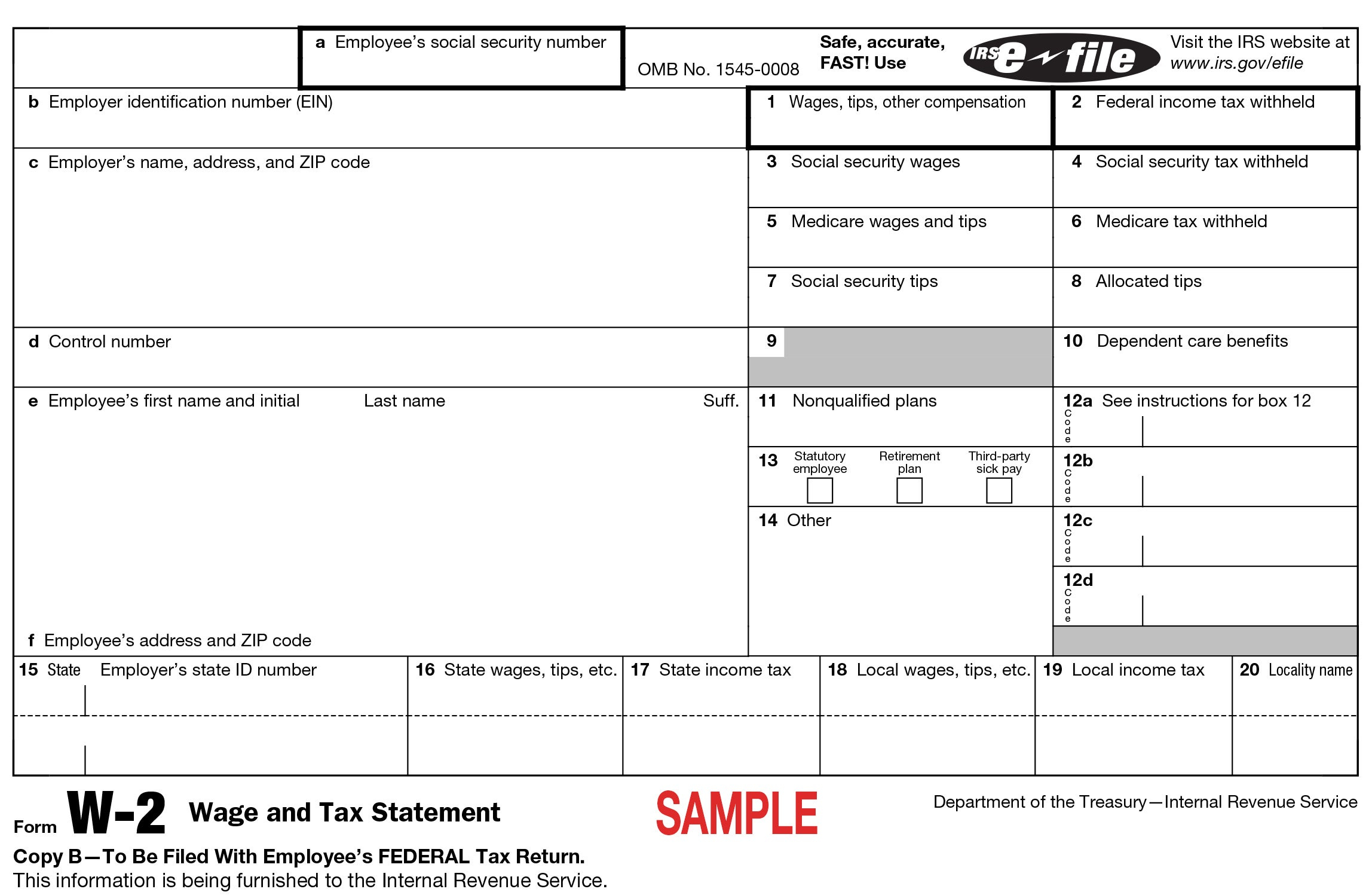

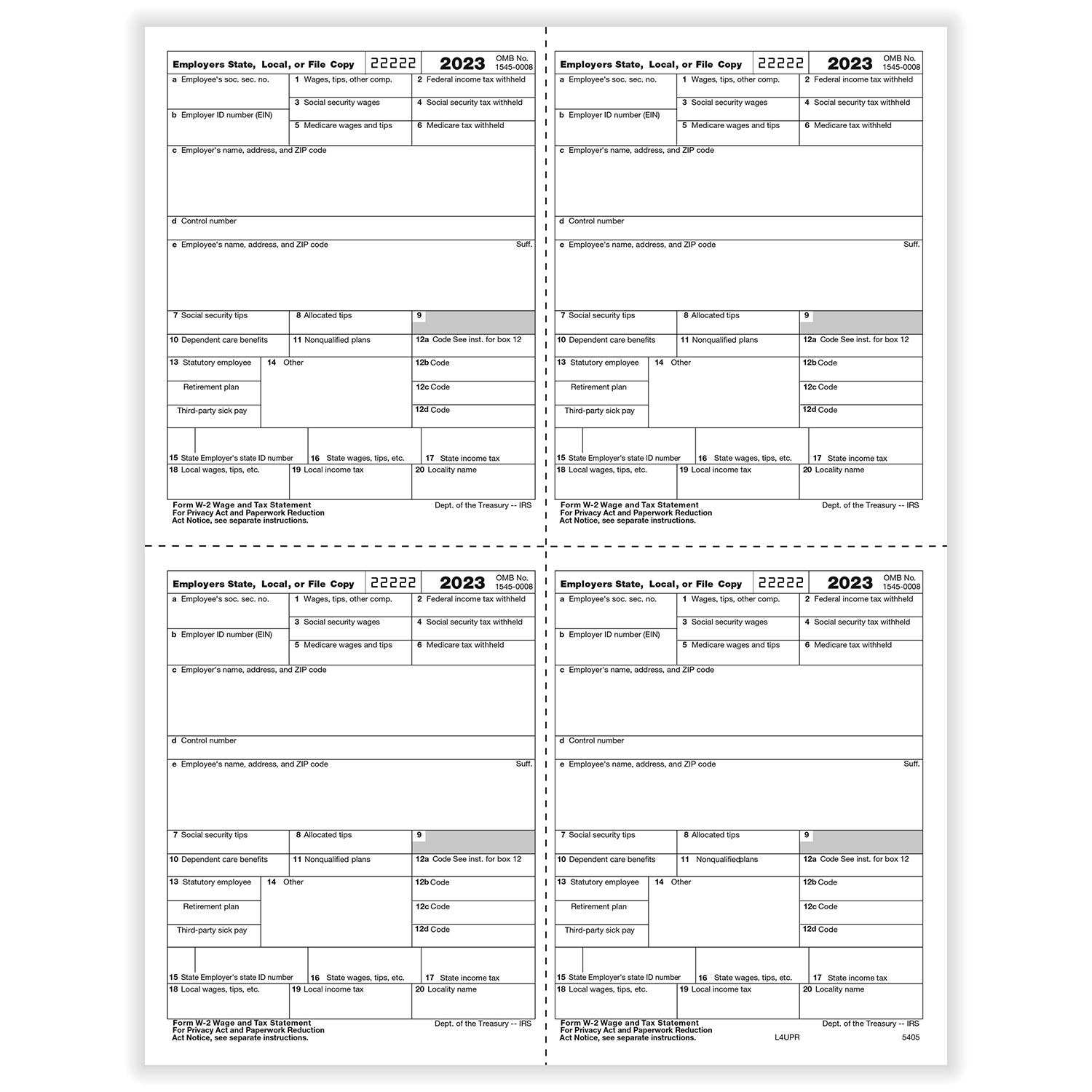

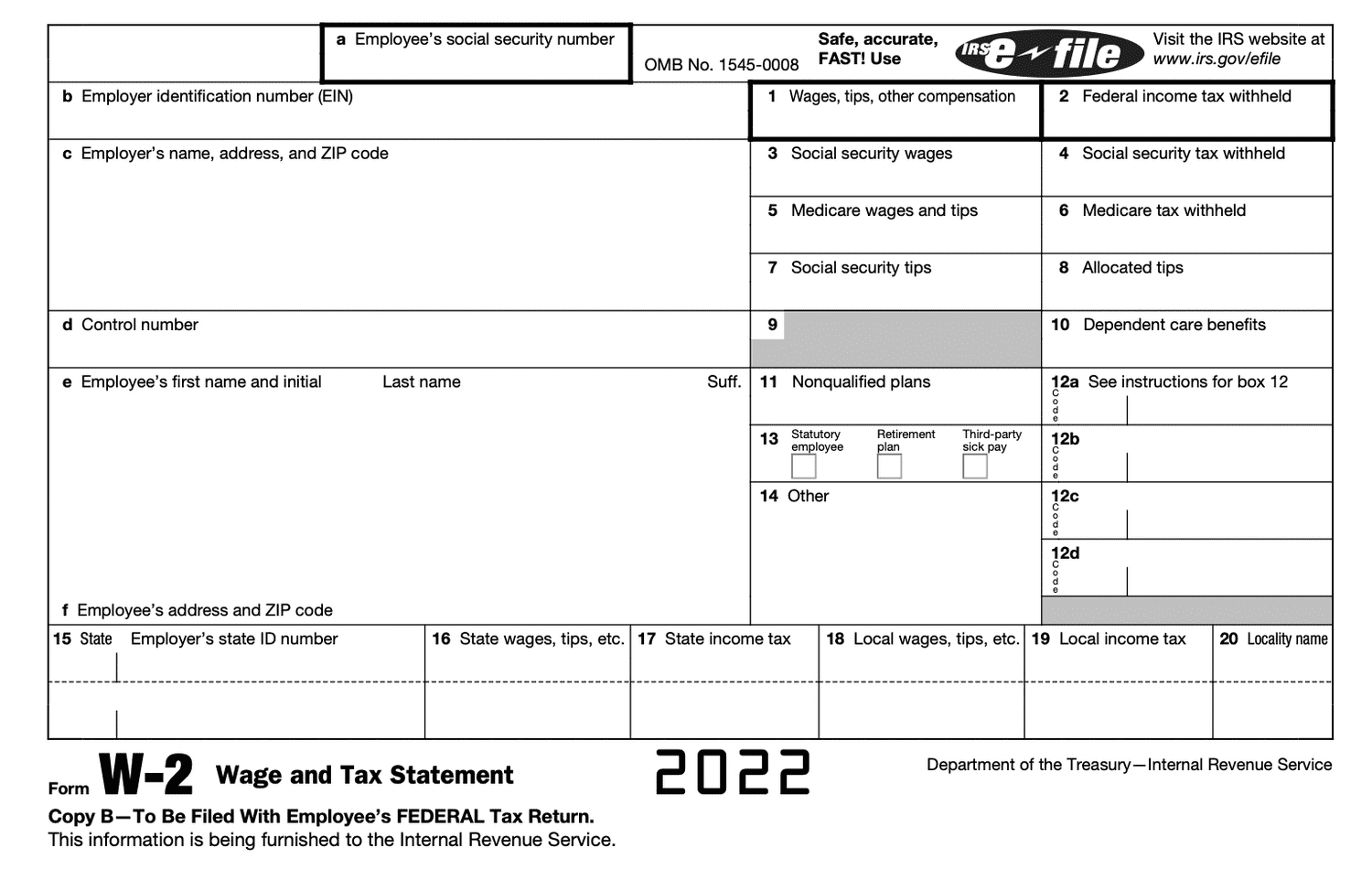

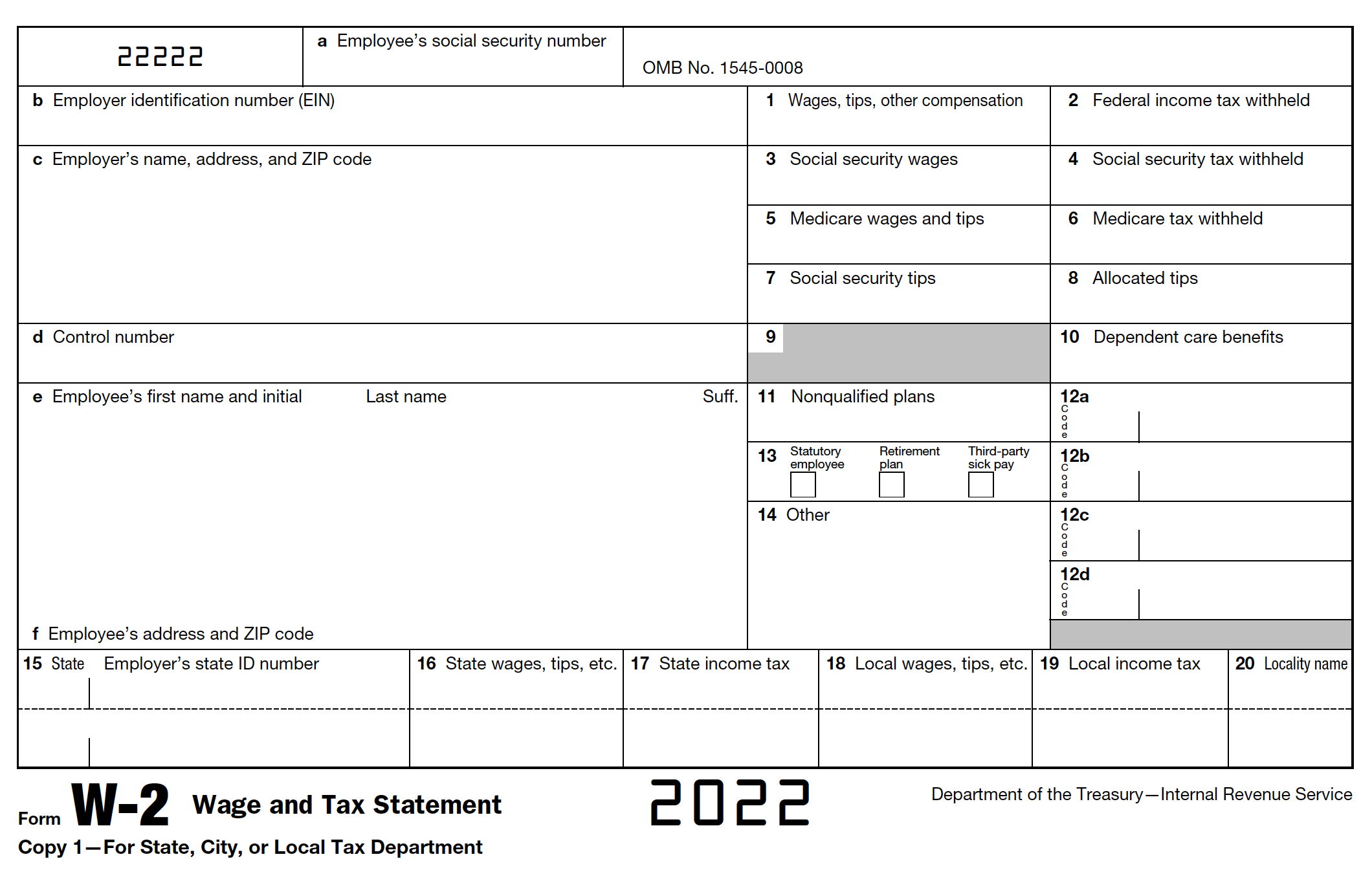

W2 Form Boxes – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Decoding W2 Form Boxes: Your Key to Tax Season Success!

Ah, tax season – that time of year when we all scramble to gather our documents and try to make sense of seemingly endless numbers and boxes. But fear not, for the key to navigating the confusing world of tax forms lies in understanding the mysterious W2 form boxes. These little boxes hold the key to unlocking the secrets of your income, taxes withheld, and more. Let’s dive in and decode the essential information hidden within each box to ensure a successful tax season!

When it comes to understanding your W2 form, the first step is to familiarize yourself with the various boxes and what each one represents. Box 1, for example, shows your total wages, while Box 2 displays the federal income tax withheld from your pay. Boxes 3 and 5 show your wages subject to Social Security and Medicare taxes, respectively. By understanding the purpose of each box, you can better grasp your overall financial picture and ensure accurate tax filings.

As you continue to unravel the mysteries of your W2 form, pay close attention to Boxes 12 and 14, which may contain additional information such as retirement plan contributions, health insurance premiums, and other deductions. These boxes can have a significant impact on your tax liability and refund, so it’s crucial to review them carefully. By taking the time to analyze each box and understand its implications, you can maximize your tax season success and potentially uncover valuable deductions and credits.

Unveiling the Secrets of W2 Form Boxes: Your Essential Guide!

As you navigate the intricate world of tax forms, remember that each box on your W2 form plays a vital role in determining your tax obligations and potential refunds. Boxes 16 and 18, for instance, show your state and local wages and taxes withheld, which are crucial for accurately reporting your income across different jurisdictions. Meanwhile, Boxes 17 and 19 detail your state and local income tax withheld, providing essential information for filing state and local tax returns.

In addition to the standard boxes on your W2 form, keep an eye out for any discrepancies or errors that may impact your tax filings. If you notice discrepancies in your wages or taxes withheld, be sure to reach out to your employer for clarification and potential corrections. By staying vigilant and proactive in reviewing your W2 form, you can avoid potential tax headaches and ensure a smooth and successful filing process. Remember, knowledge is power, and understanding the secrets of W2 form boxes is the key to tax season success!

In conclusion, unlocking the mystery of W2 form boxes is essential for navigating tax season with confidence and success. By familiarizing yourself with the various boxes and understanding their significance, you can ensure accurate tax filings and potentially uncover valuable deductions and credits. So grab your W2 form, a cup of coffee, and let’s decode those boxes together for a stress-free and successful tax season!

Below are some images related to W2 Form Boxes

w2 form box 1, w2 form box 1 and 3 difference, w2 form box 12 dd, w2 form box 14, w2 form box 14 category, , W2 Form Boxes.

w2 form box 1, w2 form box 1 and 3 difference, w2 form box 12 dd, w2 form box 14, w2 form box 14 category, , W2 Form Boxes.