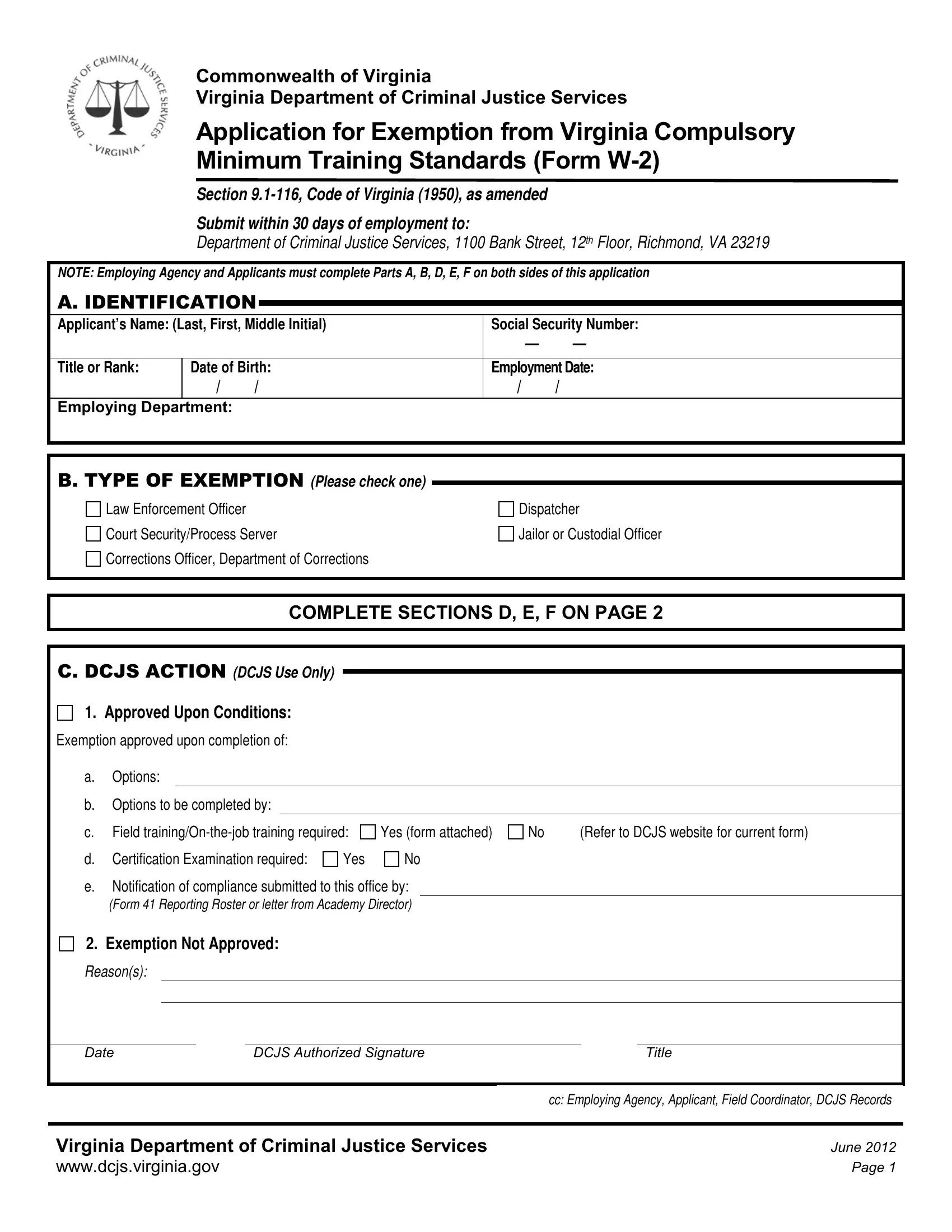

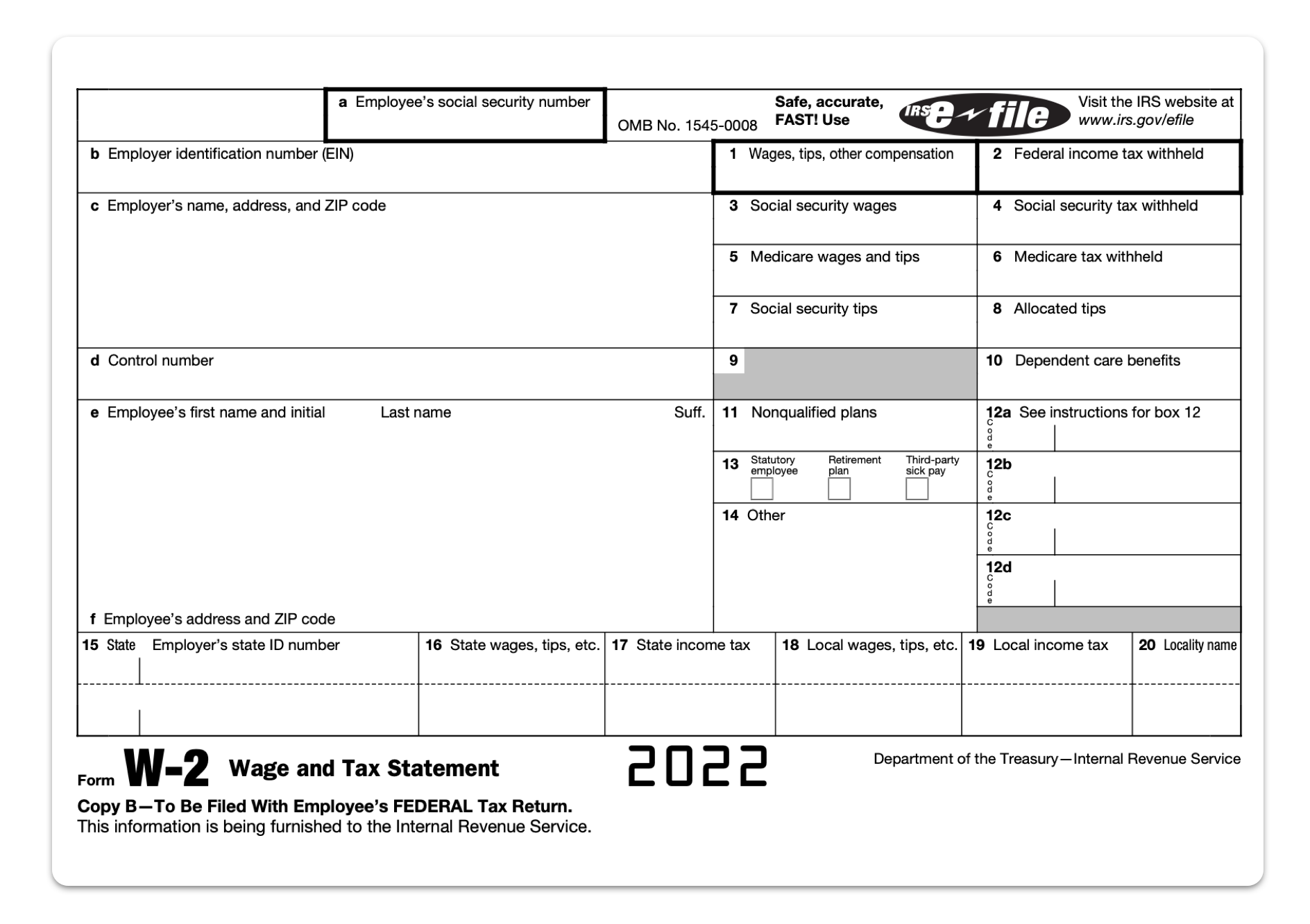

Virginia State W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Exploring the Enchanting World of Virginia State W2 Form!

Oh, the Virginia State W2 Form – a mysterious document that holds the key to unlocking the magic of tax season! While it may seem like just another piece of paperwork, this form is actually a treasure trove of information that can help you navigate the twists and turns of filing your taxes. Let’s delve into the enchanting world of the Virginia State W2 Form and discover the wonders it holds!

Unlocking the Secrets and Surprises of Virginia State W2 Form!

As you gaze upon the rows of numbers and letters on your Virginia State W2 Form, you may be amazed at the secrets and surprises it holds. From the amount of taxes withheld from your paycheck to any additional income you may have earned, this form lays it all out for you in black and white. But fear not, for with a little bit of magic and a dash of know-how, you can unlock the mysteries of this form and use it to your advantage when filing your taxes.

The Magic of Understanding Your Virginia State W2 Form

Once you have decoded the secrets of your Virginia State W2 Form, you will be amazed at the power it holds. By understanding the information on this form, you can ensure that you are accurately reporting your income and deductions, which can help you maximize your tax refund or minimize the amount you owe. So take a moment to appreciate the magic of this form and use it to your advantage this tax season!

In conclusion, the Virginia State W2 Form may seem like just another piece of paperwork, but it is so much more than that. It is a key that can unlock the mysteries of tax season and help you navigate the sometimes confusing world of filing your taxes. So embrace the magic of this form, and let it guide you towards a successful tax season!

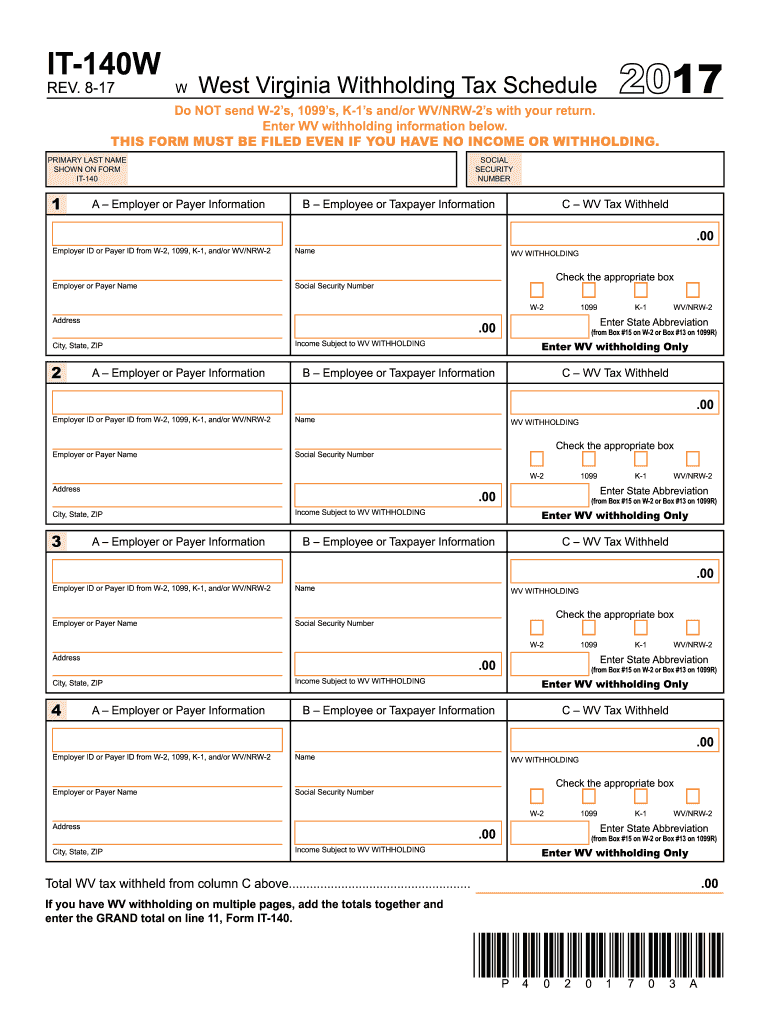

Below are some images related to Virginia State W2 Form

does virginia have a state tax form, virginia state w-2 form, virginia tax forms and instructions, virginia w2 filing requirements, , Virginia State W2 Form.

does virginia have a state tax form, virginia state w-2 form, virginia tax forms and instructions, virginia w2 filing requirements, , Virginia State W2 Form.