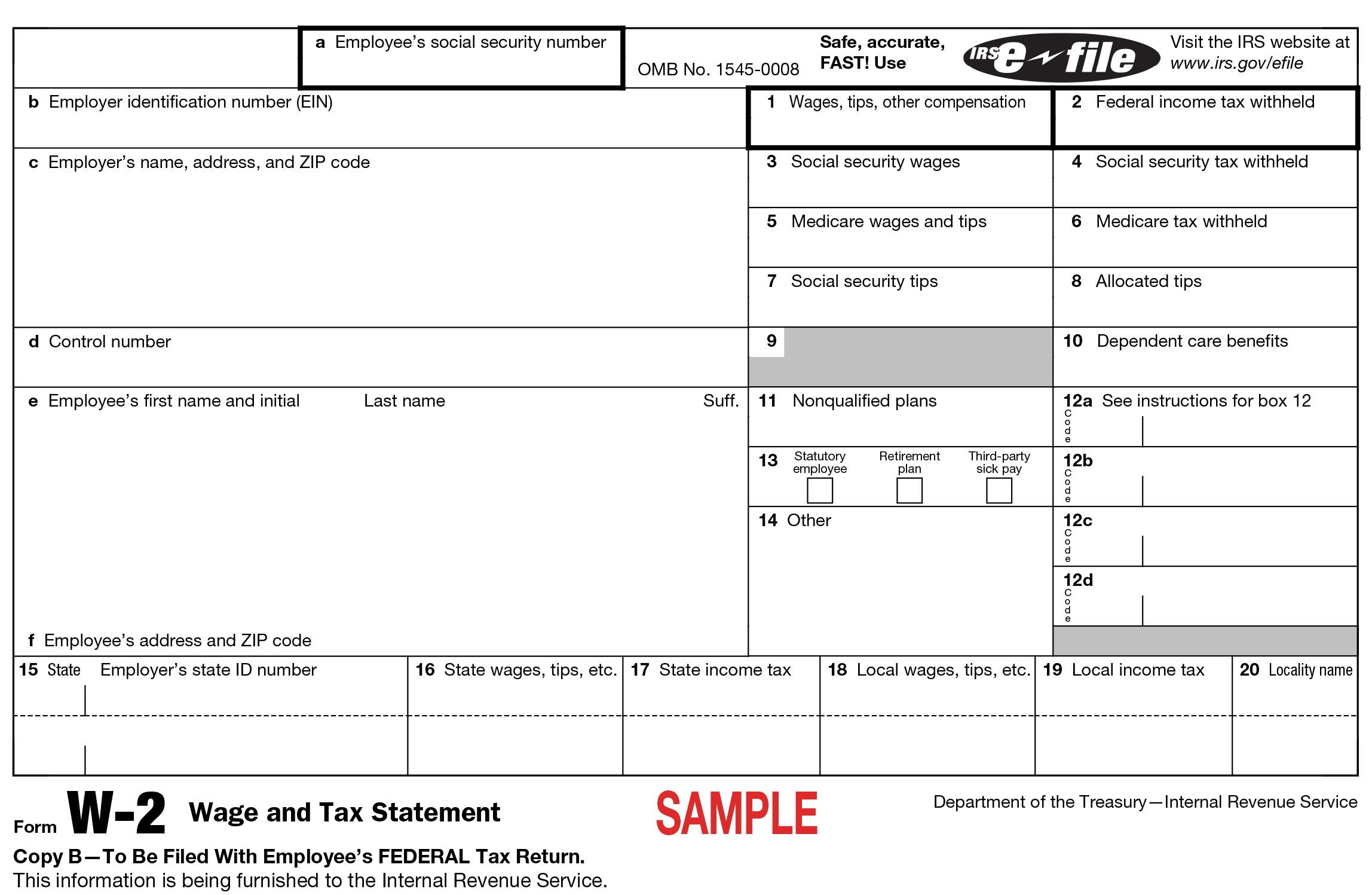

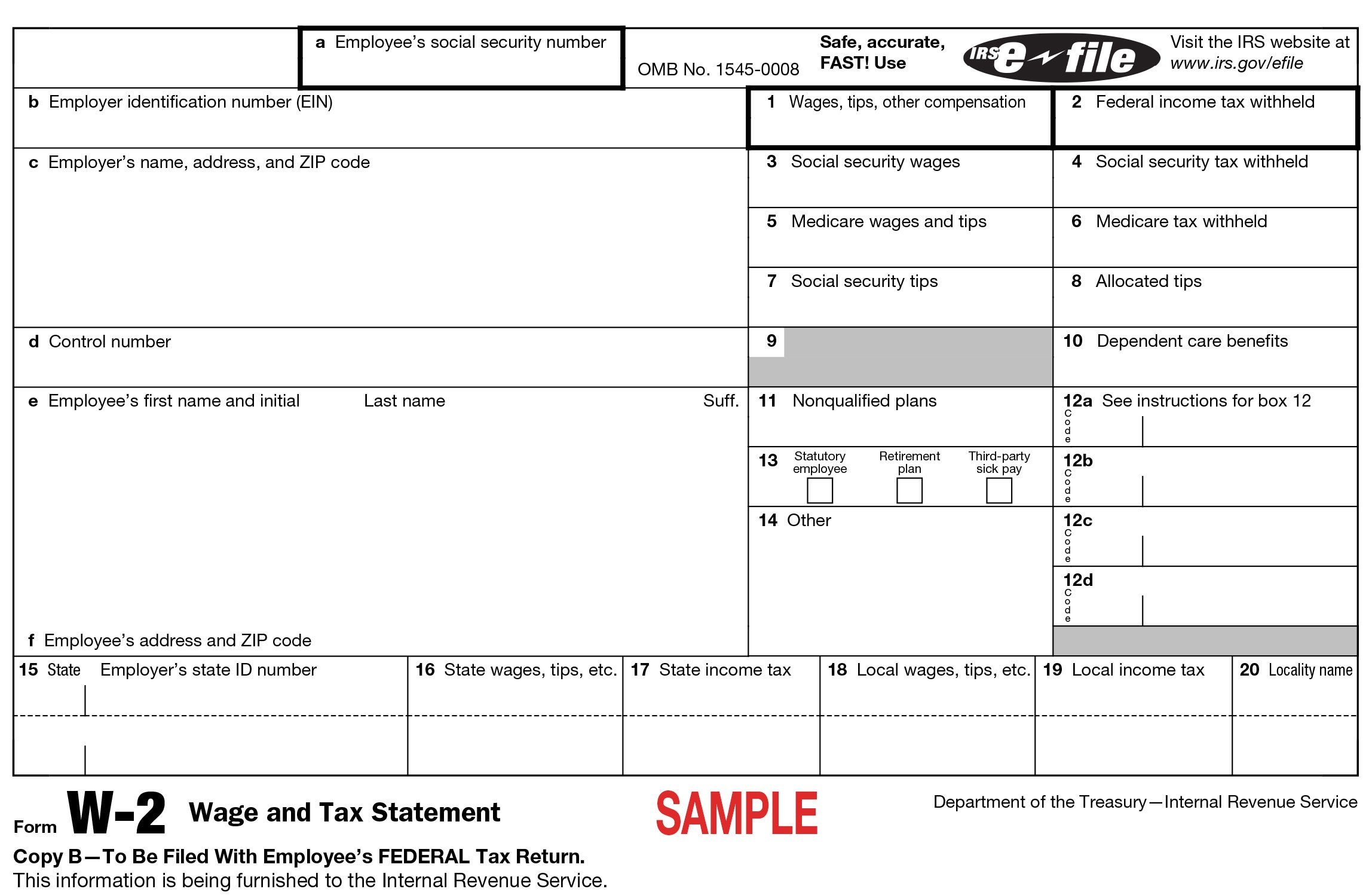

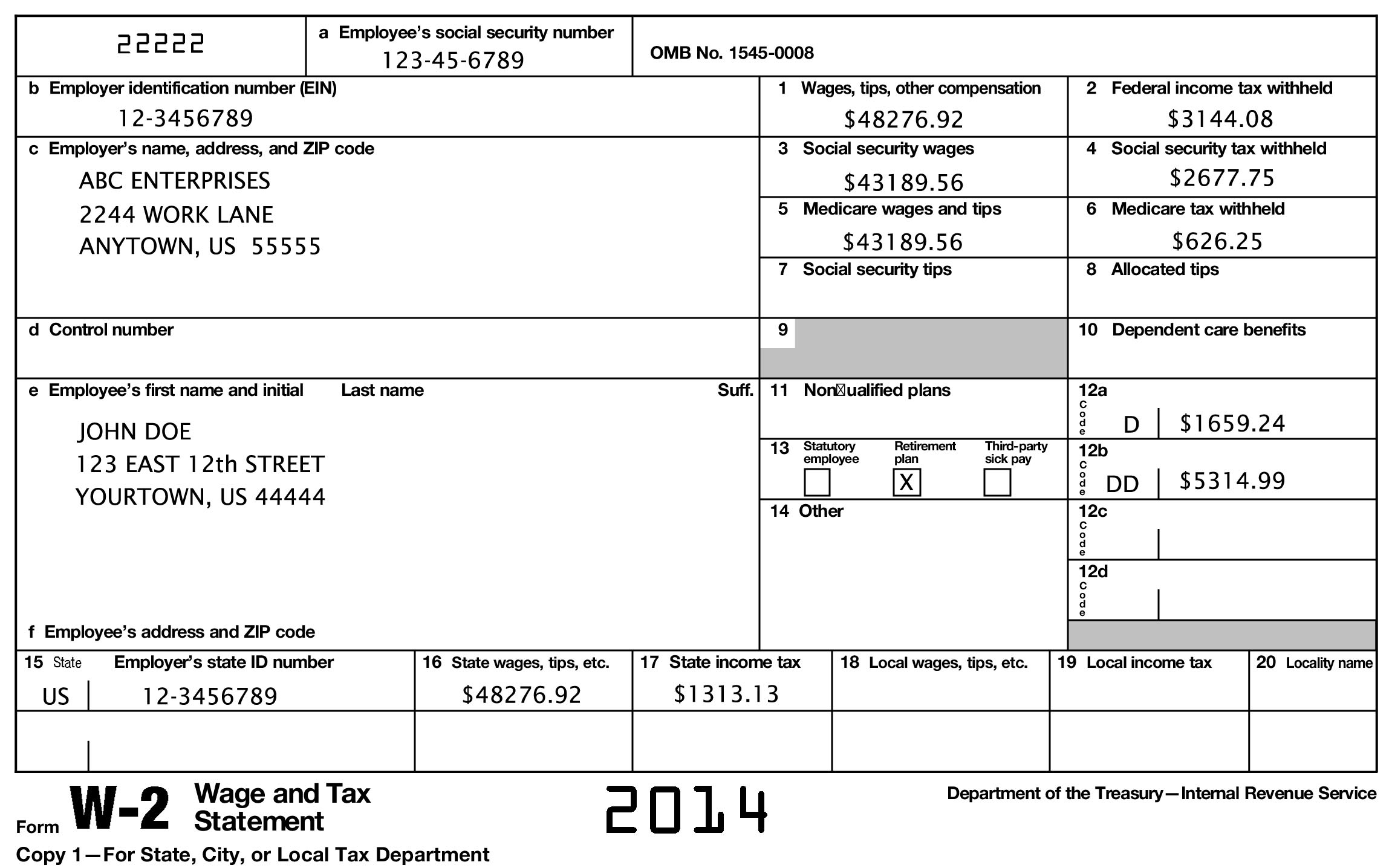

W2 Form Line 12A

W2 Form Line 12a – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount … Read more

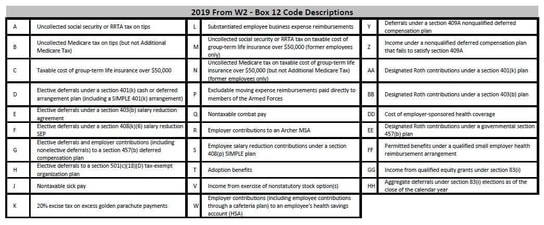

![Form W-2 Box 12 Codes | Codes And Explanations [Chart] throughout Form W2 Box 12 Code Dd](https://ezambiablog.com/wp-content/uploads/2024/02/form-w-2-box-12-codes-codes-and-explanations-chart-throughout-form-w2-box-12-code-dd.jpg)

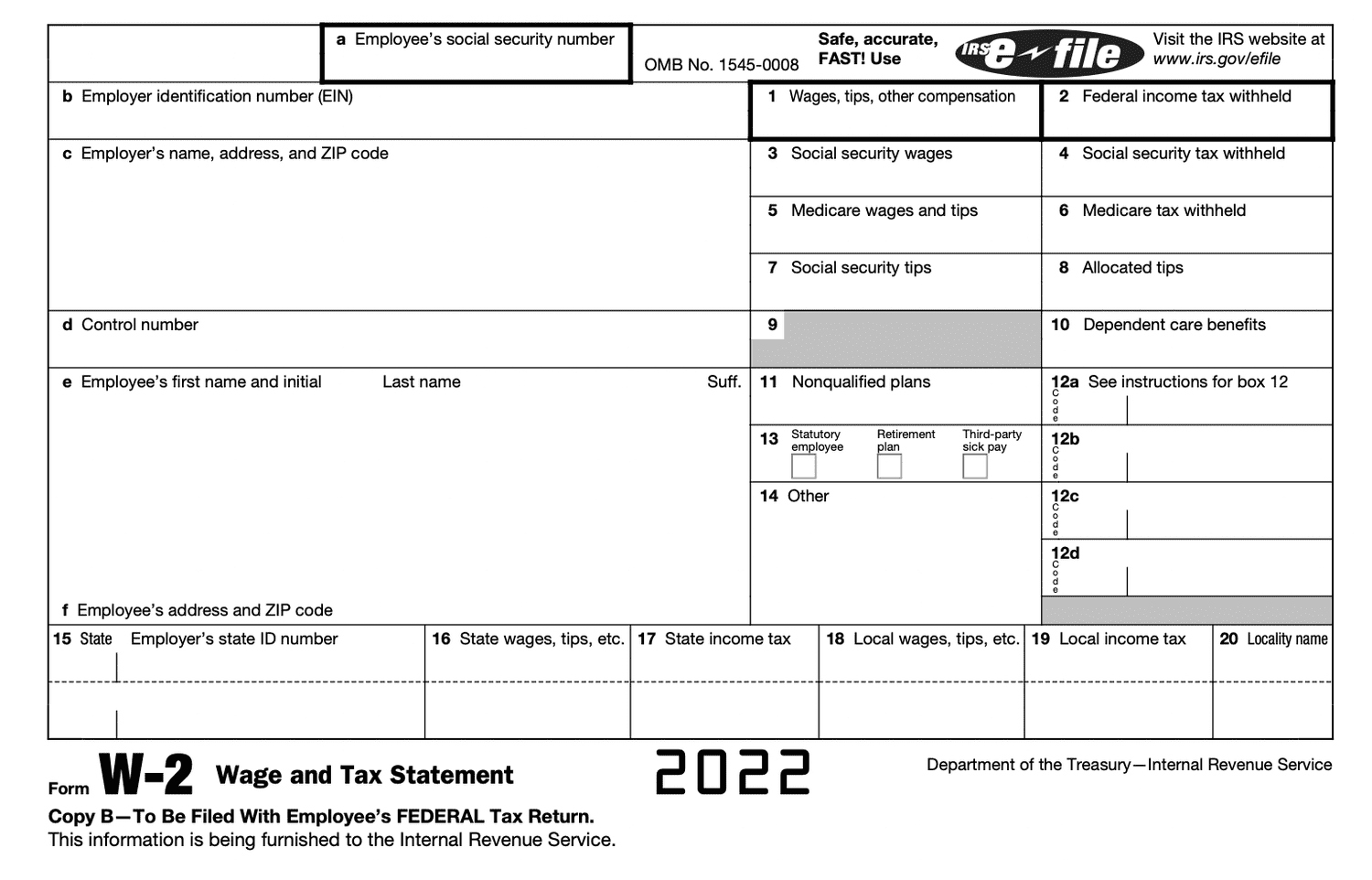

![Form W-2 Box 12 Codes | Codes And Explanations [Chart] intended for W2 Form 12A Dd](https://ezambiablog.com/wp-content/uploads/2024/02/form-w-2-box-12-codes-codes-and-explanations-chart-intended-for-w2-form-12a-dd.jpg)