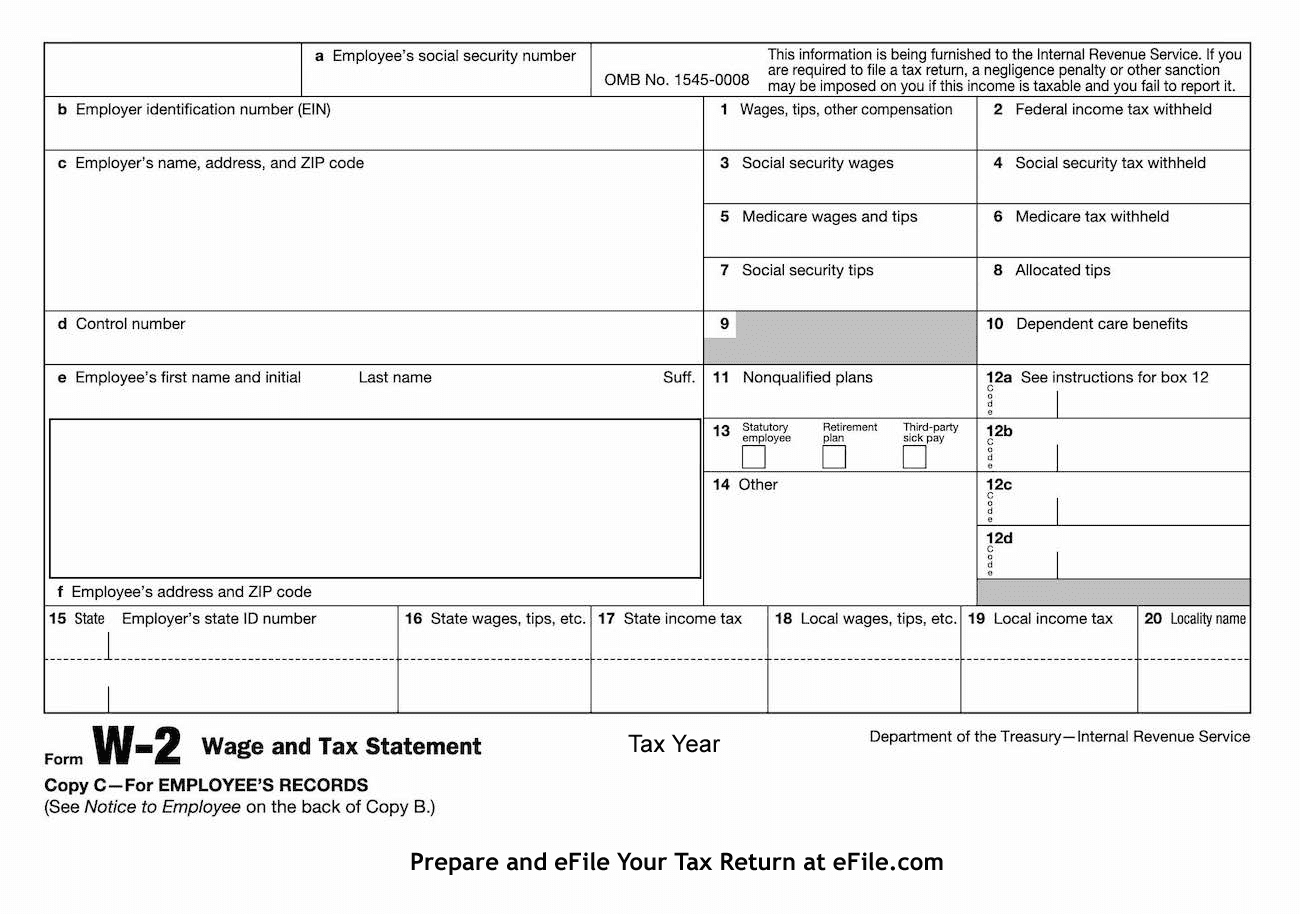

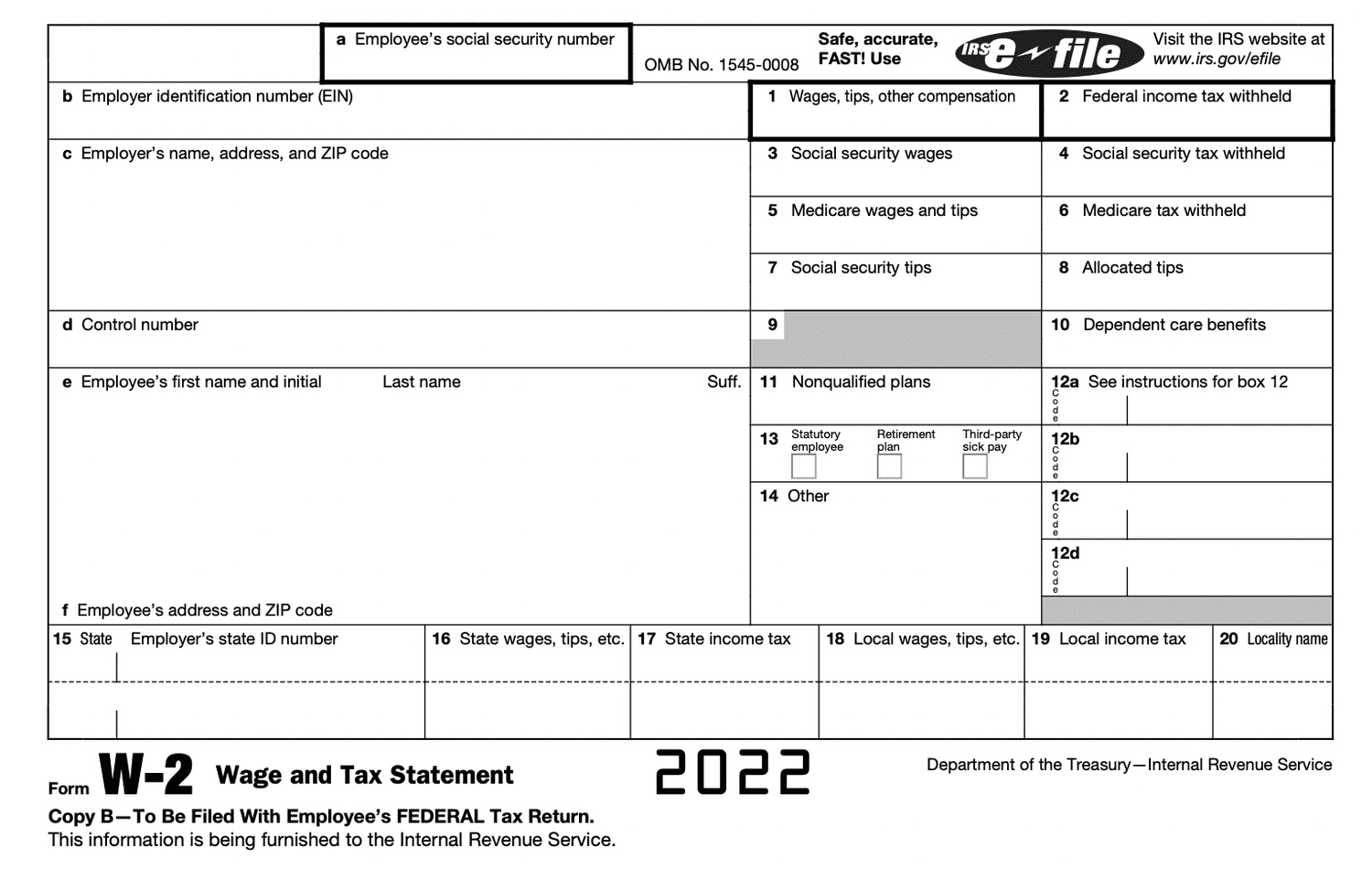

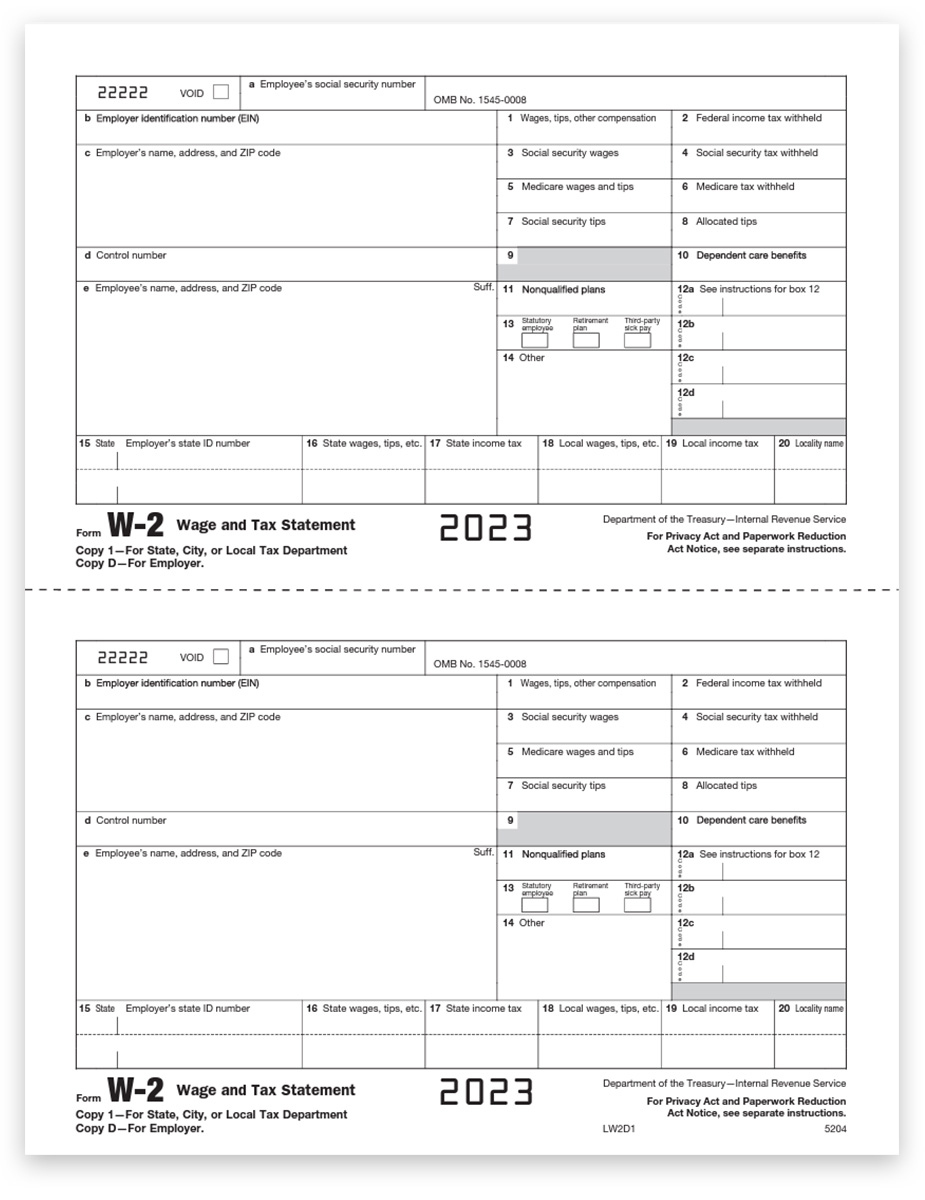

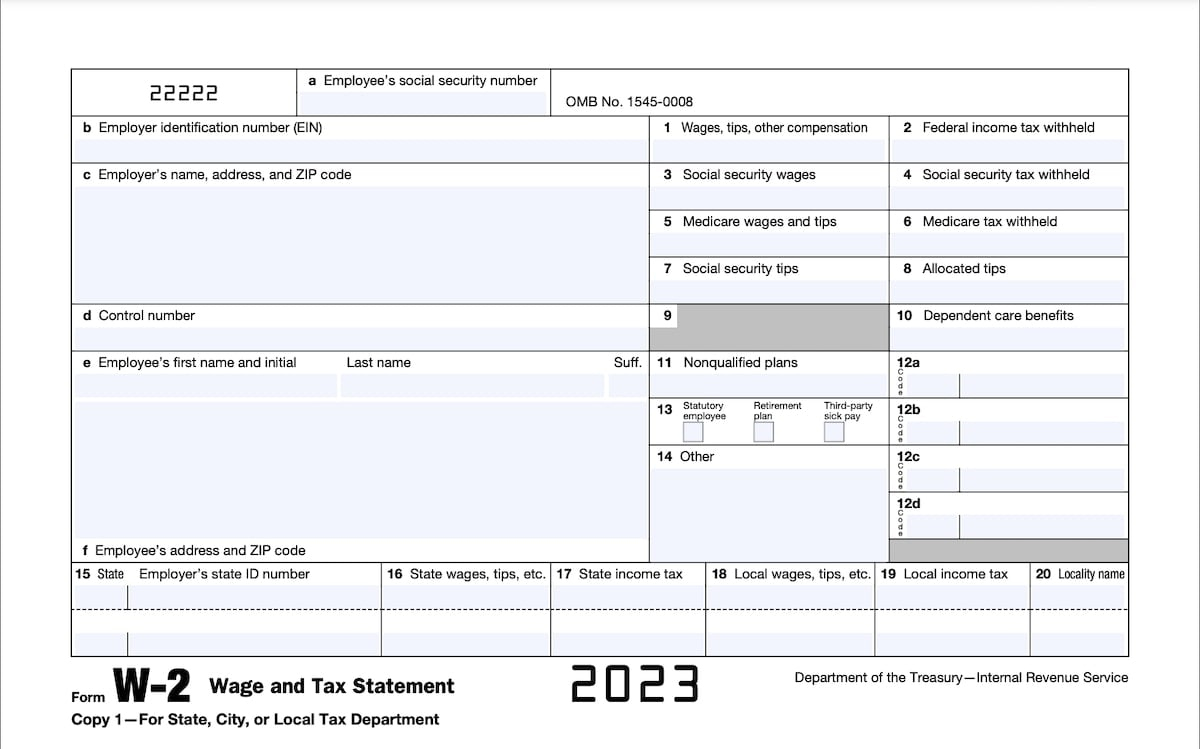

Where To Get W2 Forms – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unleash Your Inner Tax Pro: Score Your W2 Forms!

Are you ready to take control of your taxes like a pro? Look no further than your W2 forms! These little documents hold the key to unlocking potential deductions and credits that can save you money come tax season. By understanding how to navigate and score your W2 forms effectively, you’ll be well on your way to maximizing your tax refund. Get ready to unleash your inner tax pro and conquer tax season with confidence!

When it comes to scoring your W2 forms, the first step is to review all the information carefully. Double-check that your name, address, Social Security number, and employer information are all accurate. Next, take a closer look at your wages, tips, and other compensation to ensure they match your records. Keep an eye out for any discrepancies or missing information that may need to be corrected. By paying attention to these details, you can avoid potential errors that could delay your tax return.

Once you’ve thoroughly reviewed your W2 forms, it’s time to start scoring those deductions and credits. Look for opportunities to claim deductions for expenses such as student loan interest, mortgage interest, or medical expenses. Additionally, don’t forget to take advantage of tax credits like the Earned Income Tax Credit or the Child and Dependent Care Credit. By maximizing your deductions and credits, you can reduce your taxable income and potentially increase your tax refund. With a little bit of effort and attention to detail, you can navigate tax season like a pro and score big with your W2 forms!

In conclusion, by mastering the art of scoring your W2 forms, you can take control of your taxes and maximize your refund potential. Remember to review your forms carefully, look for opportunities to claim deductions and credits, and stay organized throughout the process. With this ultimate guide in hand, you’ll be well-equipped to unleash your inner tax pro and conquer tax season with ease. So go ahead, dive into your W2 forms, and score big this tax season!

Below are some images related to Where To Get W2 Forms

where can i get w2 forms for 2022, where do you get w2 forms, where to get the w2 forms online, where to get w2 forms, where to get w2 forms for employees, , Where To Get W2 Forms.

where can i get w2 forms for 2022, where do you get w2 forms, where to get the w2 forms online, where to get w2 forms, where to get w2 forms for employees, , Where To Get W2 Forms.