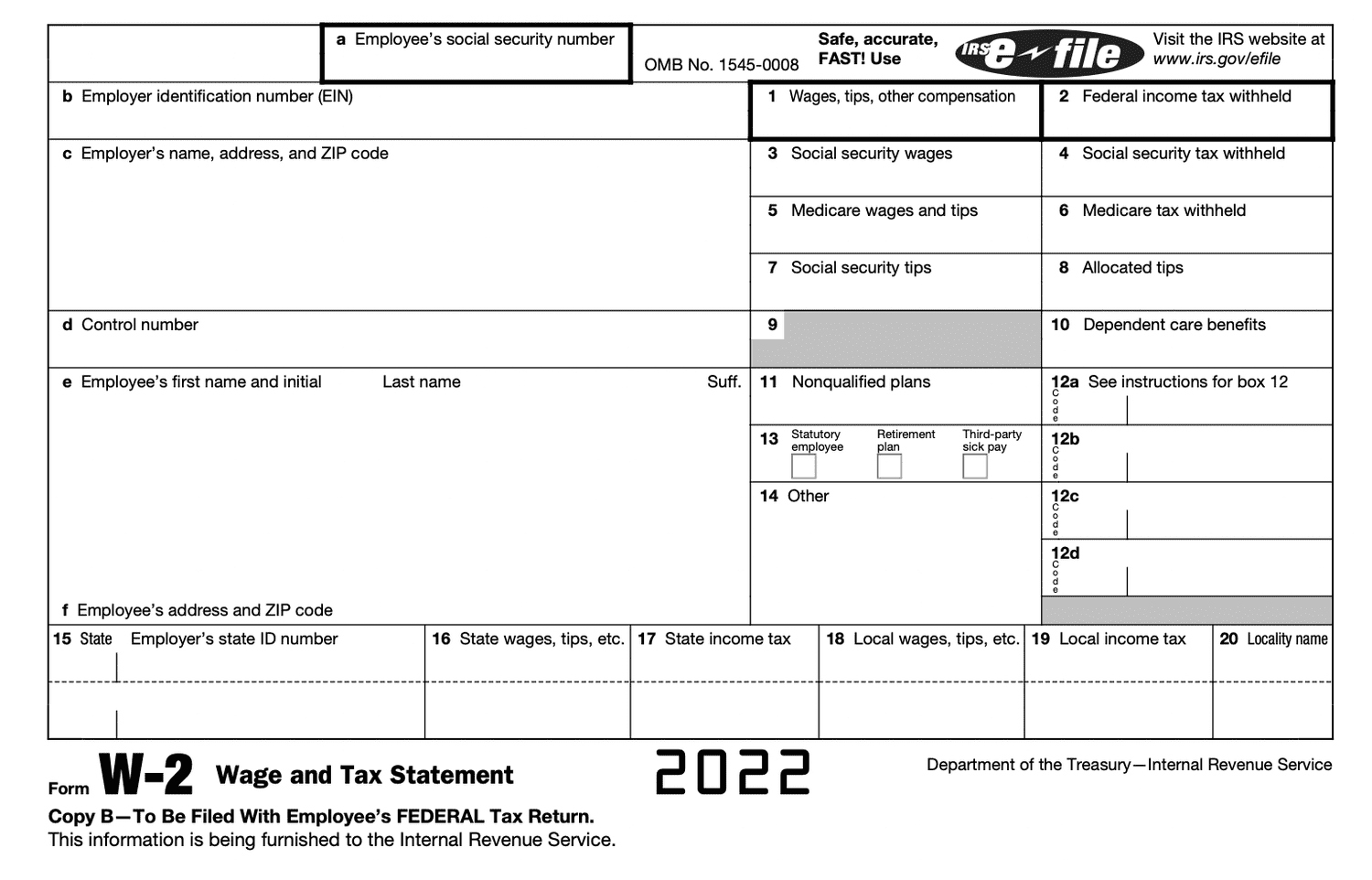

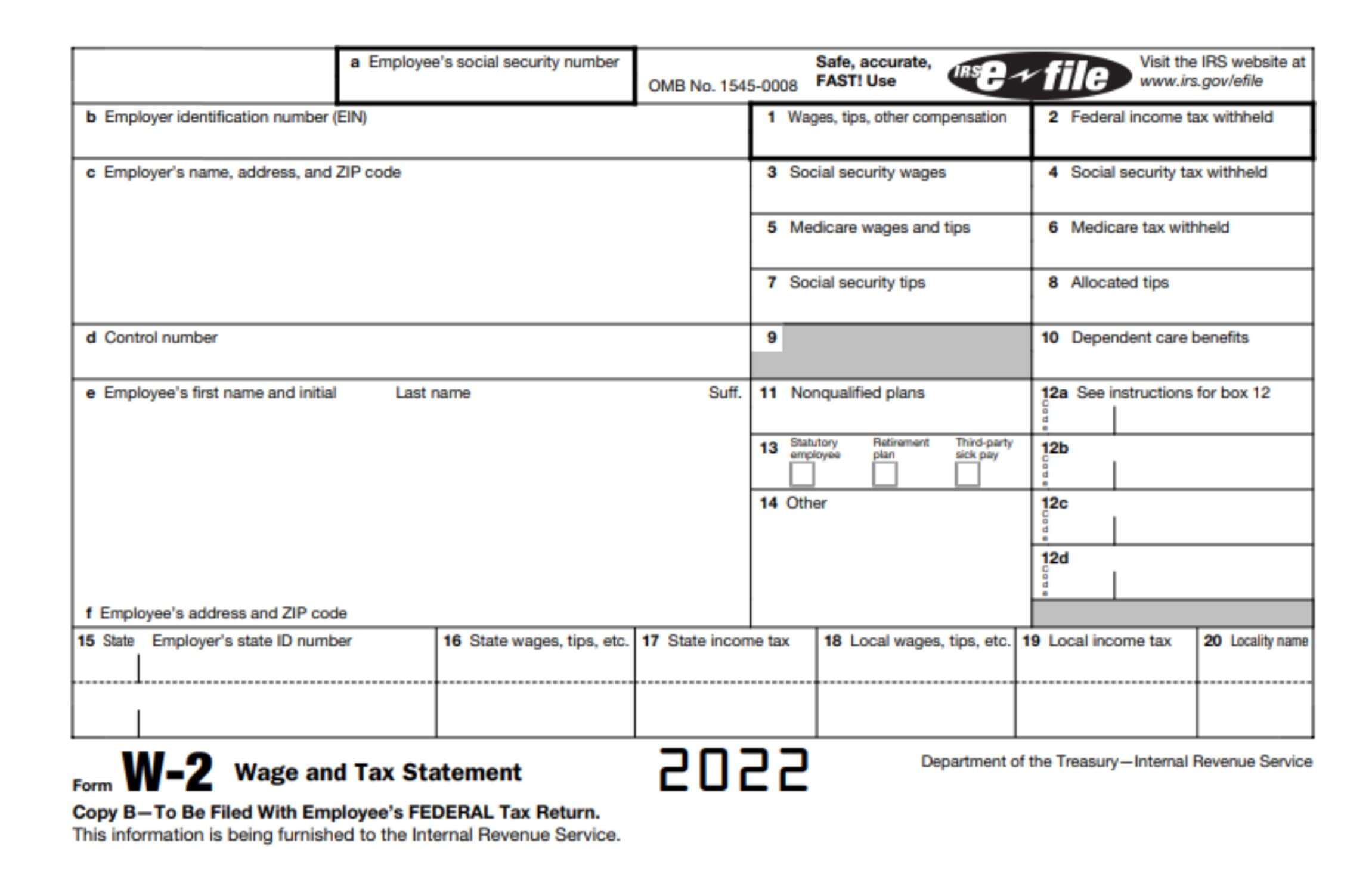

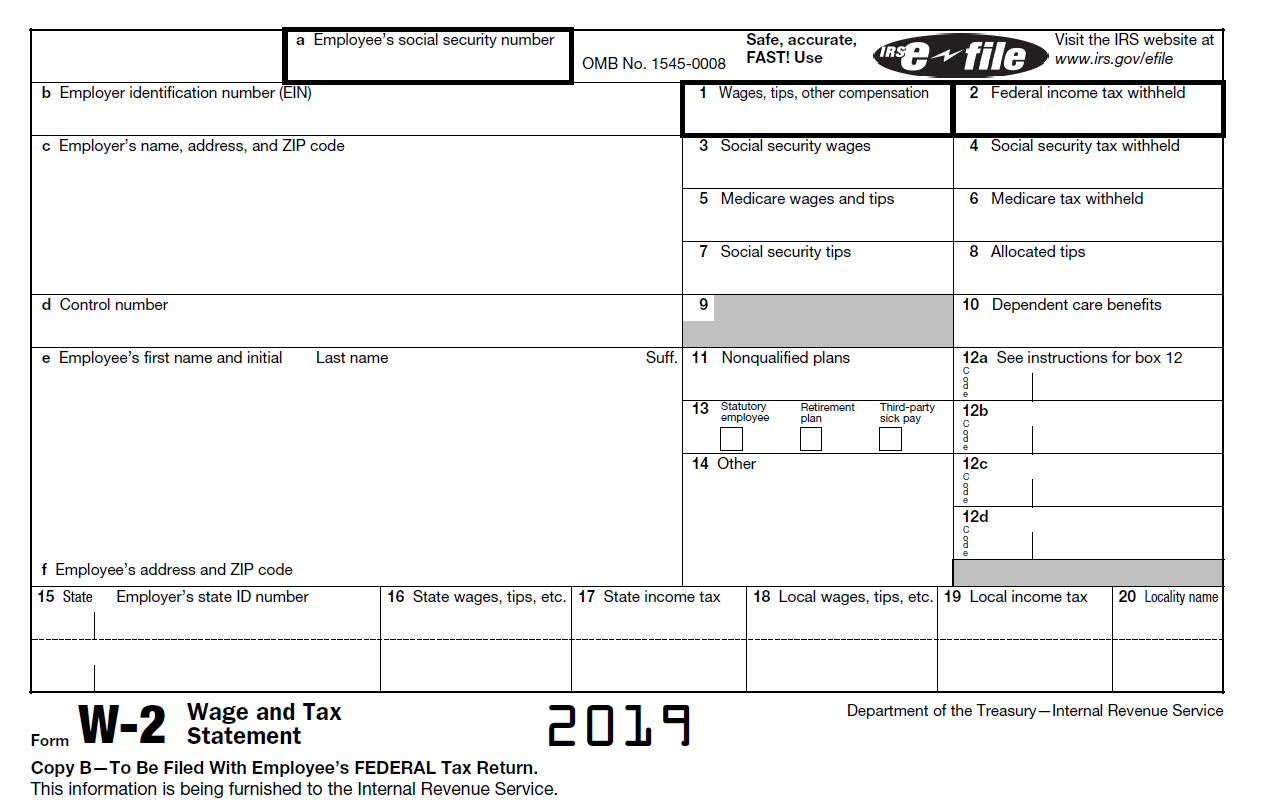

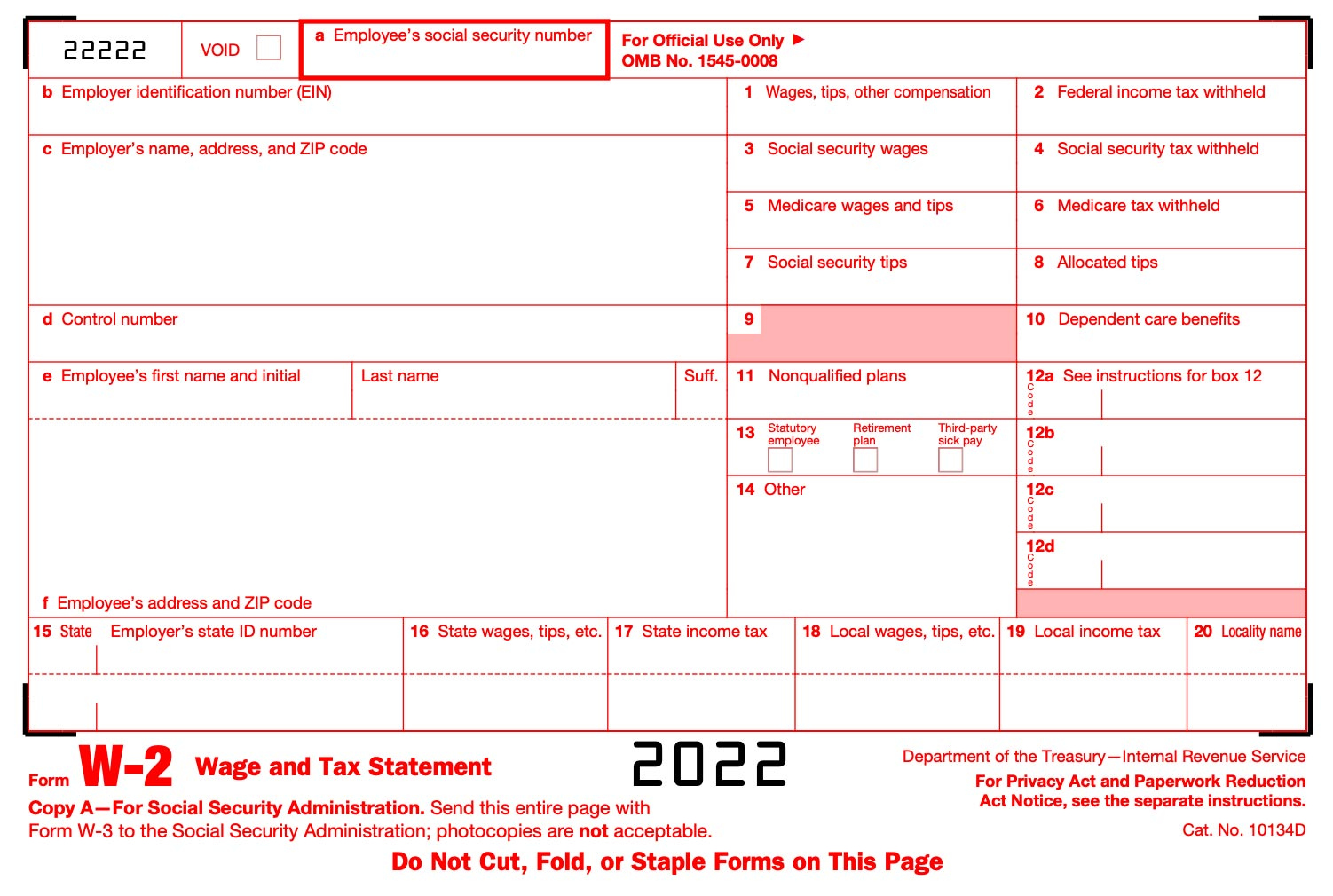

W2 Form Irs – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unwrapping the Wonders of the W2 Form: Your Key to Tax Happiness!

Tax season can often be a stressful time for many, but fear not! The W2 form is here to save the day and make your tax filing experience a breeze. This magical document holds all the key information your employer reports to the IRS, such as your earnings and taxes withheld. Let’s dive into the wonders of the W2 form and discover how it can unlock your tax joy!

Discover the Magic of the W2 Form!

The W2 form is like a treasure map leading you to potential tax refunds and savings. It provides a comprehensive summary of your annual income, tax withholdings, and other important details that are essential for accurately filing your taxes. By carefully examining your W2 form, you can uncover valuable information that may impact your tax liability. Whether you’re a seasoned tax filer or a newbie to the process, the W2 form is your key to unlocking a successful tax season.

The beauty of the W2 form lies in its simplicity and convenience. Instead of scrambling to gather various pay stubs and financial documents, your W2 form neatly consolidates all the necessary information in one place. This means less time spent searching for paperwork and more time focusing on maximizing your tax return. With the help of the W2 form, you can confidently navigate the tax filing process and ensure that you are taking advantage of all available deductions and credits.

Let the W2 Form Unlock Your Tax Joy!

Embrace the W2 form as your trusted ally in the world of taxes. This powerful document not only simplifies the tax filing process but also empowers you to take control of your financial future. By understanding the information contained in your W2 form, you can make informed decisions that may lead to tax savings and increased financial security. So, don’t dread tax season – let the W2 form be your guide to tax happiness!

In conclusion, the W2 form is a valuable tool that can transform your tax filing experience from daunting to delightful. Take the time to familiarize yourself with your W2 form and leverage its insights to your advantage. With the magic of the W2 form on your side, you can navigate the complex world of taxes with confidence and ease. So, embrace this wonderous document and unlock your tax joy today!

Below are some images related to W2 Form Irs

2019 w2 form irs, 2020 w2 form irs, download w2 form irs, w2 fillable form irs, w2 form irs, , W2 Form Irs.

2019 w2 form irs, 2020 w2 form irs, download w2 form irs, w2 fillable form irs, w2 form irs, , W2 Form Irs.