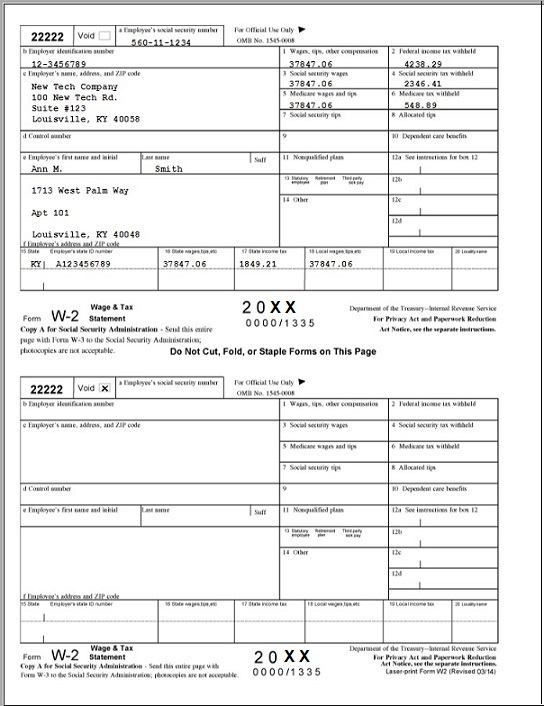

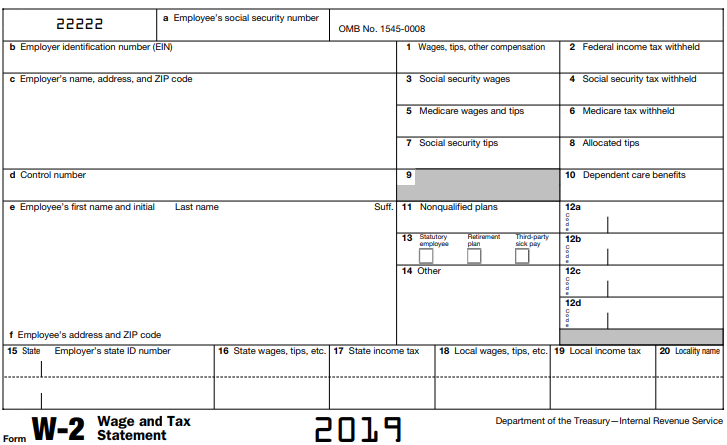

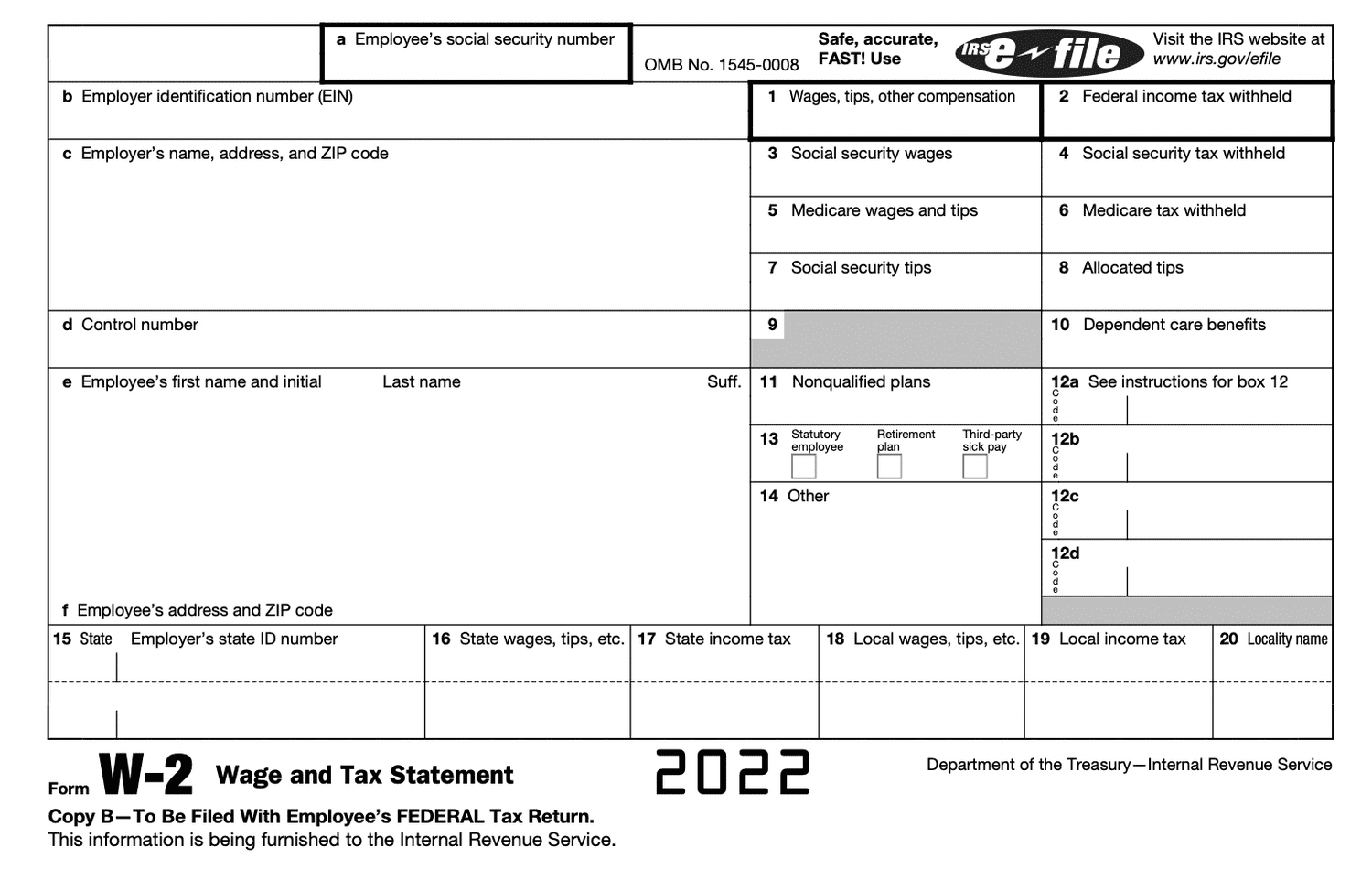

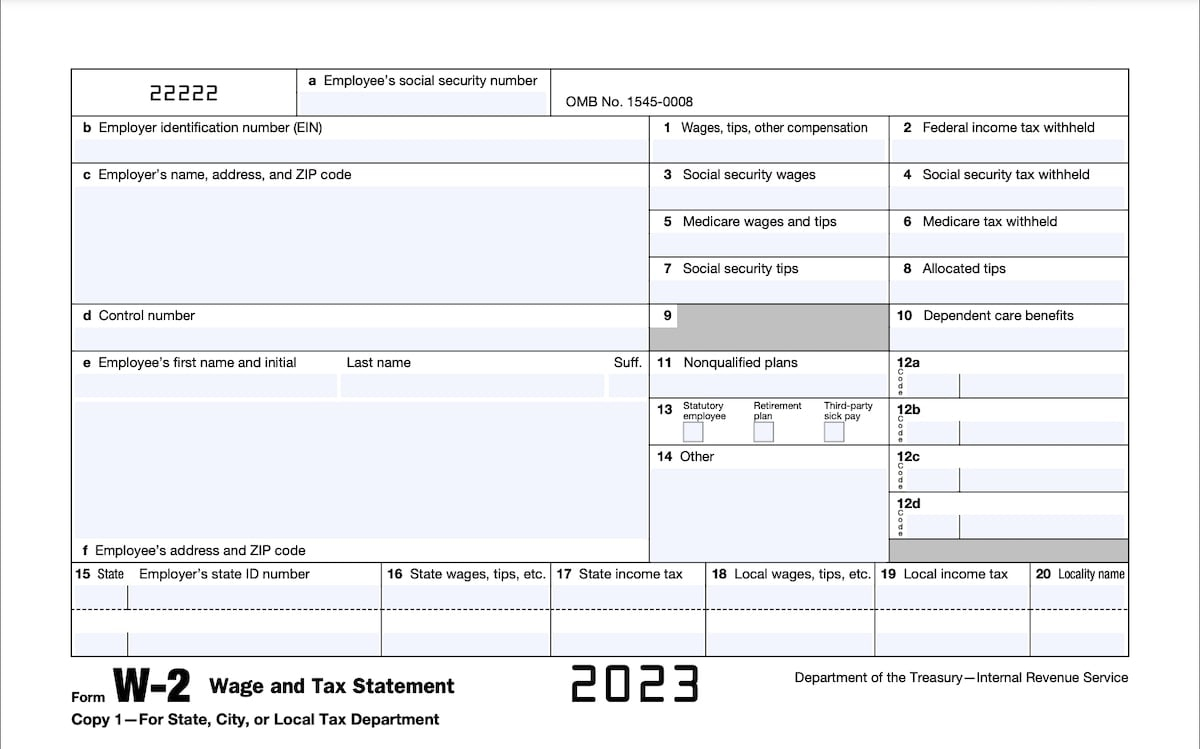

W2 Electronic Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

W2 Wonder: Embracing the Electronic Form Revolution!

In today’s fast-paced digital world, it’s time to bid farewell to the days of paper W2 forms cluttering up your desk and embrace the convenience and efficiency of electronic forms. With the rise of technology, there’s no need to deal with the hassle of lost or misplaced paperwork anymore. Say goodbye to the days of rummaging through piles of documents just to find that one important piece of information – the future is here, and it’s all about electronic forms!

Say Goodbye to Paper W2s!

Gone are the days of waiting for your paper W2 form to arrive in the mail, only to have it get lost or damaged in transit. With electronic forms, you can access your W2 information instantly and securely online. No more worrying about keeping track of physical copies or storing them in a safe place – everything you need is just a few clicks away. Say goodbye to the hassle of paper W2s and hello to the convenience of electronic forms!

Embrace the Future with Electronic Forms!

Embracing electronic forms is not just about convenience – it’s about staying ahead of the curve and adapting to the changing times. As technology continues to advance, electronic forms are becoming the new standard for document management and communication. By embracing electronic forms for your W2s, you’re not only streamlining your processes but also reducing your environmental impact by cutting down on paper usage. So why wait? Embrace the future with electronic forms and revolutionize the way you manage your W2 information!

In conclusion, the revolution of electronic forms is here to stay, and it’s time to jump on board and reap the benefits. Say goodbye to the old way of dealing with paper W2s and embrace the efficiency and convenience of electronic forms. With everything you need just a click away, there’s no reason to hold onto outdated practices any longer. Embrace the future with electronic forms and revolutionize the way you handle your W2 information – you won’t look back! Let’s make the switch to electronic forms today and experience the wonders they can bring!

Below are some images related to W2 Electronic Form

electronic w2 form, online w2 form 2022, online w2 forms for employers, w-2 form electronic delivery consent notice, w2 electronic consent form irs, , W2 Electronic Form.

electronic w2 form, online w2 form 2022, online w2 forms for employers, w-2 form electronic delivery consent notice, w2 electronic consent form irs, , W2 Electronic Form.