W2 Form Nyc – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

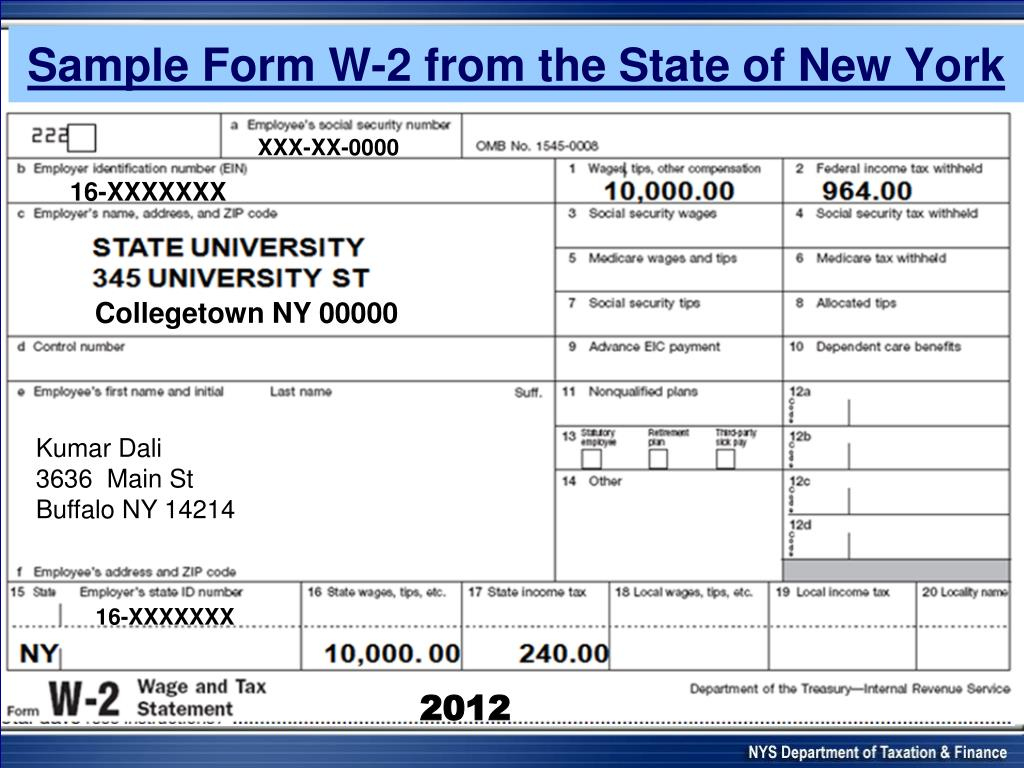

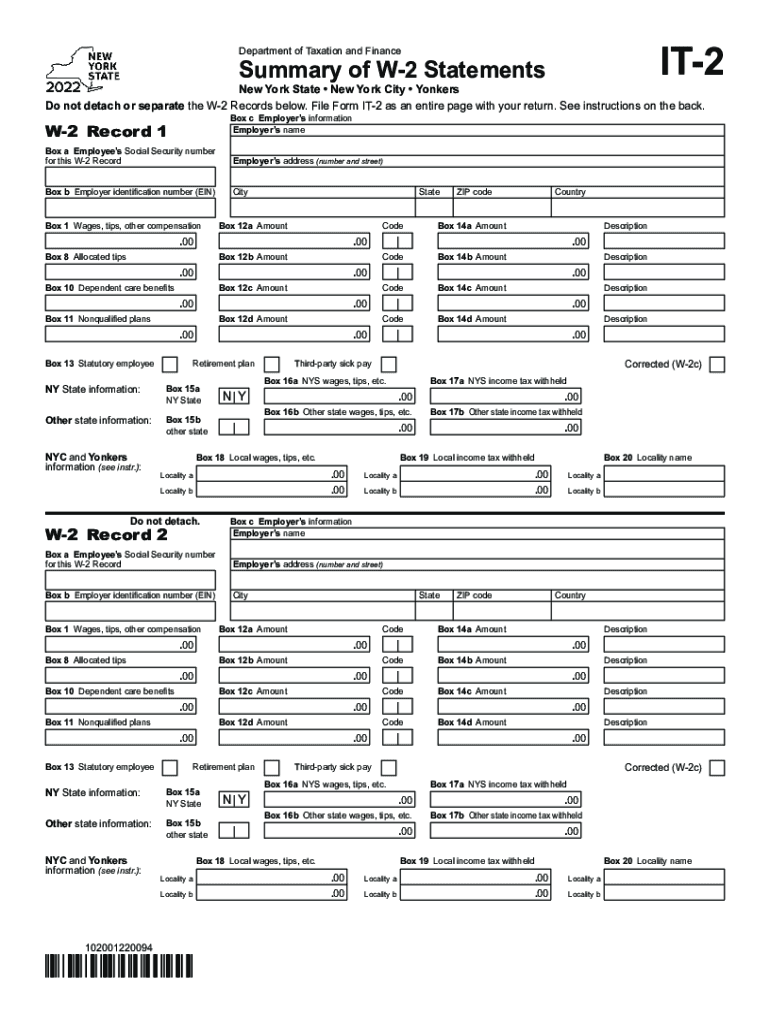

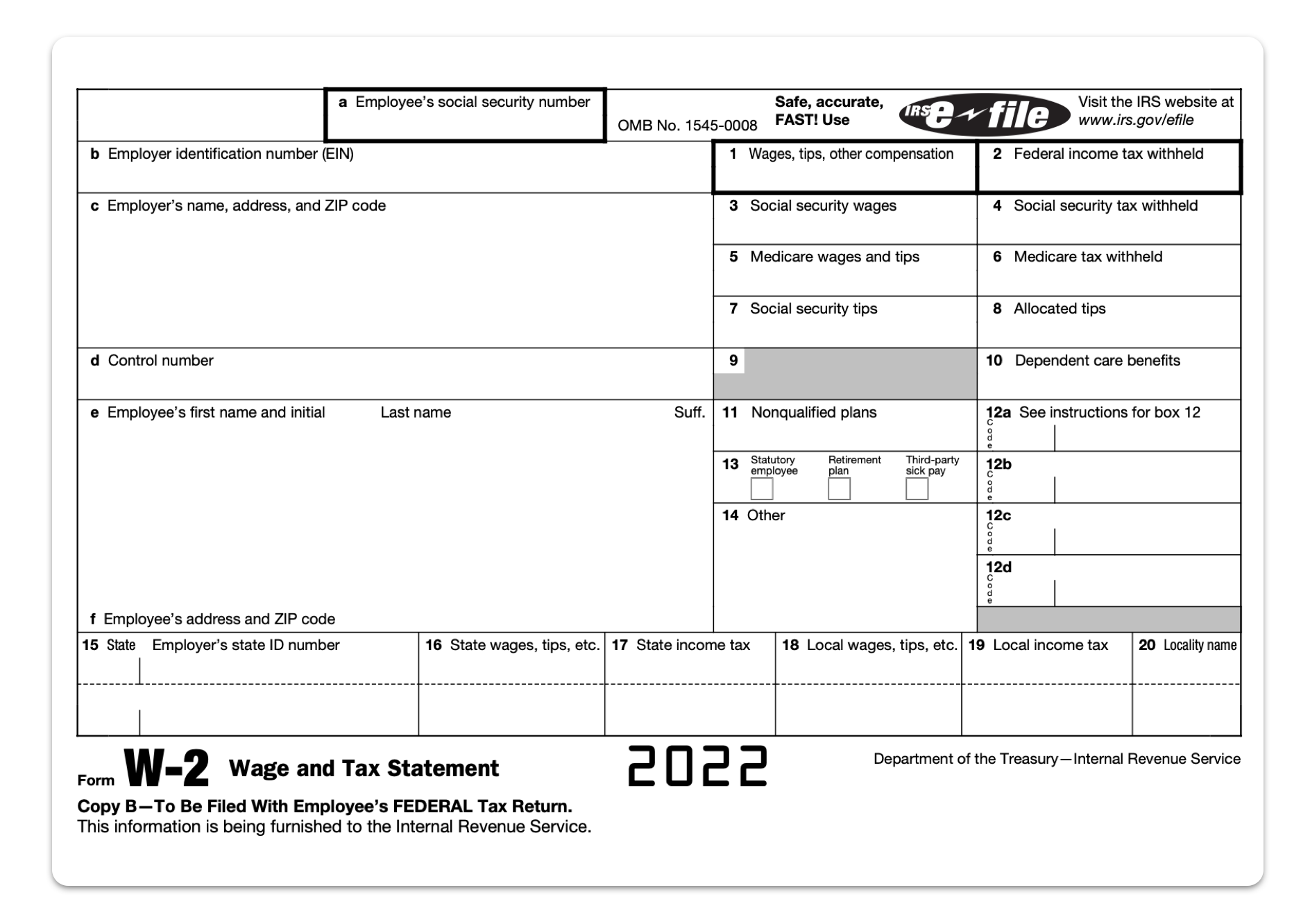

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

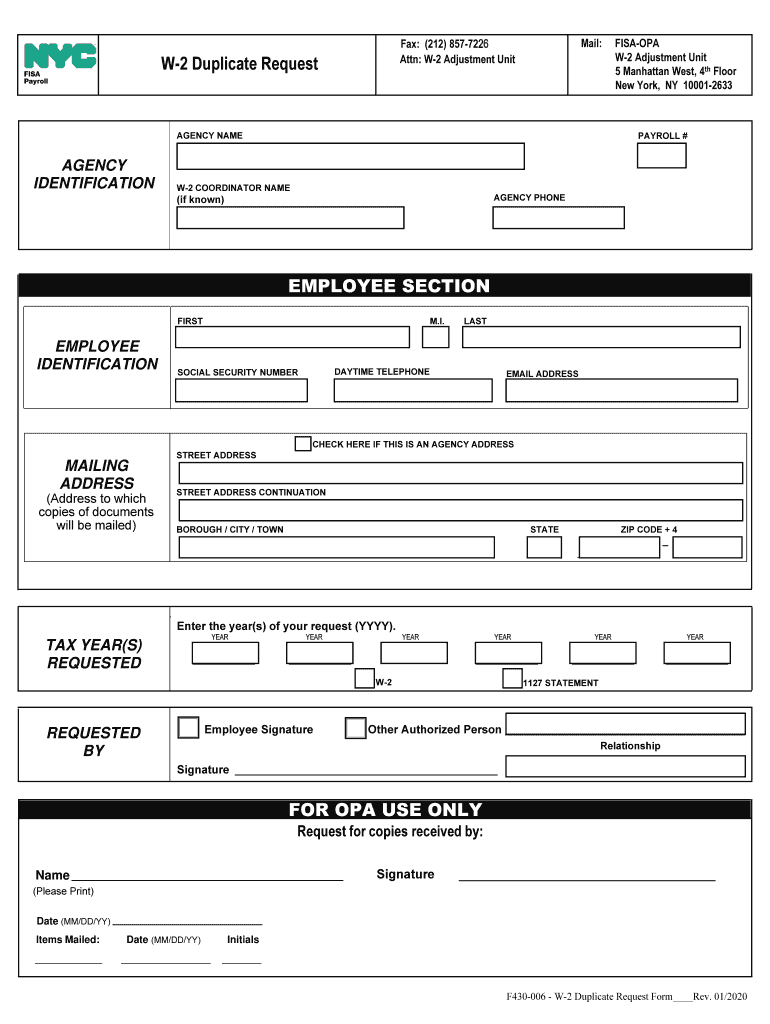

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unwrapping the W2 Form NYC: Your Ticket to Tax Season Success!

Tax season can be a daunting time for many, but fear not! Your trusty companion, the W2 form, is here to guide you through the maze of NYC taxes with ease. Understanding this crucial document is the key to unlocking your tax season success. So grab a cup of coffee, cozy up in your favorite chair, and let’s embark on a journey to decode the W2 form together!

Decoding the W2 Form: A Key to Unlocking Tax Season Success!

The W2 form may seem overwhelming at first glance, but fear not! This document is your roadmap to understanding your earnings and tax withholdings for the year. The first box on the form, labeled Wages, tips, other compensation, shows your total earnings for the year. The following boxes break down your federal, state, and local tax withholdings, as well as any deductions or contributions you may have made. By carefully reviewing each section of the form, you can ensure that your taxes are filed accurately and efficiently.

Once you’ve familiarized yourself with the contents of the W2 form, you’ll be ready to navigate NYC taxes with confidence. Whether you’re a seasoned tax filer or a first-time taxpayer, having a clear understanding of your W2 form will empower you to take control of your financial future. By using this document as a reference point, you can ensure that you’re maximizing your tax deductions and credits, ultimately saving yourself time and money in the long run.

Navigate NYC Taxes with Confidence Using Your W2 Form Today!

As you embark on your tax-filing journey, remember that your W2 form is your trusty companion every step of the way. By carefully reviewing each section of the form and understanding the information it contains, you’ll be well-equipped to tackle your NYC taxes with ease. So don’t let tax season stress you out – embrace the power of your W2 form and watch as your tax season success unfolds before your eyes!

In conclusion, the W2 form may seem like a daunting document, but with a little patience and determination, you can unlock its secrets and breeze through tax season like a pro. So grab your W2 form, put on your favorite playlist, and get ready to conquer your taxes with confidence. With the key to tax season success in hand, you’ll be well on your way to financial freedom and peace of mind. Happy filing!

Below are some images related to W2 Form Nyc

nycers w2 form, nychhc w2 form, nycsss w2 form, w2 form ny, w2 form ny pfl, , W2 Form Nyc.

nycers w2 form, nychhc w2 form, nycsss w2 form, w2 form ny, w2 form ny pfl, , W2 Form Nyc.