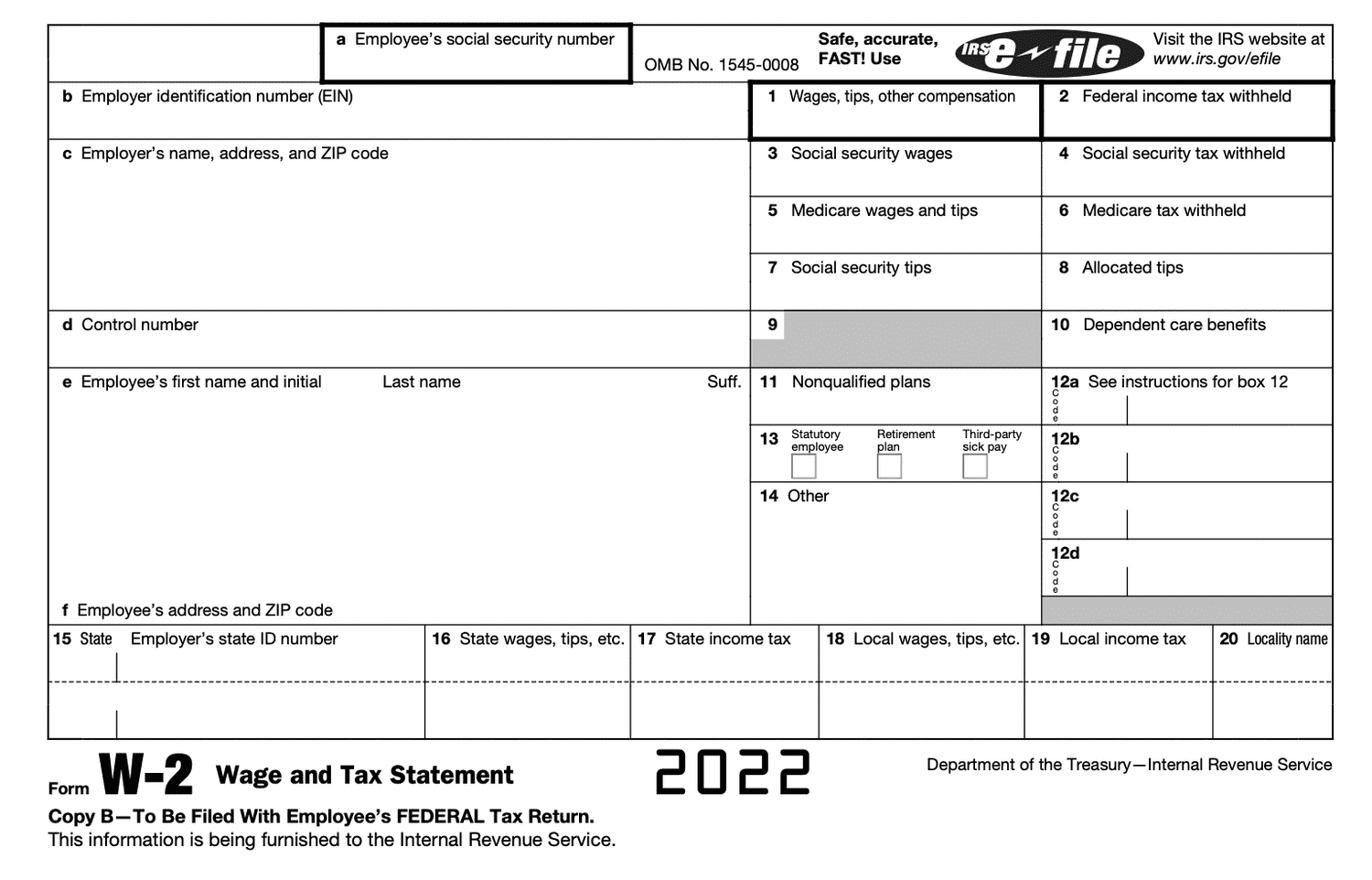

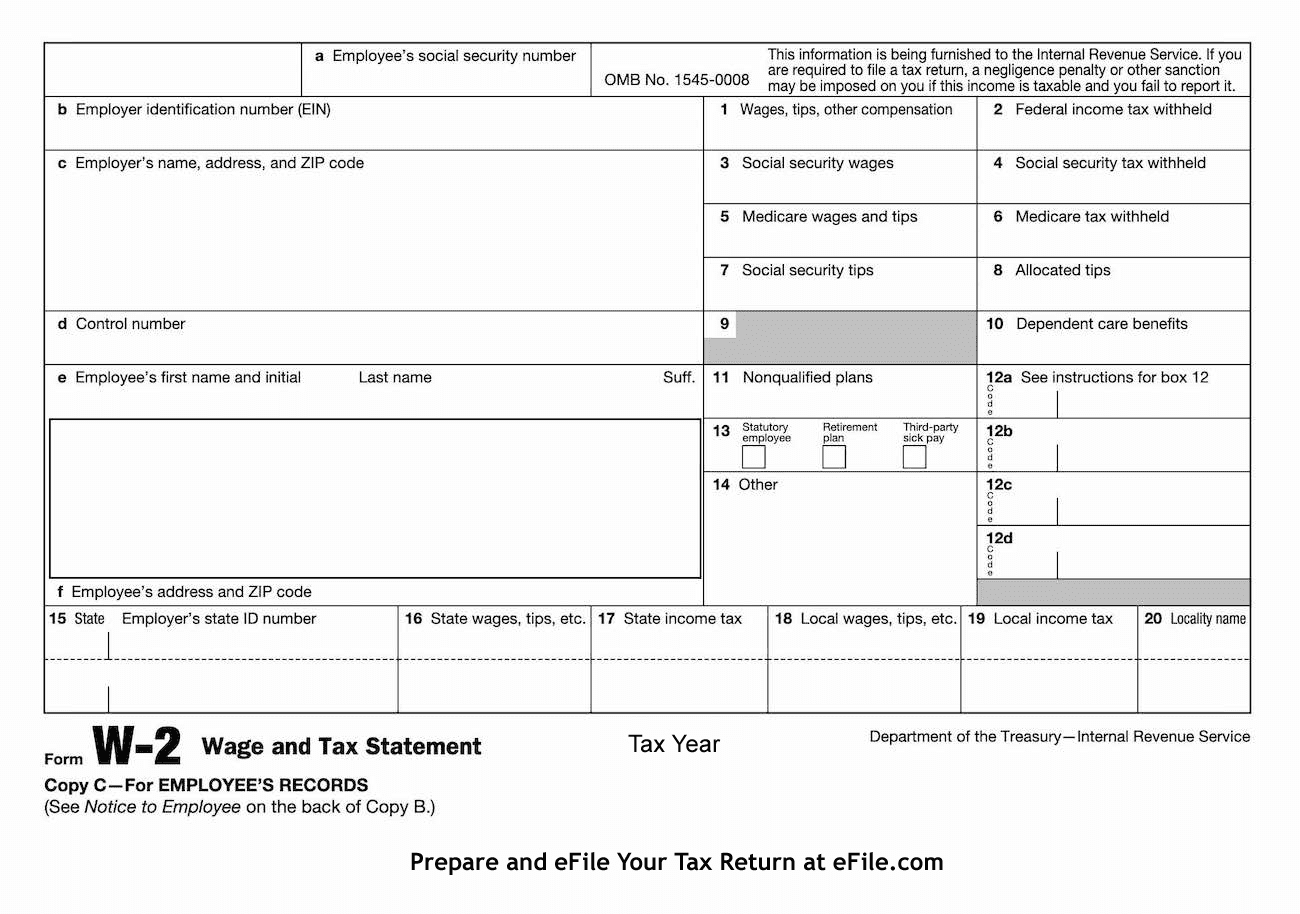

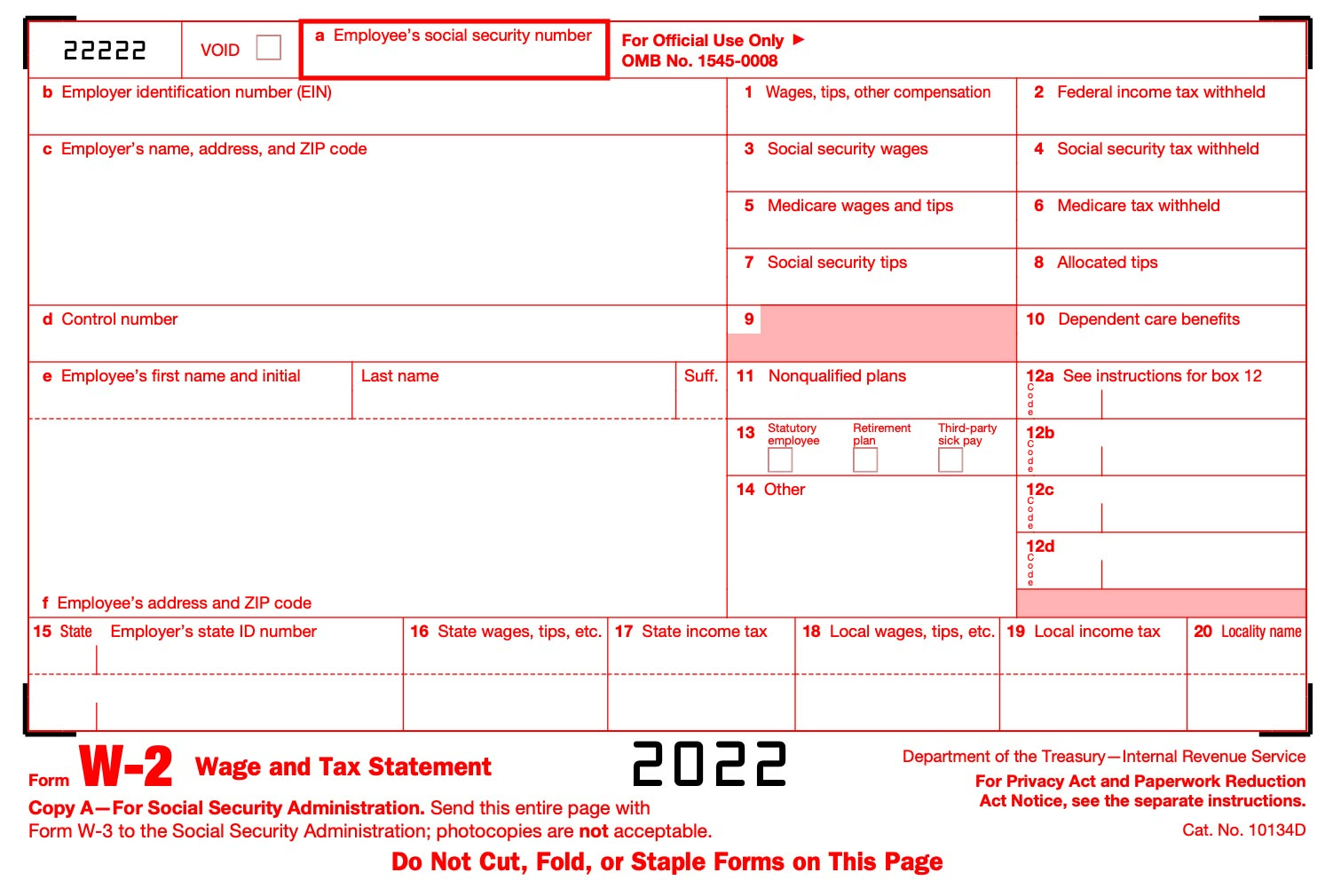

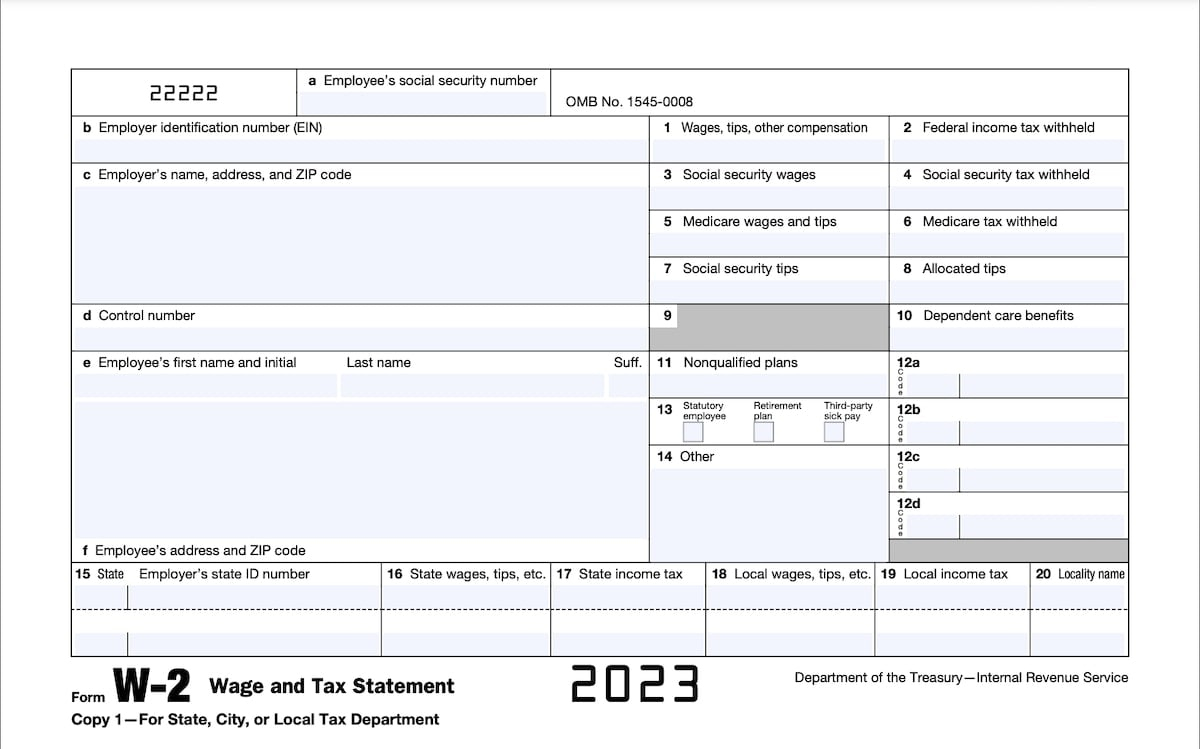

My W2 Tax Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unveiling the Secret Power of Your W2 Form

Ah, the dreaded tax season – a time when stress levels rise and wallets feel a little lighter. But fear not, for within the seemingly mundane pages of your W2 form lies the key to unlocking tax happiness! Your W2 is not just a piece of paper filled with numbers; it is a magical document that holds the secrets to maximizing your tax refund and minimizing your tax liabilities.

Your W2 form provides a snapshot of your annual income, taxes withheld, and other vital information that the IRS uses to determine your tax obligations. By understanding each section of your W2 and how it impacts your tax return, you can take control of your finances and make informed decisions to optimize your tax situation. From identifying potential deductions to ensuring accurate reporting of income, your W2 is the roadmap to a stress-free tax season.

As you delve into the depths of your W2 form, you may uncover hidden gems that can lead to significant tax savings. Did you know that certain expenses, such as work-related travel or education costs, may be deductible? Or that contributions to retirement accounts can lower your taxable income? By harnessing the power of your W2, you can navigate the complexities of the tax code with confidence and emerge victorious in the battle against Uncle Sam. So dust off that W2 form, grab your calculator, and let the magic begin!

Transforming Tax Season into a Joyful Expedition

Gone are the days of dreading tax season – with your newfound knowledge of the wonders of your W2 form, you can transform this once-dreaded time of year into a joyful expedition towards financial empowerment! As you embark on your tax journey armed with your W2, embrace the opportunity to take control of your financial destiny and pave the way for a brighter future. No longer will tax season be a source of anxiety, but rather a chance to showcase your financial savvy and reap the rewards of your hard work.

By viewing tax season as a chance to showcase your financial prowess, you can turn what was once a chore into a celebration of your financial accomplishments. Armed with your W2 form, you can confidently navigate the tax landscape, making strategic decisions that will benefit your bottom line. So don your tax wizard hat, gather your receipts, and embark on this magical journey towards tax happiness. With your W2 form as your trusty guide, the possibilities are endless, and the rewards are bountiful. Embrace the magic of your W2 and unlock the secrets to a tax season filled with joy and financial success!

In conclusion, your W2 form is not just a piece of paper – it is a powerful tool that can unlock the magic of tax happiness. By understanding the secrets hidden within your W2, you can take control of your tax situation and transform tax season into a joyful expedition towards financial empowerment. So embrace the magic of your W2, harness its power, and embark on a tax season filled with confidence, knowledge, and financial success. Let your W2 be your ticket to tax happiness, and watch as your financial dreams become a reality!

Below are some images related to My W2 Tax Form

find my w2 tax form online, how do i get my w2 tax form, how do i get my w2 wage and tax statement, how to retrieve my w-2 tax form, i lost my w2 tax form, , My W2 Tax Form.

find my w2 tax form online, how do i get my w2 tax form, how do i get my w2 wage and tax statement, how to retrieve my w-2 tax form, i lost my w2 tax form, , My W2 Tax Form.