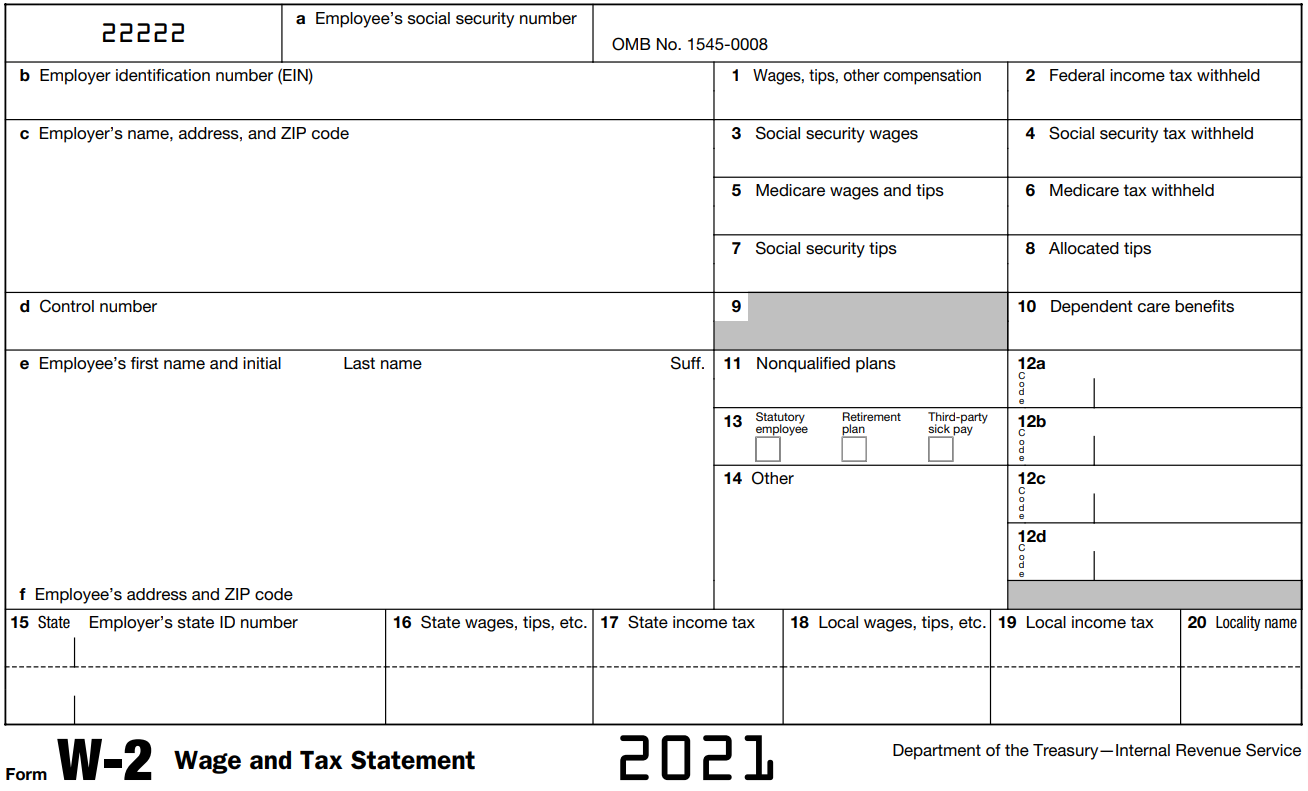

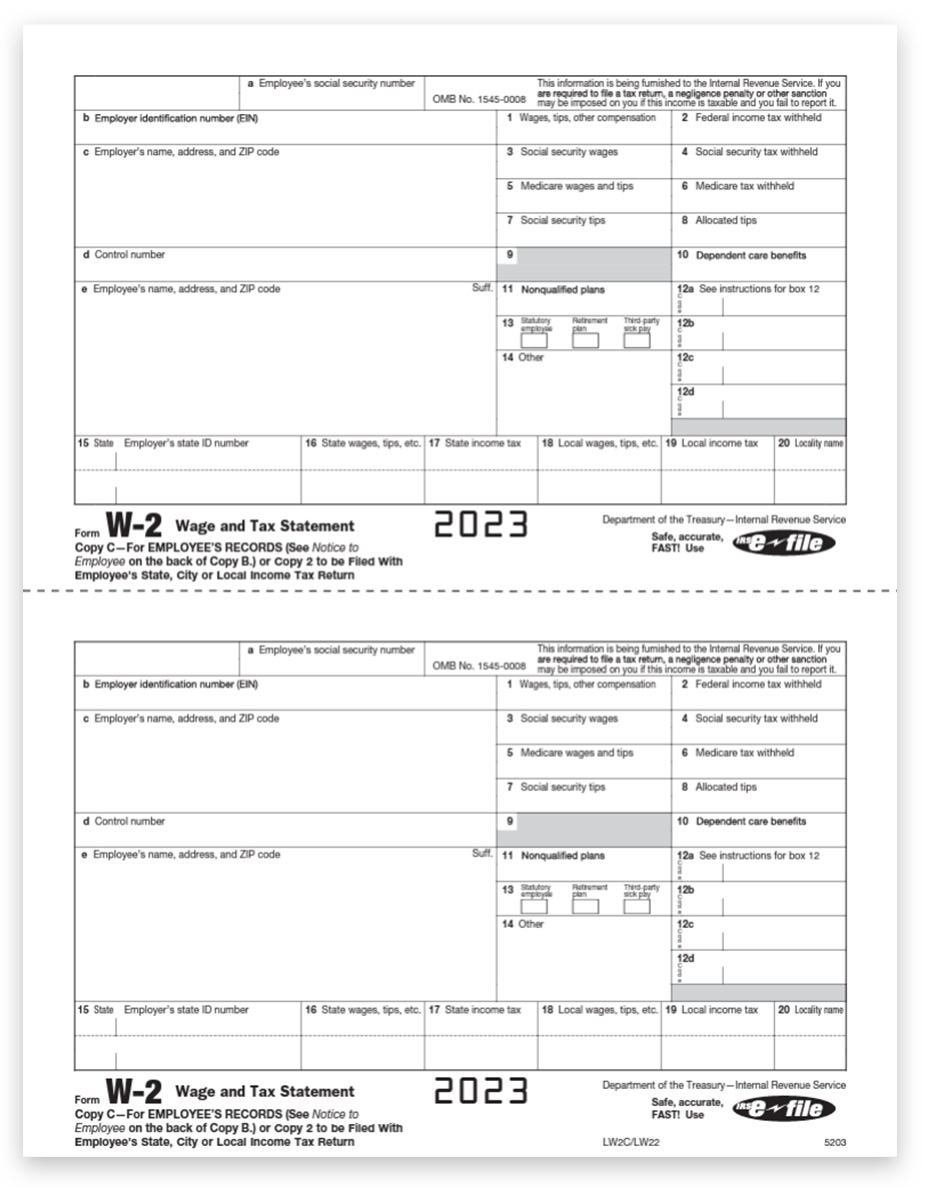

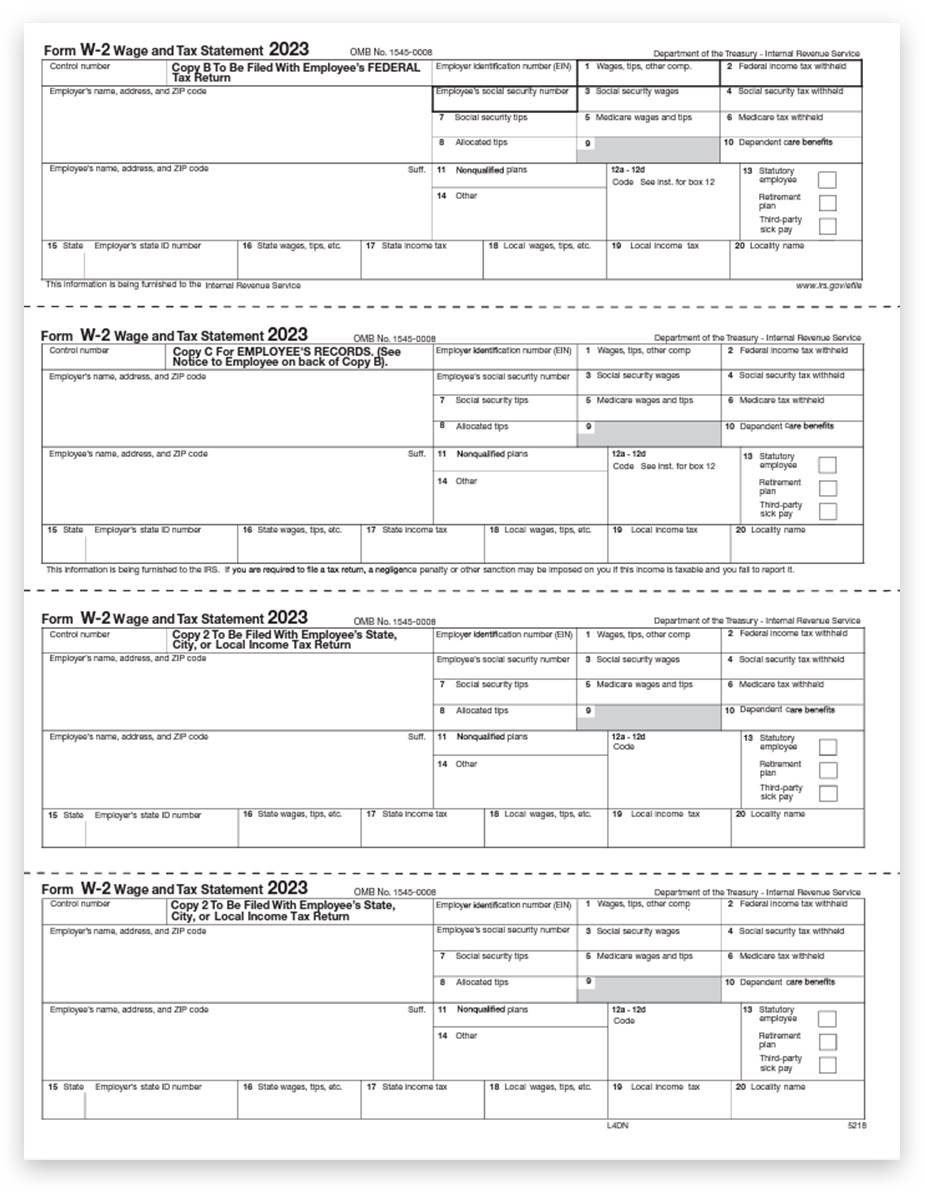

Missouri W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unveiling the Enchantment of Missouri W2 Forms

Have you ever felt the thrill of unlocking the magic contained within Missouri W2 forms? These seemingly mundane documents hold the power to provide a gateway to financial prosperity and empowerment. As you delve into the world of Missouri W2 forms, you will discover a hidden realm of possibilities waiting to be explored. Let’s embark on a journey together to unveil the enchantment of Missouri W2 forms!

Discover the Secret to Harnessing Missouri W2 Magic

The key to harnessing the magic of Missouri W2 forms lies in understanding their intricate details and utilizing them to your advantage. By decoding the information contained within these forms, you can gain valuable insights into your financial situation and take control of your future. From calculating your tax liabilities to planning for retirement, Missouri W2 forms are your ticket to financial freedom. Get ready to unlock the secrets of these mystical documents and unleash their full potential!

Unleash the Power of Missouri W2 Forms

Once you have mastered the art of deciphering Missouri W2 forms, you will be able to harness their power to achieve your financial goals. Whether you are a seasoned professional or a newcomer to the world of taxes, Missouri W2 forms can help you navigate the complexities of the financial landscape with ease. By harnessing the magic of these forms, you can make informed decisions about your finances, secure your future, and unlock a world of possibilities. Embrace the enchantment of Missouri W2 forms and watch as they transform your financial outlook for the better!

In conclusion, Missouri W2 forms are more than just paperwork – they are a gateway to financial empowerment and prosperity. By unveiling the enchantment of these forms and harnessing their magic, you can take control of your financial destiny and achieve your goals. So, let’s dive into the world of Missouri W2 forms and unlock the secrets that will lead us to a brighter, more secure future.

Below are some images related to Missouri W2 Form

does missouri have a state withholding form, does missouri unemployment send w2, how to file missouri w2, missouri w2 filing requirements, missouri w2 form, , Missouri W2 Form.

does missouri have a state withholding form, does missouri unemployment send w2, how to file missouri w2, missouri w2 filing requirements, missouri w2 form, , Missouri W2 Form.