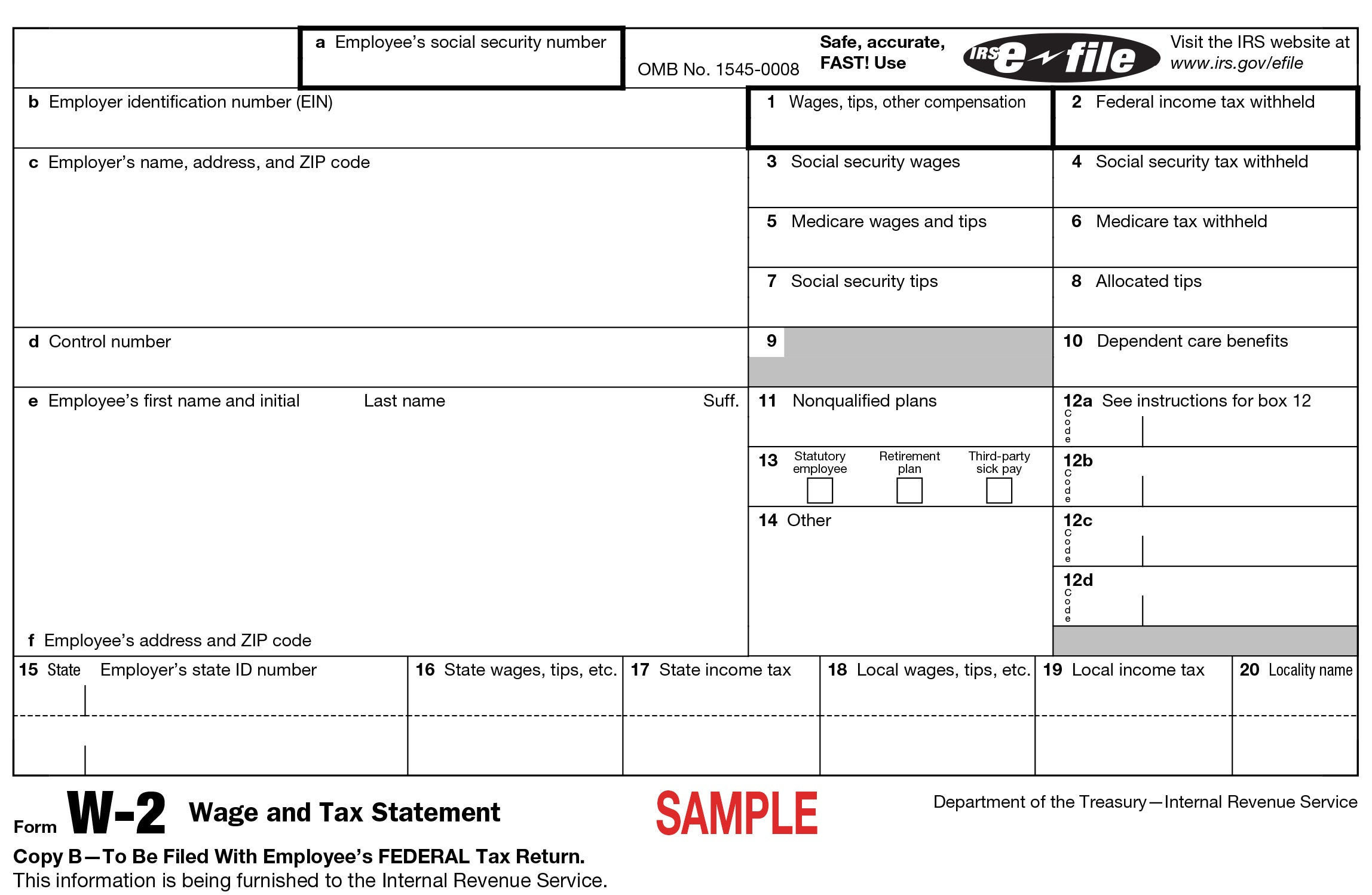

W2 Form 12a Dd – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

The Magic of W2 Form 12a Dd: Unlocking Your Tax Refund!

Are you ready to uncover the hidden treasure that lies within your W2 Form 12a Dd? This seemingly ordinary piece of paperwork holds the key to unlocking your tax refund dreams! It’s time to wave your wand and watch as the magic unfolds before your very eyes.

Discover the Enchantment of W2 Form 12a Dd!

W2 Form 12a Dd may look like just another box to check off on your tax forms, but don’t be fooled by its unassuming appearance. This little box has the power to make a big impact on your tax refund. By filling out this section correctly, you could be eligible for special tax credits and deductions that you never even knew existed. It’s like discovering a hidden chamber in a magical castle – you never know what treasures await until you explore it fully.

Not sure how to navigate the complexities of W2 Form 12a Dd? Don’t worry – there are plenty of resources available to help guide you through the process. From online tutorials to professional tax advisors, there’s no shortage of assistance to ensure you’re taking full advantage of all the tax benefits available to you. So don’t be afraid to dive into the world of W2 Form 12a Dd and see just how much you can uncover.

Let Your Tax Refund Dreams Come True!

Imagine the joy and excitement of receiving a tax refund that is bigger than you ever expected. That dream can become a reality when you tap into the magic of W2 Form 12a Dd. By simply dedicating a little time and attention to this important form, you could be opening doors to financial rewards that will leave you feeling like you’ve won the lottery. So why wait? Start exploring the possibilities today and watch as your tax refund dreams come true.

In conclusion, the power of W2 Form 12a Dd is not to be underestimated. It holds the potential to unlock a world of tax benefits that can make a significant difference in your financial well-being. So embrace the magic, fill out that form with care, and get ready to reap the rewards of your efforts. Your tax refund dreams are within reach – all you have to do is believe in the enchantment of W2 Form 12a Dd!

Below are some images related to W2 Form 12a Dd

![Form W-2 Box 12 Codes | Codes And Explanations [Chart] intended for W2 Form 12A Dd](https://ezambiablog.com/wp-content/uploads/2024/02/form-w-2-box-12-codes-codes-and-explanations-chart-intended-for-w2-form-12a-dd.jpg) w-2 form 12b dd, w-2 form box 12b dd, w-2 form line 12a code dd, w2 form 12 dd, w2 form 12a dd, , W2 Form 12a Dd.

w-2 form 12b dd, w-2 form box 12b dd, w-2 form line 12a code dd, w2 form 12 dd, w2 form 12a dd, , W2 Form 12a Dd.