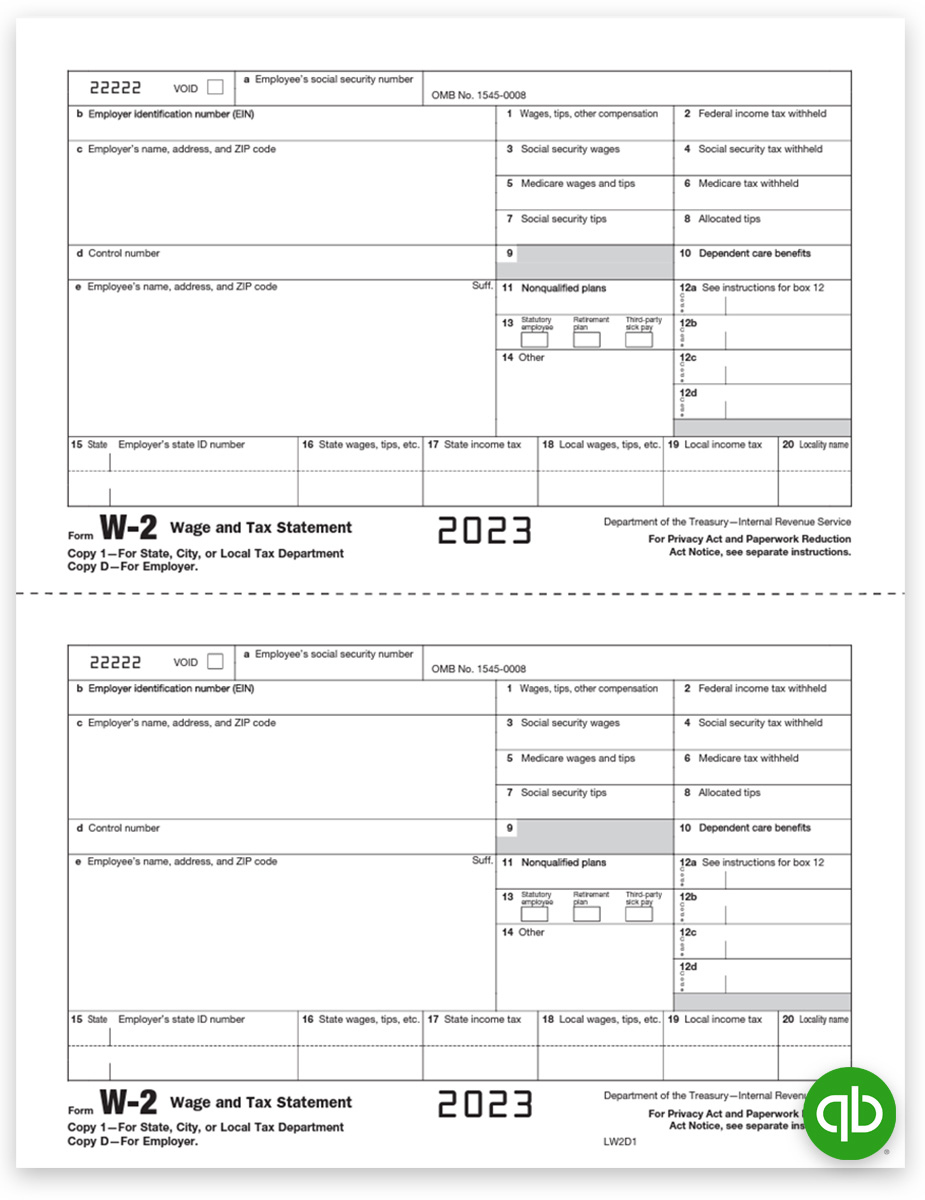

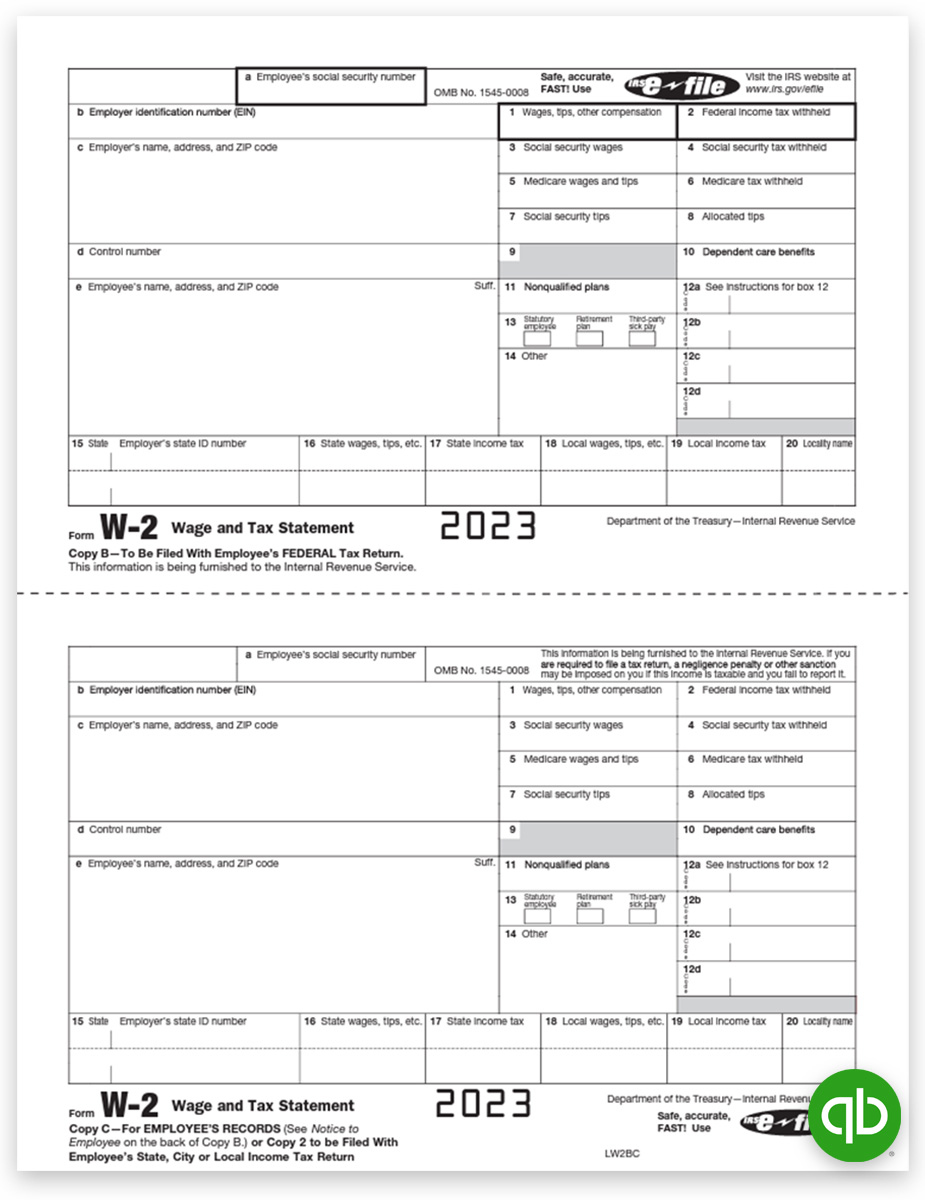

W2 Forms For Quickbooks – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Say Goodbye to W2 Chaos: Quickbooks to the Rescue!

Are you tired of the chaos that comes with managing W2 forms for your employees? Look no further, Quickbooks is here to save the day! With its user-friendly interface and powerful tools, Quickbooks makes it easy to manage and organize all your W2 forms in one place. No more digging through piles of paperwork or stressing about missing deadlines. Quickbooks streamlines the process, allowing you to focus on what really matters – running your business smoothly and efficiently.

One of the key advantages of using Quickbooks for W2 management is its ability to automatically generate and distribute forms to your employees. Gone are the days of manually filling out forms or hunting down missing information. Quickbooks simplifies the process by syncing with your payroll system, ensuring that all the necessary data is accurate and up-to-date. With just a few clicks, you can effortlessly generate and distribute W2 forms to your employees, saving you time and reducing the risk of errors.

With Quickbooks, you can also easily track and monitor the status of each W2 form, making it simple to stay organized and compliant with tax regulations. Whether you need to access past forms for auditing purposes or send out corrections, Quickbooks provides all the tools you need to stay on top of your W2 management. Say goodbye to the headaches and stress of W2 chaos, and let Quickbooks streamline the process for you.

Simplify Your Tax Season with Quickbooks W2 Management!

Tax season can be a daunting time for businesses, but with Quickbooks W2 management, you can simplify the process and breeze through tax season with ease. Quickbooks allows you to easily import employee information, track payments, and generate accurate W2 forms for all your employees. Say goodbye to manual data entry and calculations, and let Quickbooks handle the heavy lifting for you. With its intuitive features and customizable options, Quickbooks makes tax season a breeze.

In addition to simplifying W2 management, Quickbooks also provides valuable insights and reports to help you stay organized and on top of your financial obligations. From tracking employee earnings to calculating tax liabilities, Quickbooks offers a comprehensive solution to help you manage your finances with ease. With just a few clicks, you can access detailed reports and summaries to help you make informed decisions and stay compliant with tax laws. Say goodbye to the stress of tax season, and let Quickbooks help you navigate the complexities of W2 management.

In conclusion, Quickbooks is the ultimate tool for businesses looking to streamline their W2 management and simplify tax season. With its user-friendly interface, powerful tools, and customizable features, Quickbooks makes it easy to stay organized, compliant, and stress-free. Say goodbye to W2 chaos and hello to smooth sailing with Quickbooks. Try it today and see the difference it can make in managing your W2 forms!

Below are some images related to W2 Forms For Quickbooks

are office depot w2 forms compatible with quickbooks, blank w2 forms for quickbooks, order w2 forms for quickbooks, preprinted w2 forms for quickbooks, quickbooks w2 forms for 2023, , W2 Forms For Quickbooks.

are office depot w2 forms compatible with quickbooks, blank w2 forms for quickbooks, order w2 forms for quickbooks, preprinted w2 forms for quickbooks, quickbooks w2 forms for 2023, , W2 Forms For Quickbooks.