W2 Form Line 12 – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Uncovering the Treasure: W2 Form Line 12 Explained!

Are you a treasure hunter looking to uncover hidden gems in your W2 form? Look no further than Line 12! This seemingly mysterious number holds the key to unlocking valuable information about your workplace benefits. Let’s dive deep into the treasure trove of Line 12 and discover the riches that lie within.

Unlocking the Mystery of Line 12 on Your W2 Form

Line 12 on your W2 form is where your employer reports the amount of contributions made to your retirement plan throughout the year. This could include 401(k) contributions, pension plan contributions, or any other retirement savings plan offered by your employer. It’s like finding a chest full of gold coins – knowing how much you’ve saved for retirement can give you a sense of security and peace of mind for the future.

Understanding Line 12 is essential for planning your financial future. By knowing how much you’ve contributed to your retirement plan, you can make informed decisions about your savings goals and retirement timeline. Think of Line 12 as a treasure map leading you to a secure and comfortable retirement. With this knowledge in hand, you can take control of your financial destiny and set sail towards a bright and prosperous future.

Discovering the Hidden Gems: What Does Line 12 Mean?

When you see a substantial amount on Line 12, it’s like stumbling upon a hidden treasure chest filled with jewels. This number reflects the hard work and dedication you’ve put into saving for your future. It’s a reminder of the sacrifices you’ve made to secure a comfortable retirement. So, take pride in that number on Line 12 – it represents your commitment to building a secure financial future for yourself.

In addition to the satisfaction of knowing you’ve saved for retirement, there may also be tax benefits associated with the contributions listed on Line 12. Depending on the type of retirement plan you have and your individual tax situation, you may be eligible for deductions or credits that can lower your taxable income. So, not only does Line 12 signify your commitment to saving for the future, but it may also provide some tax advantages along the way. It truly is a hidden gem waiting to be uncovered!

In conclusion, Line 12 on your W2 form is more than just a number – it’s a treasure trove of information about your retirement savings. By understanding and appreciating the value of Line 12, you can take control of your financial future and set sail towards a secure and prosperous retirement. So, the next time you receive your W2 form, don’t just glance over Line 12 – take a closer look and uncover the hidden gems within. Happy treasure hunting!

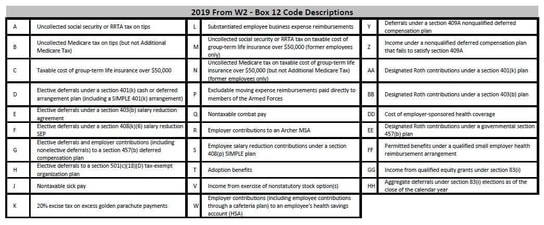

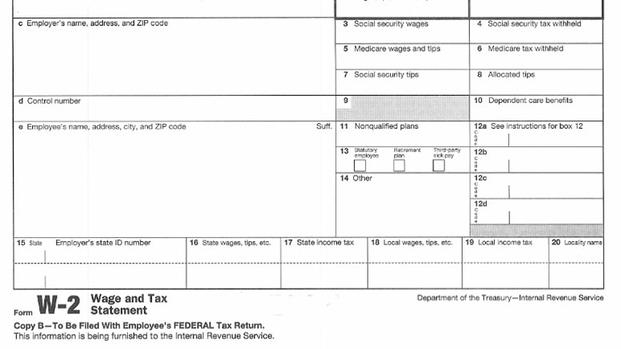

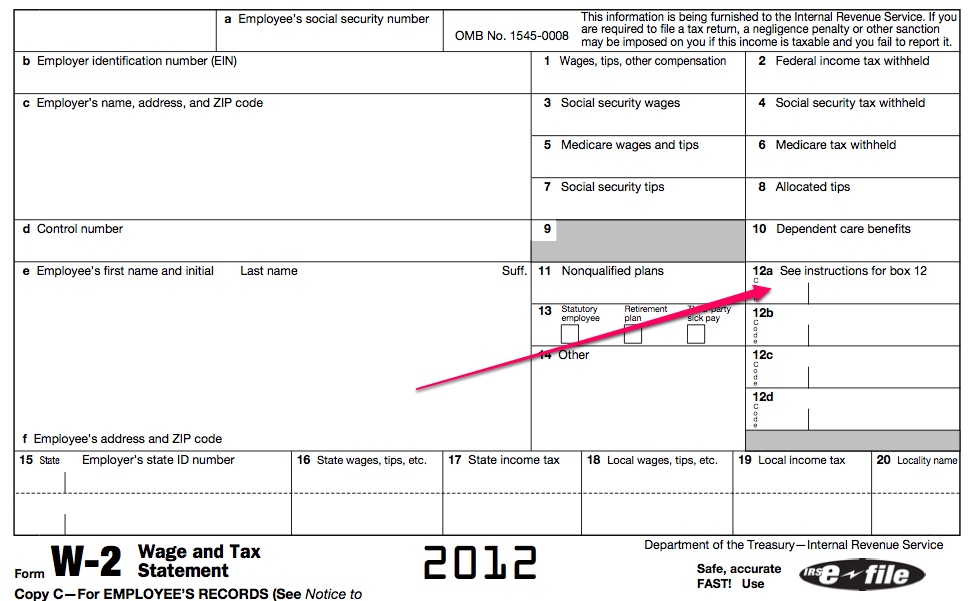

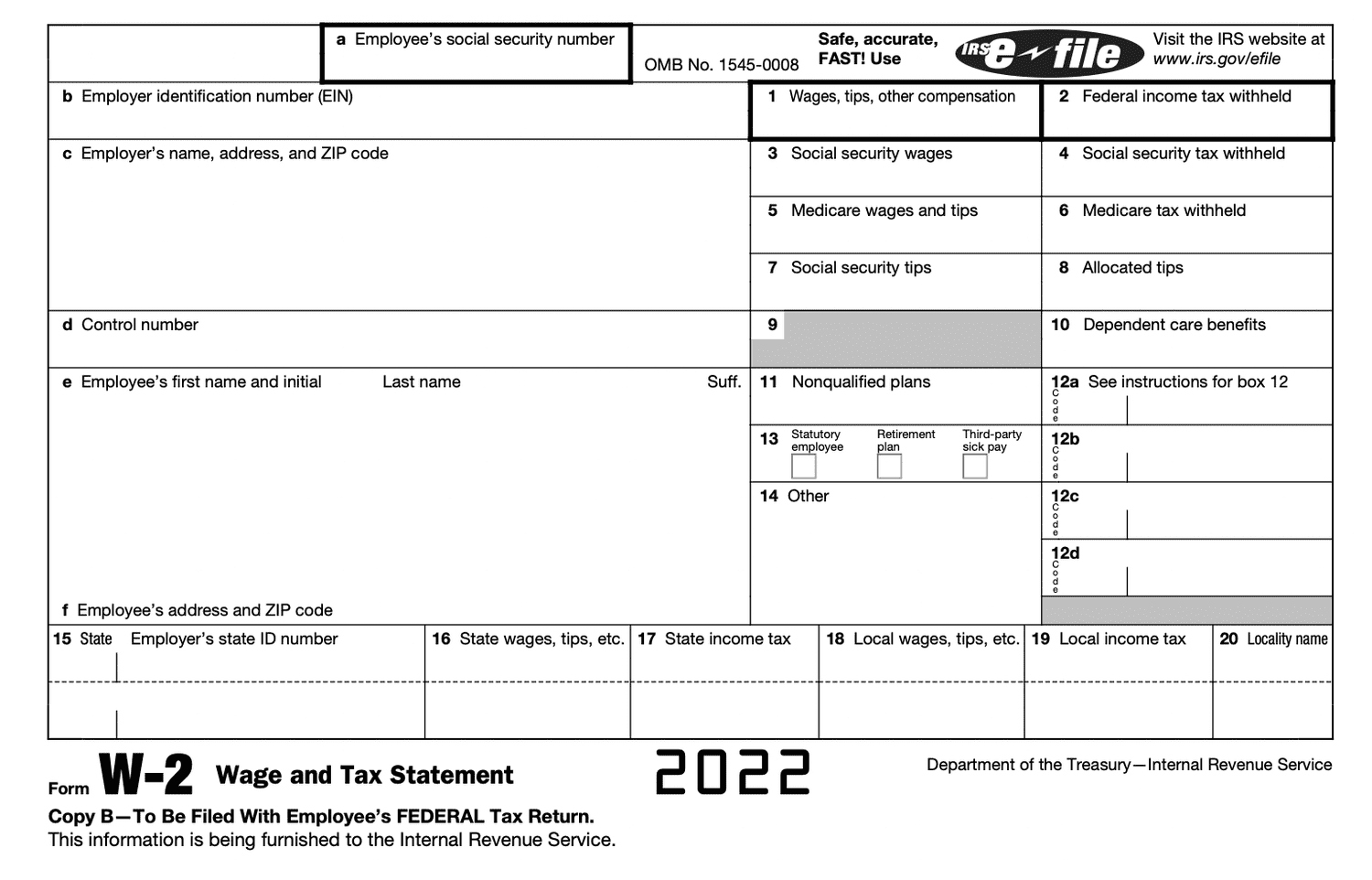

Below are some images related to W2 Form Line 12

w-2 form line 12a code dd, w-2 form line 12c dd, w2 form line 12 dd, w2 form line 12a, w2 form line 12a c, , W2 Form Line 12.

w-2 form line 12a code dd, w-2 form line 12c dd, w2 form line 12 dd, w2 form line 12a, w2 form line 12a c, , W2 Form Line 12.