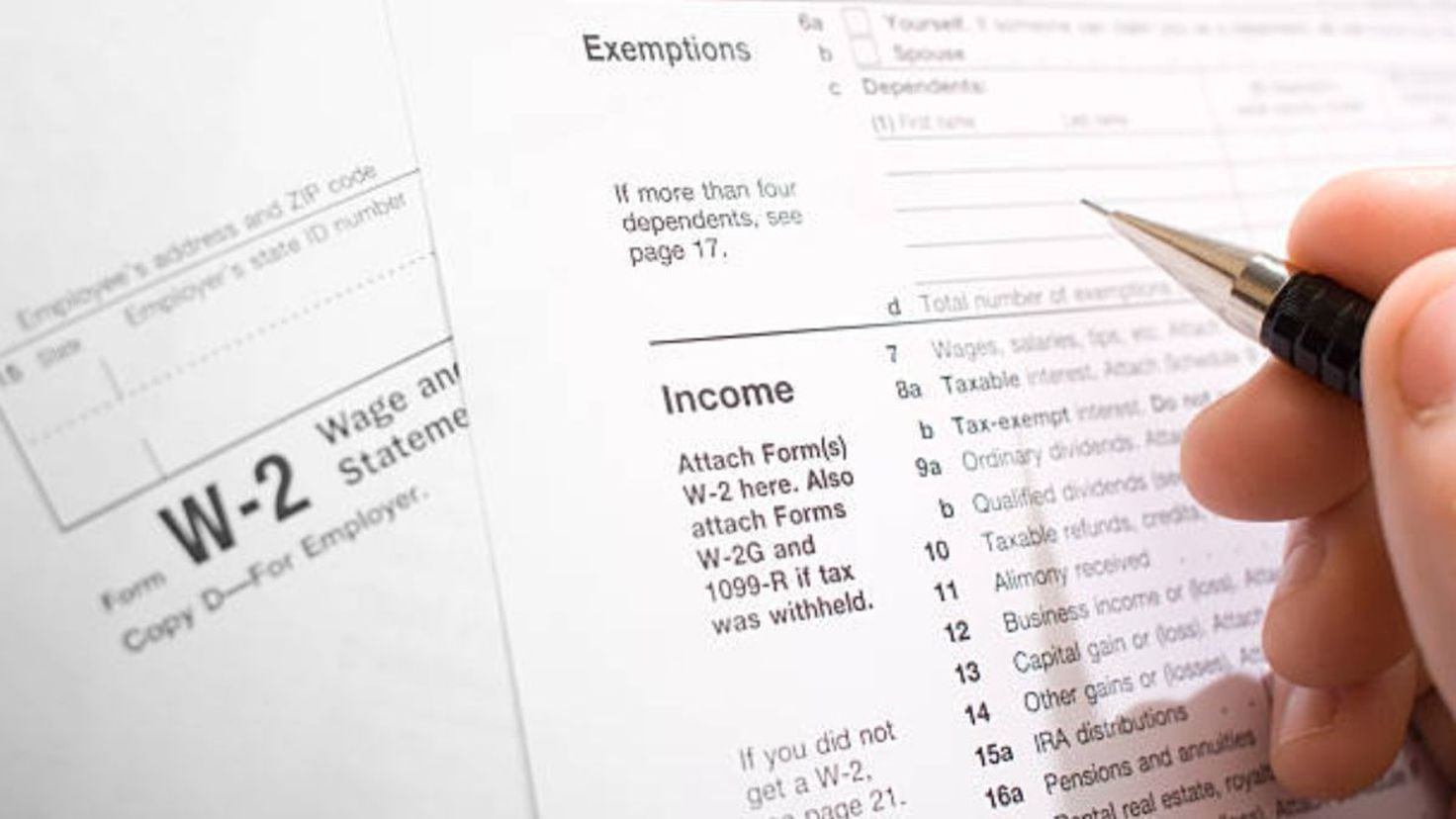

My Former Employer Won’t Give Me My W2 – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

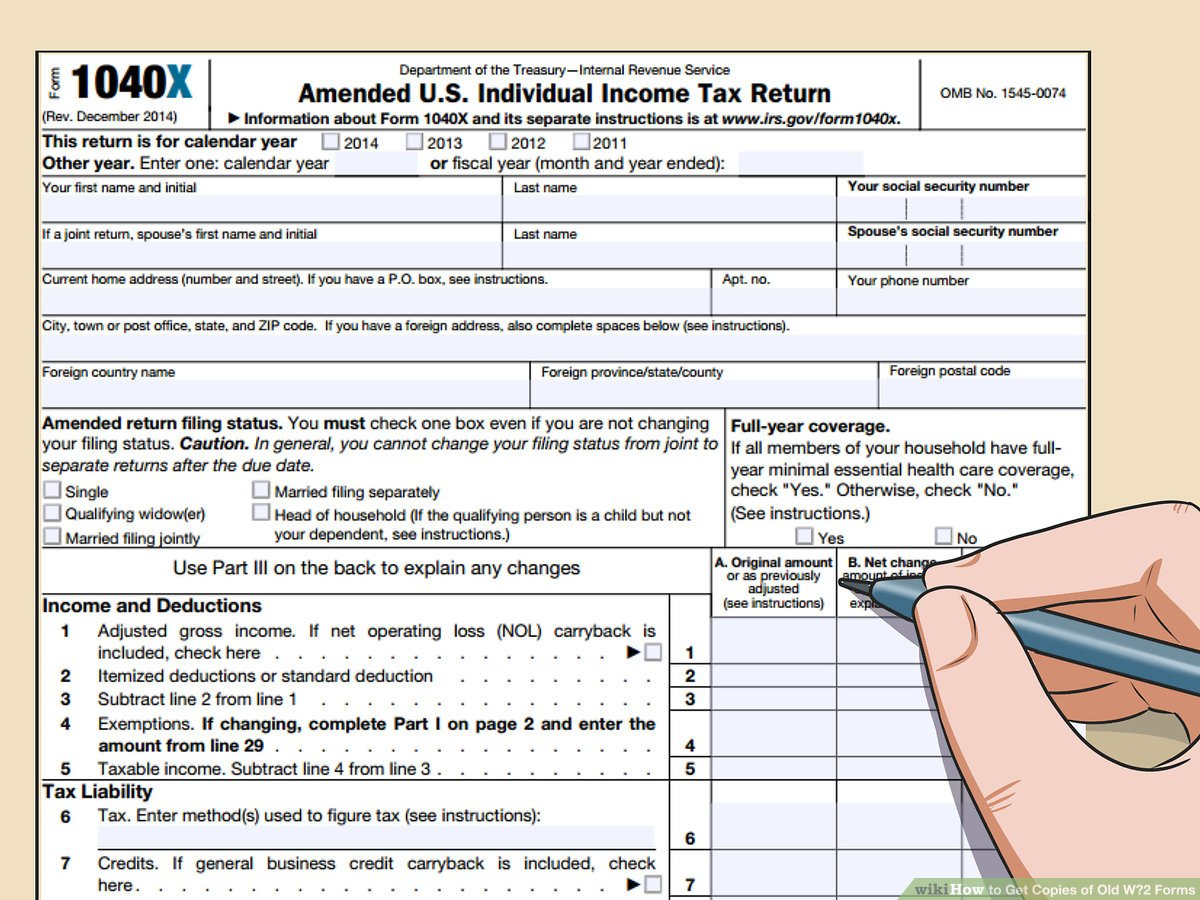

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

A Payroll Predicament: Where’s My W2?

Ah, tax season – a time of year that strikes fear into the hearts of many. As I sat down to file my taxes this year, I realized I was missing a crucial piece of the puzzle: my W2 form. After reaching out to my former employer, I was met with apologies and excuses, but no sign of the elusive document. It seems my former boss had forgotten to send out W2s to several employees, myself included. Now, I find myself stuck in a W2-less wonderland, unsure of how to proceed.

The frustration of not having my W2 in hand is palpable. Without this vital piece of information, I am unable to accurately report my income for the year and may face penalties for filing late. It’s a stressful situation, to say the least. As I scramble to piece together my financial records and track down the necessary information, I can’t help but wonder how my former boss could have let this slip through the cracks. It’s a reminder of the importance of diligence and attention to detail when it comes to payroll and employee documentation.

As I anxiously await the arrival of my missing W2, I can’t help but feel a sense of powerlessness. My former boss’s forgetfulness has put me in a difficult position, one that could have serious consequences if not resolved quickly. As I navigate this unexpected hurdle, I can’t help but hope that this experience serves as a wake-up call for my former employer. In the meantime, I’ll continue to chase down my missing W2 and hope for a speedy resolution to this payroll predicament.

The Tale of a Forgetful Boss: Lost in Wonderland

In the midst of tax season chaos, it’s easy to feel like I’ve fallen down the rabbit hole into a W2-less wonderland. The tale of my forgetful boss and the missing W2s reads like a modern-day fable of payroll mishaps. As I recount the events that led to this predicament, I can’t help but shake my head in disbelief. How could something as important as tax documentation slip through the cracks?

It’s a classic case of the importance of attention to detail in the world of payroll. One small oversight can have far-reaching consequences, as I am now experiencing firsthand. As I navigate the maze of tax forms and deadlines, I can’t help but think about the impact of my former boss’s forgetfulness on myself and my fellow employees. It’s a stark reminder of the need for accuracy and accountability in all aspects of business operations.

As I reflect on this unexpected twist in my tax filing journey, I can’t help but find a glimmer of humor in the situation. After all, what is life without a little bit of chaos and confusion? While I may be stuck in a W2-less wonderland for the time being, I am hopeful that this experience will ultimately lead to a positive outcome. In the meantime, I’ll keep my spirits high and my eye on the prize: a resolution to this payroll puzzle.

Below are some images related to My Former Employer Won’t Give Me My W2

can’t get w2 from old employer, did not receive w2 from previous employer, how can i get my w2 from former employer, how to get my w2 from a past employer, my former employer will not give me my w2, , My Former Employer Won’t Give Me My W2.

can’t get w2 from old employer, did not receive w2 from previous employer, how can i get my w2 from former employer, how to get my w2 from a past employer, my former employer will not give me my w2, , My Former Employer Won’t Give Me My W2.