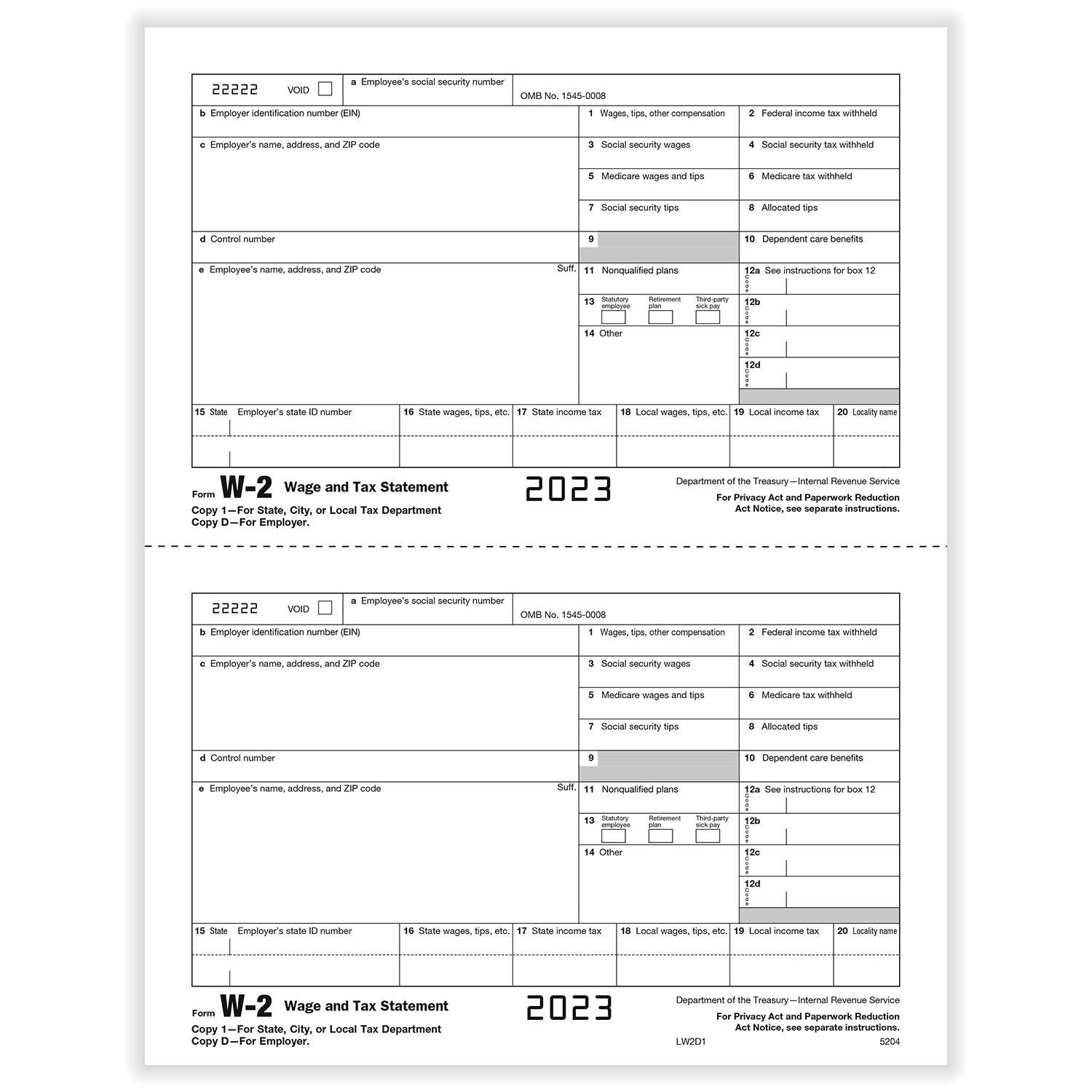

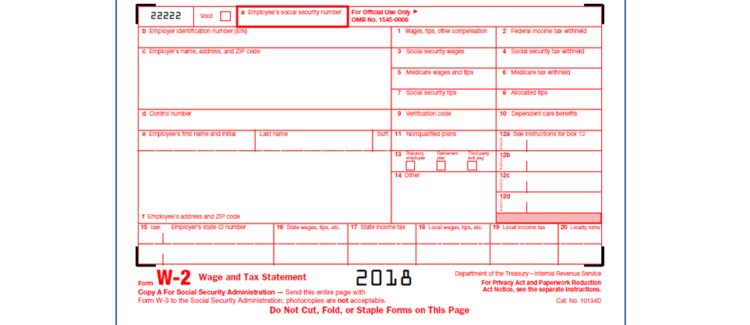

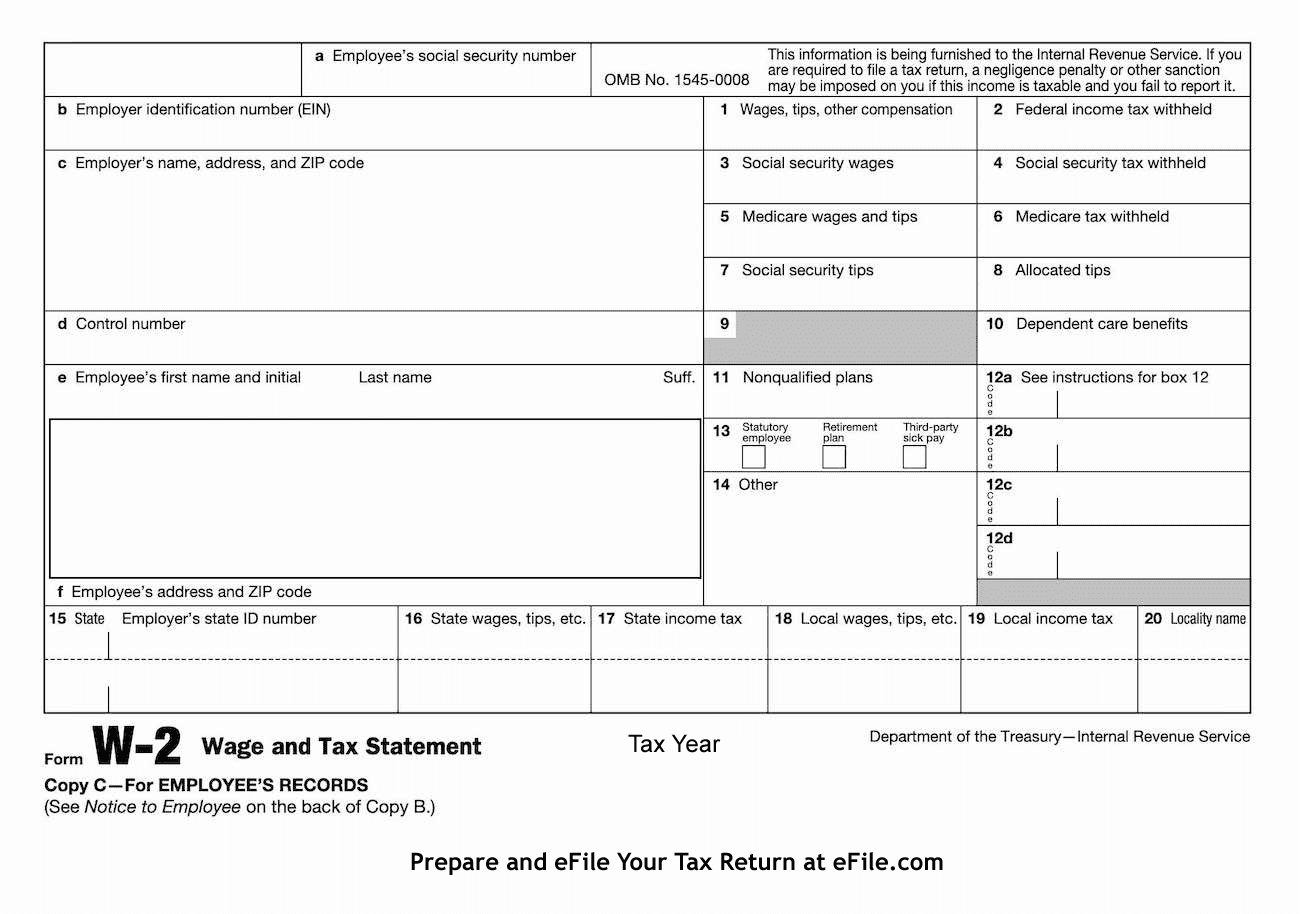

If I Have 2 W2 Forms From Different Employers – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

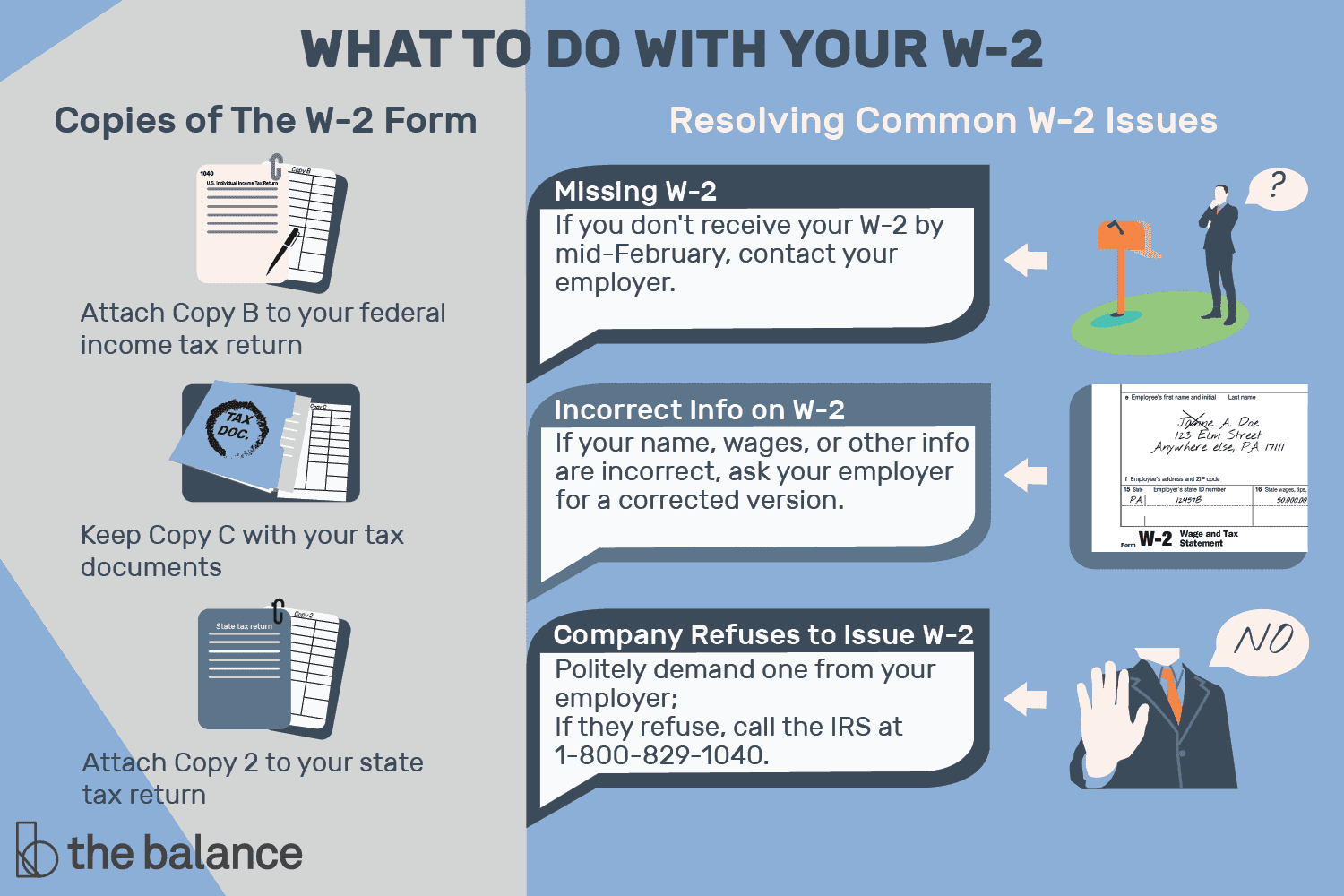

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Juggling Two W2s Like a Pro!

Are you one of the lucky individuals who get to enjoy the benefits of having two jobs? Double the pay, double the experience, double the fun! But along with double the perks comes double the paperwork, specifically handling two W2s. However, fear not! With a little organization and some handy tips, you can easily navigate through tax season without breaking a sweat.

The key to juggling two W2s like a pro is to stay organized from the get-go. Make sure to keep all your pay stubs, W2 forms, and any other relevant documents in one designated folder or file. This will not only make it easier for you to access the information when needed but also help prevent any mix-ups or confusion when it comes time to file your taxes. Setting up a system early on will save you time and stress in the long run.

When it comes to actually filing your taxes with two W2s, it’s important to remember that each job will have its own set of income and withholding information. Take the time to carefully review each W2 and ensure that all the details are accurate. If you notice any discrepancies or errors, be sure to reach out to the respective employer to get them corrected promptly. Being proactive in addressing any issues will help prevent any delays or complications in the tax filing process. With a little attention to detail and diligence, you’ll be well on your way to mastering the art of handling dual incomes.

Mastering the Art of Handling Dual Incomes

Having two sources of income can be a great advantage, but it also comes with its own set of challenges, especially when it comes to tax season. One of the key strategies for mastering the art of handling dual incomes is to keep track of your expenses and deductions for each job separately. This will help you maximize your tax savings and ensure that you’re taking full advantage of any deductions or credits that you may be eligible for. Additionally, consider consulting with a tax professional to help you navigate through the complexities of filing taxes with multiple incomes.

Another important aspect of handling dual incomes is to be mindful of how your tax withholdings are structured for each job. Depending on the amount of income you earn from each job, you may need to adjust your withholdings to avoid owing taxes at the end of the year. Take the time to review your W4 forms for each employer and make any necessary adjustments to ensure that you’re on track with your tax obligations. By staying proactive and informed about your tax situation, you can confidently manage two W2s with ease and enjoy the benefits of having dual incomes.

In conclusion, while handling two W2s may seem daunting at first, with the right approach and mindset, you can navigate through tax season like a pro. Stay organized, pay attention to detail, and seek guidance when needed to make the process smoother and more manageable. With a little bit of effort and a positive attitude, you’ll be well-equipped to handle dual incomes with ease and maximize your tax savings along the way. Double the fun, double the rewards – here’s to a successful tax season ahead!

Below are some images related to If I Have 2 W2 Forms From Different Employers

can you get two w2 from same employer, i have 2 w2 forms from different employers, if i have 2 w2 forms from different employers, if i have 2 w2 forms from different employers do i have to file both, what if i have two w2 forms from different employers, , If I Have 2 W2 Forms From Different Employers.

can you get two w2 from same employer, i have 2 w2 forms from different employers, if i have 2 w2 forms from different employers, if i have 2 w2 forms from different employers do i have to file both, what if i have two w2 forms from different employers, , If I Have 2 W2 Forms From Different Employers.