W2 Form When Do I Get It – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

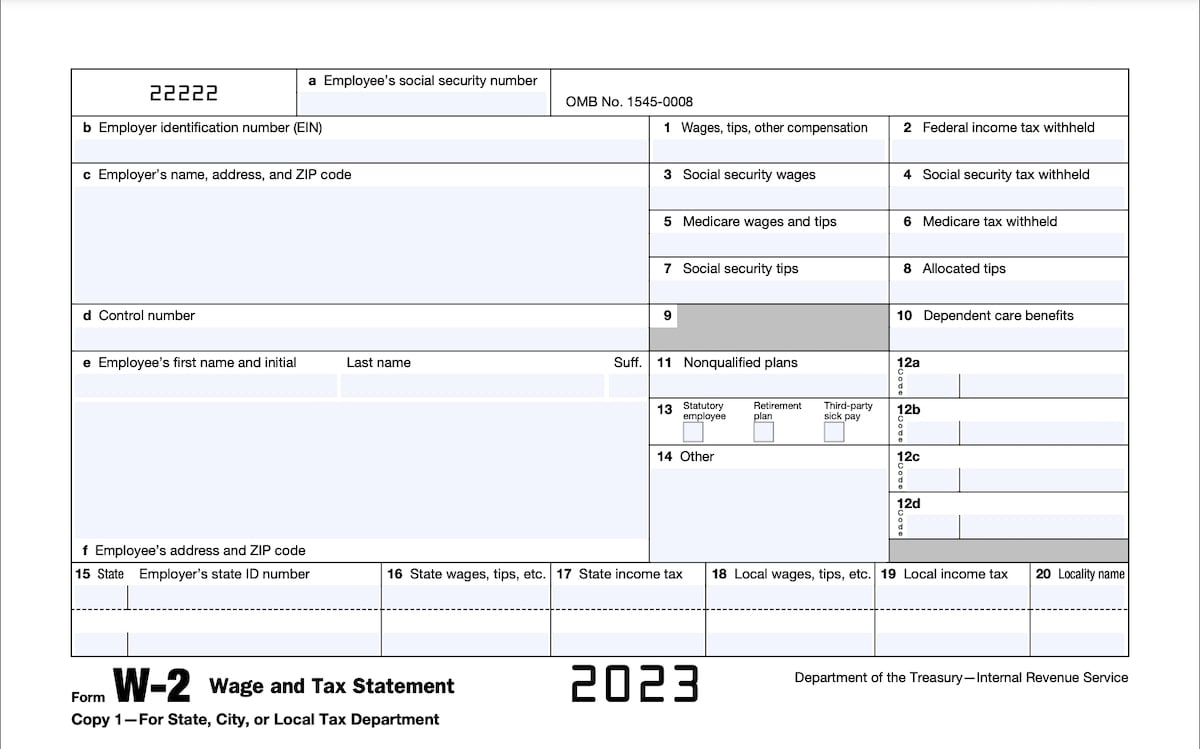

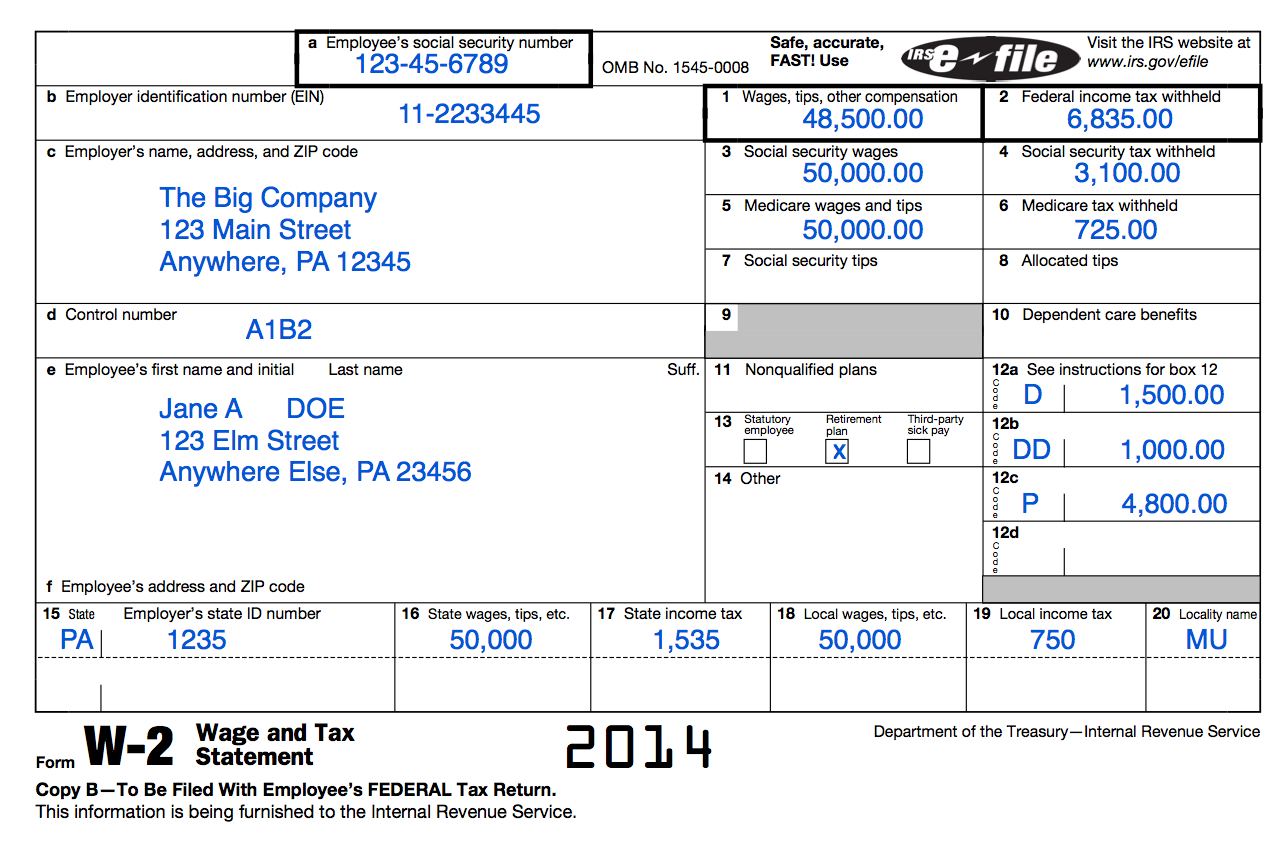

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

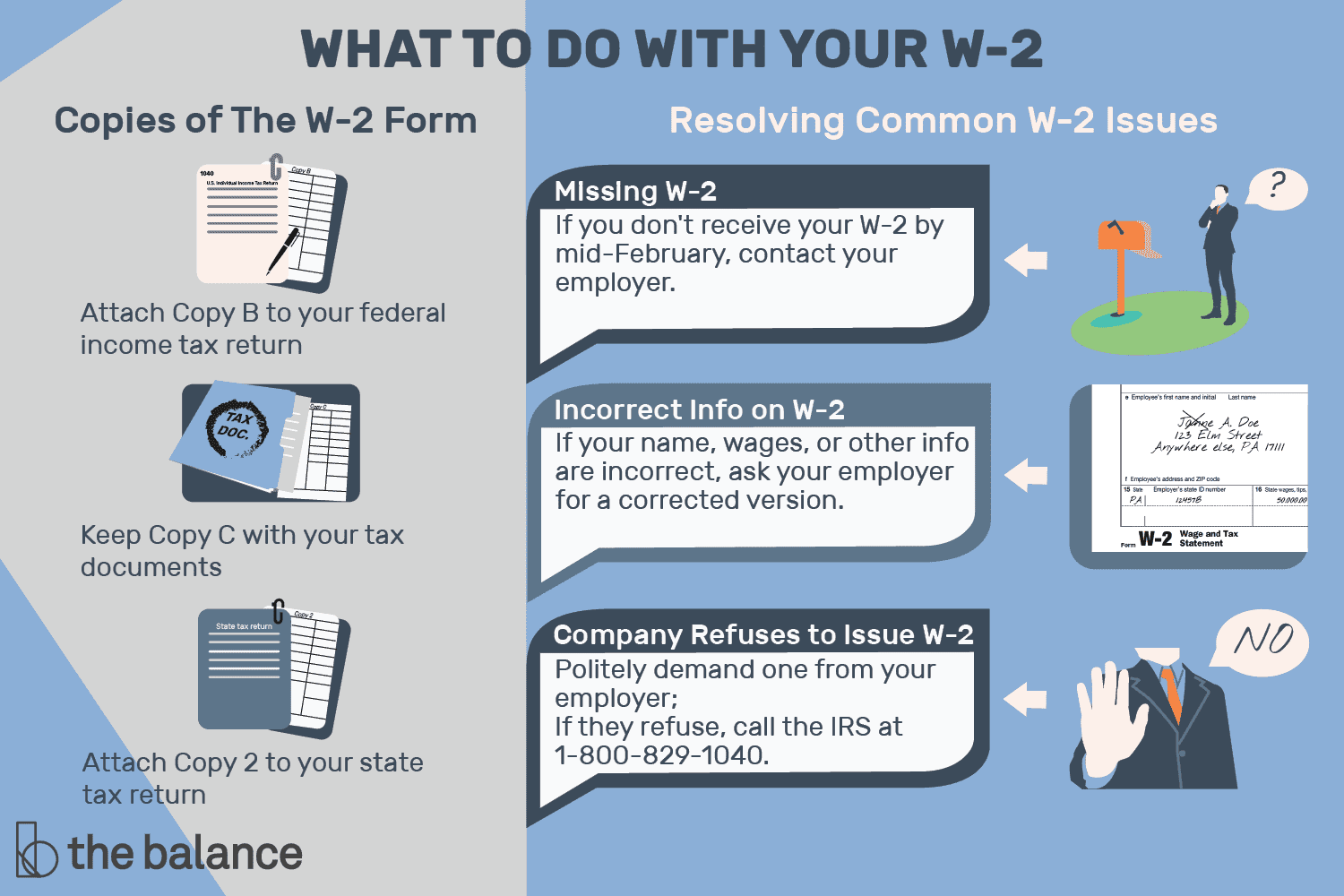

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Ready, Set, W2! Learn When You’ll Get Yours

Are you ready for tax season? It’s that time of year again when you gather all your financial documents and prepare to file your taxes. One important document you’ll need is your W2 form, which summarizes your earnings and taxes withheld by your employer. Knowing when you’ll receive your W2 can help you plan ahead and make sure you file your taxes on time. So, let’s dive in and find out when you’ll get yours!

Get Ready for Tax Season!

As tax season approaches, it’s essential to start gathering all the necessary documents to prepare for filing your taxes. Make sure you have your social security number, income statements, and any receipts for deductions handy. One of the most crucial documents you’ll need is your W2 form, which your employer is required to send to you by January 31st. Keeping all your documents organized and ready will make the tax filing process much smoother and less stressful.

Once you have all your documents in order, it’s time to start thinking about when you’ll receive your W2. Employers are required by law to send out W2 forms by January 31st, so be on the lookout for it in the mail or through electronic delivery. If you haven’t received your W2 by mid-February, be sure to reach out to your employer to ensure it was sent out correctly. Having your W2 in hand will allow you to accurately report your income and file your taxes on time.

Find Out When You’ll Get Your W2!

Now that you know the importance of your W2 form, you’re probably wondering when you can expect to receive it. Most employers choose to send out W2 forms in January, but the exact timing can vary. Some companies provide electronic access to W2 forms, allowing you to download and print them at your convenience. Others may mail physical copies to your home address. Check with your employer to find out their specific process and timeline for distributing W2 forms.

In conclusion, getting ready for tax season and knowing when you’ll receive your W2 are essential steps to ensure a smooth and stress-free filing process. By gathering all your documents early, staying organized, and reaching out to your employer if needed, you’ll be well-prepared to file your taxes on time. So, get ready, set, and prepare to receive your W2 soon! Happy tax season!

Below are some images related to W2 Form When Do I Get It

w2 form when do i get it, when can i get my w2 online, when should i get my w2 forms, when should i receive my w2 by, , W2 Form When Do I Get It.

w2 form when do i get it, when can i get my w2 online, when should i get my w2 forms, when should i receive my w2 by, , W2 Form When Do I Get It.