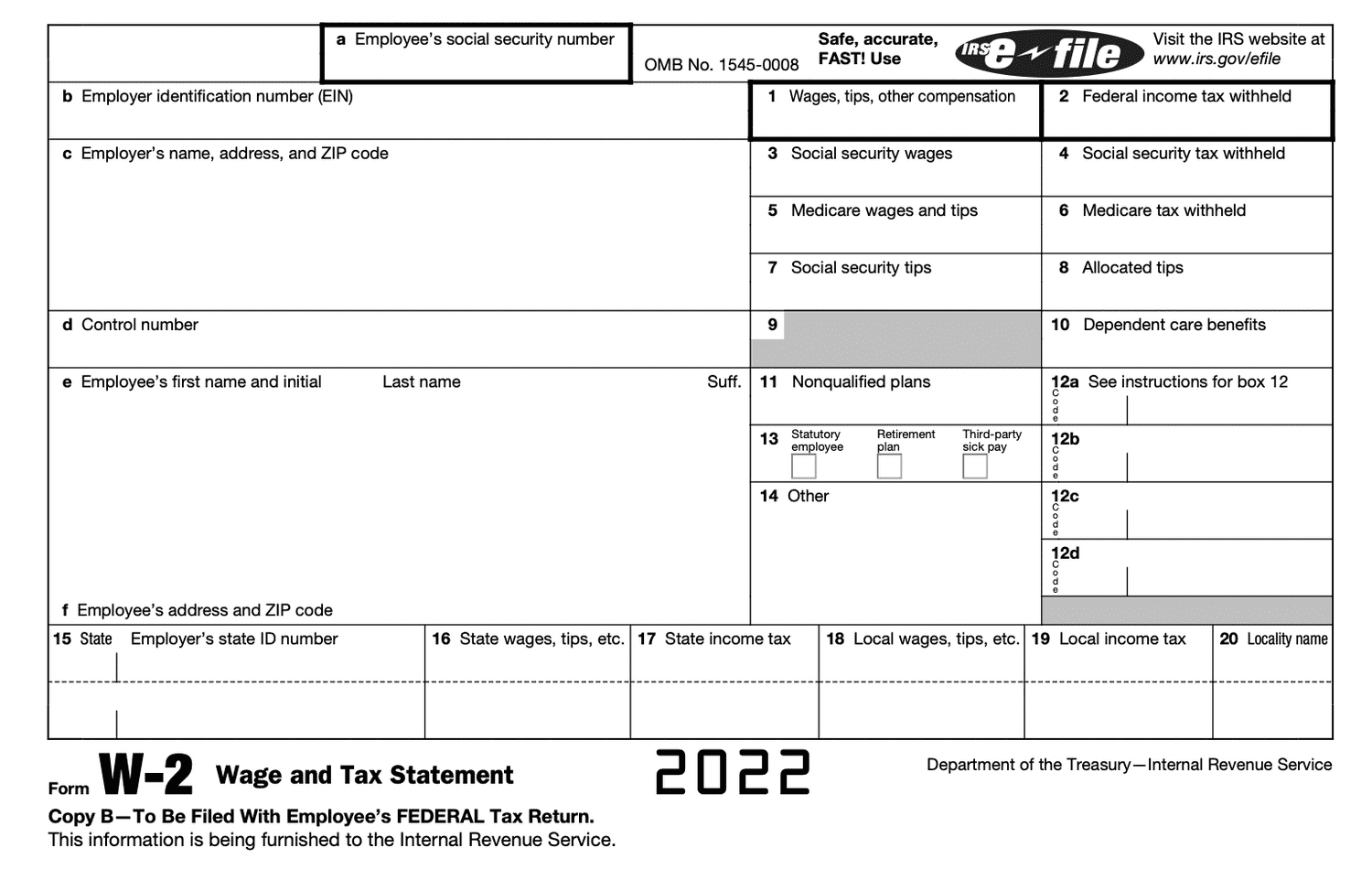

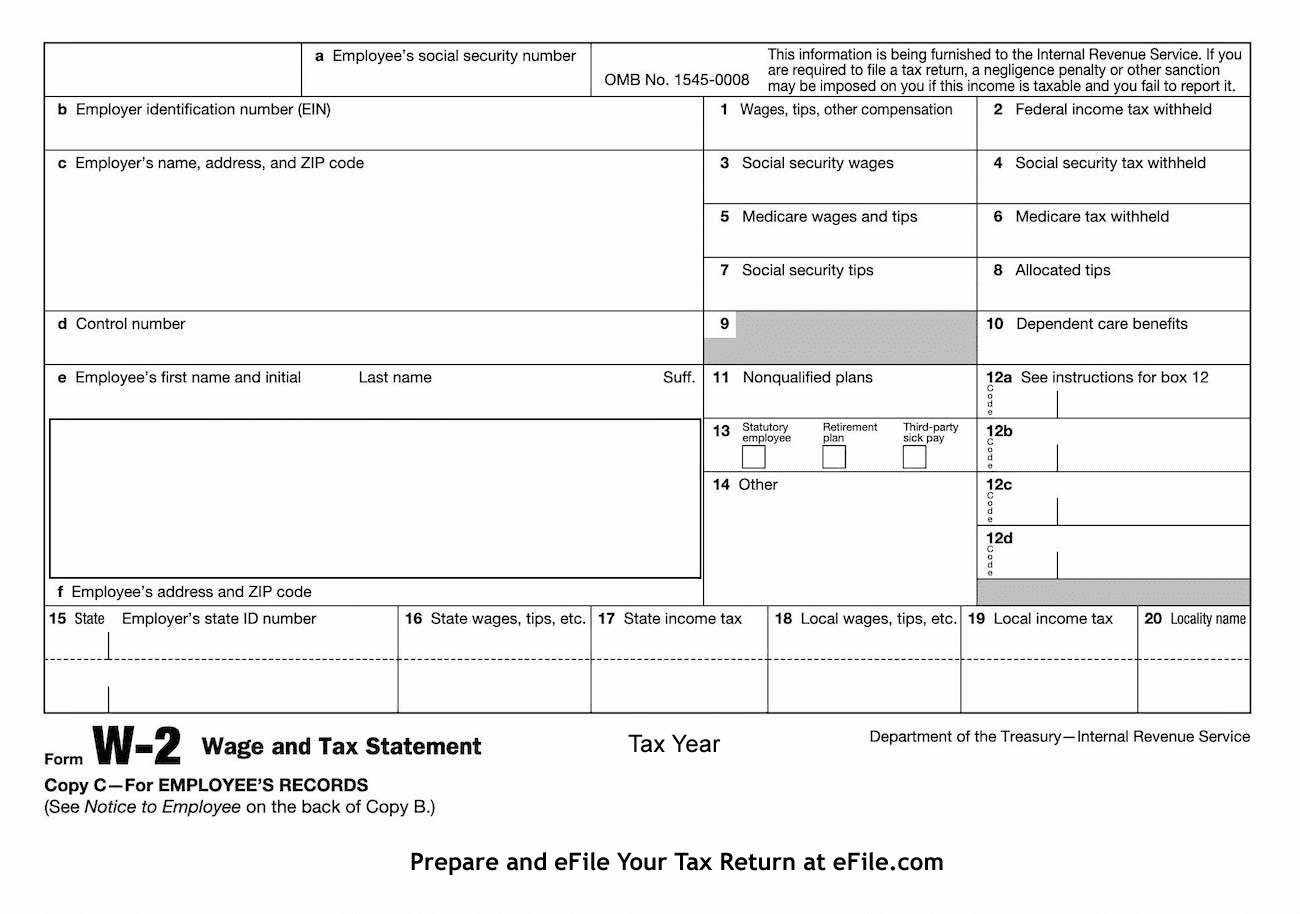

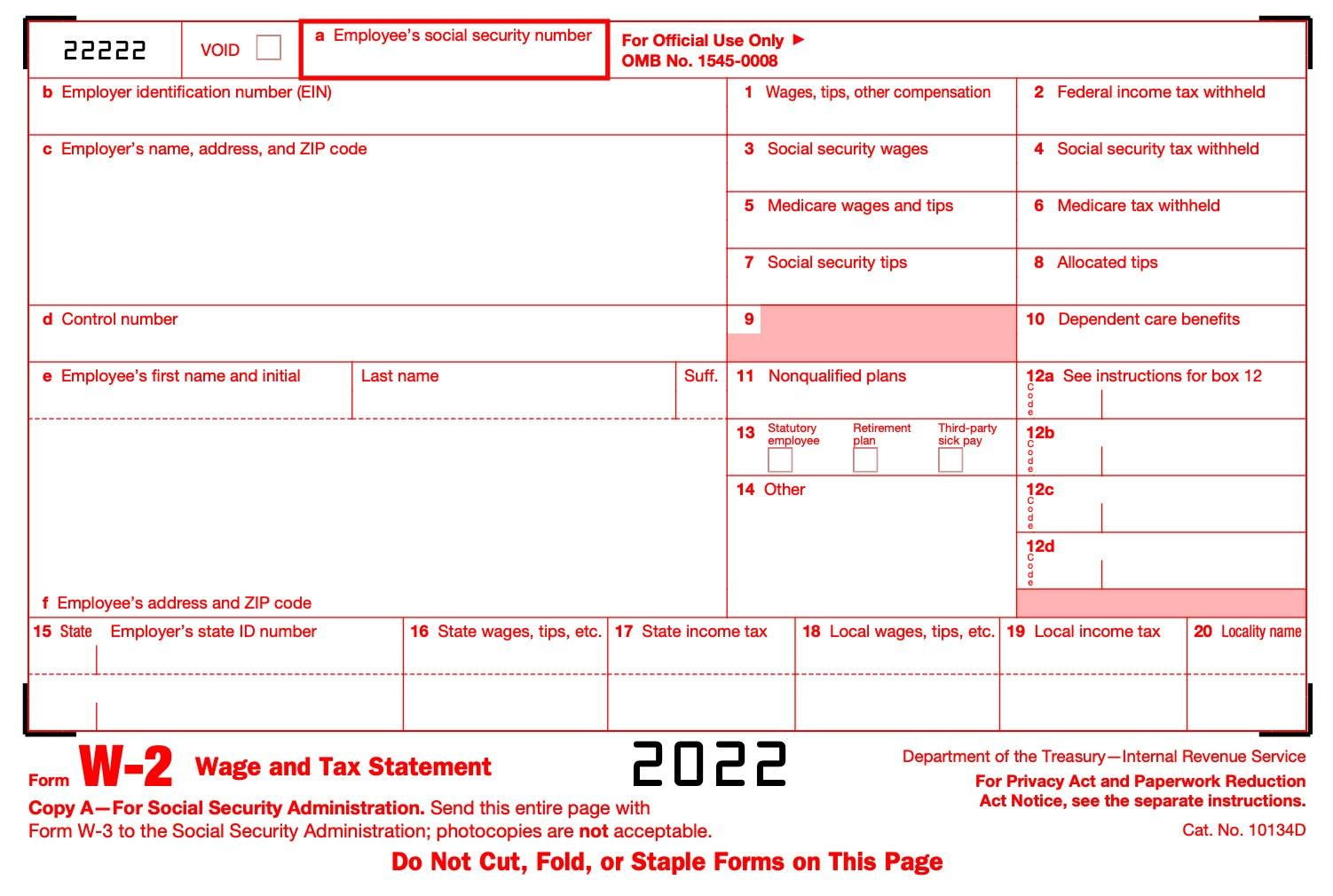

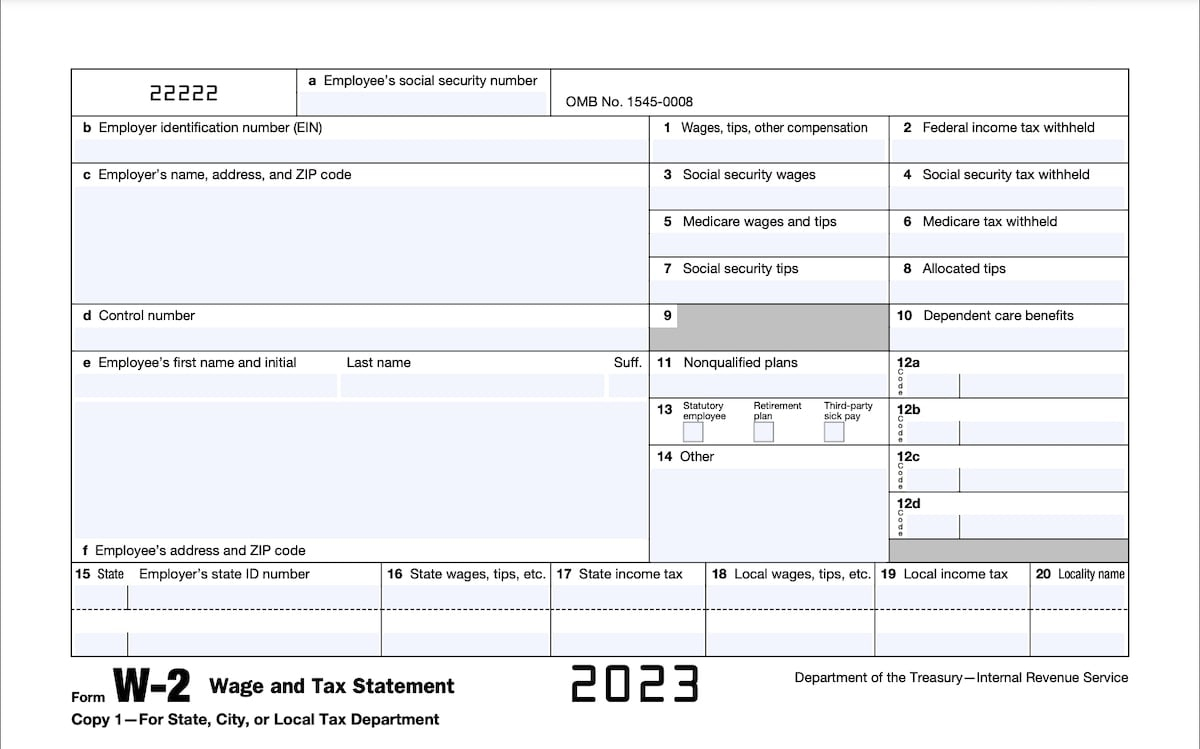

When The W2 Forms Will Be Available – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Get Ready for Tax Season: W2 Forms Coming Soon!

Taxes may not be the most exciting thing to think about, but let’s face it, they’re a part of life. And with tax season just around the corner, it’s time to start getting prepared. Whether you’re a seasoned tax pro or a newbie just dipping your toes into the world of tax returns, now is the time to brace yourself and get ready to tackle those forms!

Brace Yourself: Tax Season is Coming!

The time has come to gather all of your documents, receipts, and financial statements. Make sure you have everything you need to file your taxes accurately and on time. It’s never too early to start organizing your paperwork and getting your ducks in a row. Whether you file your taxes on your own or enlist the help of a professional, being prepared is key to a stress-free tax season.

Once you have all of your documents in order, take a deep breath and remind yourself that you’ve got this. Tax season can be daunting, but with a little organization and preparation, you can breeze through it like a pro. And remember, the sooner you get started, the sooner you can get your refund (if you’re lucky enough to get one)!

Time to Shine: W2 Forms on the Way!

One of the most important documents you’ll need for tax season is your W2 form. This form shows how much you earned and how much was withheld for taxes throughout the year. Employers are required to provide W2 forms to their employees by January 31st, so keep an eye out for yours in the mail or through your company’s online portal.

Once you receive your W2 form, double-check all the information to ensure its accuracy. If you spot any mistakes, be sure to contact your employer and get them corrected as soon as possible. Your W2 form is crucial for filing your taxes, so make sure it’s accurate before you start crunching numbers.

In conclusion, tax season may not be the most exciting time of year, but it doesn’t have to be stressful either. By getting organized, staying on top of deadlines, and being proactive with your paperwork, you can make tax season a breeze. So, get ready to tackle those forms, and before you know it, you’ll be one step closer to that sweet tax refund!

Below are some images related to When The W2 Forms Will Be Available

when the w2 forms will be available, when will 2022 w2 forms be available, when will 2023 w2 forms be available, who sends out w2 forms, , When The W2 Forms Will Be Available.

when the w2 forms will be available, when will 2022 w2 forms be available, when will 2023 w2 forms be available, who sends out w2 forms, , When The W2 Forms Will Be Available.