W2 Form Transcript – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Deciphering your W2: A New Approach

Ah, the dreaded W2 form – that mysterious piece of paper that arrives in the mail once a year, causing confusion and stress for many. But fear not, my friends! There is a new approach to unraveling the magic of your W2, and it involves taking a closer look at the transcript edition. By diving into the details of your W2 transcript, you can uncover hidden gems of information that will help you better understand your tax situation.

One of the key benefits of delving into your W2 transcript is gaining a deeper understanding of the numbers and codes that are listed on your form. By deciphering these codes, you can unlock valuable insights into your income, deductions, and tax withholding. This newfound knowledge will not only help you file your taxes accurately but also empower you to make informed financial decisions throughout the year. So, say goodbye to confusion and hello to clarity with the transcript edition of your W2.

Navigating the complexities of your W2 transcript may seem daunting at first, but with a little patience and persistence, you can crack the code like a pro. Start by familiarizing yourself with the various sections of your transcript, such as wages, taxes withheld, and deductions. Next, pay close attention to the codes and descriptions provided for each entry, as they hold the key to understanding how your taxes are calculated. With practice and determination, you’ll soon be able to master your W2 transcript like a seasoned tax expert.

Crack the Code: Mastering W2 Transcripts

As you continue to unravel the magic of your W2 transcript, you’ll soon discover the wealth of information it contains. From identifying potential errors in your tax withholding to maximizing your deductions, the transcript edition of your W2 is a treasure trove of valuable insights. By honing your skills in deciphering codes and interpreting data, you can take control of your finances and ensure that you are making the most of your tax return. So, roll up your sleeves and get ready to crack the code like never before.

In addition to providing a detailed breakdown of your tax information, your W2 transcript can also serve as a roadmap for future financial planning. By analyzing your income and expenses, you can identify areas where you can save money, reduce debt, and increase your overall financial health. Armed with this knowledge, you can set realistic goals for the future and take proactive steps to achieve them. So, embrace the power of your W2 transcript and watch as it transforms your financial outlook for the better.

In conclusion, the transcript edition of your W2 is not just a piece of paper – it’s a valuable tool that can help you navigate the complexities of your taxes and empower you to take control of your financial future. By approaching your W2 with a fresh perspective and a willingness to learn, you can unravel its magic and unlock a world of financial possibilities. So, don’t be afraid to dive into your W2 transcript and discover the hidden gems within – your financial future depends on it.

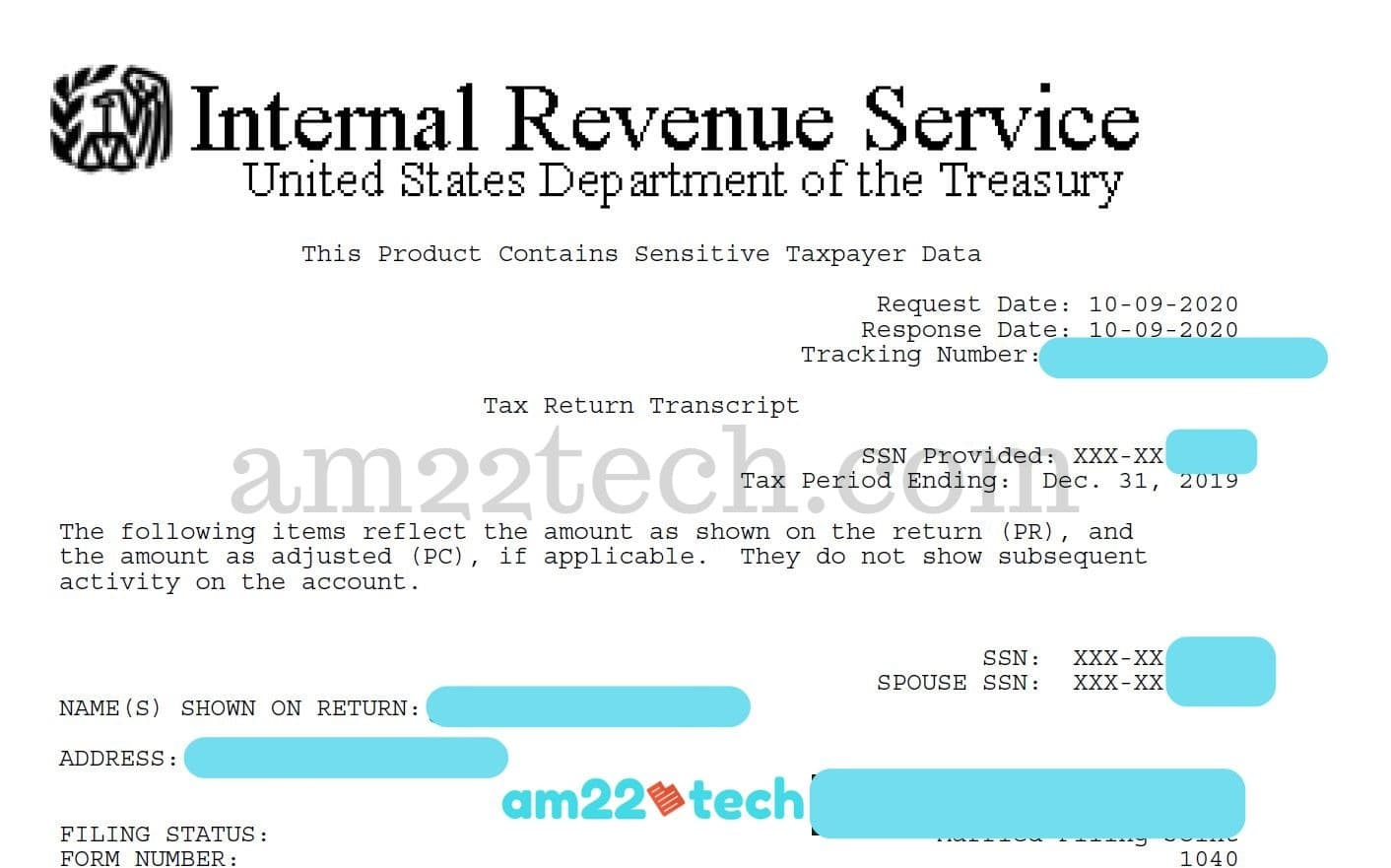

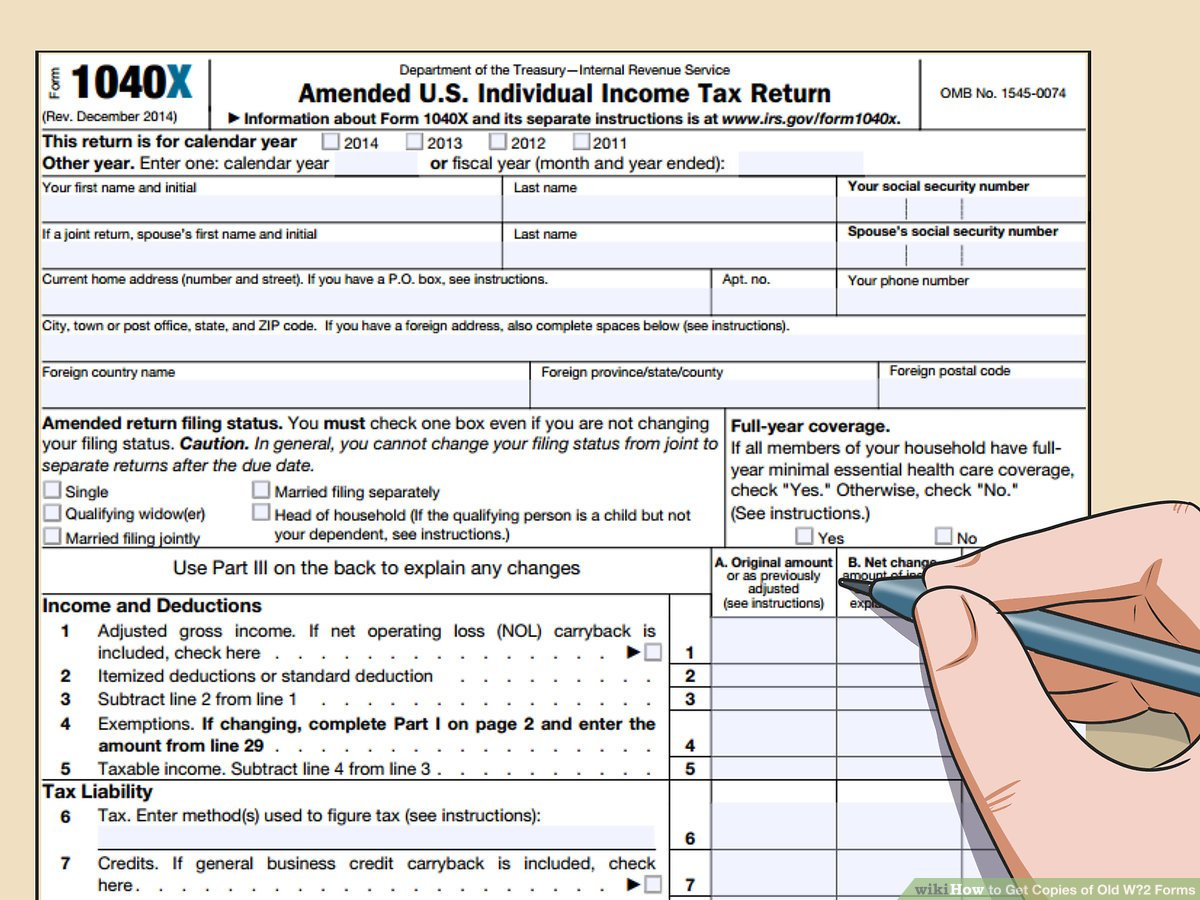

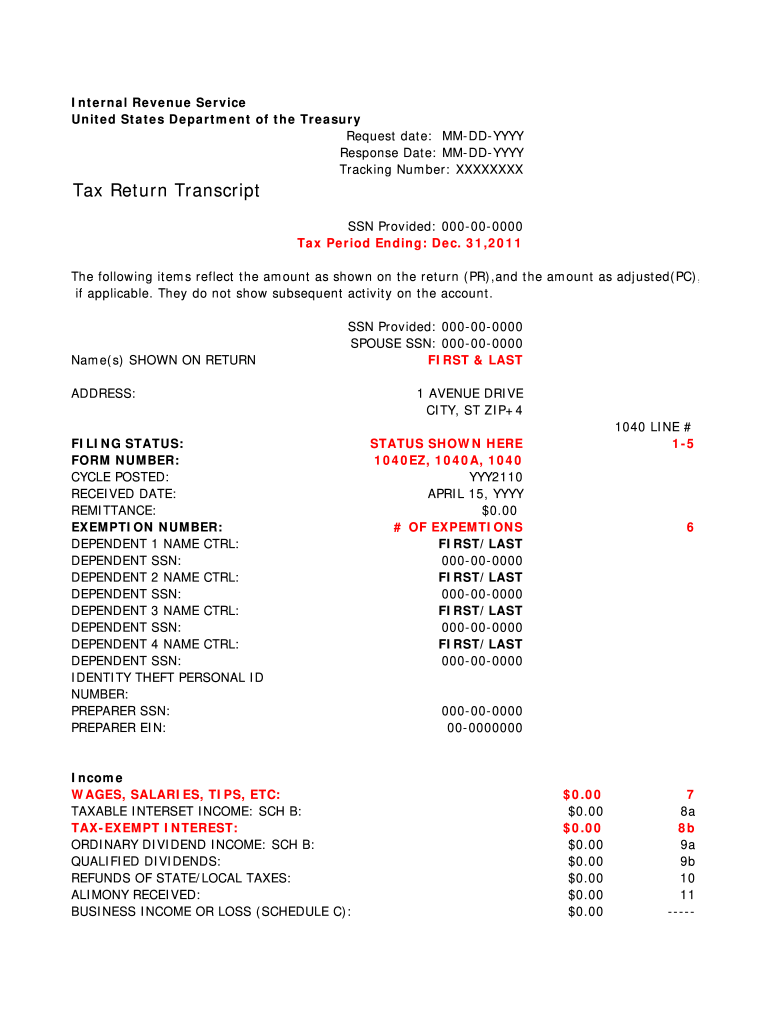

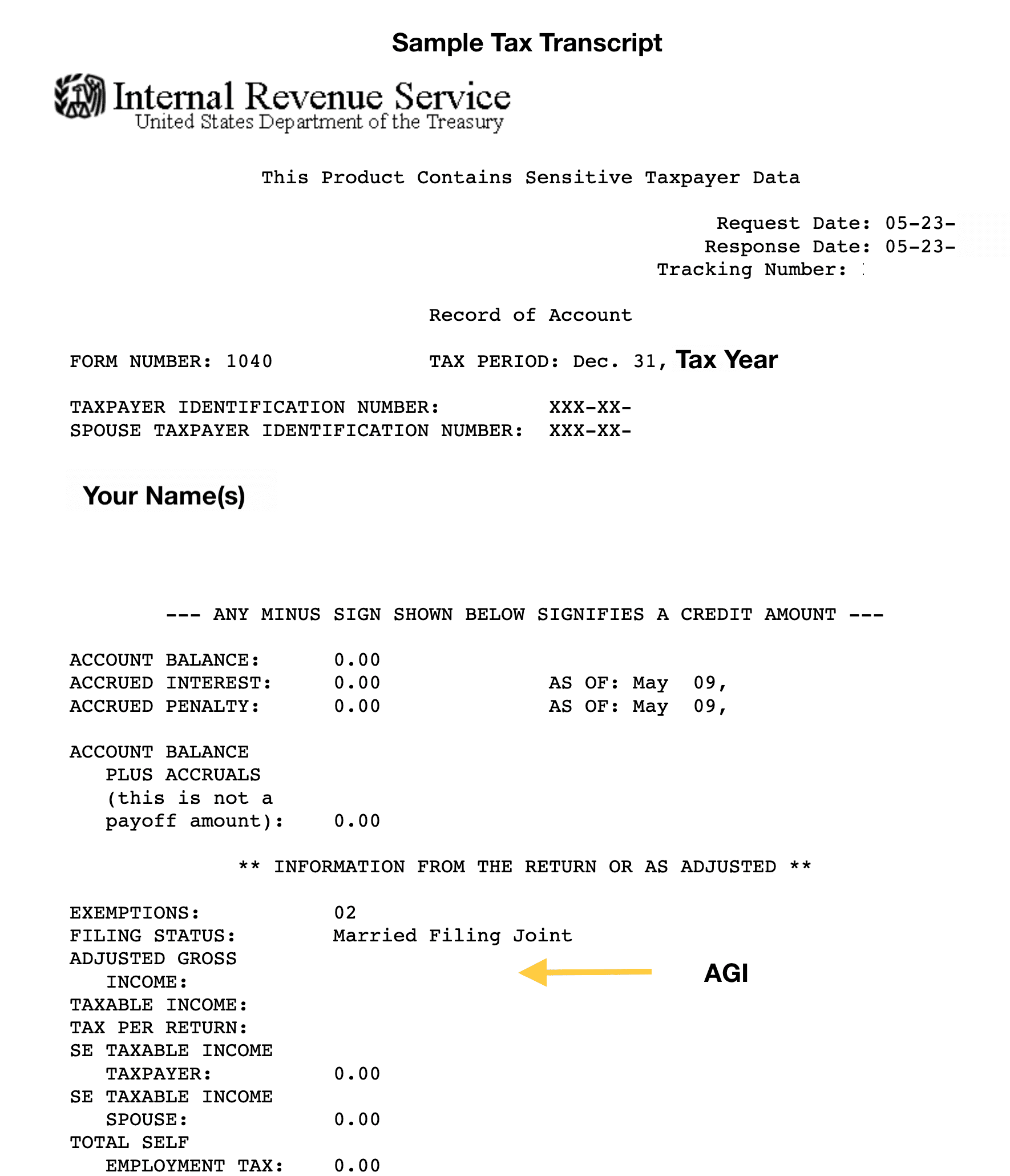

Below are some images related to W2 Form Transcript

how can i get my w2 transcript online, how to get my w2 transcripts, w2 form transcript, w2 online transcript, w2 transcript online irs, , W2 Form Transcript.

how can i get my w2 transcript online, how to get my w2 transcripts, w2 form transcript, w2 online transcript, w2 transcript online irs, , W2 Form Transcript.