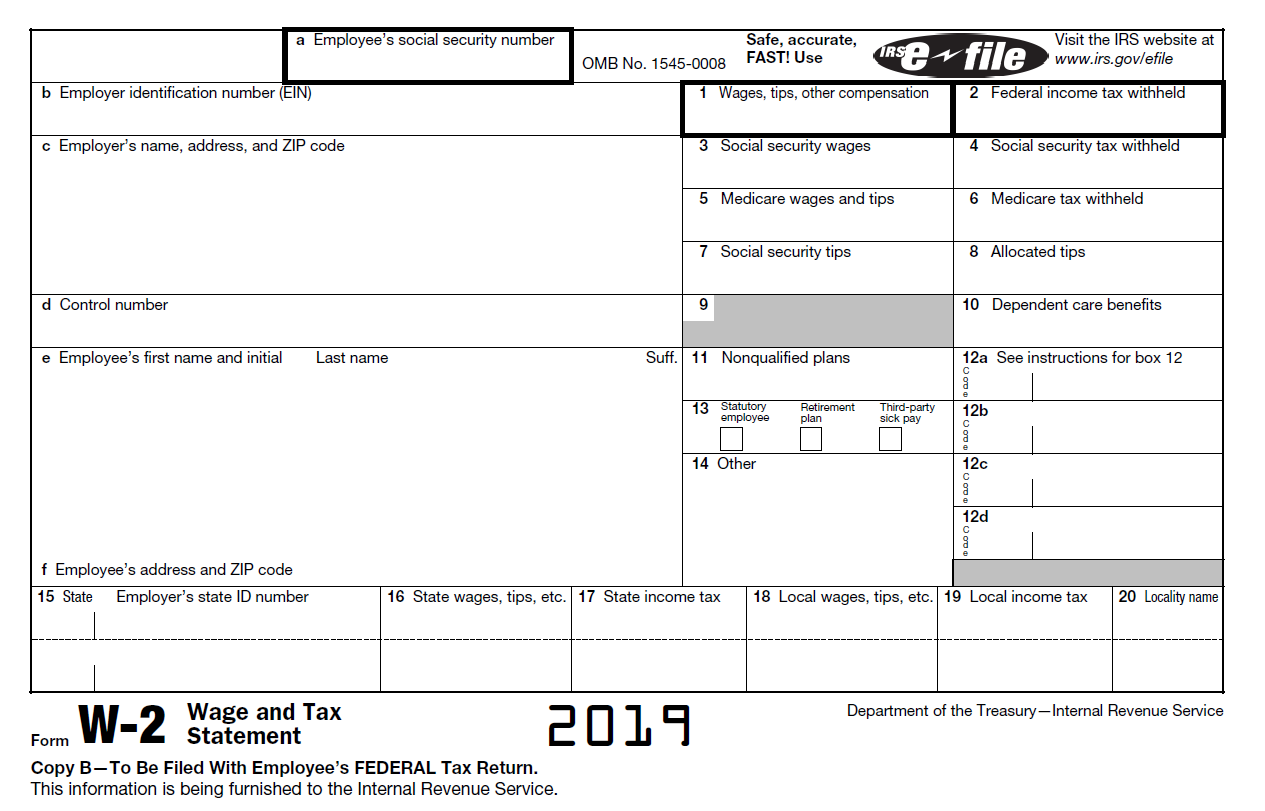

W2 Form Deadline – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

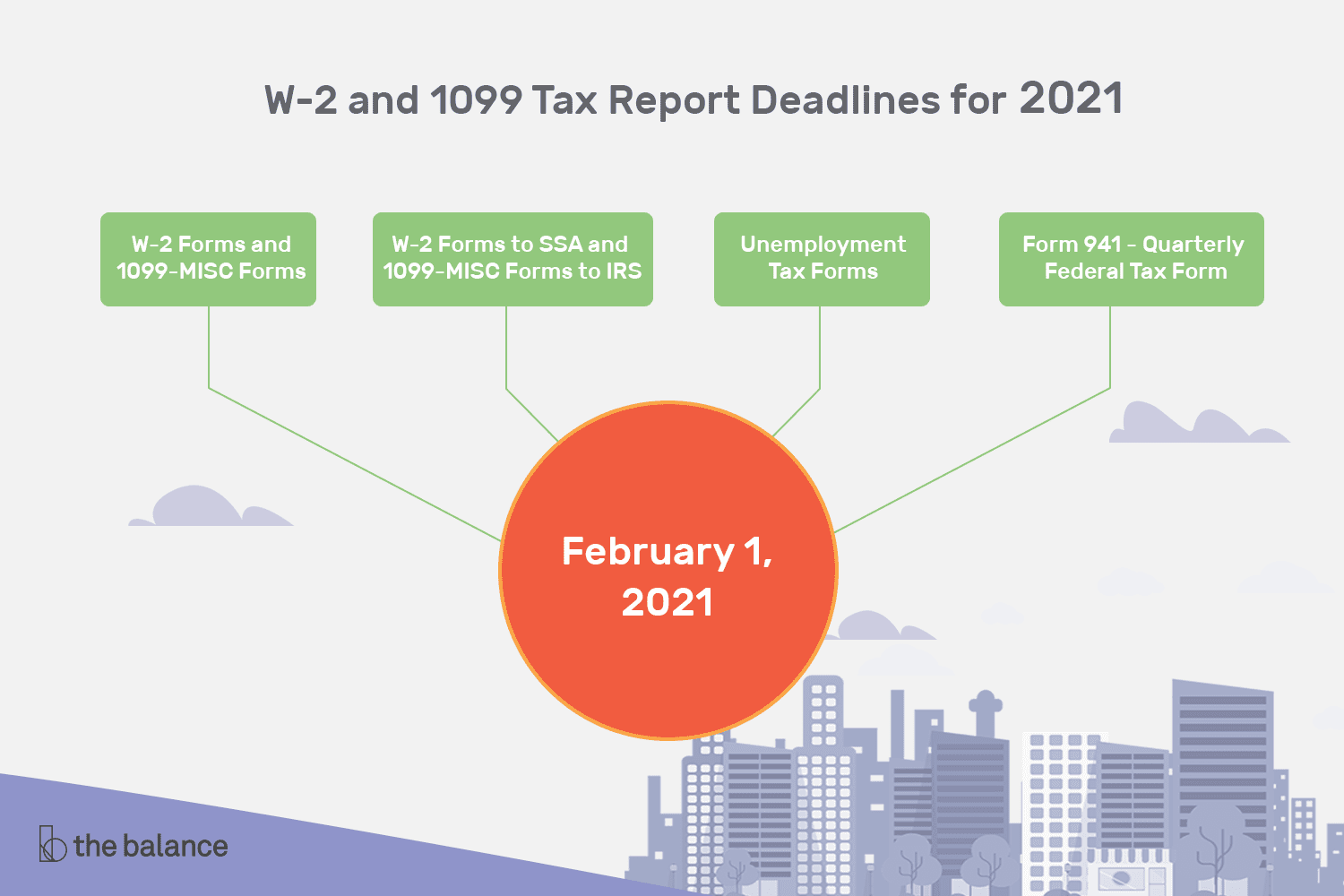

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Don’t Wait! W2 Form Deadline Approaching Fast!

Tick-tock, tick-tock! The deadline for employers to send out W2 forms to their employees is quickly approaching. Don’t wait until the last minute to gather all your tax documents and start preparing for tax season. Getting a head start on your taxes will not only save you from the stress of rushing to meet the deadline, but it will also give you more time to explore deductions and credits that could potentially save you money.

As the days fly by, make sure you keep an eye out for that crucial W2 form in your mailbox or inbox. The information on your W2 form is essential for filing your taxes accurately and efficiently. If you have multiple jobs or sources of income, you’ll need to gather all your W2 forms to ensure you report all your income correctly. So, clear your schedule, grab a cup of coffee, and get ready to tackle those taxes like a pro!

The W2 form deadline is not something to dread but rather an opportunity to take control of your financial situation. Use this time to organize your finances, review your income and deductions, and set yourself up for a successful tax season. And remember, if you need assistance or have questions about filling out your W2 form, there are plenty of resources available to help you navigate the process with ease.

Get Ready to Tackle Your Taxes with W2 Form!

It’s time to dust off your calculator, sharpen your pencils, and embrace the challenge of tax season with open arms. The W2 form is your key to unlocking a successful tax filing process, so don’t underestimate its importance. Take the time to review your W2 form carefully, double-checking all the information to ensure its accuracy. This form holds the key to claiming deductions, credits, and refunds, so make sure you have it in hand before diving into your tax return.

As you dive into the world of tax preparation, remember to stay organized and keep track of all your tax documents, including your W2 form. Whether you choose to file your taxes independently or seek the help of a professional, having your W2 form ready will streamline the process and make it easier for you to file accurately and on time. So, roll up your sleeves, gather your documents, and get ready to conquer tax season like a boss!

In the midst of the hustle and bustle of tax season, don’t forget to stay positive and focused on the end goal. Filing your taxes may seem daunting, but with the right attitude and a little bit of preparation, you can tackle it head-on and come out on top. So, embrace the challenge, gather your W2 forms, and get excited for the opportunity to take control of your financial future. Time’s ticking, but with a little bit of determination and a positive mindset, you can conquer tax season with confidence.

In conclusion, the W2 form deadline may be fast approaching, but there’s no need to panic. Embrace the challenge of tax season with excitement and enthusiasm, knowing that you have the tools and resources to navigate the process successfully. Take the time to gather your W2 forms, review your information carefully, and prepare for a smooth and efficient tax filing experience. With a positive attitude and a little bit of preparation, you can tackle your taxes like a pro and come out on top. So, get ready to conquer tax season and take control of your financial future – the deadline is just around the corner!

Below are some images related to W2 Form Deadline

w2 filing deadline 2021, w2 filing deadline 2023, w2 filing deadline 2024, w2 form dates, w2 form deadline, , W2 Form Deadline.

w2 filing deadline 2021, w2 filing deadline 2023, w2 filing deadline 2024, w2 form dates, w2 form deadline, , W2 Form Deadline.