Do You Need A W2 Form To File Taxes – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

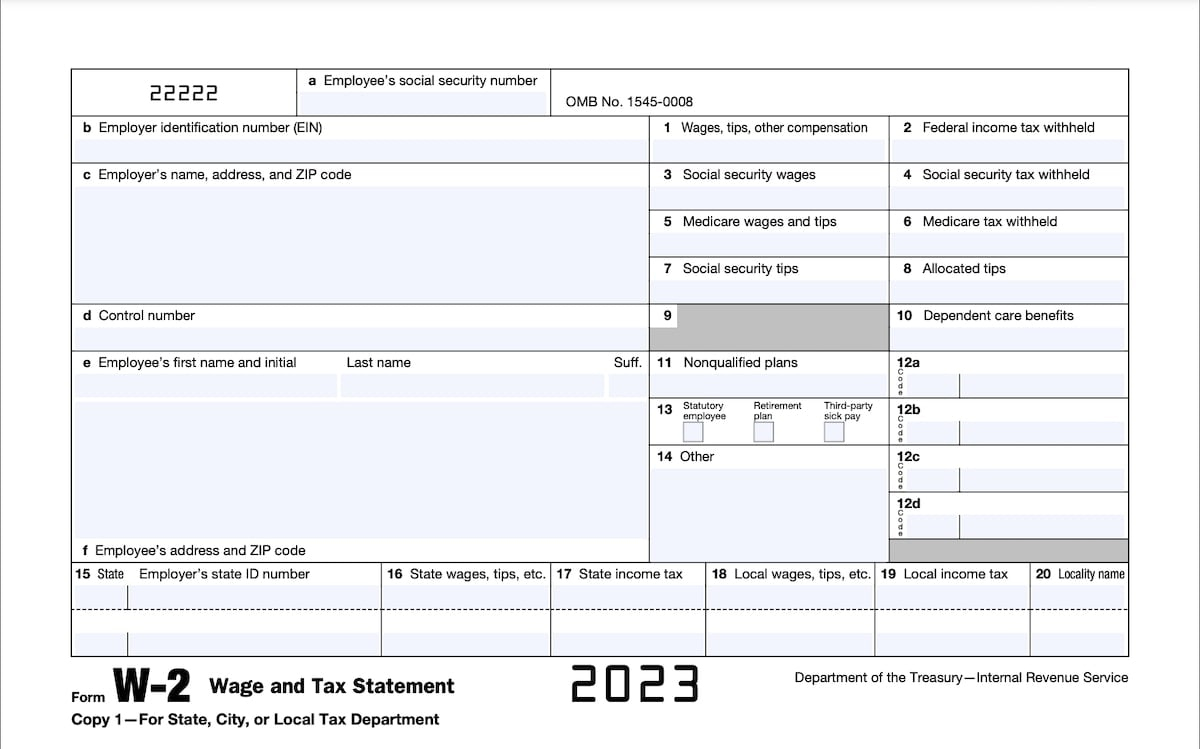

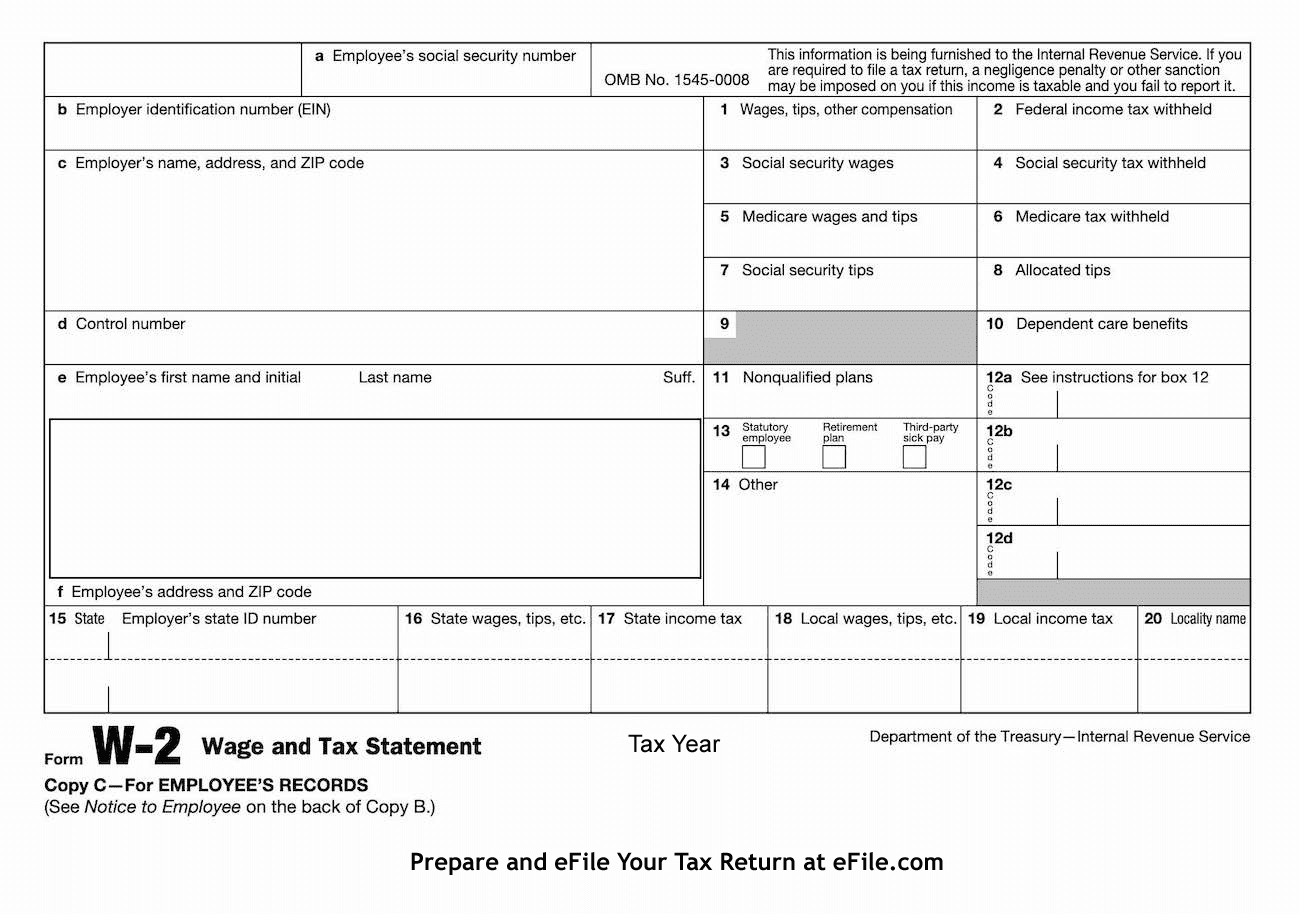

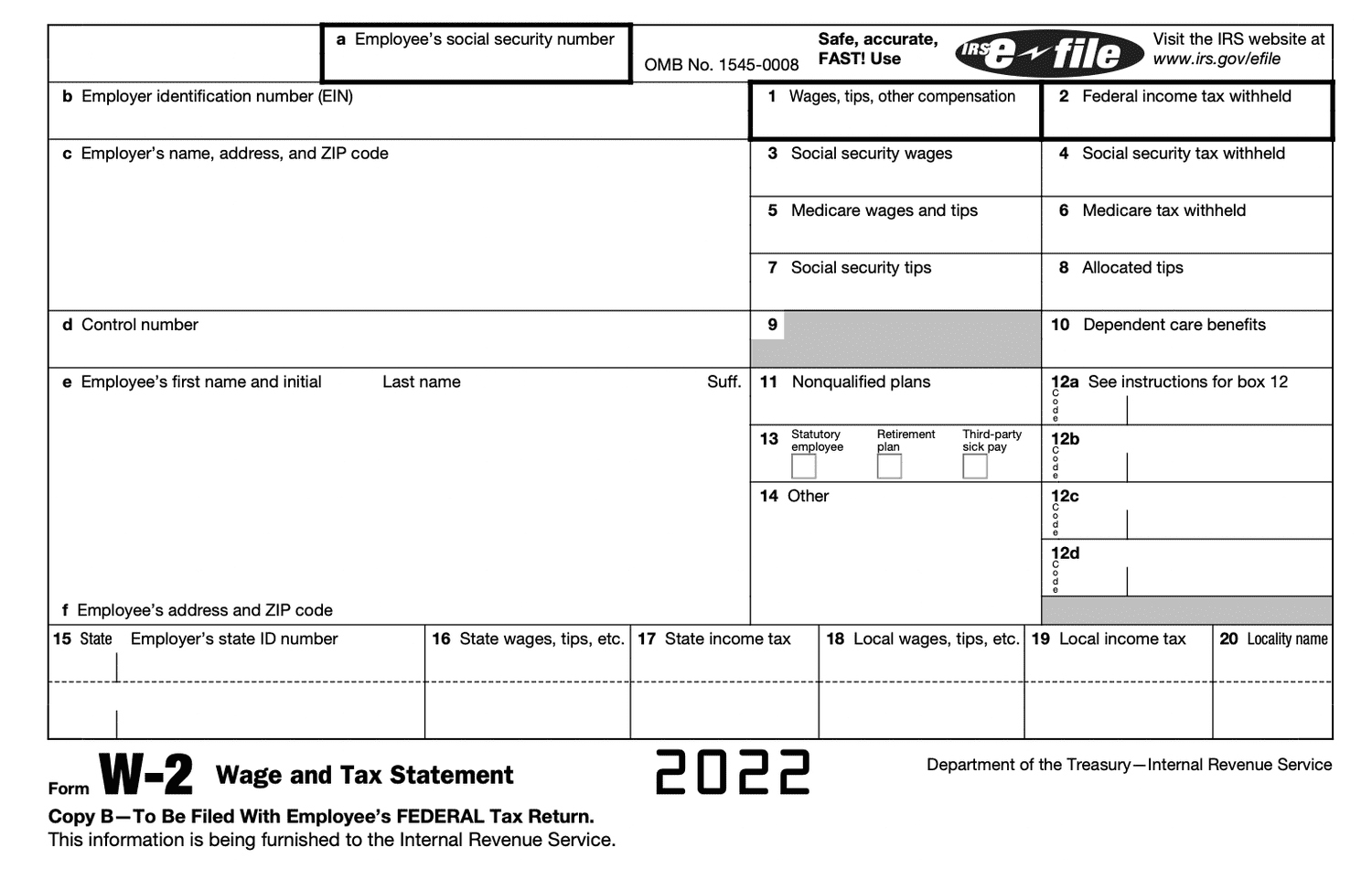

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

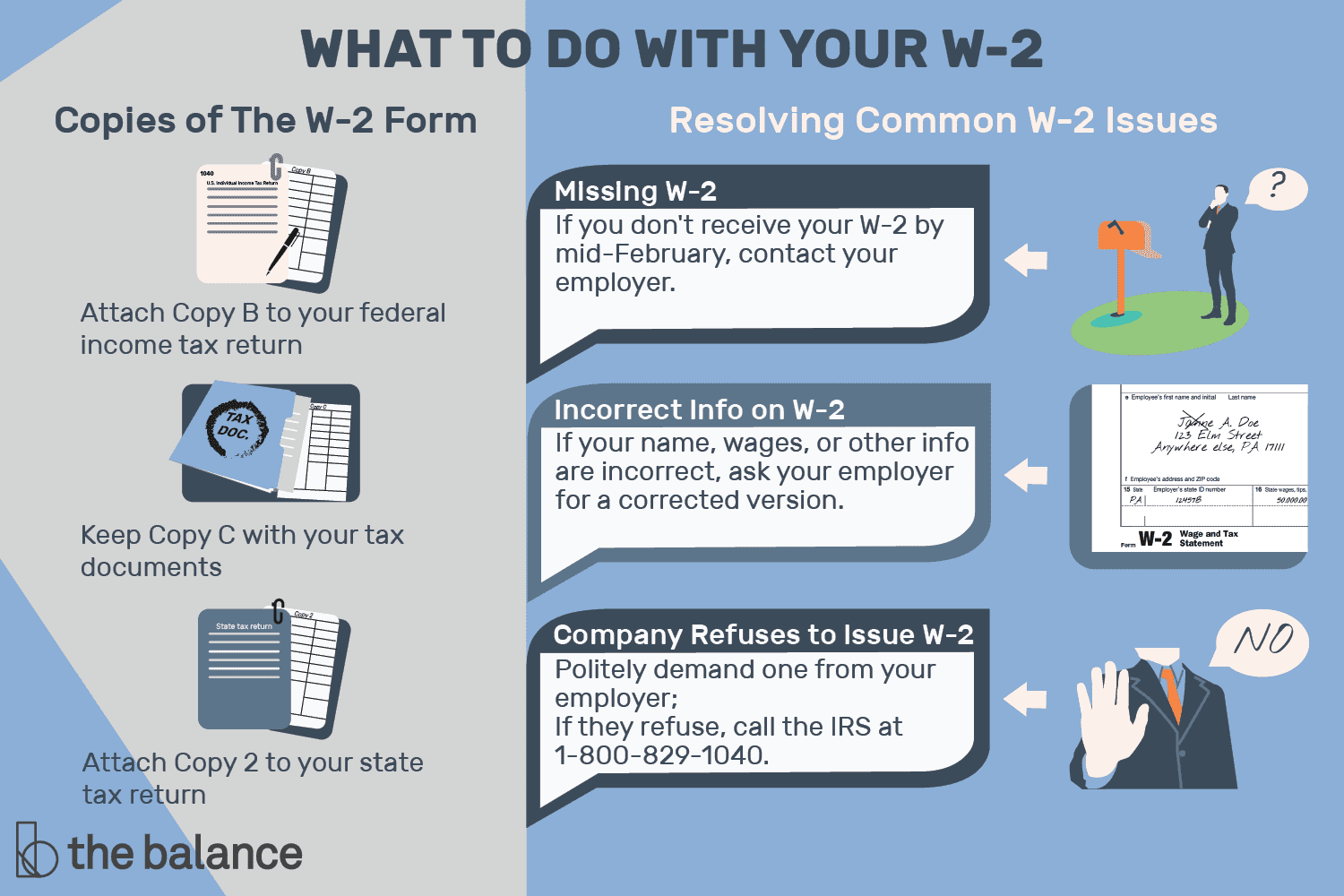

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Tax Time Tango: Embracing the W2 Form Dance!

Are you ready to put on your dancing shoes and twirl your way through tax season? It’s time to embrace the W2 Form Dance and make the most out of filing your taxes. With the right attitude and a little bit of rhythm, you can turn tax time into a fun and exciting experience. So let’s kick off the season with some W2 form fun!

Let’s Kick Off Tax Season with Some W2 Form Fun!

The W2 form may seem daunting at first, with all those boxes and numbers to sort through. But fear not! Think of it as a dance routine waiting to be mastered. Take it step by step, box by box, and before you know it, you’ll be gliding through the tax season like a pro. Put on some music, grab a cup of coffee, and let’s get ready to boogie with those W2 forms!

As you start filling out your W2 form, remember to keep track of all your income, deductions, and credits. Treat it like a dance partner – leading you through the steps of tax filing. Take your time to ensure accuracy and double-check your figures. By the time you’re done, you’ll feel like you’ve just aced a complex dance routine, with your W2 form as your trusty partner.

Once you’ve completed your W2 form and filed your taxes, take a moment to celebrate your accomplishment. You’ve successfully navigated through the tax time tango and emerged victorious. Treat yourself to a well-deserved reward and pat yourself on the back for a job well done. Remember, tax season doesn’t have to be a dreaded chore – with the right mindset and a little bit of creativity, you can turn it into a fun and enjoyable experience. So embrace the W2 form dance and make this tax season one to remember!

Below are some images related to Do You Need A W2 Form To File Taxes

do i need a w2 form to file taxes, do you need a w-2 form to file state taxes, do you need a w2 form to file taxes, do you need a w2 to file taxes, do you need paper w2 to file taxes, , Do You Need A W2 Form To File Taxes.

do i need a w2 form to file taxes, do you need a w-2 form to file state taxes, do you need a w2 form to file taxes, do you need a w2 to file taxes, do you need paper w2 to file taxes, , Do You Need A W2 Form To File Taxes.