W2 Form Understanding – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

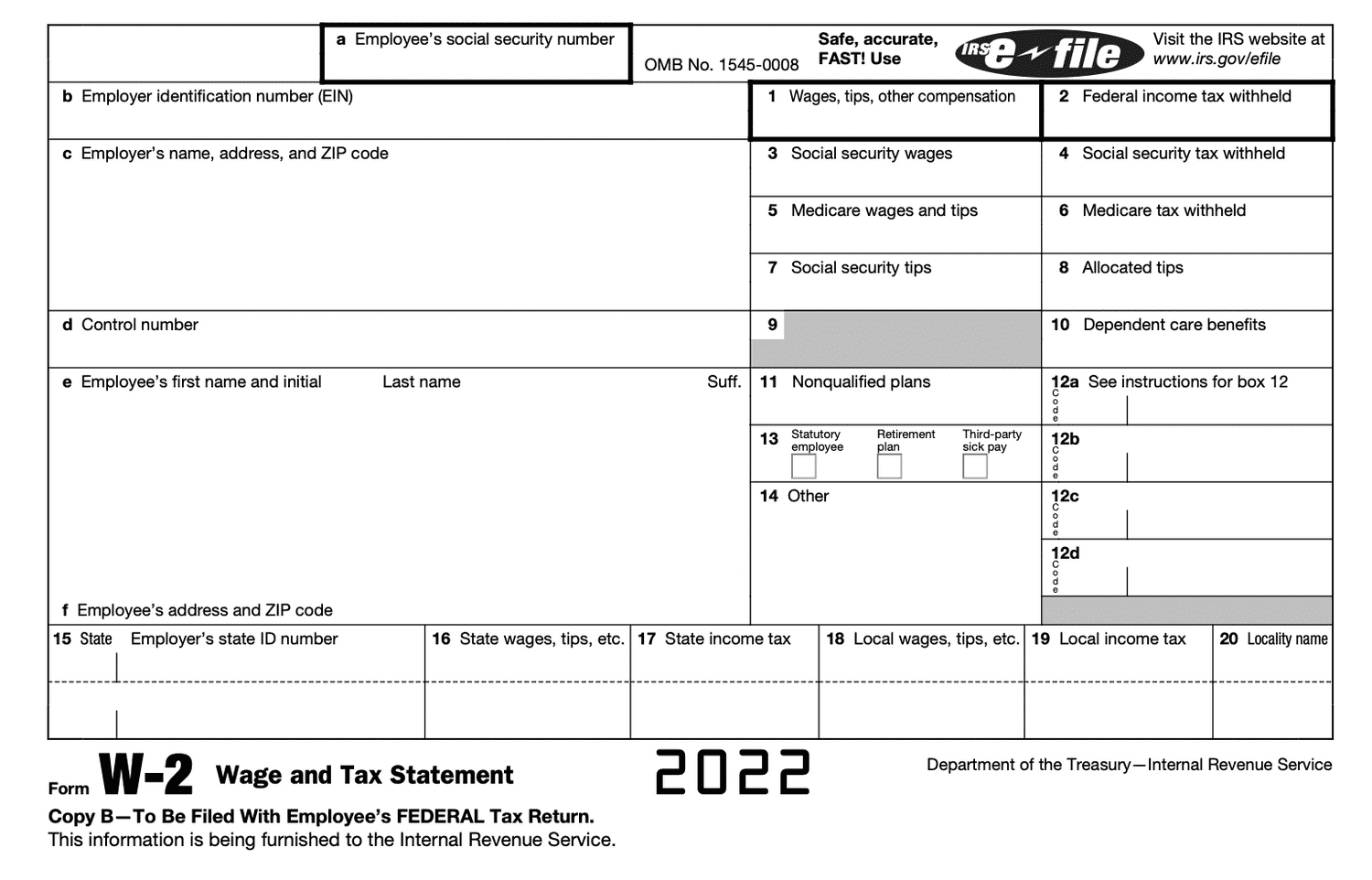

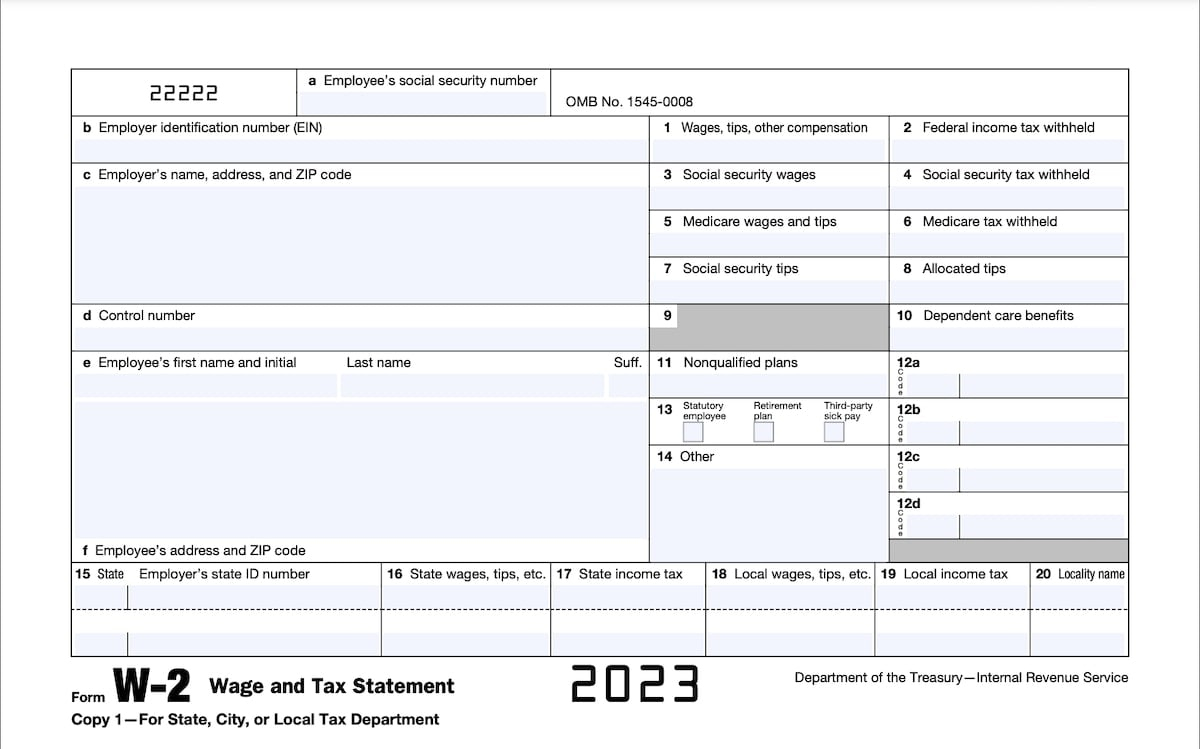

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

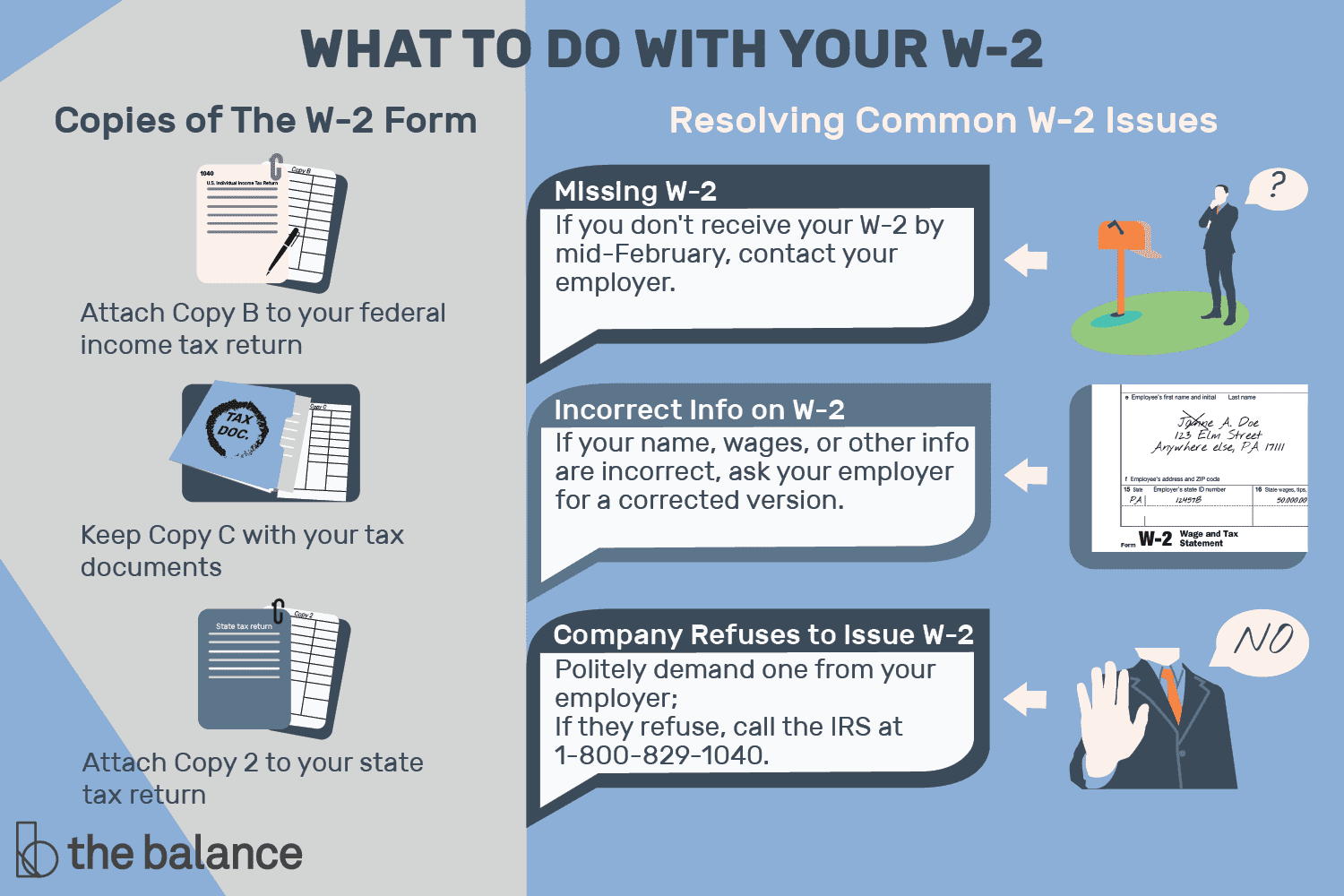

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unravel the Mystery Behind Your W2 Form!

Have you ever received your W2 form in the mail and felt completely lost as to what it all means? You’re not alone! The W2 form can seem like a jumbled mess of numbers and codes, but fear not – we’re here to help you crack the code and become a W2 wizard! By understanding the different sections of your W2 form and what they represent, you can take control of your finances and make the most of your tax return.

Become a W2 Wizard with These Tips!

The first step to mastering your W2 form is to familiarize yourself with the different boxes and codes. Box 1, for example, shows your total wages for the year, while Box 2 displays the amount of federal income tax that was withheld from your paychecks. Understanding these numbers can give you insight into how much you earned and how much you’ve already paid in taxes. Additionally, pay attention to Box 12, which shows any additional income or benefits you may have received, such as bonuses or retirement plan contributions.

Next, don’t overlook the importance of double-checking your personal information on your W2 form. Make sure your name, address, social security number, and other details are accurate and up to date. Any errors could lead to delays in processing your tax return or even trigger an audit. If you spot any mistakes, be sure to contact your employer to have them corrected promptly. Taking the time to review your W2 form thoroughly can save you headaches down the road.

Lastly, use your W2 form as a tool to plan for the future. By analyzing your income, tax withholdings, and any deductions you may qualify for, you can make informed decisions about your financial goals and strategies. Whether you’re saving for a big purchase, planning for retirement, or looking to invest in your education, your W2 form can provide valuable insights into your financial situation. With a little knowledge and planning, you can turn your W2 form from a confusing document into a powerful tool for financial success.

In conclusion, don’t let your W2 form intimidate you – embrace it as a key to unlocking your financial potential! By unraveling the mystery behind your W2 form and mastering its contents, you can take control of your finances and make smarter decisions about your money. With the tips and tricks outlined above, you’ll be well on your way to becoming a W2 wizard and making the most of tax season. So grab your W2 form, crack the code, and watch your financial future flourish!

Below are some images related to W2 Form Understanding

how to interpret w-2 form, w2 form description, w2 form explained, w2 form explanation, w2 form explanation of boxes, , W2 Form Understanding.

how to interpret w-2 form, w2 form description, w2 form explained, w2 form explanation, w2 form explanation of boxes, , W2 Form Understanding.