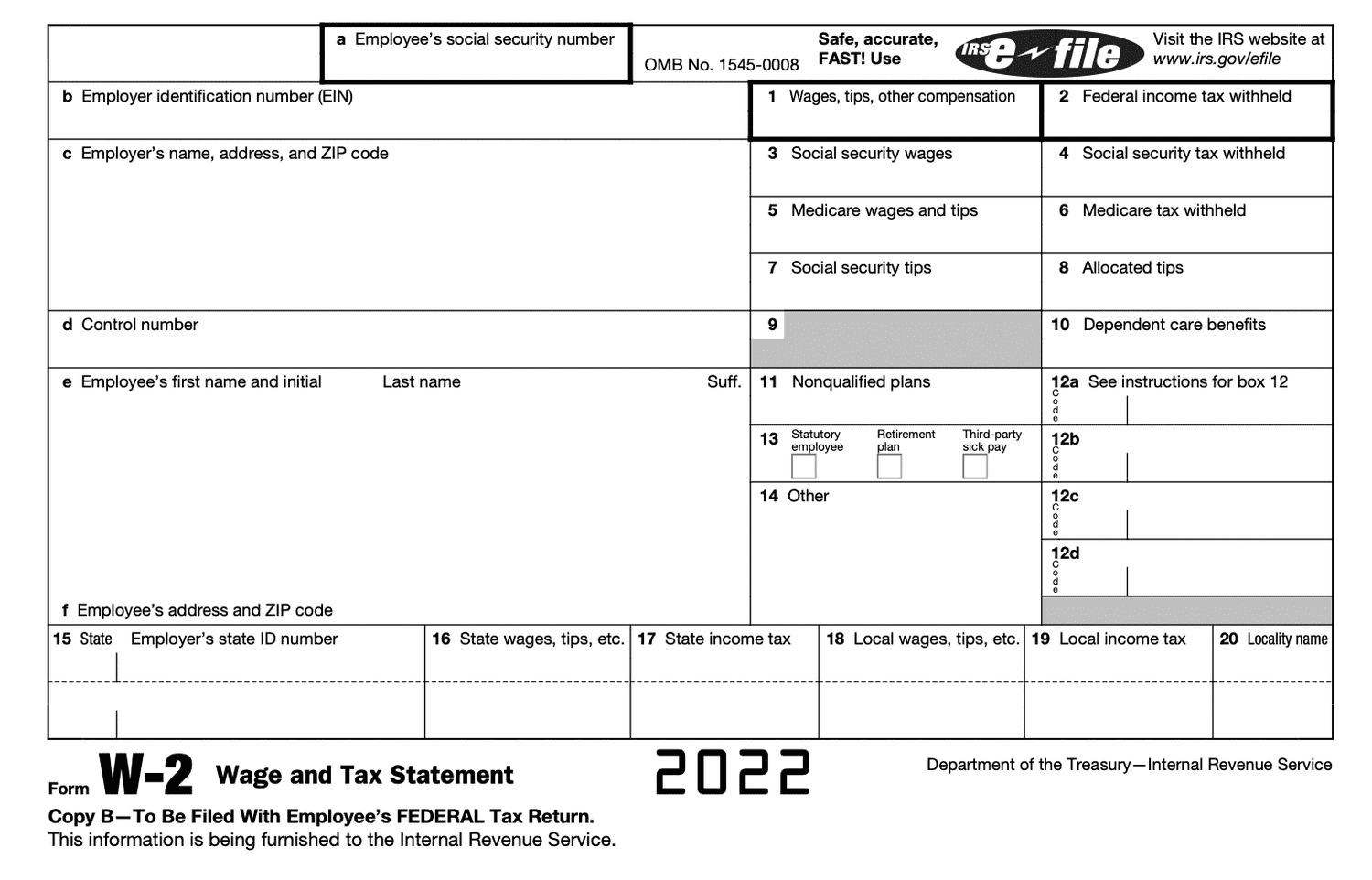

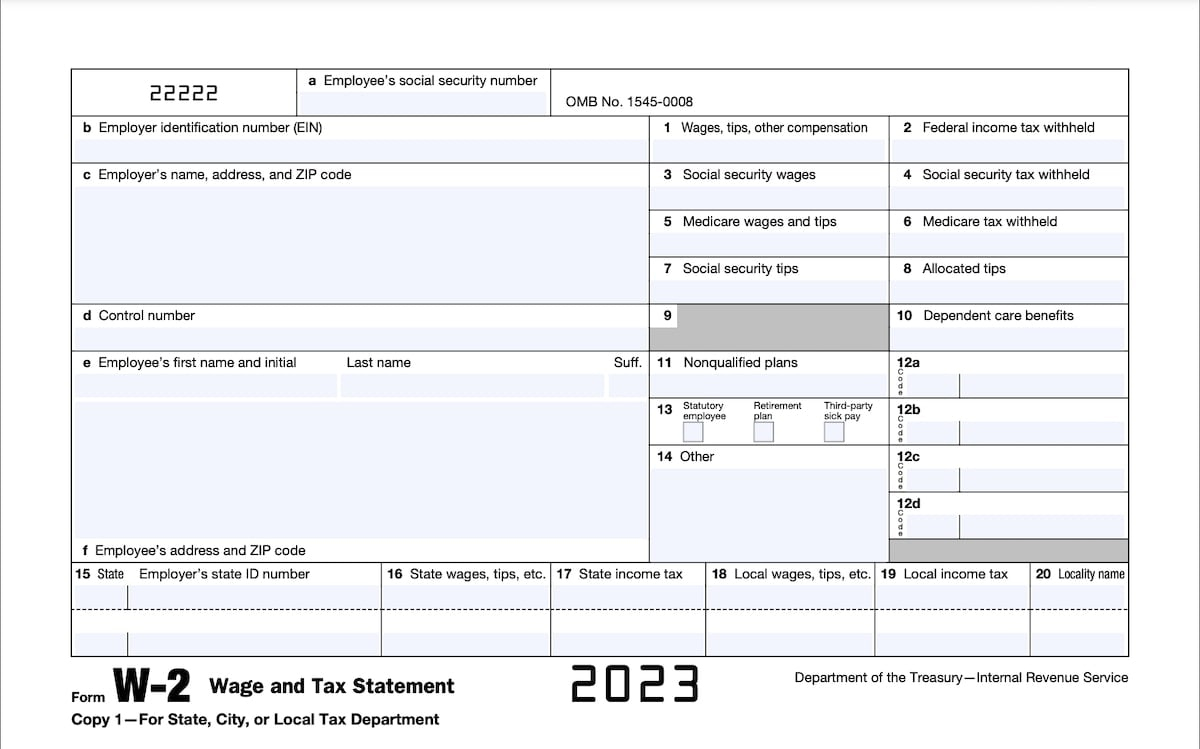

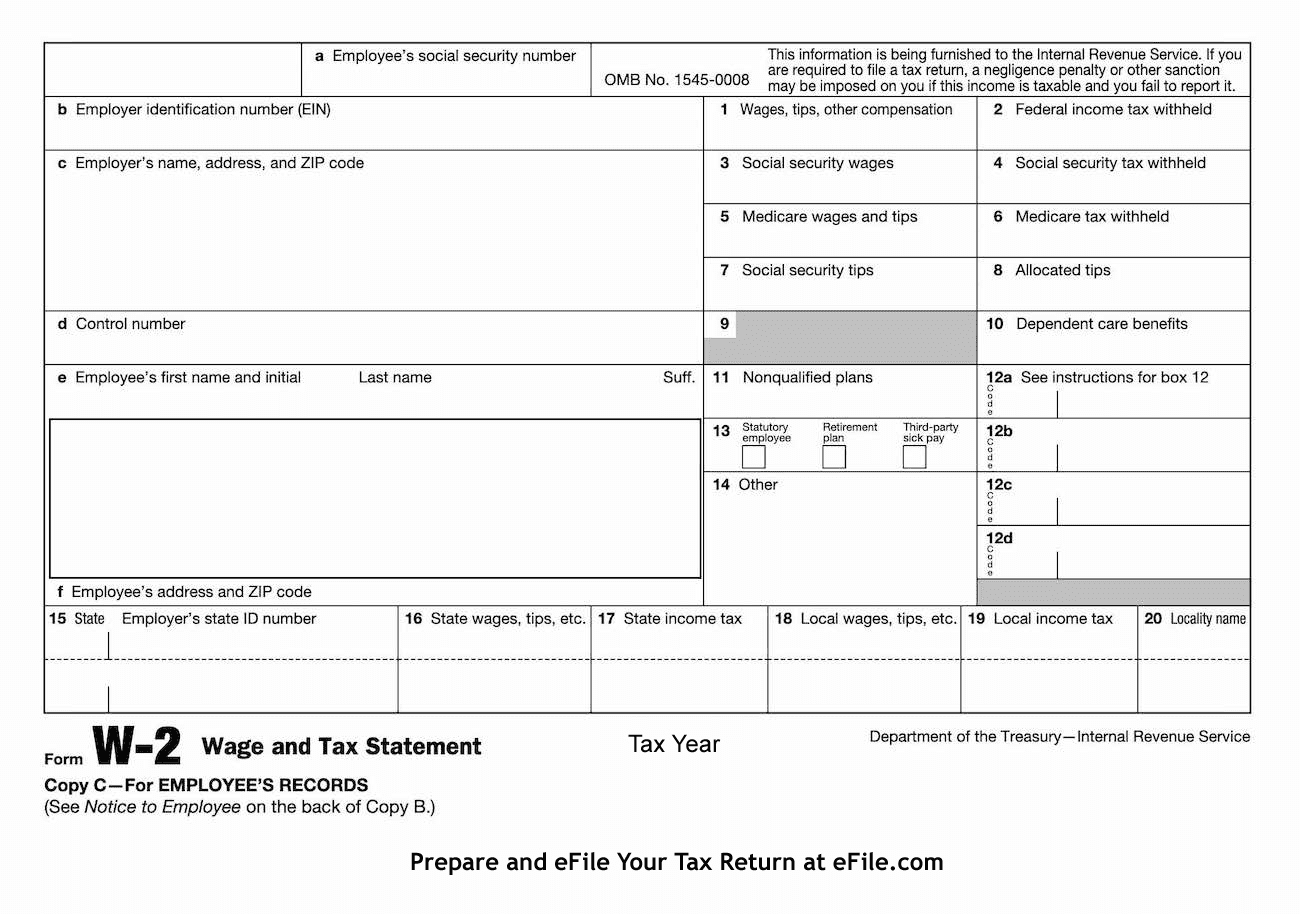

W2 Form And 1040 – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unlocking the Magic of W2 Form and 1040!

Have you ever felt overwhelmed or confused by tax forms like the W2 and 1040? Fear not, for these documents hold the key to unlocking the magic of your financial world! By understanding the secrets they hold, you can take control of your taxes and harness their power to your advantage. Let’s embark on a journey together to unveil the enchantment of the W2 Form and discover the mysteries of the 1040!

Unveiling the Enchantment of W2 Form!

The W2 Form is like a magical map that reveals the income you earned throughout the year and the taxes that were withheld from your paychecks. It provides a detailed breakdown of your earnings, deductions, and credits, giving you a clear picture of your financial status. By deciphering the codes and numbers on your W2, you can uncover hidden gems that may help you maximize your tax refund or minimize what you owe. So don’t fear the W2 – embrace it as a tool to unlock your financial potential!

As you delve deeper into the world of the W2 Form, you’ll begin to see how each line tells a story about your financial journey. From your wages and salary to your retirement contributions and healthcare benefits, every detail plays a role in shaping your tax liability. By understanding the information on your W2, you can make informed decisions about your finances and plan for a brighter future. So let the magic of the W2 guide you on your quest for financial empowerment!

With a bit of patience and a sprinkle of curiosity, the W2 Form can transform from a daunting document into a source of empowerment and insight. So don’t be afraid to explore its mysteries and unlock the secrets it holds. By embracing the enchantment of the W2, you can take control of your taxes and pave the way for a more prosperous future. Remember, you hold the key to your financial destiny – so let the magic of the W2 be your guiding light!

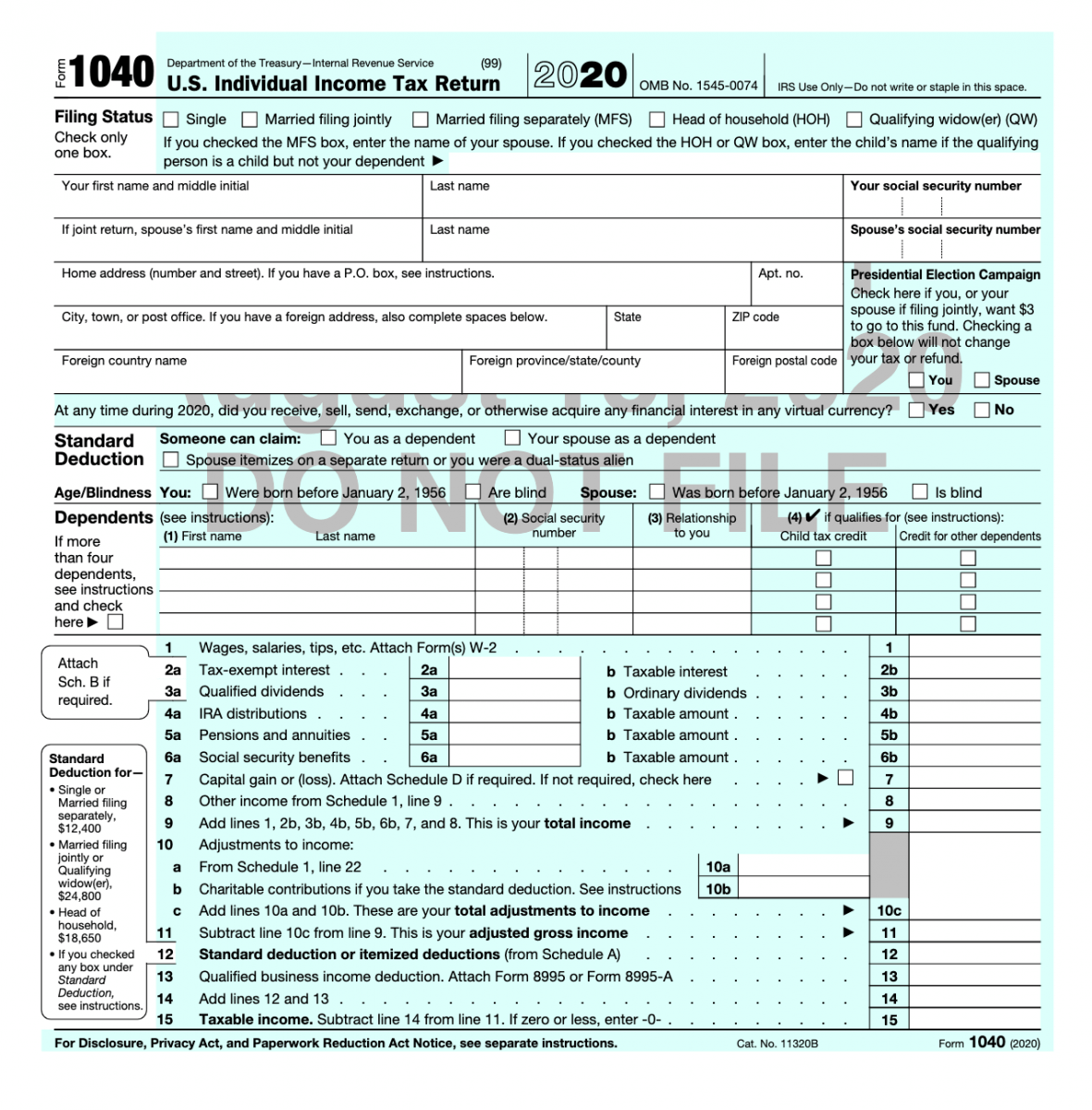

Discovering the Mysteries of 1040!

Just as the W2 Form reveals the details of your income and taxes withheld, the 1040 Form is where the real magic happens. This document is like a spellbook that allows you to calculate your final tax liability and determine whether you owe money or are entitled to a refund. By following the instructions and filling out the 1040 with care, you can unleash the full potential of your tax return and ensure that you’re getting the most out of your money. So let’s embark on a quest to discover the mysteries of the 1040 and harness its power for your benefit!

As you navigate the twists and turns of the 1040 Form, you’ll encounter various schedules and worksheets that offer additional insights into your tax situation. From deductions and credits to income adjustments and tax calculations, each section plays a crucial role in shaping your final tax bill. By taking the time to explore these hidden corners of the 1040, you can uncover opportunities to save money, reduce your tax liability, and make the most of your financial resources. So don’t be afraid to dive deep into the mysteries of the 1040 – for within its pages lie the keys to a brighter financial future!

In the end, the 1040 Form is more than just a tax document – it’s a gateway to financial empowerment and security. By mastering its intricacies and understanding its nuances, you can take control of your taxes and ensure that you’re making the most of your hard-earned money. So embrace the magic of the 1040 and let it guide you on your journey to financial success. With a little bit of knowledge and a touch of determination, you can unlock the full potential of the 1040 and turn tax season into a magical experience. So go forth, brave adventurer, and conquer the mysteries of the 1040 with confidence and grace!

In conclusion, the W2 Form and 1040 are not just mundane tax documents – they are powerful tools that can help you navigate the complexities of your financial world. By unveiling the enchantment of the W2 Form and discovering the mysteries of the 1040, you can take control of your taxes and unlock the magic of your financial future. So don’t be afraid to explore these documents, for within their pages lie the keys to your financial destiny. Embrace the magic, embrace the adventure, and let your financial journey begin!

Below are some images related to W2 Form And 1040

difference between w2 form and 1040, irs form 1040 and w2, is w2 same as 1040, w2 and tax return- form 1040, w2 form and 1040, , W2 Form And 1040.

difference between w2 form and 1040, irs form 1040 and w2, is w2 same as 1040, w2 and tax return- form 1040, w2 form and 1040, , W2 Form And 1040.