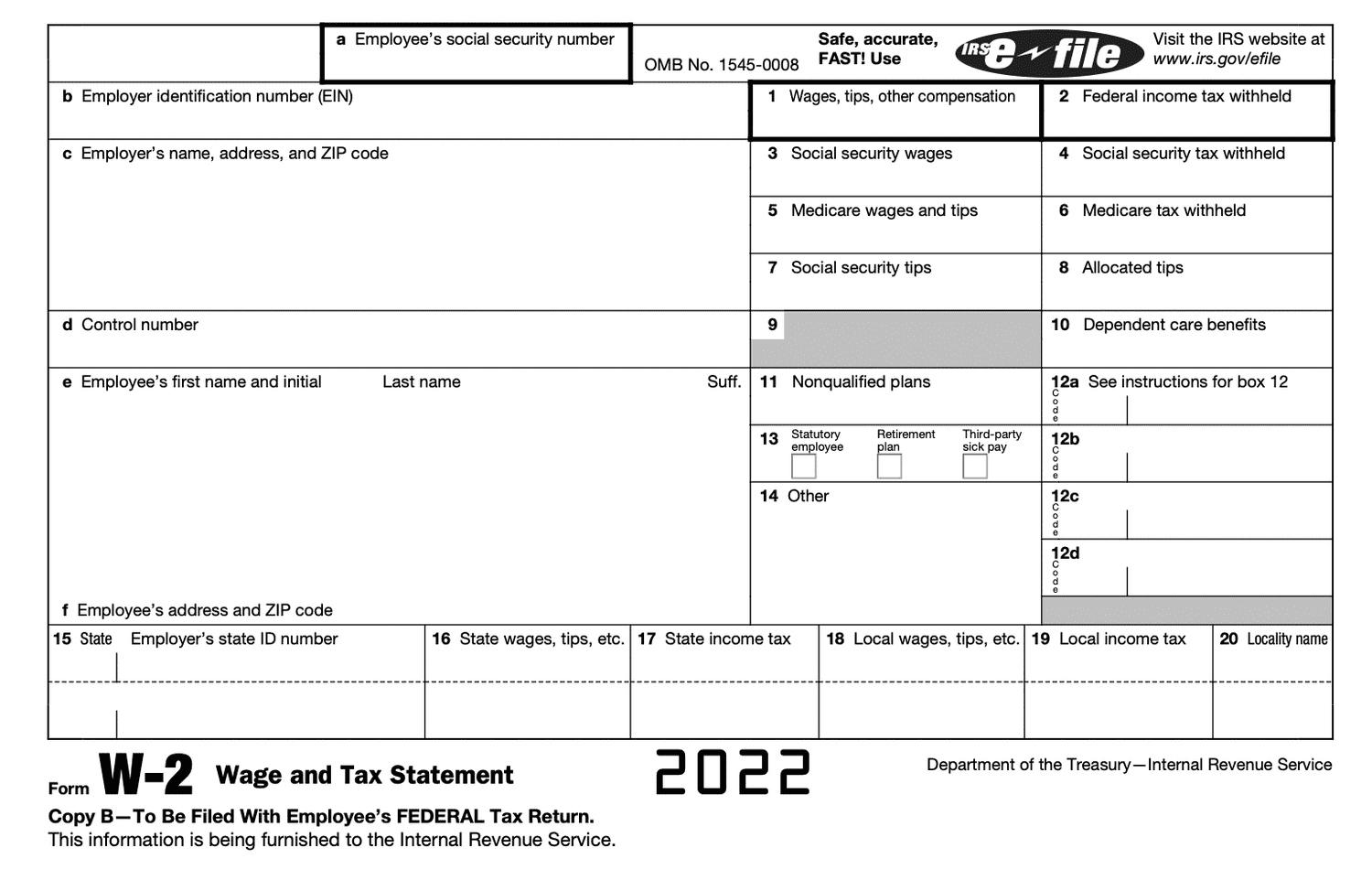

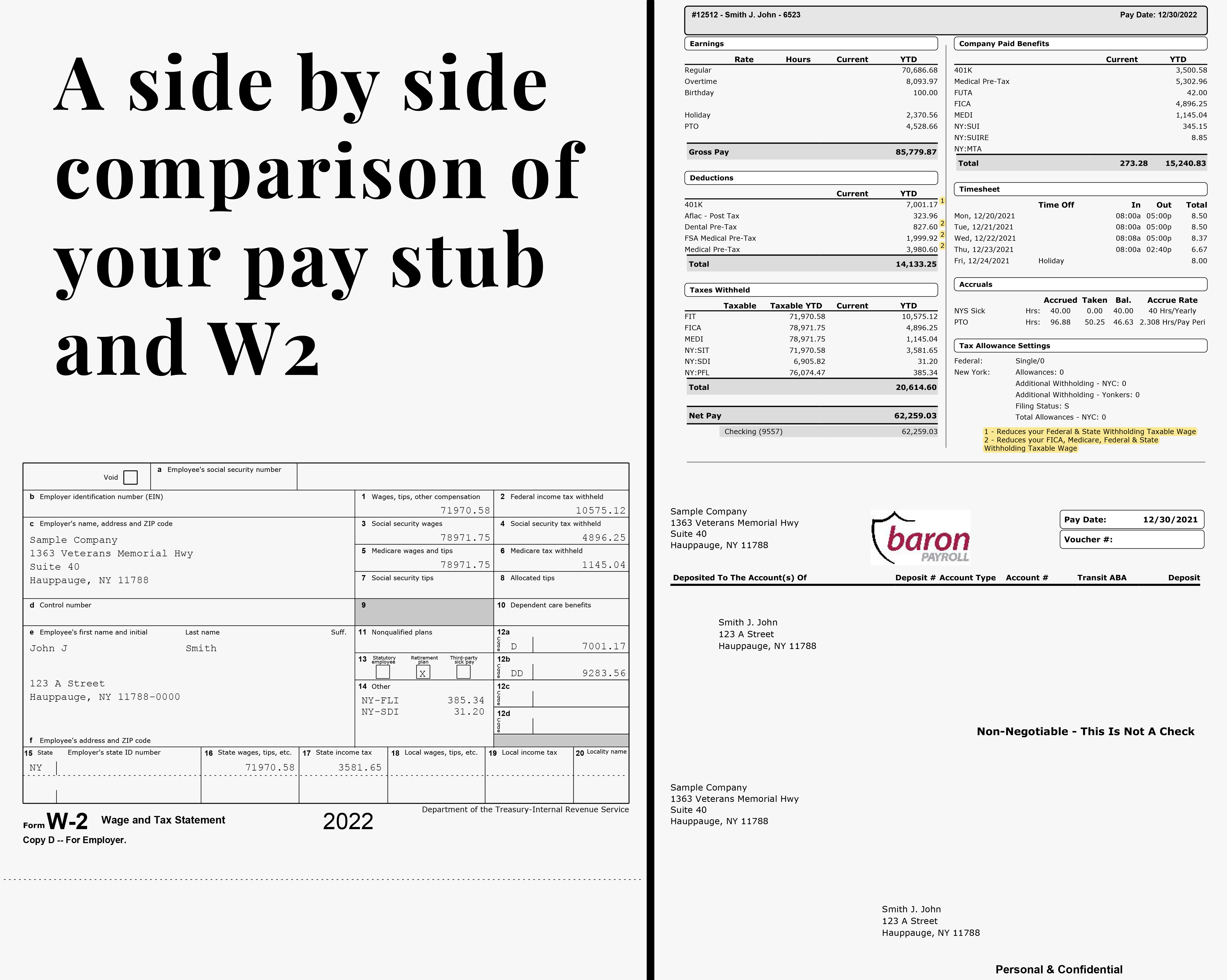

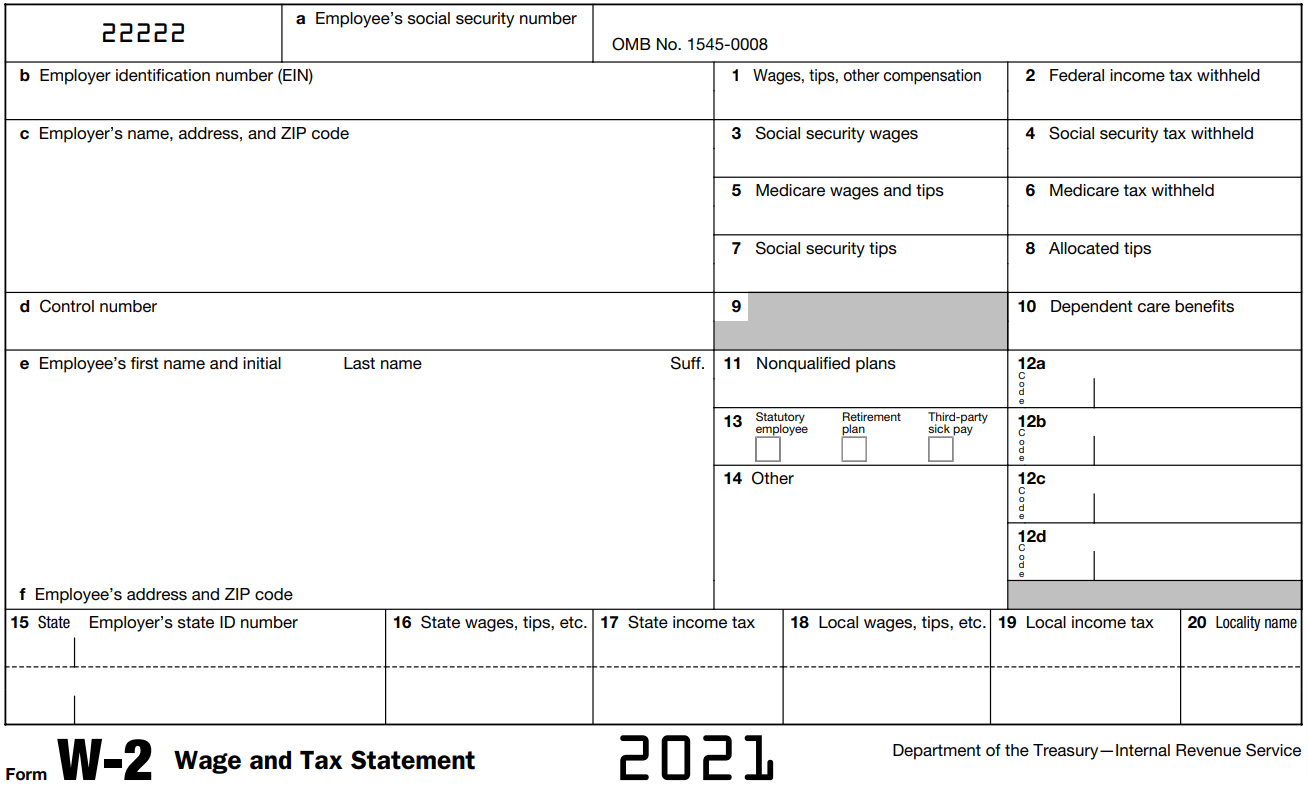

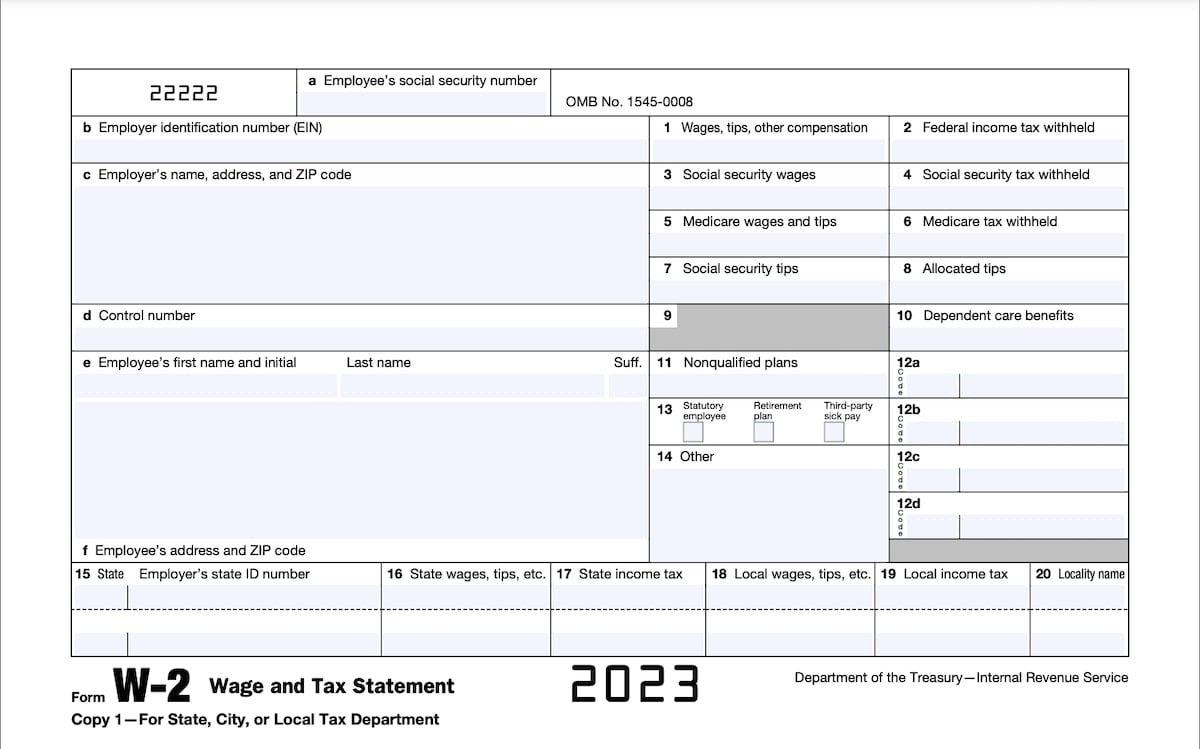

401k W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unlock Your Retirement Savings: The 401k W2 Magic!

Are you tired of living paycheck to paycheck? Are you dreaming of a future where money stress is a thing of the past? Look no further than the 401k W2 Magic! This hidden gem in your paycheck can be the key to unlocking your financial freedom and securing a comfortable retirement. Say goodbye to money worries and hello to a brighter future with your retirement savings!

Discover the Key to Financial Freedom: The 401k W2 Magic!

The 401k W2 Magic is a powerful tool that allows you to save for retirement while also reducing your taxable income. By contributing to your employer-sponsored 401k plan, you can watch your savings grow over time, thanks to the power of compound interest. Plus, many employers offer matching contributions, essentially giving you free money to boost your retirement savings even further. It’s like a magic trick that turns your hard-earned dollars into a nest egg for your golden years!

Not only does the 401k W2 Magic help you save for retirement, but it also provides tax benefits along the way. By contributing to your 401k, you can lower your taxable income, potentially putting you in a lower tax bracket and saving you money on taxes. And since your contributions are made pre-tax, you won’t even miss the money from your paycheck. It’s like saving for your future self without even feeling the pinch in the present. With the 401k W2 Magic, you can enjoy the peace of mind that comes with knowing you’re building a secure financial future for yourself.

Say Goodbye to Money Stress with Your Retirement Savings!

Imagine a future where money stress is a thing of the past. Thanks to the 401k W2 Magic, that dream can become a reality. By consistently contributing to your retirement savings, you can build a nest egg that will provide for you in your golden years. Say goodbye to worrying about how you’ll afford retirement and hello to a future where financial freedom is within reach. With the 401k W2 Magic, your retirement savings can truly work like magic, transforming your financial future for the better.

In conclusion, the 401k W2 Magic is a powerful tool that can help you unlock your retirement savings and say goodbye to money stress. By taking advantage of your employer-sponsored 401k plan, you can watch your savings grow over time and enjoy tax benefits along the way. Say goodbye to living paycheck to paycheck and hello to a future where financial freedom is within reach. Let the 401k W2 Magic work its wonders and secure a comfortable retirement for yourself.

Below are some images related to 401k W2 Form

401k w2 form, do i get a w2 for 401k withdrawal, is 401k on w2, is my 401k information on my w2, w2 form 401k box, , 401k W2 Form.

401k w2 form, do i get a w2 for 401k withdrawal, is 401k on w2, is my 401k information on my w2, w2 form 401k box, , 401k W2 Form.