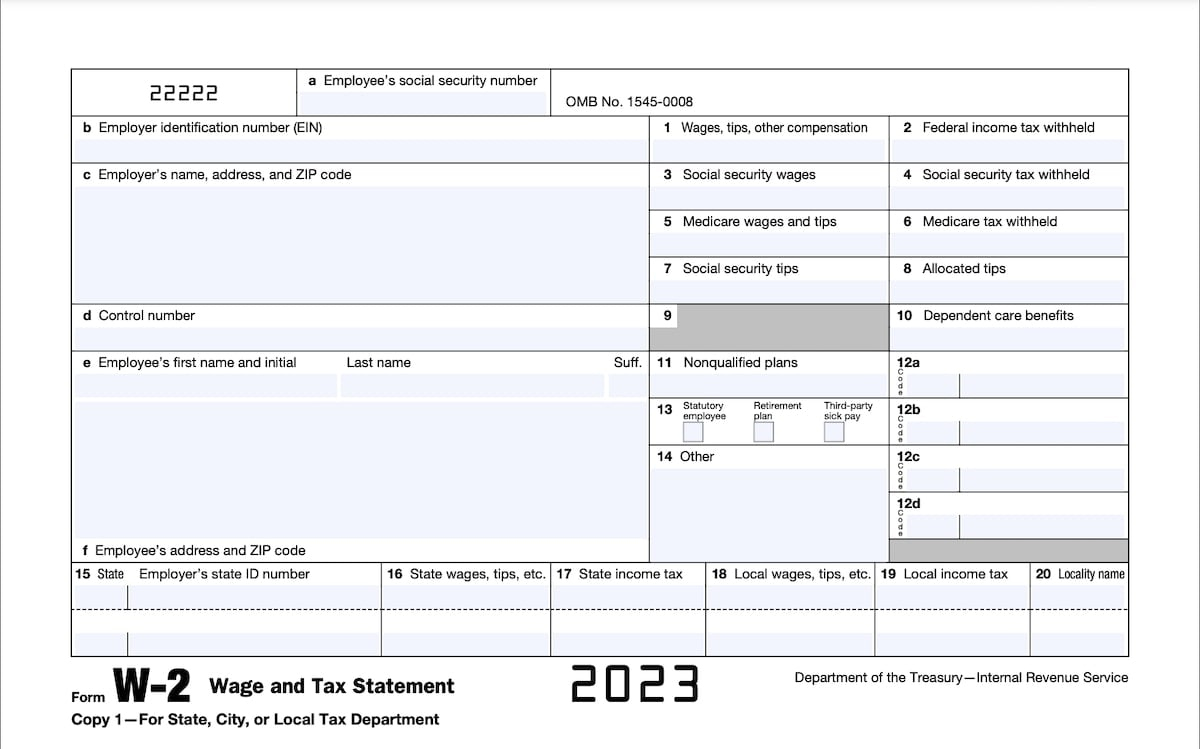

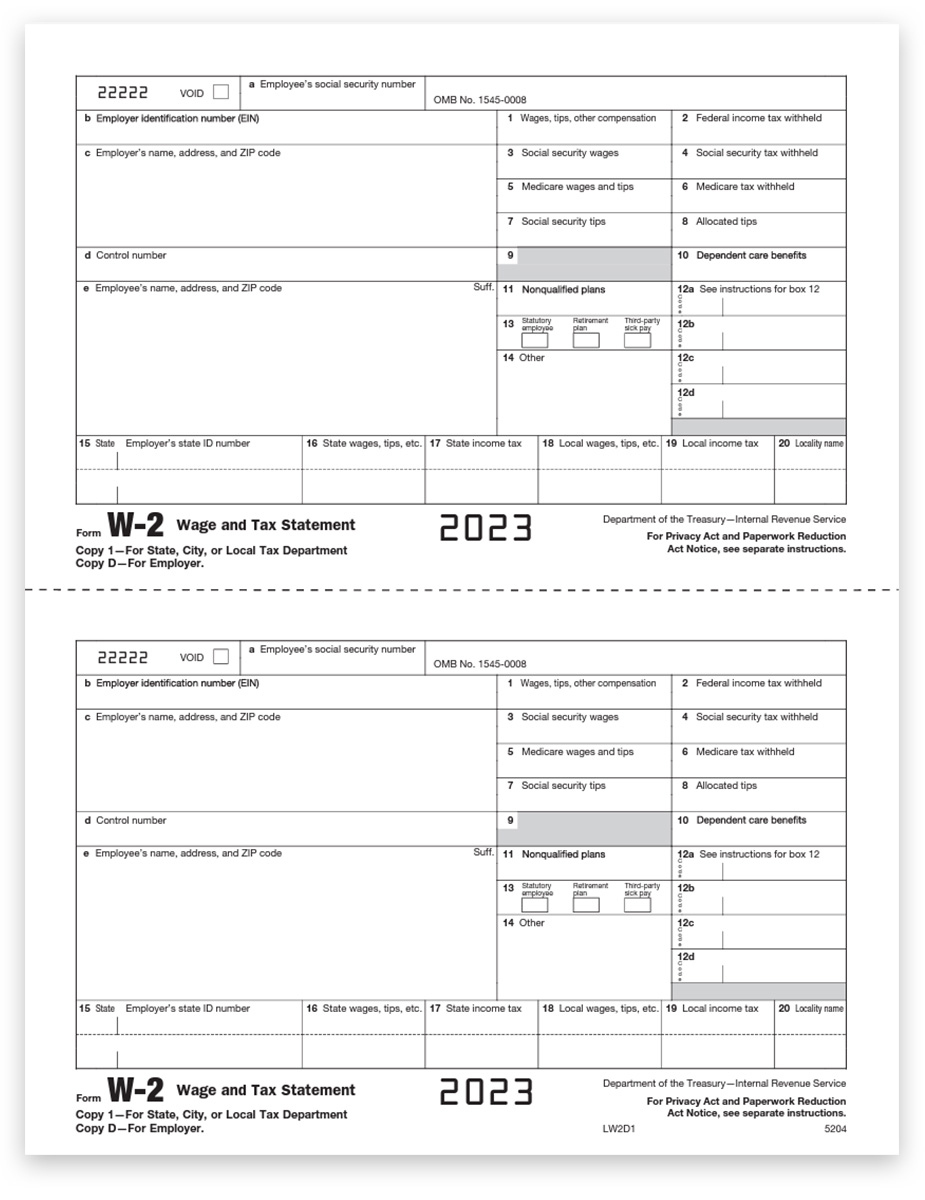

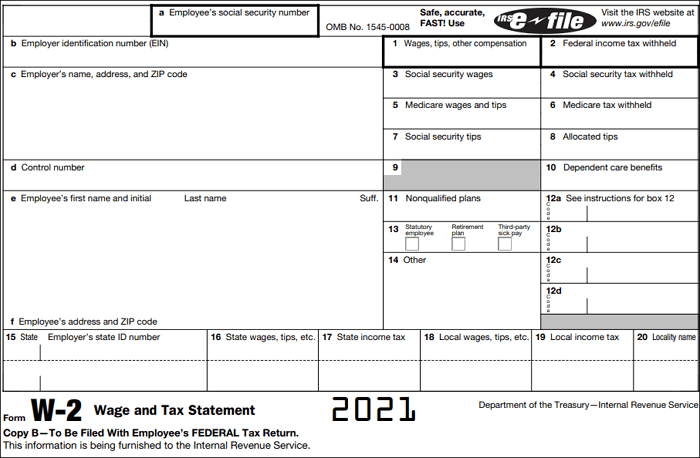

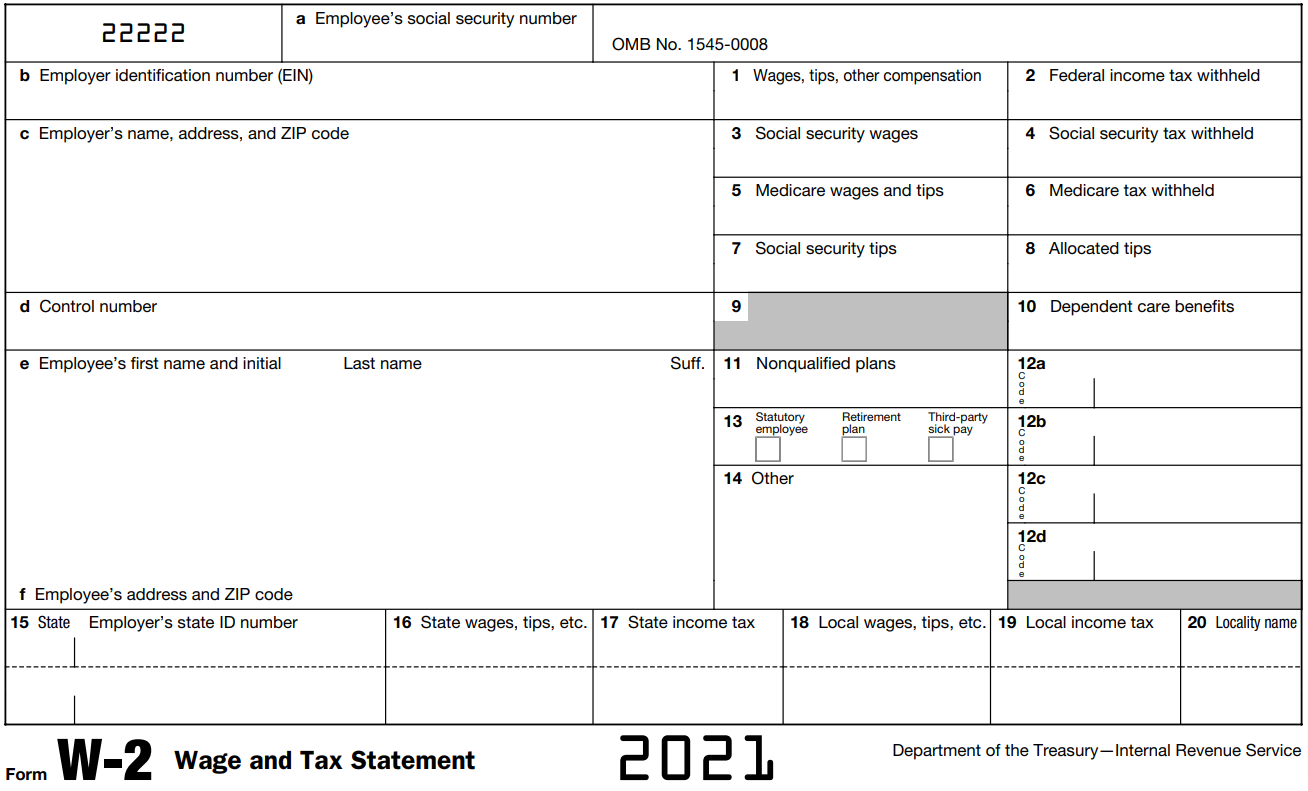

Il W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

The Lowdown on the Cheerful W2 Form

Do you break out in a cold sweat at the thought of tax season? Fear not, for the cheerful W2 form is here to save the day! This little document may seem daunting at first, but with a bit of guidance, you’ll be navigating its twists and turns like a pro. So sit back, relax, and let’s unveil the mysteries of the cheerful W2 form together!

Unveiling the Mysteries of the Cheerful W2 Form!

Ah, the W2 form – that magical piece of paper that summarizes your earnings and deductions for the year. But fear not, dear reader, for there’s nothing to be afraid of! The W2 form is your key to filing your taxes with ease and confidence. It’s like a puzzle waiting to be solved, and once you crack the code, you’ll feel like a tax superhero!

The W2 form is divided into various sections, each containing valuable information about your income and tax withholdings. From your Social Security wages to your federal income tax withheld, every detail is carefully laid out for you to review. So grab a cup of coffee, put on your favorite music, and dive into the world of the W2 form with a smile on your face – after all, it’s not as complicated as it may seem!

Navigating the W2 form may seem like a daunting task, but fear not – help is always at hand! Whether you’re filling out your form manually or using software, there are plenty of resources available to guide you through the process. So don’t let tax season stress you out – take a deep breath, stay positive, and tackle that W2 form like a champ! Remember, you’ve got this!

Your Ultimate Guide to Navigating the W2 Form with Ease!

As you embark on your journey through the cheerful W2 form, remember to keep a positive attitude and a sense of humor. After all, taxes may be a necessary evil, but they don’t have to be a source of dread! So put on your thinking cap, gather your documents, and conquer that W2 form like a boss. With a little bit of patience and a whole lot of cheer, you’ll breeze through tax season with confidence and ease!

In conclusion, the cheerful W2 form may seem intimidating at first, but with the right mindset and a bit of guidance, you’ll soon realize that it’s not so scary after all. So embrace the challenge, tackle your taxes head-on, and remember that the W2 form is your ticket to a stress-free filing experience. Happy tax season, and may the cheerful W2 form be forever in your favor!

Below are some images related to Il W2 Form

do you get a w2 for unemployment in illinois, how to file illinois w2 online, il w2 form, il w2 form 2022, il w2 form 2023, , Il W2 Form.

do you get a w2 for unemployment in illinois, how to file illinois w2 online, il w2 form, il w2 form 2022, il w2 form 2023, , Il W2 Form.