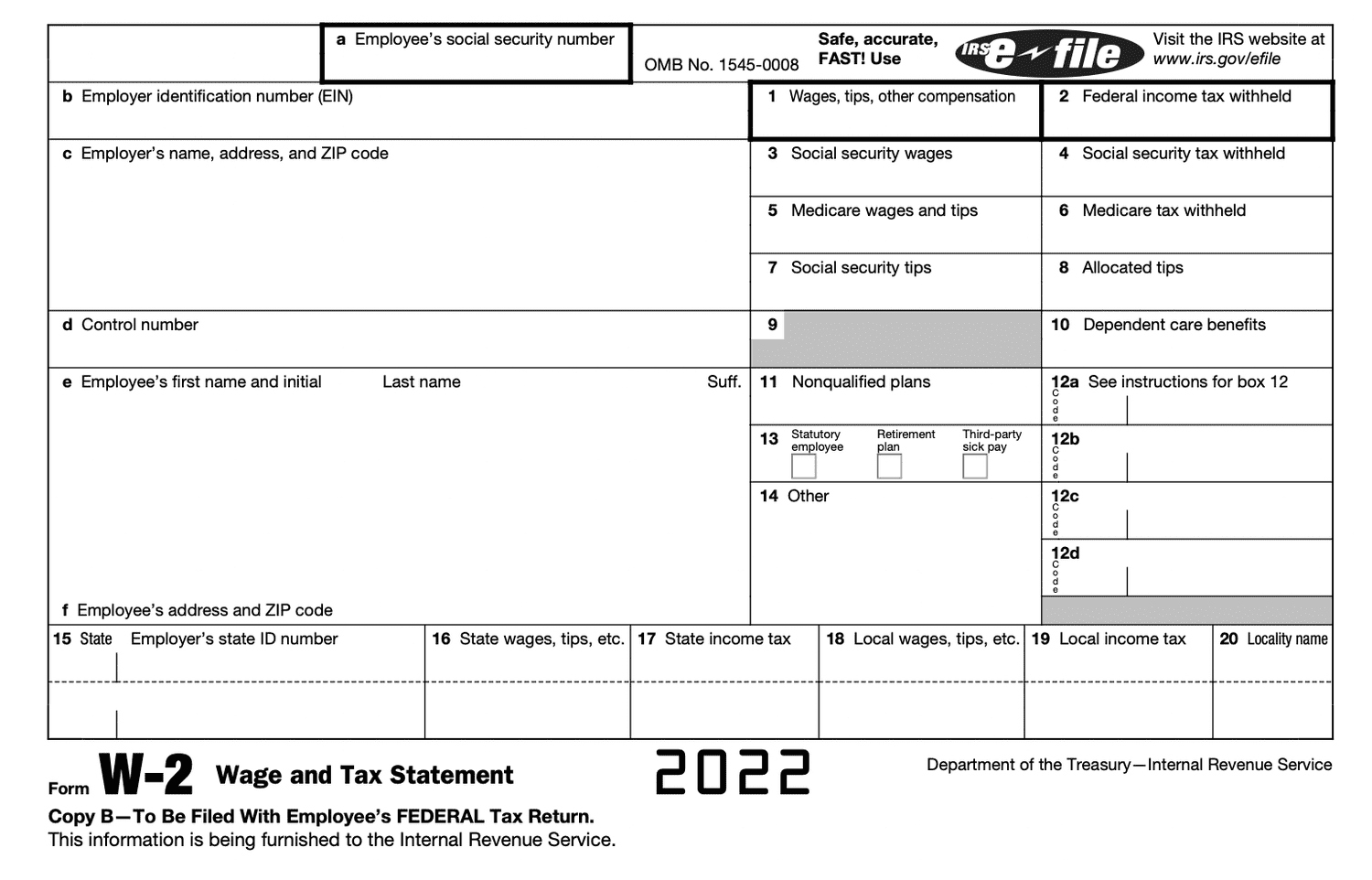

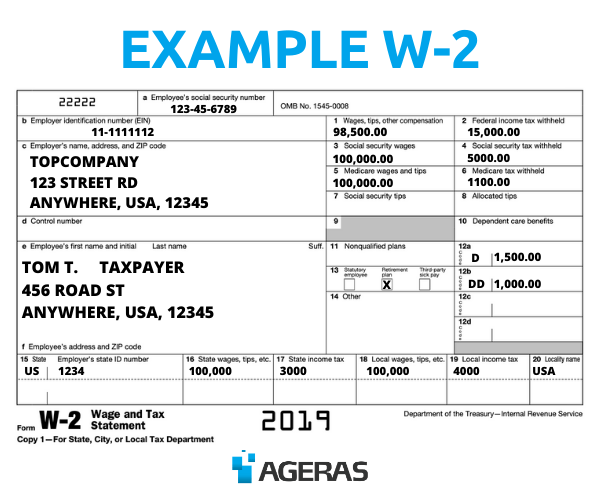

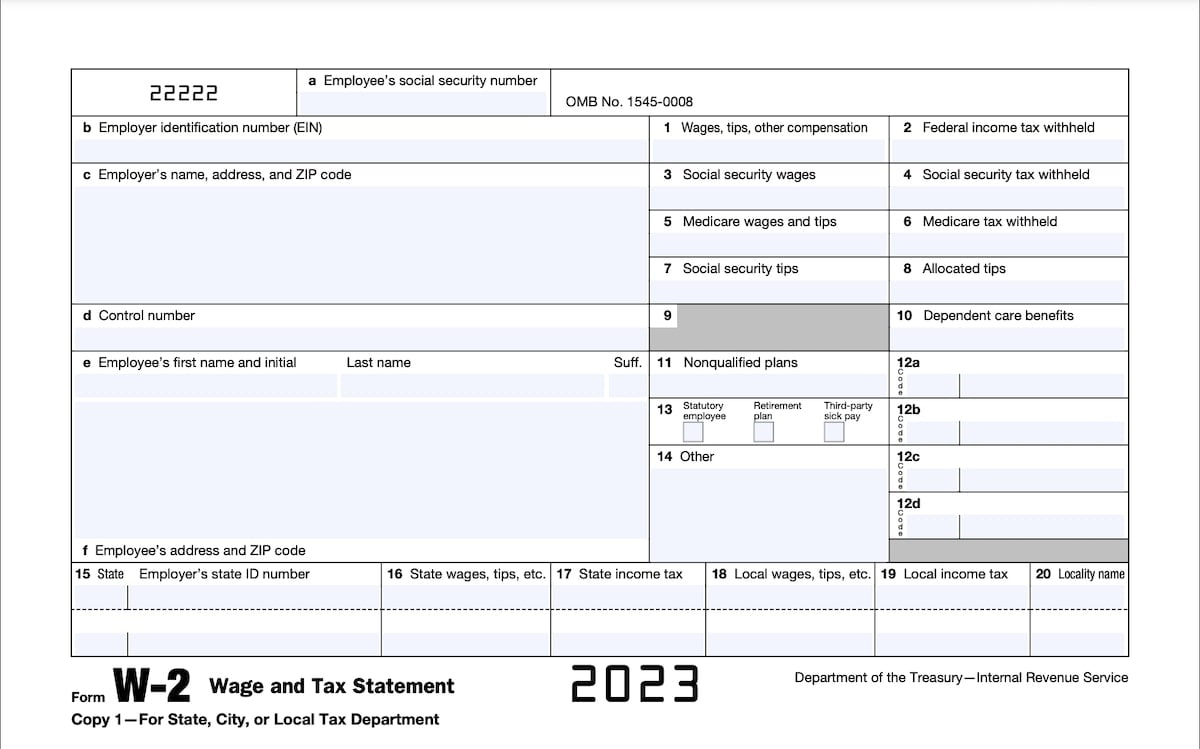

When Do W2 Forms Come Out – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Get Ready to Celebrate: W2 Forms Have Arrived!

It’s that time of year again – tax season! And what better way to kick off the season than with the arrival of your W2 forms. The wait is finally over, and your much-anticipated forms are now in your hands. So go ahead, celebrate this milestone in your journey towards filing your taxes!

With your W2 forms in hand, you can now start preparing for the upcoming tax season with ease. Whether you file your taxes yourself or seek the help of a professional, having your W2 forms ready is a crucial step in the process. Say goodbye to the days of waiting anxiously for your forms to arrive in the mail – the wait is over, and your tax season just got a whole lot easier.

Now that you have your W2 forms, take a moment to breathe a sigh of relief. The hardest part is behind you, and you can now focus on gathering any additional documents you may need to complete your taxes. With your W2 forms in hand, you are one step closer to checking off file taxes from your to-do list. So go ahead, revel in the fact that the wait is over, and you are well on your way to a stress-free tax season.

Your Tax Season Just Got Easier: W2 Forms Now Available!

With your W2 forms now available, you can take a proactive approach to filing your taxes this year. No more last-minute scrambling or waiting until the eleventh hour to gather all your necessary paperwork. By having your W2 forms early, you can start the process sooner and avoid any unnecessary stress or anxiety as the tax deadline approaches.

Having your W2 forms in hand is like having the key to unlock the door to a successful tax season. With this crucial piece of information, you can accurately report your income and ensure that you are in compliance with all tax laws. So don’t delay – take advantage of the fact that your W2 forms are now available and start preparing your taxes today.

In conclusion, the wait is over, and your W2 forms have arrived just in time for tax season. Embrace this momentous occasion with open arms and get ready to tackle your taxes with confidence. With your W2 forms in hand, you are well on your way to a smooth and stress-free filing process. So rejoice, celebrate, and make this tax season your best one yet!

Below are some images related to When Do W2 Forms Come Out

are w2 forms mailed out, did w2 forms come out, when do w2 forms come out, when do w2 forms come out 2023, when do w2 forms come out 2024, , When Do W2 Forms Come Out.

are w2 forms mailed out, did w2 forms come out, when do w2 forms come out, when do w2 forms come out 2023, when do w2 forms come out 2024, , When Do W2 Forms Come Out.