Box 10 W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unveiling the Magic of Box 10 on Your W2 Form!

Have you ever looked at your W2 form and wondered what all those boxes mean? Well, get ready to be enchanted by the magic of Box 10! This seemingly ordinary box holds a special power that many people overlook. Let’s dive into the wonder and mystery of Box 10 and discover its hidden charm.

Unleashing the Enchantment of Box 10!

Box 10 on your W2 form may seem like just another box filled with numbers, but it actually holds the key to unlocking a world of possibilities. This box contains the amount of dependent care benefits provided by your employer, which can have a significant impact on your tax return. By understanding the magic of Box 10, you can maximize your tax savings and take full advantage of the benefits you receive from your employer.

But the magic of Box 10 doesn’t stop there! This box also allows you to plan ahead for future tax filings and make informed decisions about your dependent care expenses. By keeping track of the amount listed in Box 10 each year, you can better prepare for tax season and ensure that you are taking full advantage of any benefits available to you. So don’t overlook the power of Box 10 – it may just hold the key to unlocking financial success!

Discover the Charm of Box 10 on Your W2 Form!

As you gaze upon Box 10 on your W2 form, take a moment to appreciate the charm and wonder it holds. This box is not just a random number on a piece of paper – it is a symbol of the support and benefits provided to you by your employer. By understanding and embracing the magic of Box 10, you can harness its power to secure a brighter financial future for yourself and your loved ones. So the next time you receive your W2 form, remember to give Box 10 the attention and appreciation it deserves!

In conclusion, don’t underestimate the magic of Box 10 on your W2 form. This seemingly ordinary box holds the key to unlocking a world of financial possibilities and tax savings. By understanding the significance of Box 10 and embracing its charm, you can make informed decisions about your dependent care benefits and plan ahead for future tax filings. So let the magic of Box 10 guide you on your journey to financial success and prosperity!

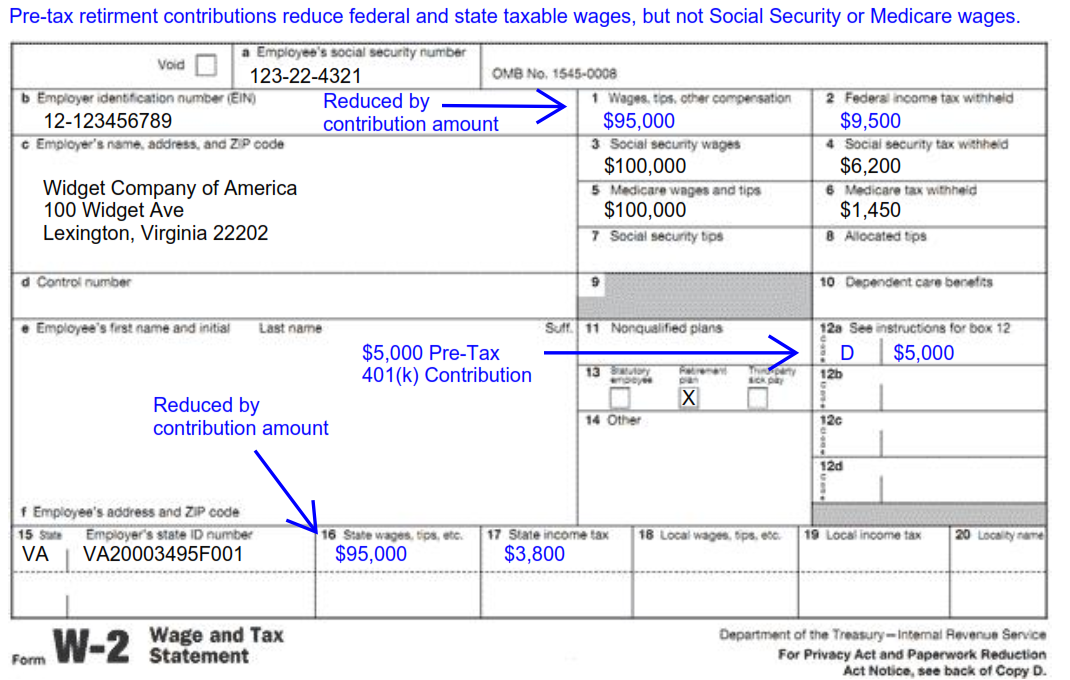

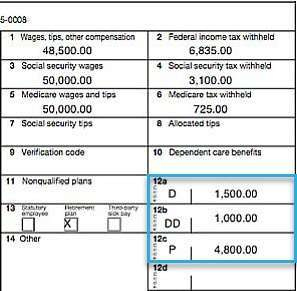

Below are some images related to Box 10 W2 Form

box 10 w2 form, w2 form boxes explained, what goes in box 10 of the w2, what is box 10 on w2, , Box 10 W2 Form.

box 10 w2 form, w2 form boxes explained, what goes in box 10 of the w2, what is box 10 on w2, , Box 10 W2 Form.