W2 Form Codes Box 14 – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unlocking the Mystery of Box 14: Decoding W2 Form Fun!

Have you ever received your W2 form and felt a sense of confusion when you saw Box 14? Fear not, for we are here to help you unlock the mystery and dive into the exciting world of decoding W2 forms! Box 14 may seem like a daunting puzzle at first, but with a little guidance, you’ll be able to crack the code and reveal the hidden treasures within.

Cracking the Code: Unveiling the Secrets of Box 14

Box 14 on your W2 form may contain various types of information, such as union dues, educational assistance, or even state disability insurance taxes. Understanding the contents of Box 14 can provide valuable insights into your tax situation and help you maximize your deductions. By decoding the information in Box 14, you can uncover hidden gems that may have a significant impact on your tax return.

Additionally, Box 14 may also contain codes that correspond to specific tax benefits or employer-provided perks. These codes can provide valuable information about your employment history and help you understand the full scope of your compensation package. By unraveling the secrets of Box 14, you can gain a deeper understanding of your financial situation and make informed decisions when it comes to tax planning and reporting.

Exploring the depths of Box 14 can be a fun and rewarding experience, as you uncover the mysteries of your tax forms and gain a better understanding of your financial health. So don’t be afraid to dive in and embrace the excitement of decoding W2 form fun!

Dive into the World of W2 Form Excitement

In conclusion, unlocking the mystery of Box 14 is a rewarding journey that can help you take control of your tax situation and make more informed financial decisions. By embracing the challenge of decoding W2 form fun, you can gain valuable insights into your compensation package, tax benefits, and overall financial health. So don’t be afraid to roll up your sleeves, grab your magnifying glass, and dive into the world of Box 14 excitement today!

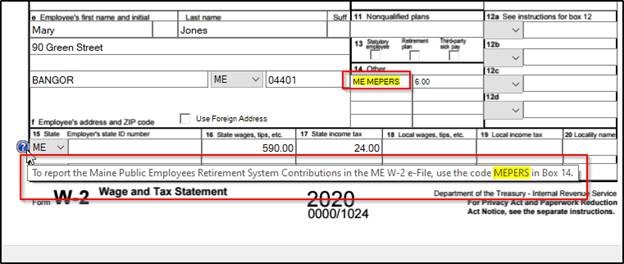

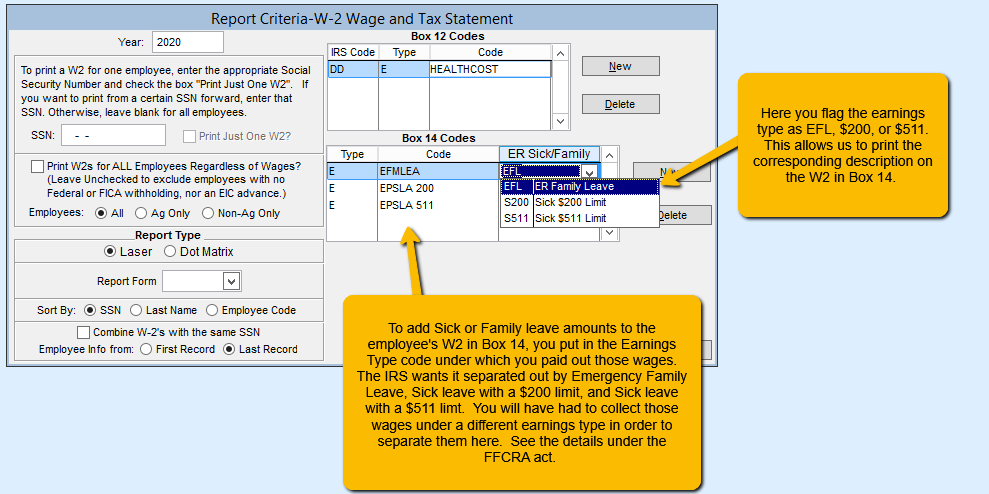

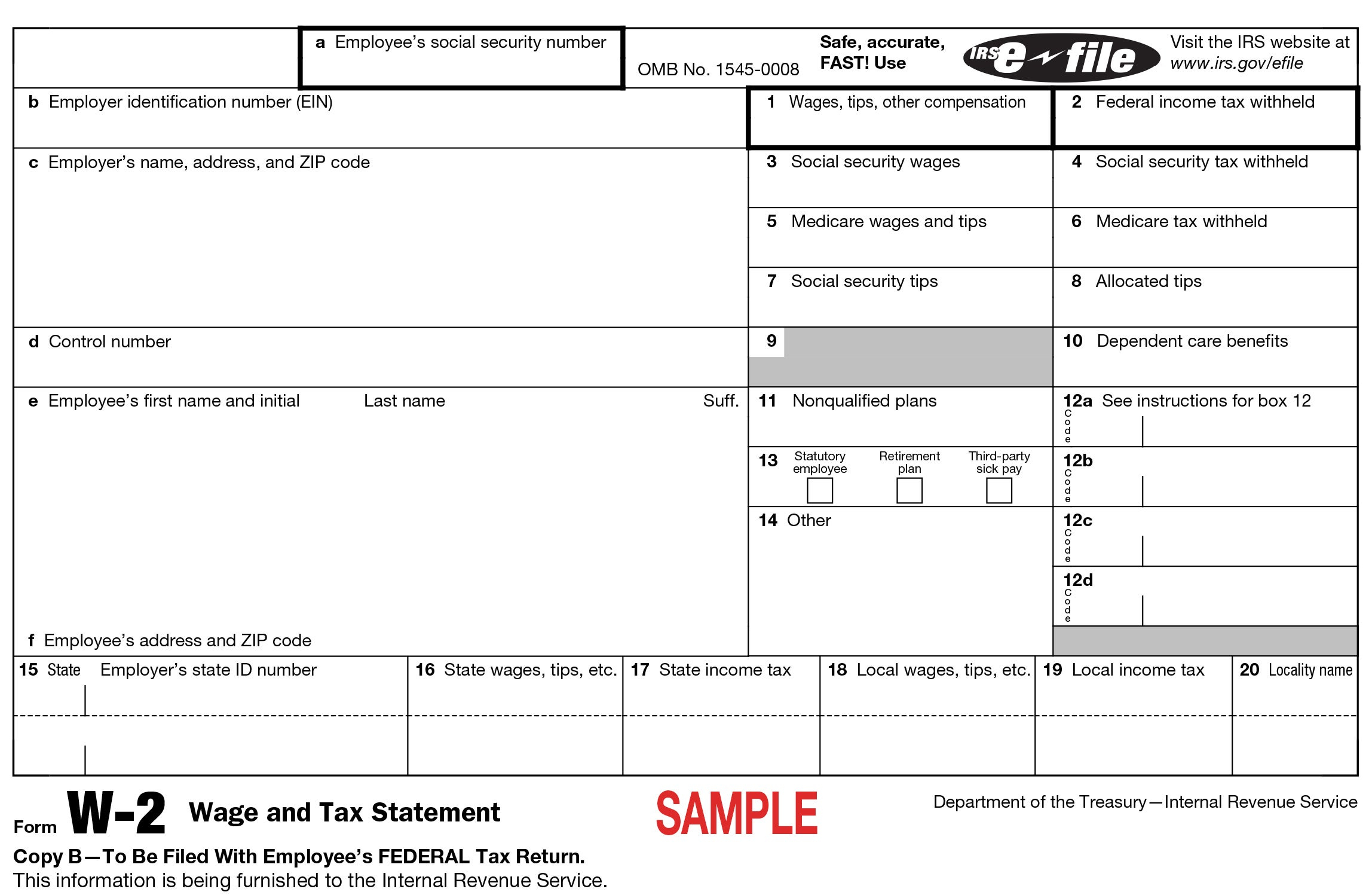

Below are some images related to W2 Form Codes Box 14

form w-2 reference guide for box 14 codes, w-2 form 2022 box 14 codes, w-2 form box 14 code s125, w2 box 14 codes list, w2 box 14 other codes, , W2 Form Codes Box 14.

form w-2 reference guide for box 14 codes, w-2 form 2022 box 14 codes, w-2 form box 14 code s125, w2 box 14 codes list, w2 box 14 other codes, , W2 Form Codes Box 14.