W2 Tax Form 2022 – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Prepare for Prosperity: Mastering Your W2 Form 2022!

Are you ready to take control of your financial future and pave the way to prosperity in the new year? The first step is to master your W2 tax form for 2022! Your W2 form is a crucial document that provides detailed information about your earnings and taxes withheld throughout the year. By understanding how to navigate and interpret your W2 form, you can optimize your tax return and make informed financial decisions that will set you on the path to success.

One key element to pay attention to on your W2 form is your total earnings for the year. This includes not only your regular wages but also any bonuses, commissions, or other forms of income you received. By having a clear picture of your total earnings, you can better plan for your financial goals and budget accordingly. Additionally, understanding how your earnings are broken down can help you identify areas where you may be able to increase your income or reduce expenses.

When reviewing your W2 form, be sure to take note of the taxes that have been withheld from your paycheck throughout the year. This includes federal income tax, Social Security tax, Medicare tax, and any state or local taxes that may apply. By understanding how much tax has already been deducted from your earnings, you can determine if you are likely to receive a refund or owe additional taxes when you file your return. This information can also help you make adjustments to your withholding for the next year to ensure you are not overpaying or underpaying taxes.

Navigate Your Way to Financial Freedom with W2 Form Insights!

Unlocking your financial future starts with gaining insight into your W2 form for 2022. By understanding the information provided on this important document, you can take control of your finances and make strategic decisions that will set you on the path to financial freedom. Whether you are saving for a big purchase, planning for retirement, or simply looking to improve your financial literacy, your W2 form can provide valuable insights to help you achieve your goals.

One key benefit of mastering your W2 form is the ability to track your income and expenses over time. By reviewing your W2 forms from previous years, you can identify trends in your earnings and spending habits, allowing you to make adjustments as needed. This can help you make informed decisions about budgeting, saving, and investing, ultimately leading to a more secure financial future.

In addition to tracking your income and expenses, your W2 form can also provide valuable information about your tax liability and potential deductions. By understanding how your taxes are calculated and what deductions you may be eligible for, you can optimize your tax return and potentially save money. This can free up additional funds that you can put towards your financial goals, whether that be paying off debt, saving for a rainy day, or investing for the future.

In conclusion, unlocking your financial future starts with mastering your W2 form for 2022. By taking the time to understand and analyze this important document, you can gain valuable insights into your earnings, taxes, and overall financial situation. Armed with this knowledge, you can make informed decisions that will set you on the path to prosperity and financial freedom. So, grab your W2 form, dive in, and prepare to unlock a brighter financial future for yourself in the coming year!

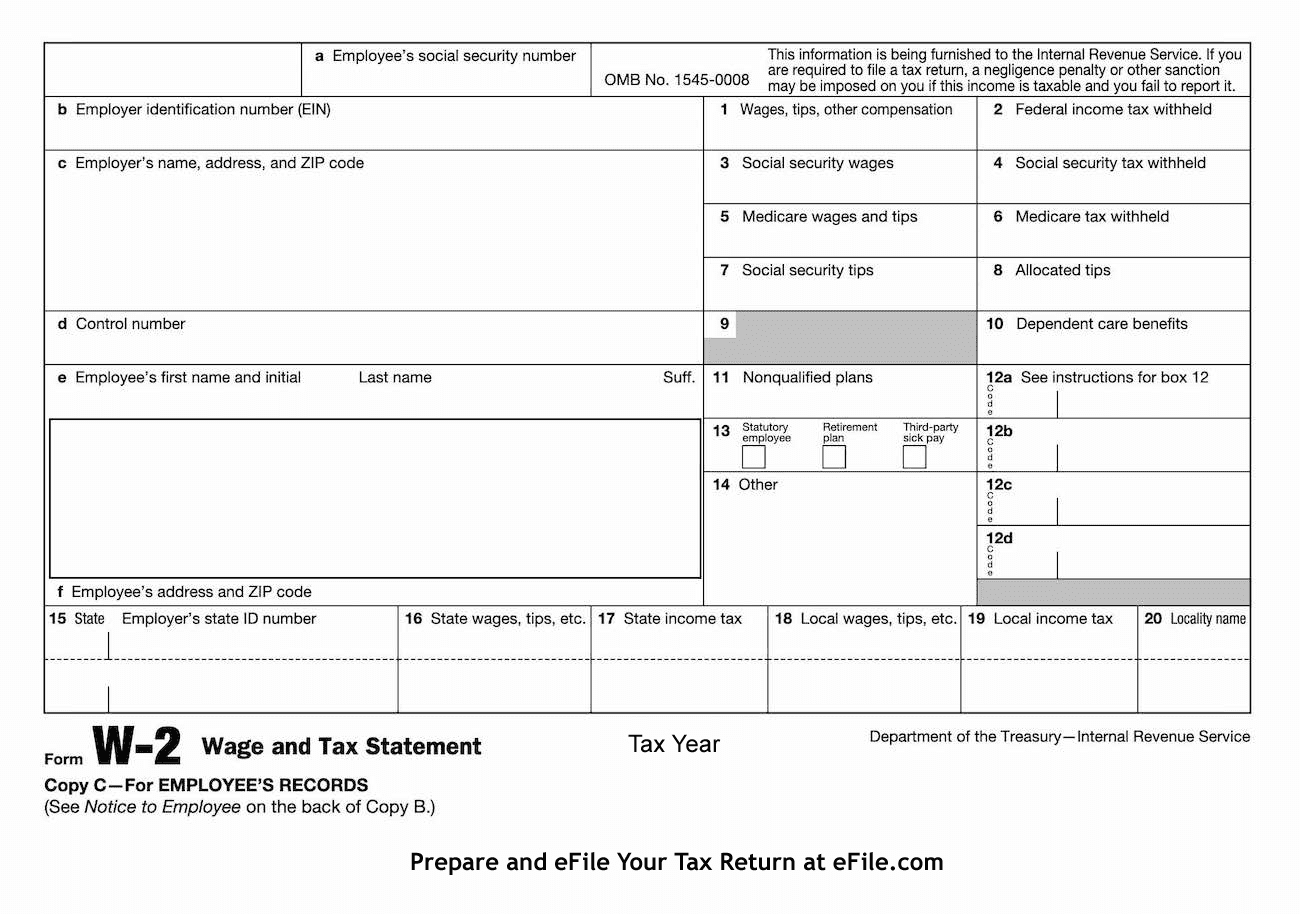

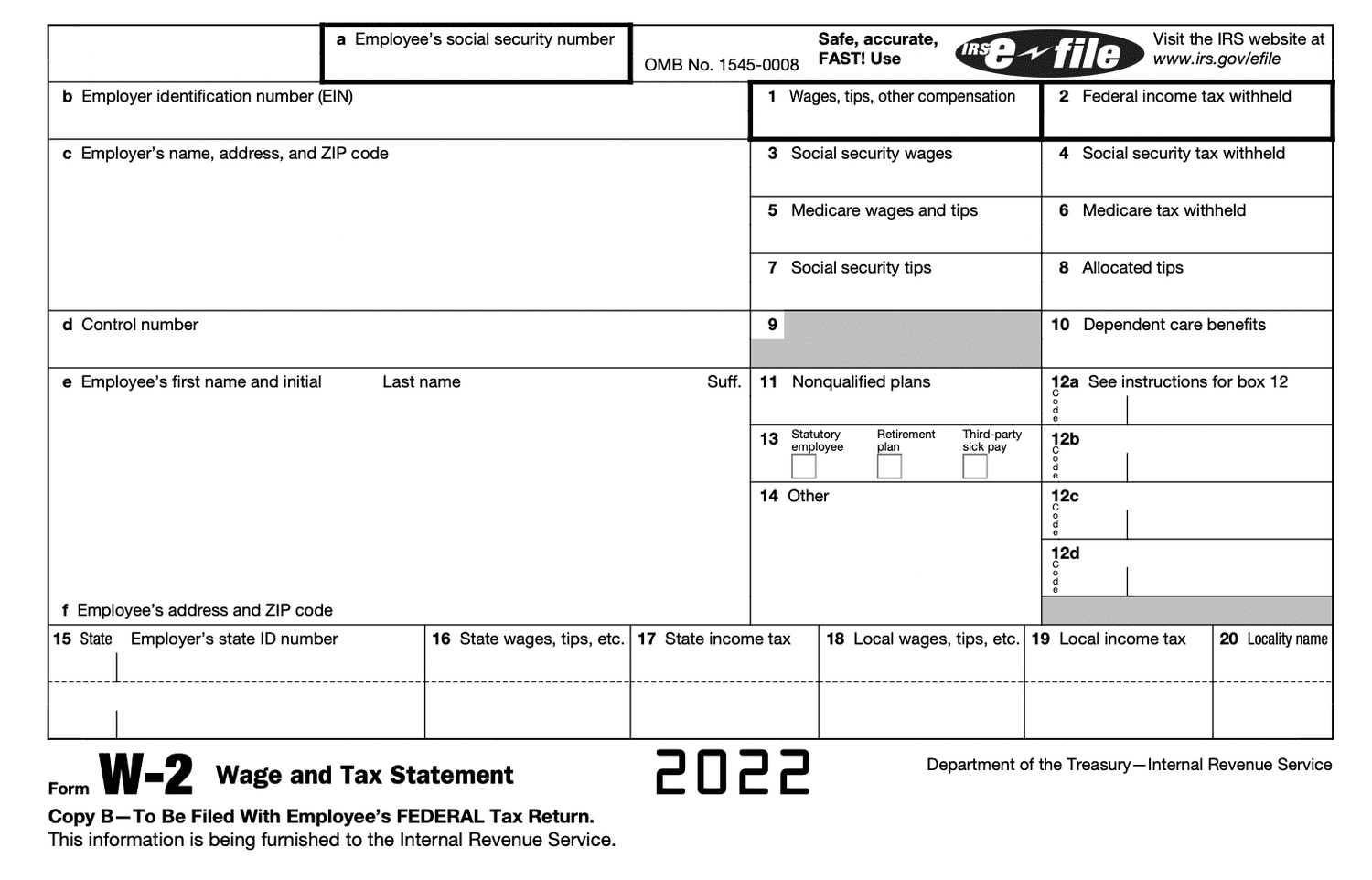

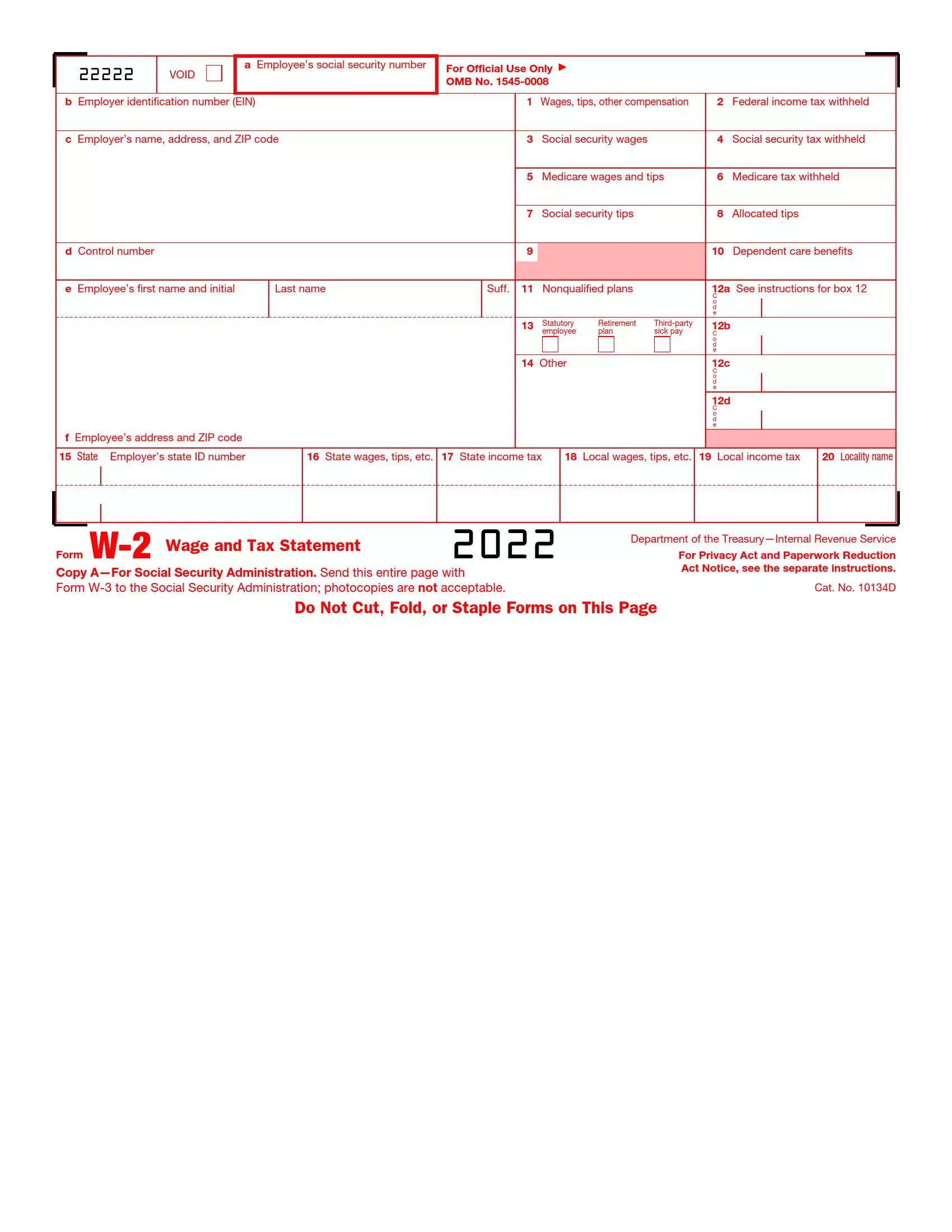

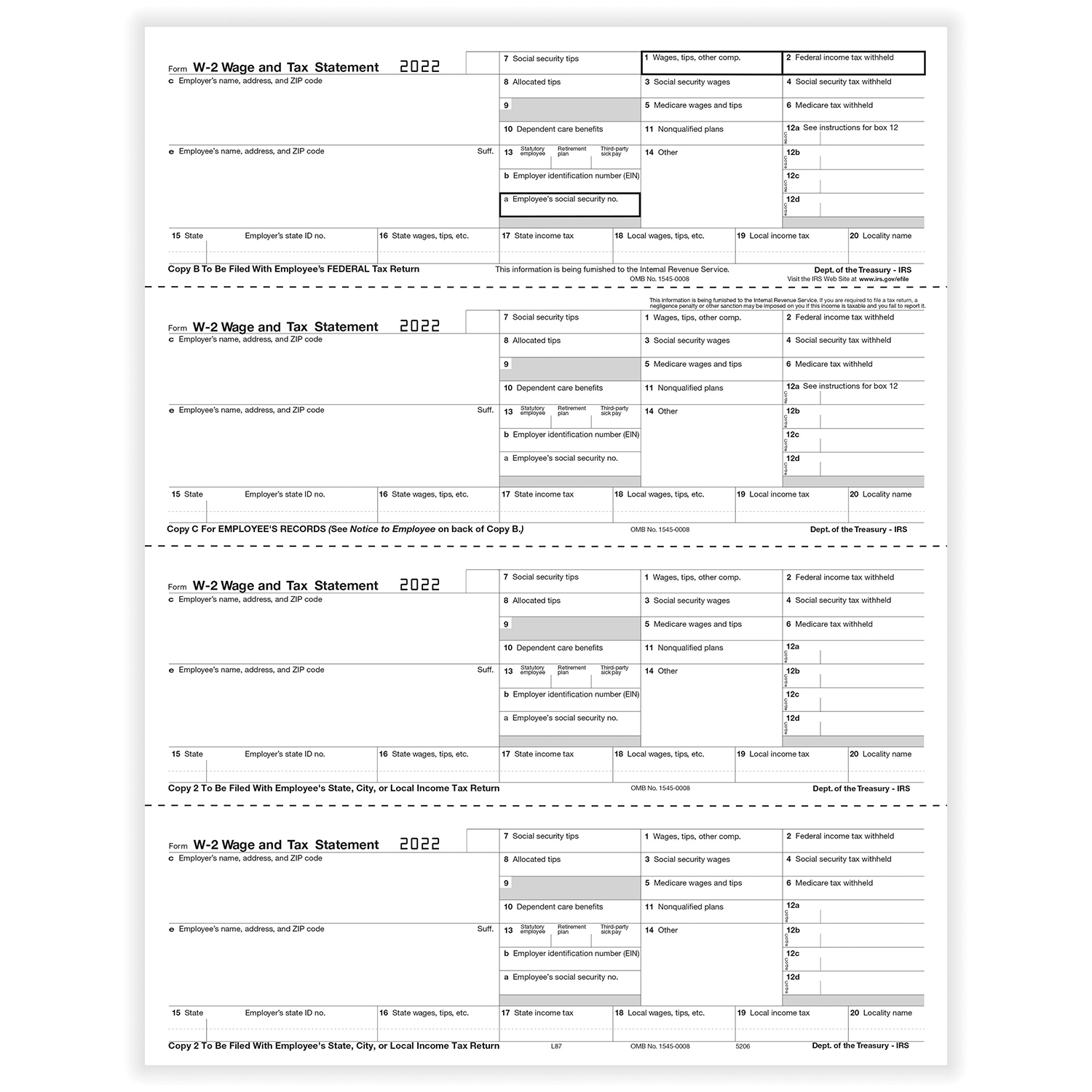

Below are some images related to W2 Tax Form 2022

form w2 tax year 2022, how do i get my w2 for 2020, irs w-2 form 2022 instructions, irs w2 form 2022 pdf, w-2 form for tax year 2022, , W2 Tax Form 2022.

form w2 tax year 2022, how do i get my w2 for 2020, irs w-2 form 2022 instructions, irs w2 form 2022 pdf, w-2 form for tax year 2022, , W2 Tax Form 2022.