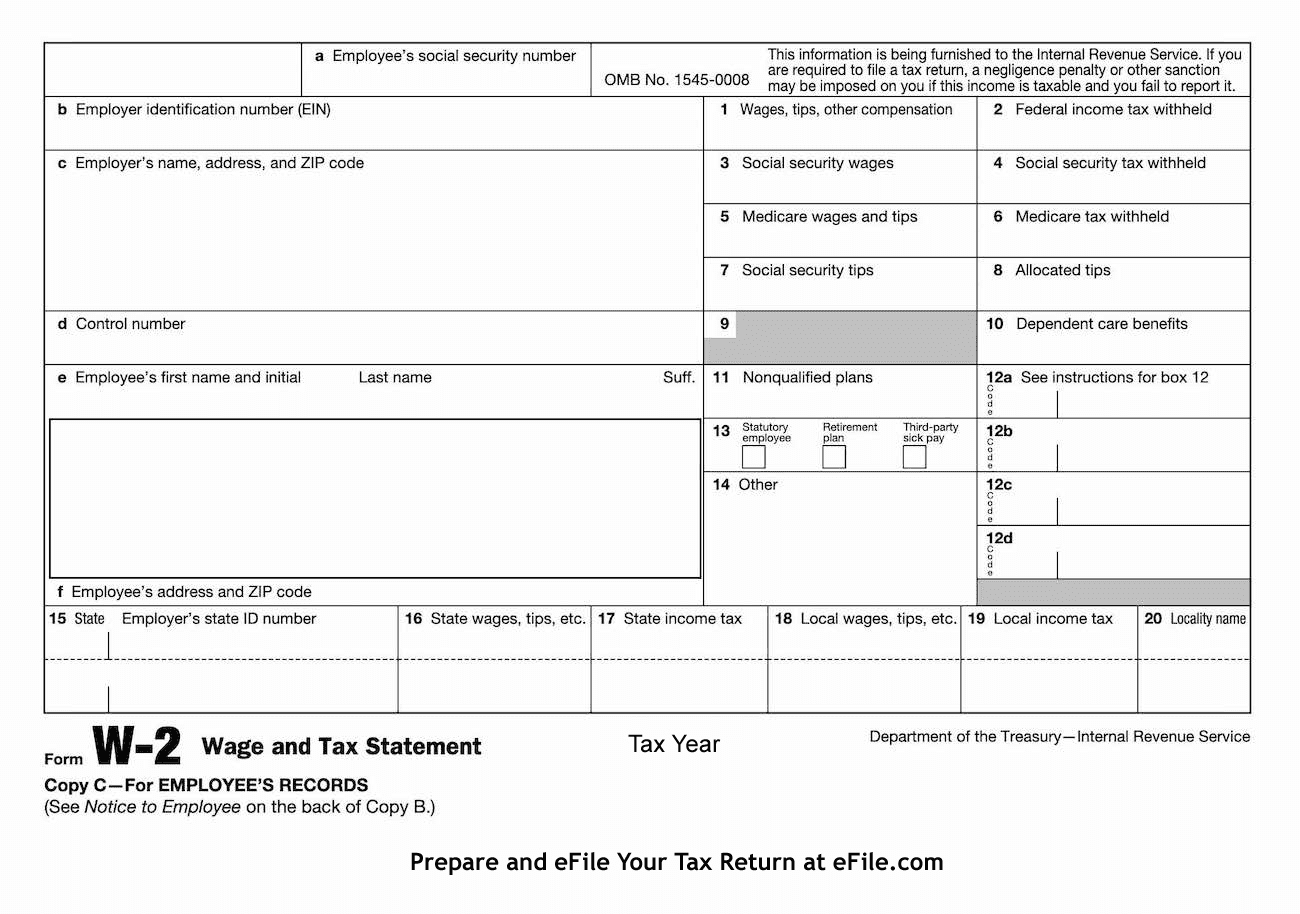

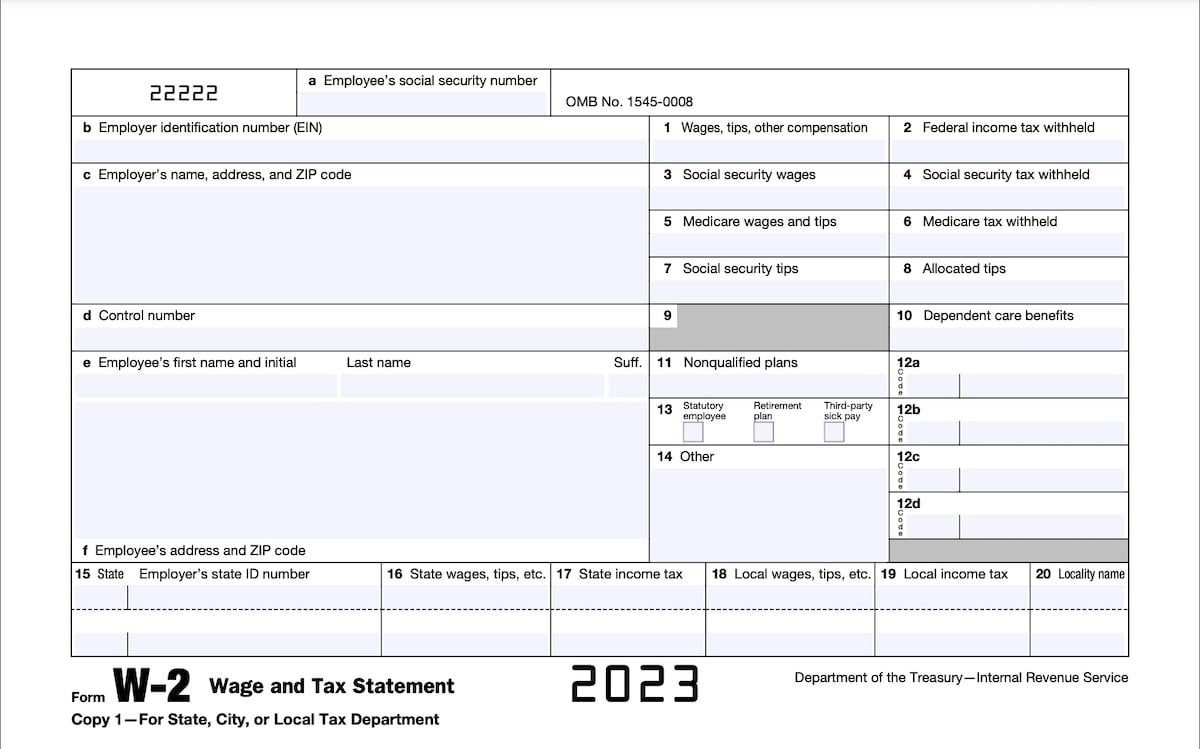

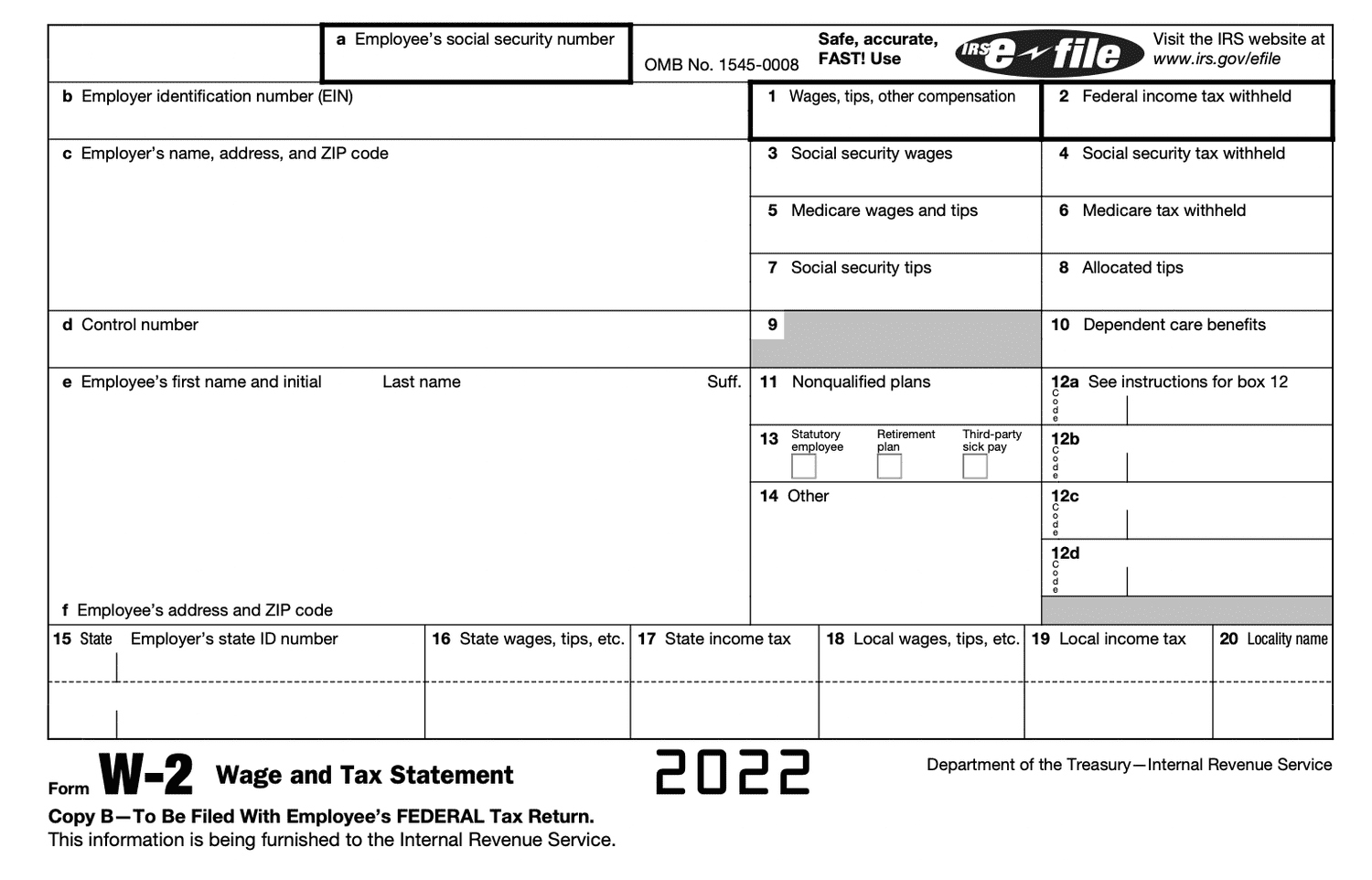

Get Your W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Time to Snag Your W2 Form!

Are you ready to start thinking about that sweet, sweet tax refund? Well, the first step in the process is snagging your W2 form from your employer. This little piece of paper is your ticket to getting that refund you’ve been dreaming of. It contains all the information the IRS needs to calculate how much money you’ll be getting back this tax season. So, don’t delay – make sure you get your hands on that W2 form as soon as possible!

Once you’ve got your hands on your W2 form, it’s time to start getting excited about that refund you’ll be receiving. Whether you’re planning on splurging on a new gadget, saving up for a vacation, or just paying off some bills, that extra money will definitely come in handy. So, gather up all your receipts and start tracking down any deductions you might be eligible for. The sooner you start getting your paperwork in order, the sooner you’ll be able to file your taxes and get that refund in your bank account.

Getting that refund might seem like a daunting task, but with your W2 form in hand and a little bit of organization, you’ll be well on your way to a stress-free tax season. So, don’t procrastinate – make sure you’re prepared and ready to tackle your taxes head-on. Remember, that refund is just waiting for you to claim it, so why wait any longer? Get that W2 form, start preparing your paperwork, and get ready to enjoy the fruits of your hard work this tax season!

Get Ready to Get That Refund!

As tax season approaches, it’s time to start thinking about getting that refund you’ve been eagerly anticipating. With your W2 form in hand, you’re one step closer to filing your taxes and getting that money back in your pocket. So, gather up all your financial documents, double-check your calculations, and make sure you’re ready to submit your tax return. The sooner you file, the sooner you’ll be able to start enjoying that refund!

While the process of filing your taxes might seem overwhelming, there’s no need to stress. Take your time, double-check your work, and make sure you’re maximizing your deductions to get the biggest refund possible. Whether you’re a tax-filing pro or a newbie to the process, there are plenty of resources available to help guide you through the process. So, don’t be afraid to ask for help if you need it. With a little bit of effort and some patience, you’ll be well on your way to receiving that refund you’ve been dreaming of.

As you prepare to file your taxes and snag that refund, remember to stay positive and keep your eye on the prize. Whether you’re planning on saving, investing, or treating yourself to something special, that refund is your hard-earned money coming back to you. So, celebrate your financial responsibility and take pride in the fact that you’re taking control of your finances. With your W2 form in hand and your paperwork in order, you’re ready to tackle tax season head-on and get that refund you deserve!

In conclusion, tax season is upon us, and it’s time to start thinking about snagging that W2 form and getting ready to get that refund. With a little bit of organization, preparation, and positivity, you’ll be well on your way to receiving that extra cash back in your pocket. So, don’t wait any longer – make sure you’ve got your W2 form, start gathering your financial documents, and get ready to file your taxes. That refund is just around the corner, and with a little bit of effort, it’ll be yours to enjoy in no time!

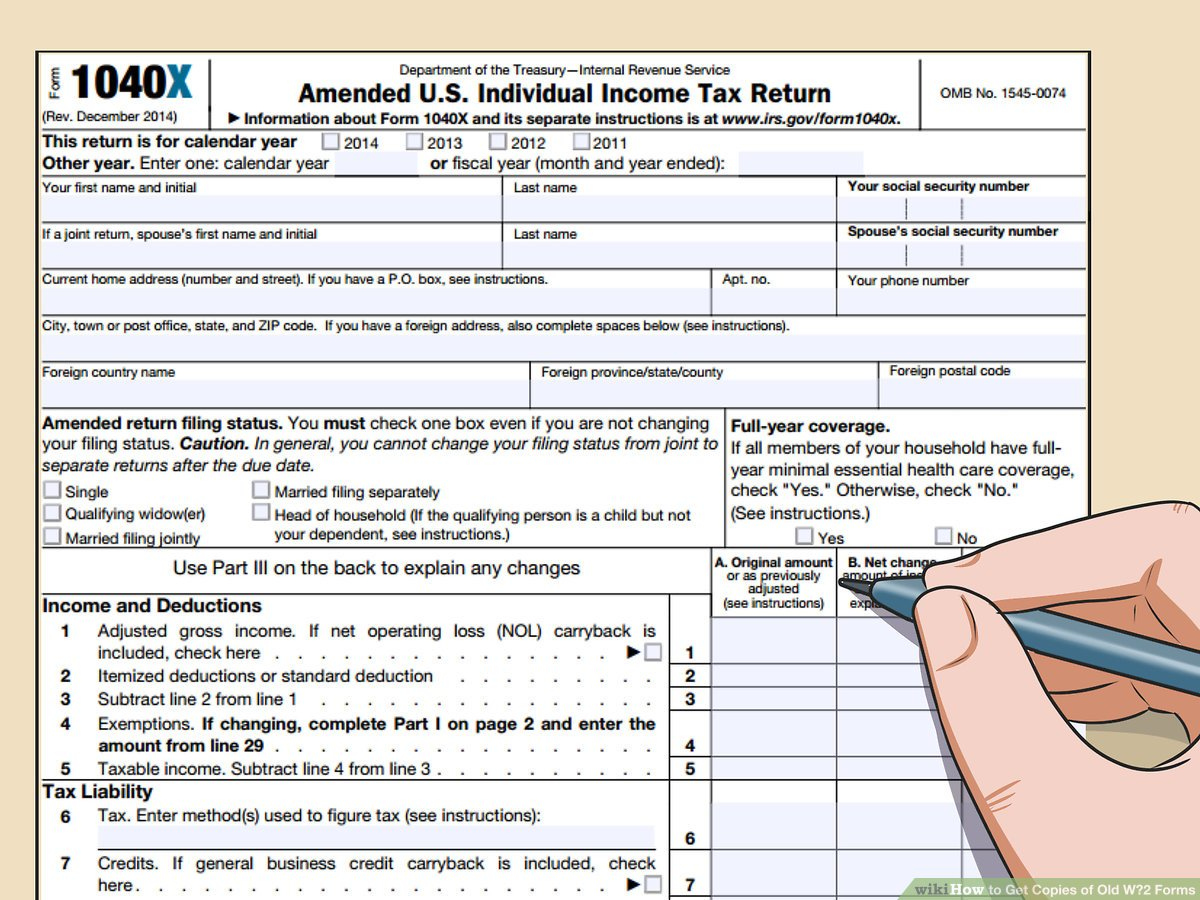

Below are some images related to Get Your W2 Form

find your w2 online adp, get my w2 online now, get my w2 online walmart, get your w2 form, how to get your w2 form from doordash, , Get Your W2 Form.

find your w2 online adp, get my w2 online now, get my w2 online walmart, get your w2 form, how to get your w2 form from doordash, , Get Your W2 Form.