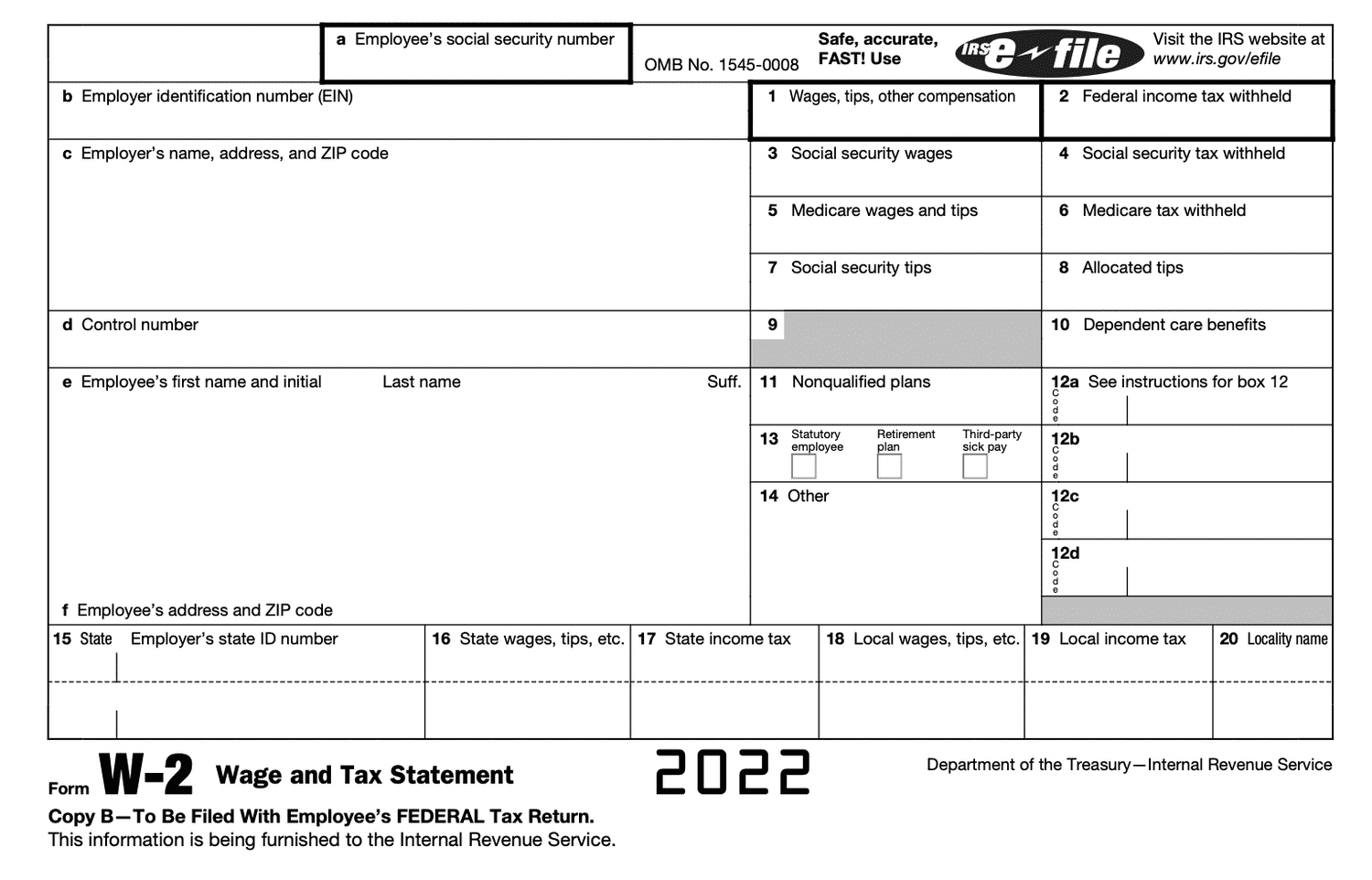

W2/1099 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unleash Your Inner Superstar with Your W2/1099 Form!

Are you ready to take center stage and show the world your financial prowess? Your W2/1099 form is your ticket to shining bright like a diamond this tax season. Whether you’re a W2 employee or a 1099 contractor, these documents hold the key to unlocking your tax refund potential and showcasing your financial success. It’s time to step into the spotlight and let your inner superstar shine through!

With your W2/1099 form in hand, you have the power to showcase your financial achievements and highlight your hard work throughout the year. Just like a performer stepping onto a stage, you can use your tax documents to tell a story of dedication, perseverance, and success. Let your W2/1099 form be your script, guiding you through the performance of a lifetime as you navigate the world of taxes and deductions. It’s time to take the spotlight and show the world what you’re made of!

Transform Your Tax Documents into a Spotlight-Worthy Performance!

Ready to transform your tax documents into a show-stopping performance that will leave the audience in awe? Your W2/1099 form is your chance to dazzle with your financial savvy and tax knowledge. With a little creativity and flair, you can turn your tax documents into a masterpiece that will impress even the toughest critics. So grab your W2/1099 form, don your metaphorical costume, and get ready to take the stage like the superstar you are!

Just like a seasoned performer, you can use your W2/1099 form to showcase your unique talents and financial achievements. Highlight your income, deductions, and credits in a way that captivates and inspires. With a bit of pizzazz and flair, you can turn your tax documents into a work of art that will have everyone talking. It’s time to embrace your inner financial superstar and let your W2/1099 form be your shining moment in the spotlight!

Conclusion

As tax season approaches, it’s time to dust off your W2/1099 form and get ready to shine like never before. With a little creativity and enthusiasm, you can turn your tax documents into a dazzling performance that will leave a lasting impression. So channel your inner superstar, embrace the spotlight, and let your W2/1099 form be your moment to shine! Get ready to showcase your financial success and tax expertise with style and flair. You’ve got this!

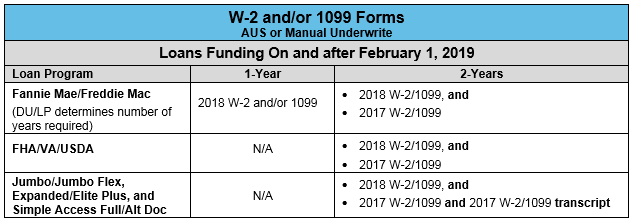

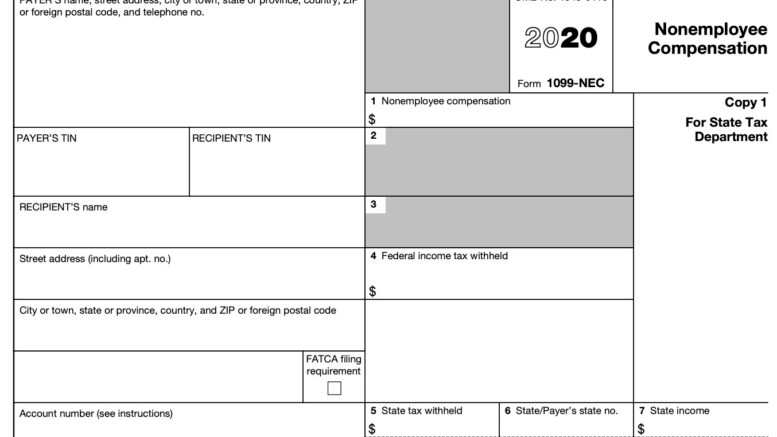

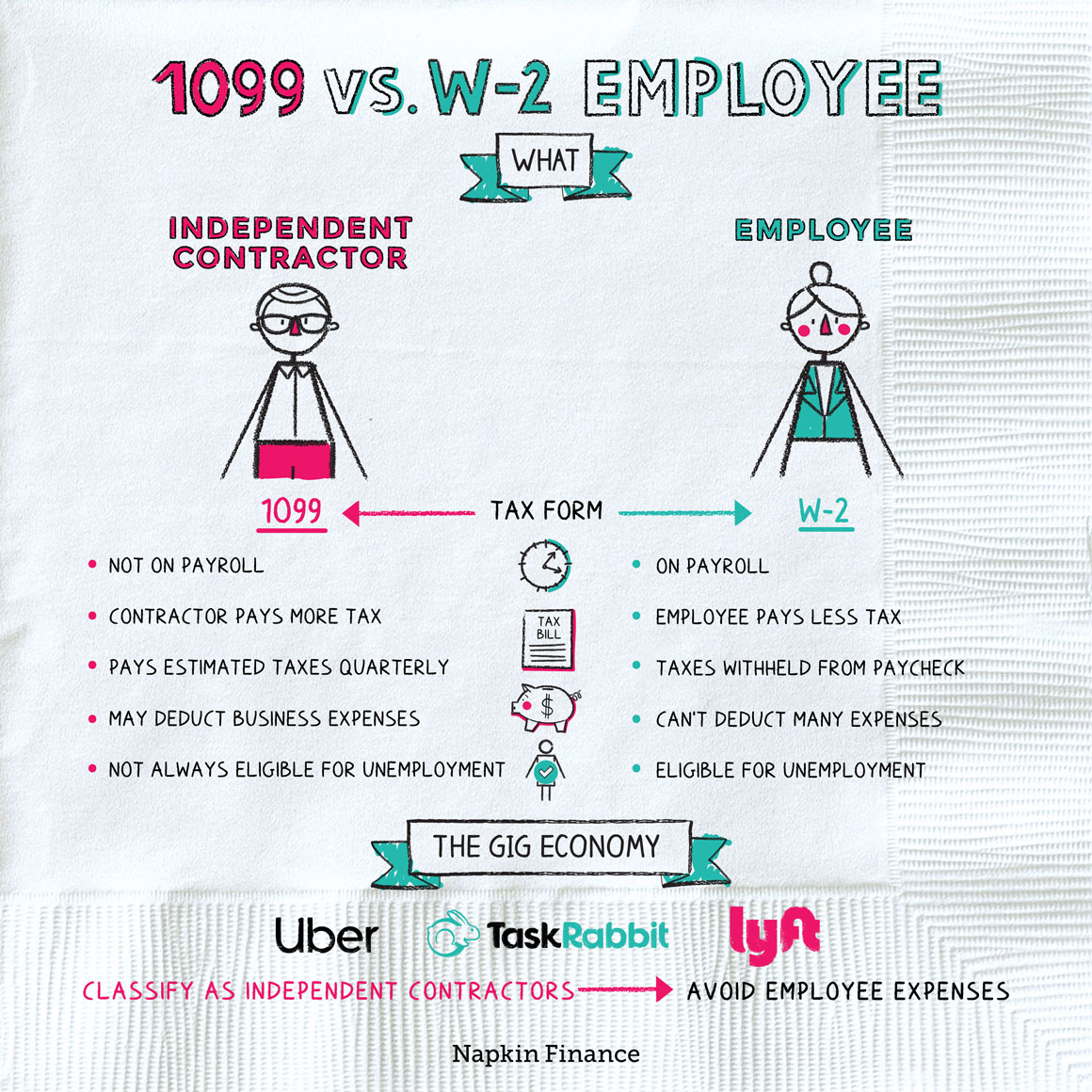

Below are some images related to W2/1099 Form

2019 w-2/1099 form, 2020 w-2/1099 form, 2021 w-2/1099 form, define w2 1099 form, w-2/1099 form download, , W2/1099 Form.

2019 w-2/1099 form, 2020 w-2/1099 form, 2021 w-2/1099 form, define w2 1099 form, w-2/1099 form download, , W2/1099 Form.