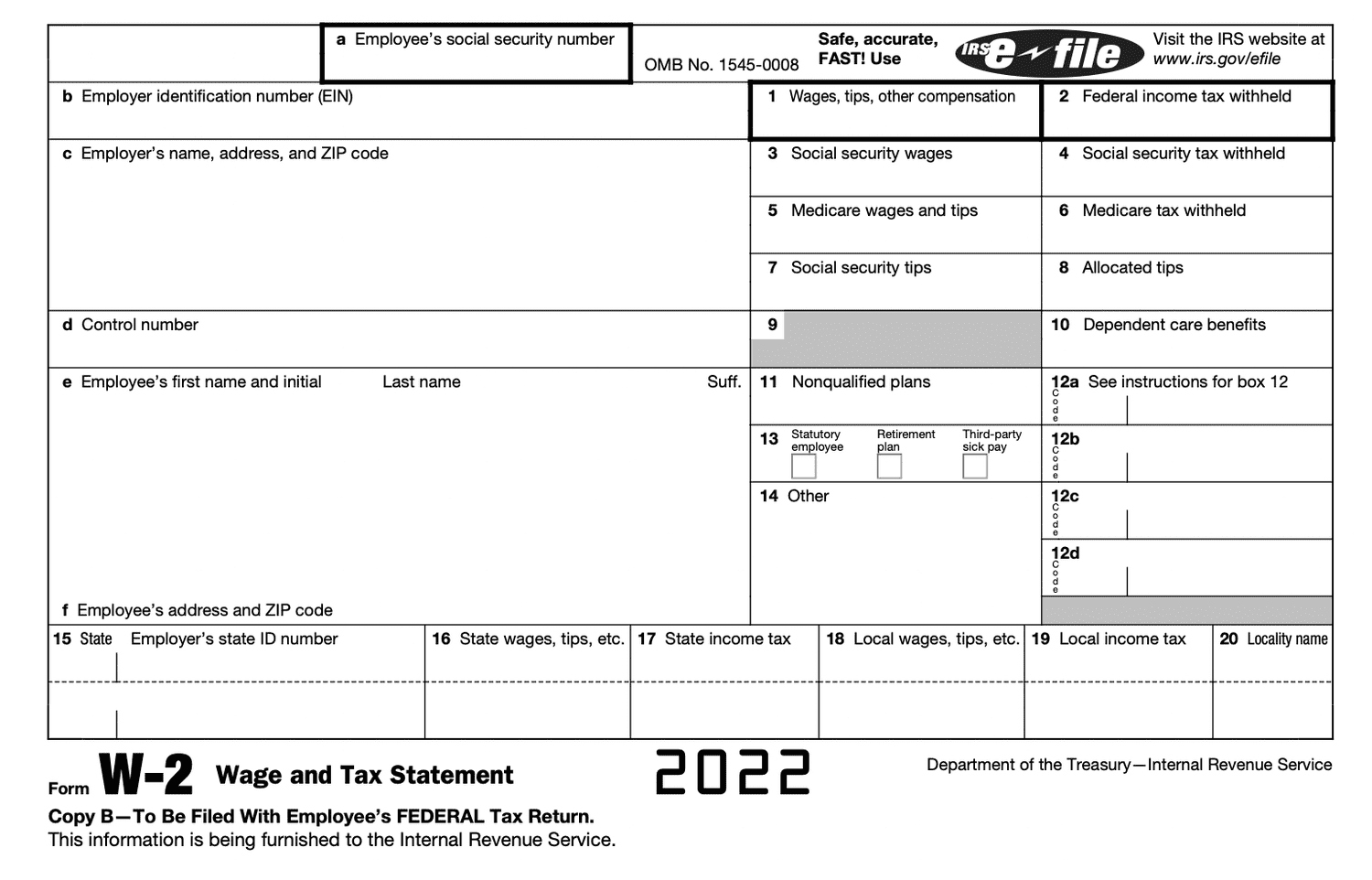

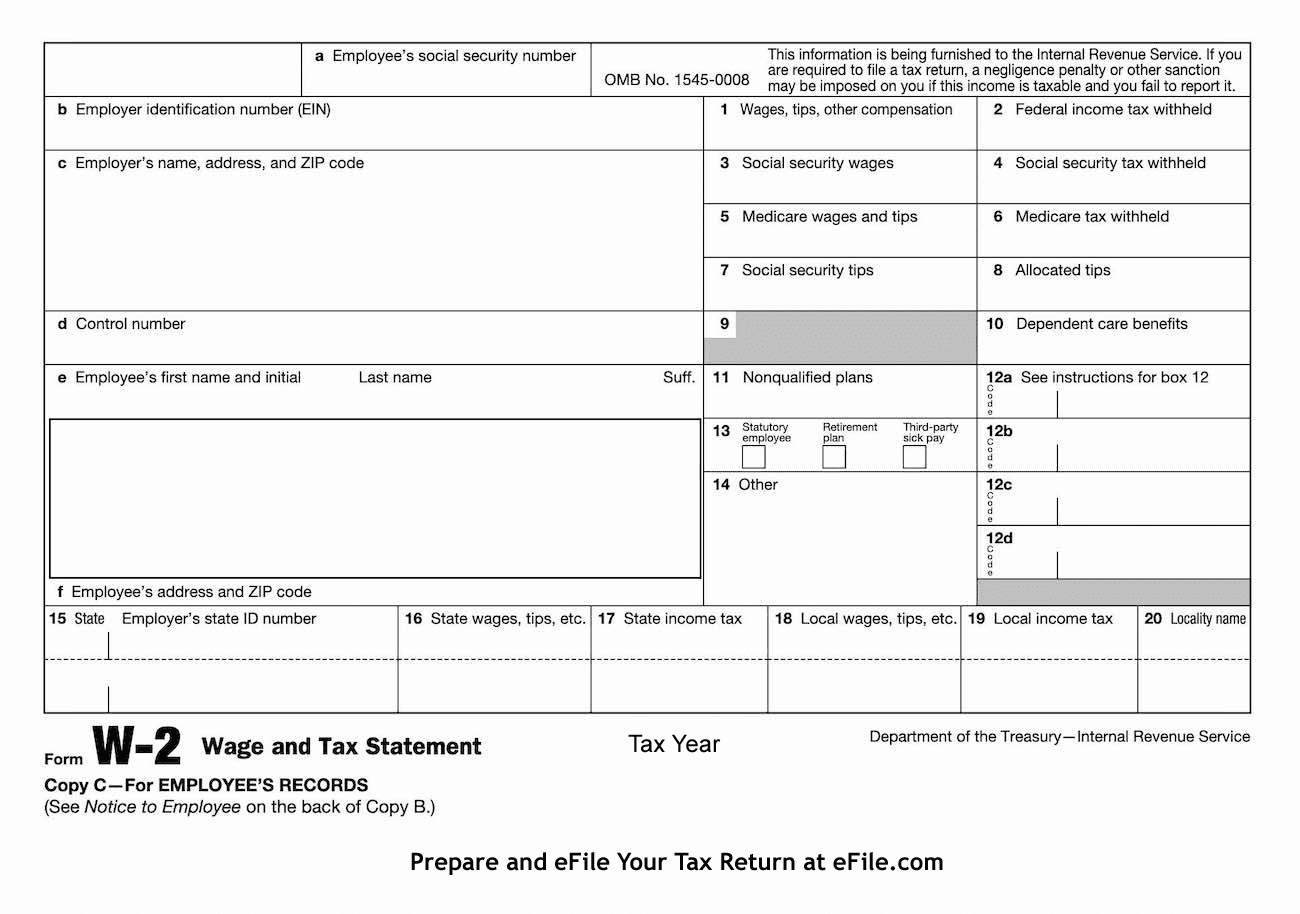

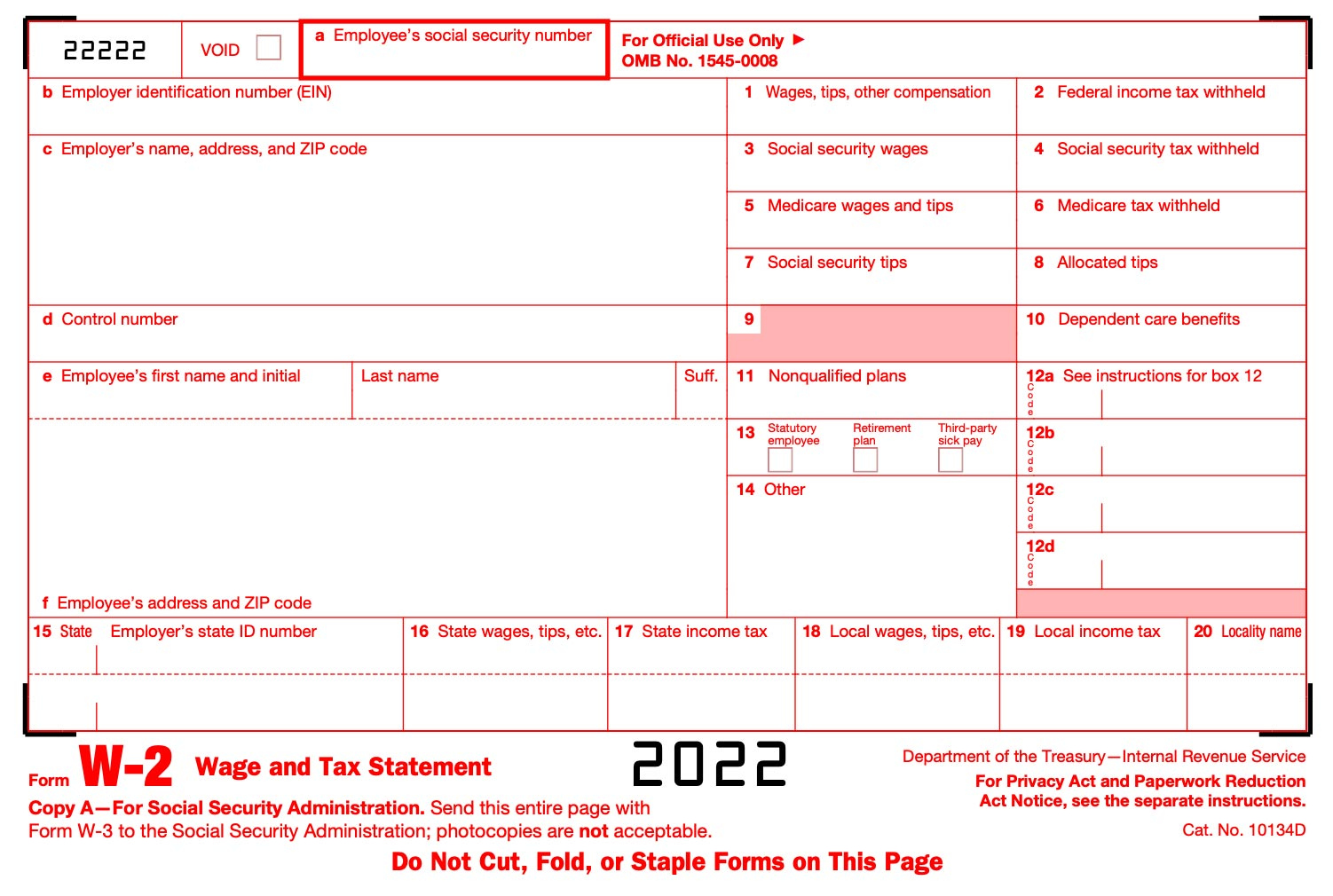

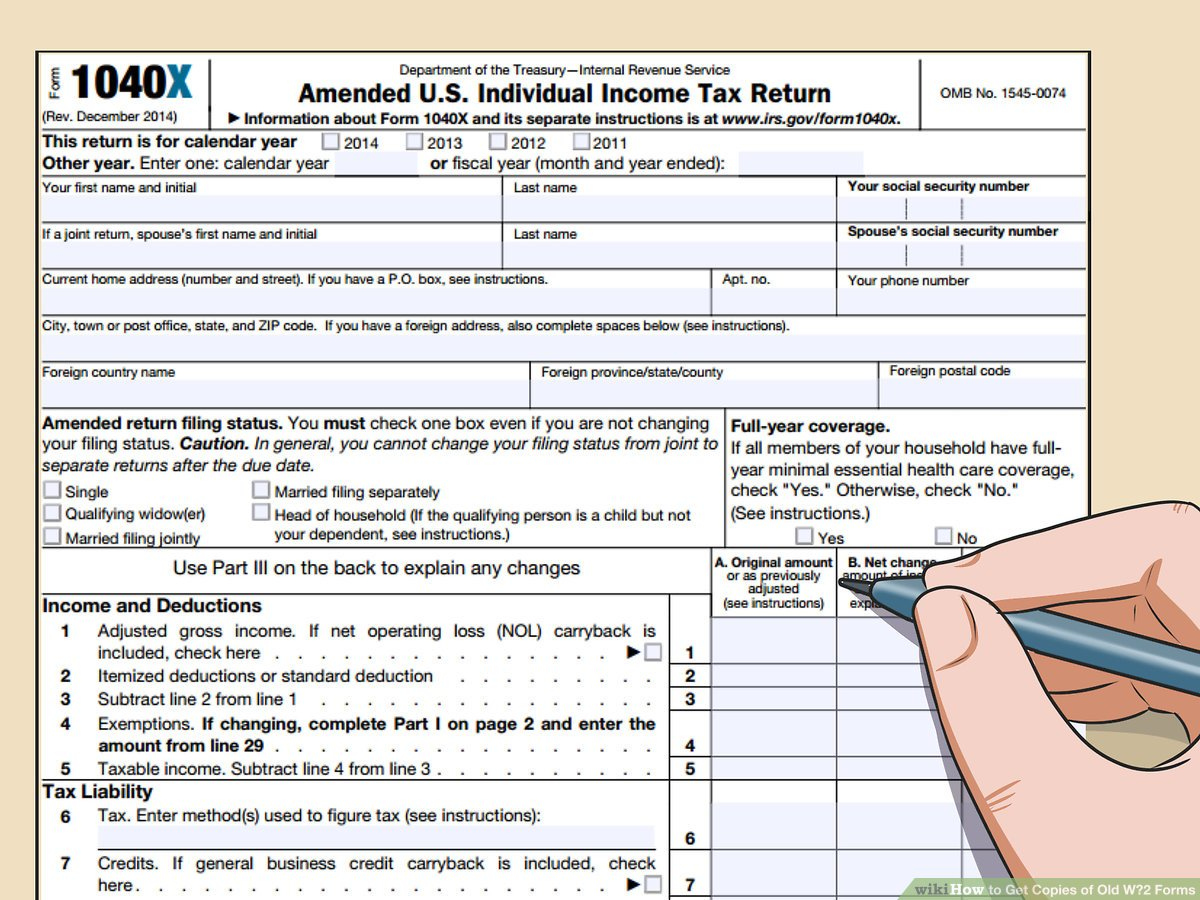

How To Get W2 Forms – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unlock Your W2 Magic: The Ultimate Guide to Getting Your Forms!

Are you ready to unlock the magic of your W2 form and take control of your taxes like never before? With the right knowledge and tools, you can discover the secrets to maximizing your tax return and ensuring you get every deduction you deserve. Say goodbye to tax season stress and hello to financial empowerment with our ultimate guide to getting your W2 forms!

Unleash the Power of Your W2 Form!

Your W2 form is more than just a piece of paper – it holds the key to unlocking your financial potential. This important document provides vital information about your earnings, taxes withheld, and other crucial details that can impact your tax return. By understanding how to read and interpret your W2 form, you can take control of your tax situation and make informed decisions about how to maximize your refund. From identifying potential deductions to ensuring accurate reporting of your income, unleashing the power of your W2 form is the first step towards financial success.

Discover the Secrets to Unlocking Your Tax Magic!

Getting your hands on your W2 form is the first step towards unlocking your tax magic, but there are plenty of other secrets to discover along the way. From utilizing tax software to working with a professional tax preparer, there are countless resources available to help you make the most of your tax return. By staying organized, keeping detailed records, and staying informed about changes to the tax code, you can ensure that you are taking full advantage of every opportunity to save money and maximize your refund. Don’t let tax season overwhelm you – with the right tools and knowledge, you can unlock your tax magic and take control of your financial future.

Conclusion

With the tips and tricks outlined in this guide, you can unlock the magic of your W2 form and make the most of your tax return. By understanding the power of your W2 form and utilizing the resources available to you, you can take control of your finances and secure a brighter financial future. Say goodbye to tax season stress and hello to financial empowerment – it’s time to unlock your W2 magic and get the refund you deserve!

Below are some images related to How To Get W2 Forms

how to get w2 forms, how to get w2 forms for employees, how to get w2 forms from amazon, how to get w2 forms from edd, how to get w2 forms from last year, , How To Get W2 Forms.

how to get w2 forms, how to get w2 forms for employees, how to get w2 forms from amazon, how to get w2 forms from edd, how to get w2 forms from last year, , How To Get W2 Forms.