I 9 Form Vs W2 – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unraveling the Mysteries: I-9 Form vs. W-2

In the world of employment paperwork, two forms often cause confusion: the I-9 Form and the W-2. While both are essential for maintaining compliance with federal regulations, they serve different purposes and are used at different stages of the employment process. Let’s delve into the differences between the I-9 Form and W-2 to clear up any confusion and ensure you’re on the right track when it comes to completing these forms.

Let’s Break it Down: Understanding the Key Differences

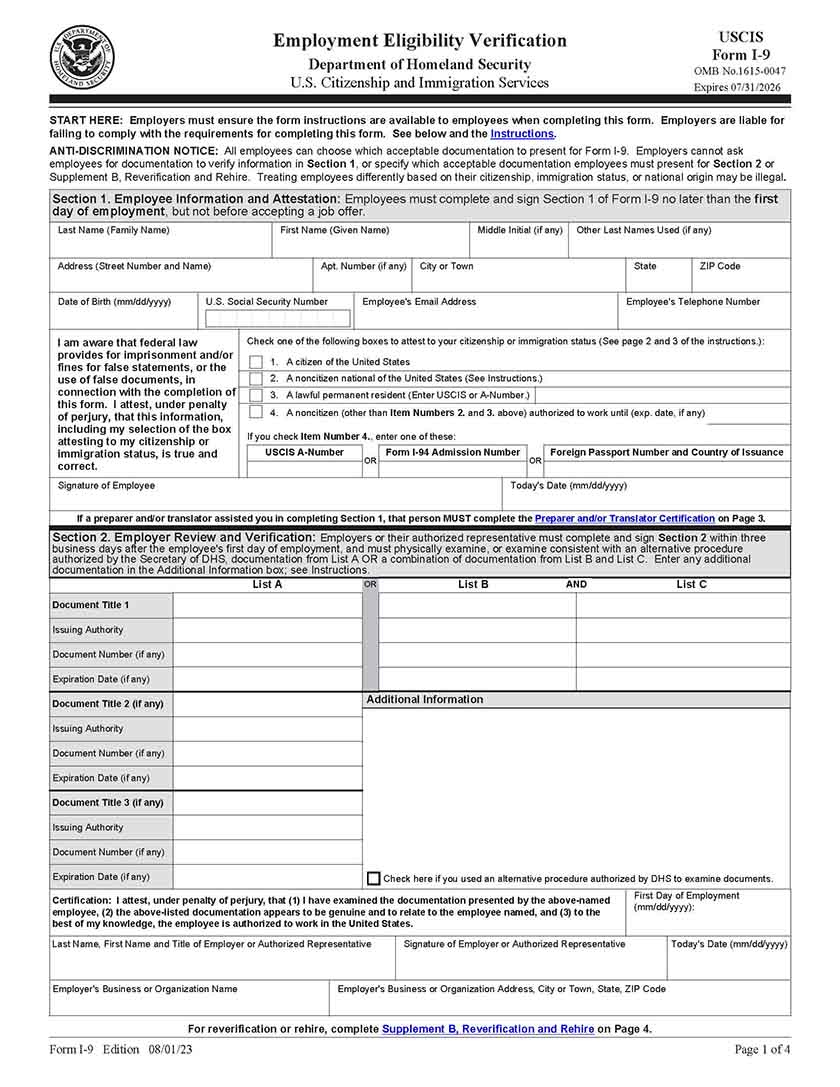

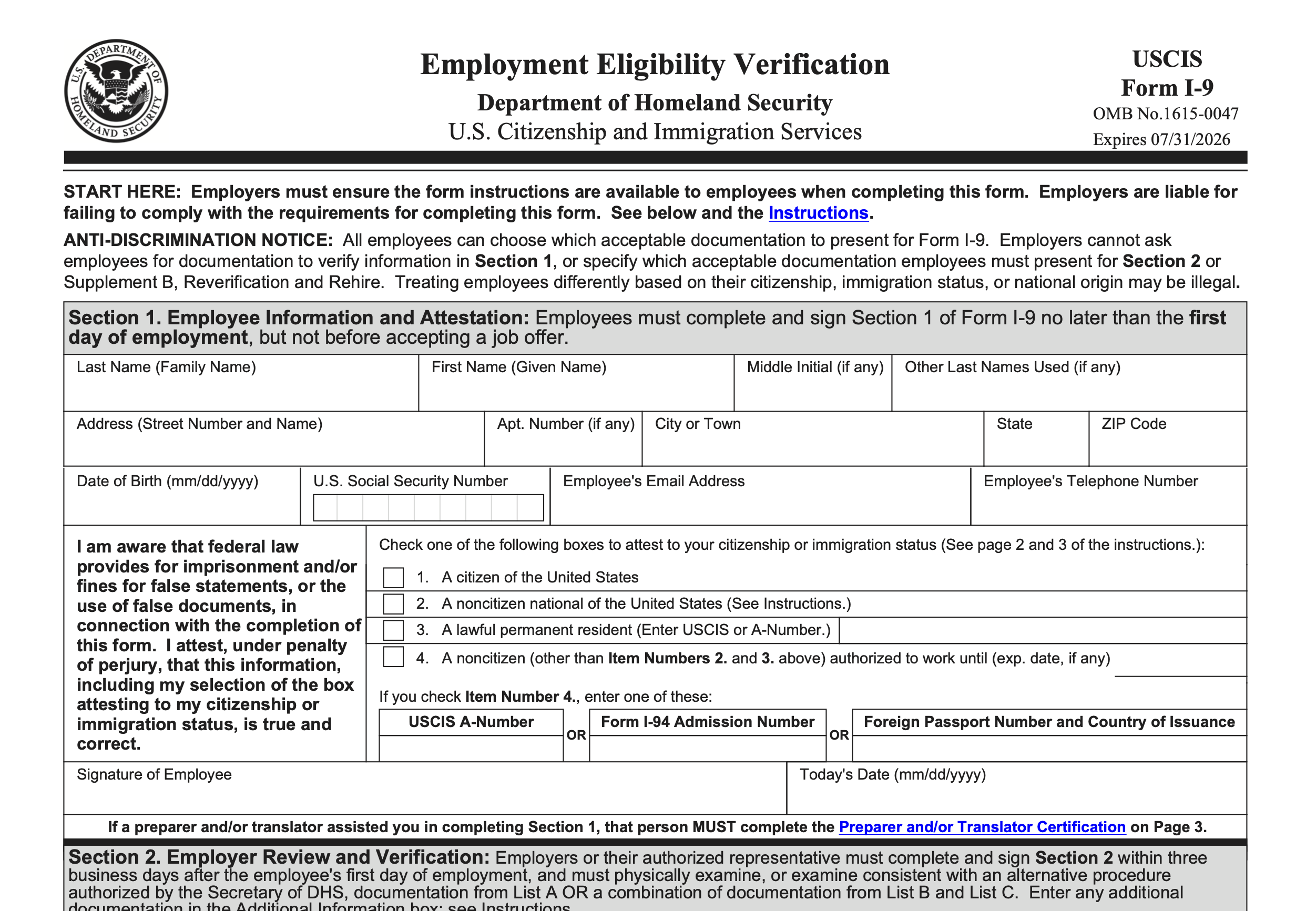

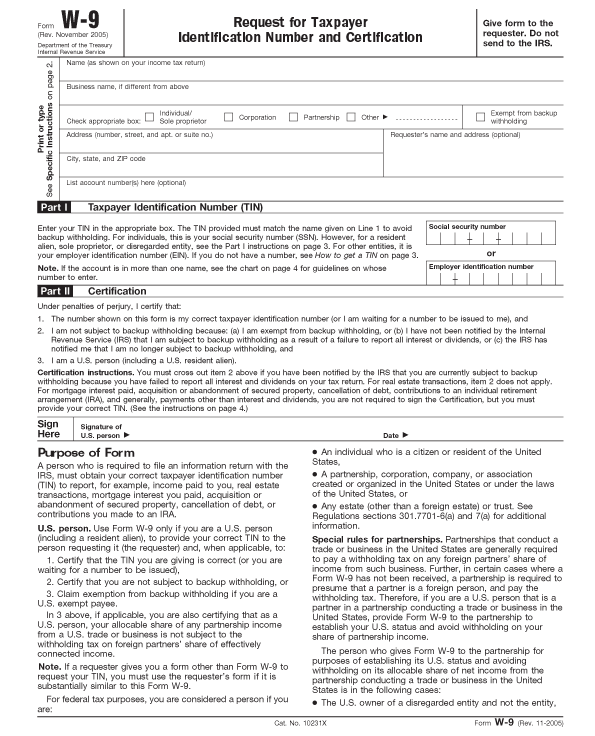

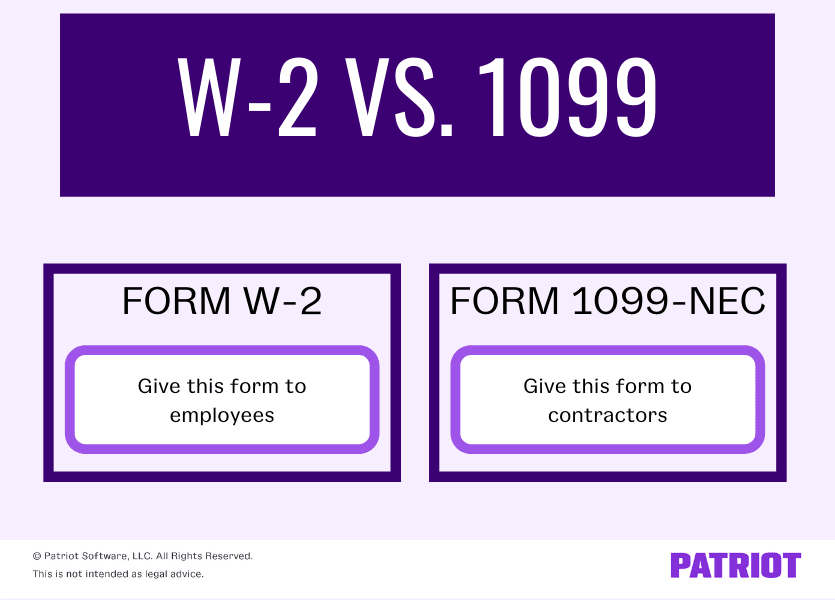

The I-9 Form is used to verify the identity and employment eligibility of individuals hired for employment in the United States. This form requires employees to provide specific documents that establish their identity and authorization to work in the country. On the other hand, the W-2 Form is used to report an employee’s wages and taxes withheld by their employer. This form is typically issued at the end of the year for tax reporting purposes.

When it comes to timing, the I-9 Form must be completed by both the employee and employer within three days of the employee’s hire date. Failure to do so can result in hefty fines for the employer. Conversely, the W-2 Form is issued by employers to employees by January 31st of each year, outlining the employee’s earnings for the previous calendar year. It is crucial for employees to review their W-2 for accuracy and report any discrepancies to their employer promptly.

While the I-9 Form and W-2 may seem similar in terms of their importance in the employment process, they serve distinct purposes and are completed at different times. By understanding the differences between these two forms and ensuring they are completed accurately and on time, both employers and employees can stay in compliance with federal regulations and avoid any potential pitfalls. So, next time you’re faced with filling out these forms, remember the key distinctions and sail through the process with ease.

Below are some images related to I 9 Form Vs W2

can i use w2 for i9, i 9 form vs w2, w 9 form vs w2, what is an i9 vs w2, , I 9 Form Vs W2.

can i use w2 for i9, i 9 form vs w2, w 9 form vs w2, what is an i9 vs w2, , I 9 Form Vs W2.