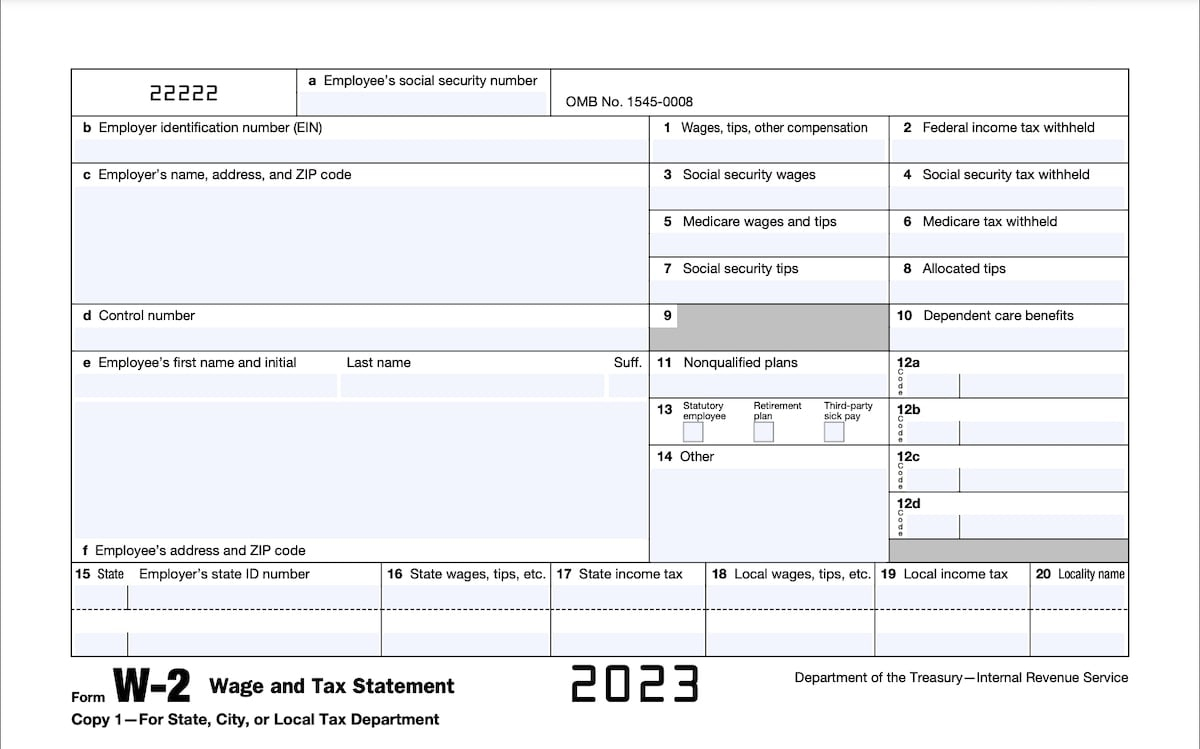

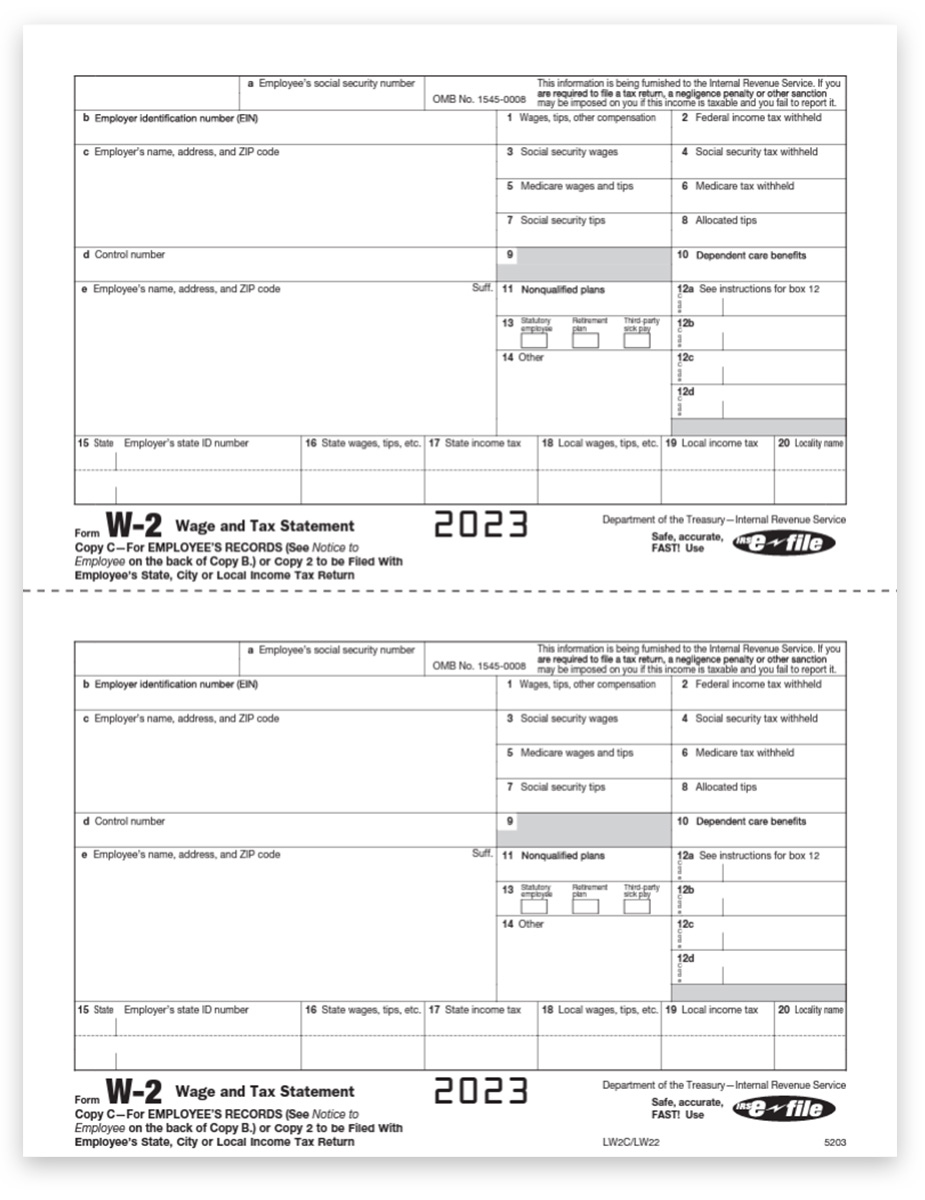

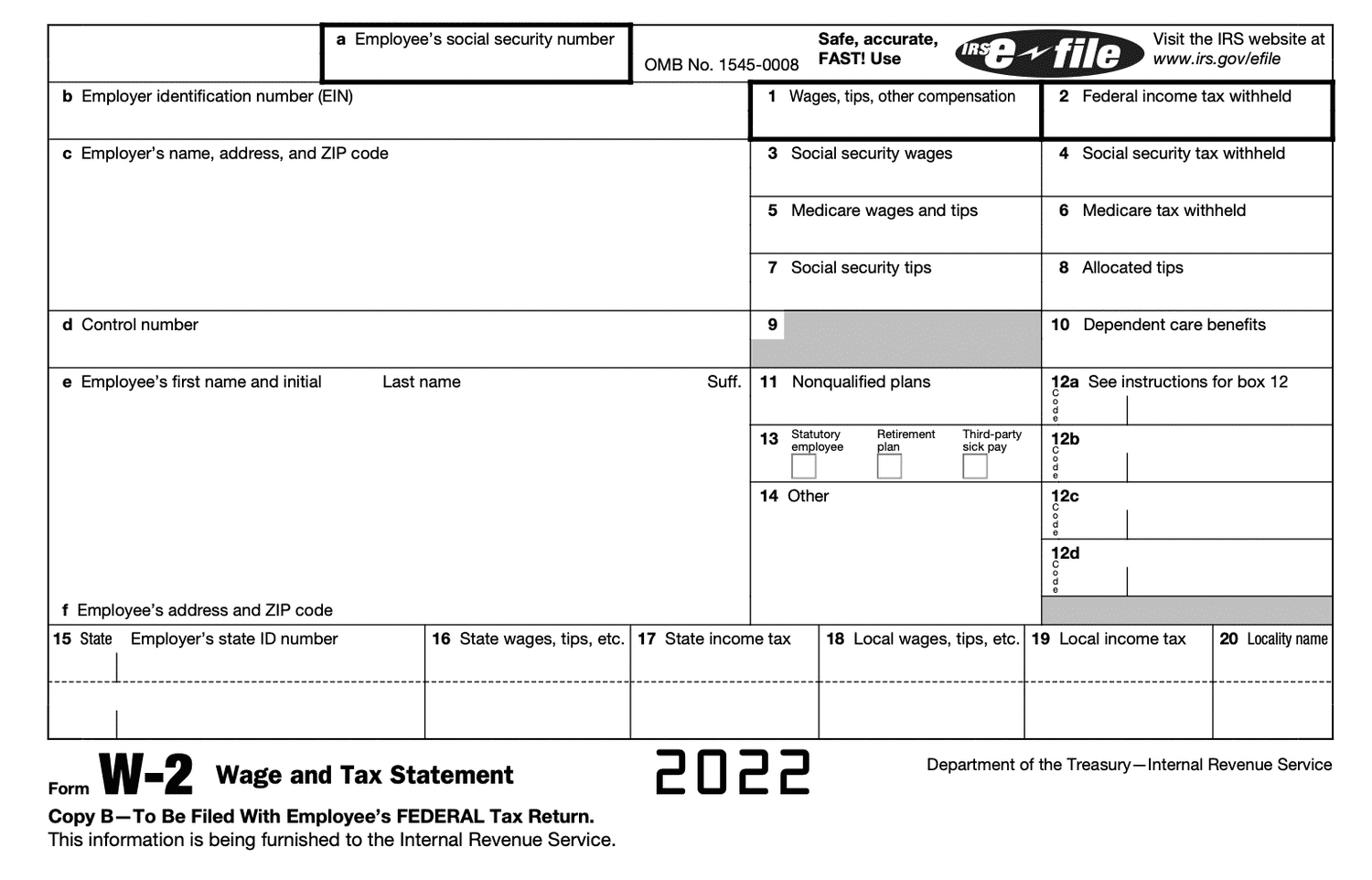

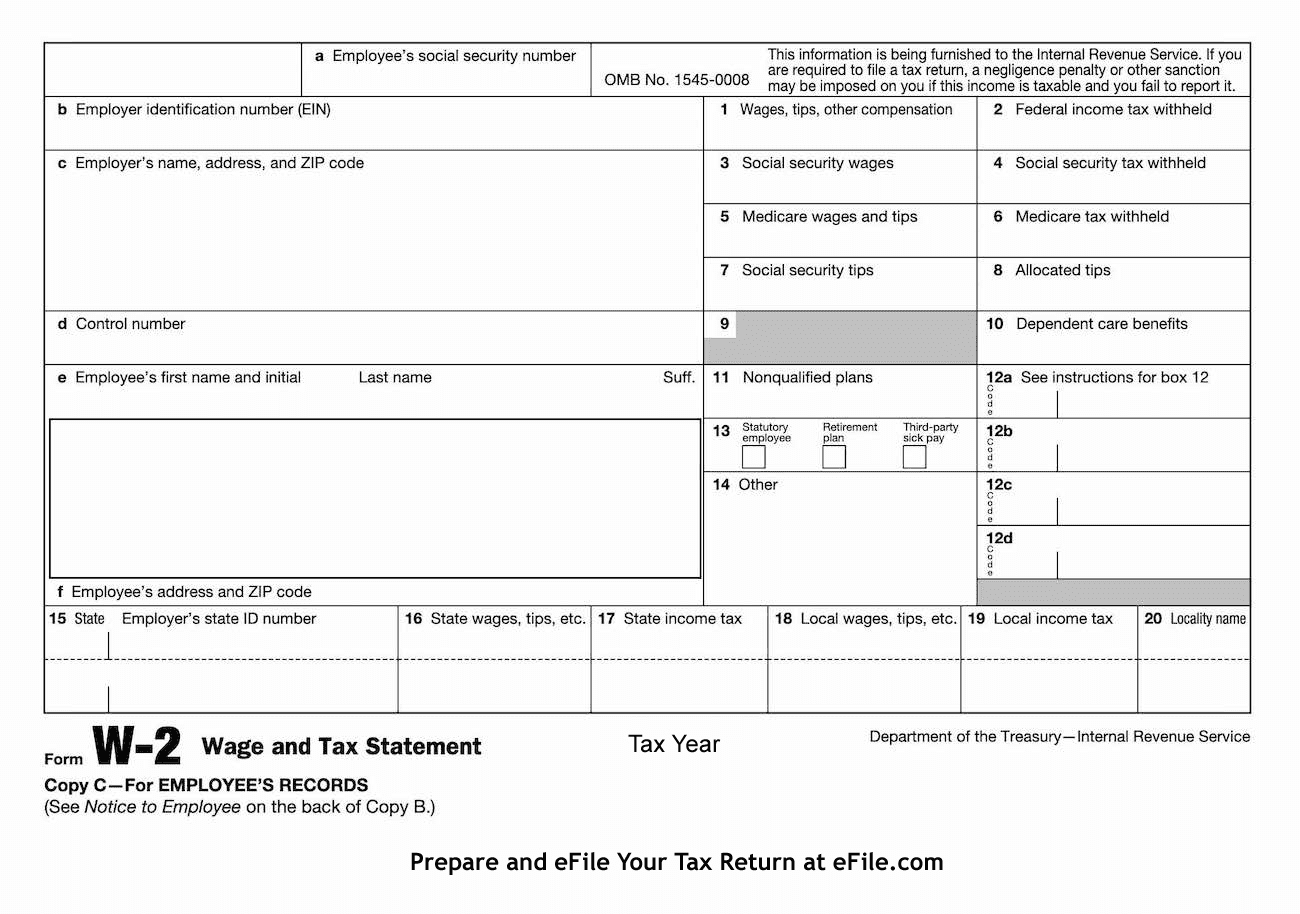

W2 Forms For Employees – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unveiling the Magic of W2 Forms!

Ah, the joyous time of year when W2 forms start arriving in our mailboxes! It’s like receiving a golden ticket to tax success. These little pieces of paper hold all the vital information you need to tackle your taxes with ease. Your employer has diligently filled out your W2 form, detailing your earnings, taxes withheld, and any other relevant financial data. Once you have this treasure in your hands, you’re one step closer to mastering your taxes like a pro!

W2 forms aren’t just a boring piece of paper – they’re your key to unlocking a world of tax deductions and credits. As you unwrap your W2 form, you’ll discover valuable information that will help you navigate the often confusing realm of tax preparation. From understanding your taxable income to identifying potential deductions, your W2 form holds the key to maximizing your tax refund. With a little bit of knowledge and some careful attention to detail, you can use your W2 form to ensure that you’re not paying a penny more in taxes than necessary.

As you delve into the depths of your W2 form, you’ll uncover a treasure trove of information that will empower you to take control of your tax situation. Armed with this valuable document, you can confidently tackle your tax return and ensure that you’re not missing out on any potential tax savings. So, grab your W2 form, a cup of coffee, and prepare to embark on a journey to tax success!

Mastering Your Taxes with W2 Forms!

With your W2 form in hand, you have everything you need to conquer tax season like a champ. Take the time to review each section of your form carefully, ensuring that all the information is accurate and up to date. If you notice any discrepancies, don’t hesitate to reach out to your employer for clarification. Understanding the information on your W2 form is crucial to ensuring that your tax return is filed correctly and that you’re taking advantage of all available tax breaks.

As you familiarize yourself with your W2 form, pay special attention to box 1, which outlines your total taxable wages for the year. This figure serves as the foundation for calculating your tax liability, so it’s essential to ensure its accuracy. Additionally, review boxes 2 through 6, which detail the taxes withheld from your paycheck throughout the year. These amounts can impact your tax refund or the amount you owe, so it’s important to verify that they align with your records. By mastering the information on your W2 form, you can approach tax season with confidence and ease.

In conclusion, don’t underestimate the power of your W2 form when it comes to achieving tax success. By unwrapping this valuable document and diving into its contents, you can arm yourself with the knowledge and tools needed to navigate tax season with ease. So, embrace your W2 form as your ticket to tax success and let it guide you towards maximizing your tax refund and minimizing your tax liability. Happy tax season, and may the W2 be ever in your favor!

Below are some images related to W2 Forms For Employees

amazon w2 online for employees, blank w2 forms for employees, w-2 forms for walmart employees, w2 form for employees 2023, w2 form for target employees, , W2 Forms For Employees.

amazon w2 online for employees, blank w2 forms for employees, w-2 forms for walmart employees, w2 form for employees 2023, w2 form for target employees, , W2 Forms For Employees.