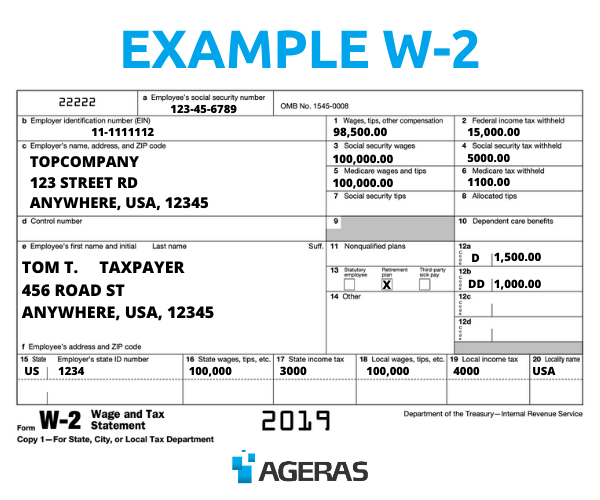

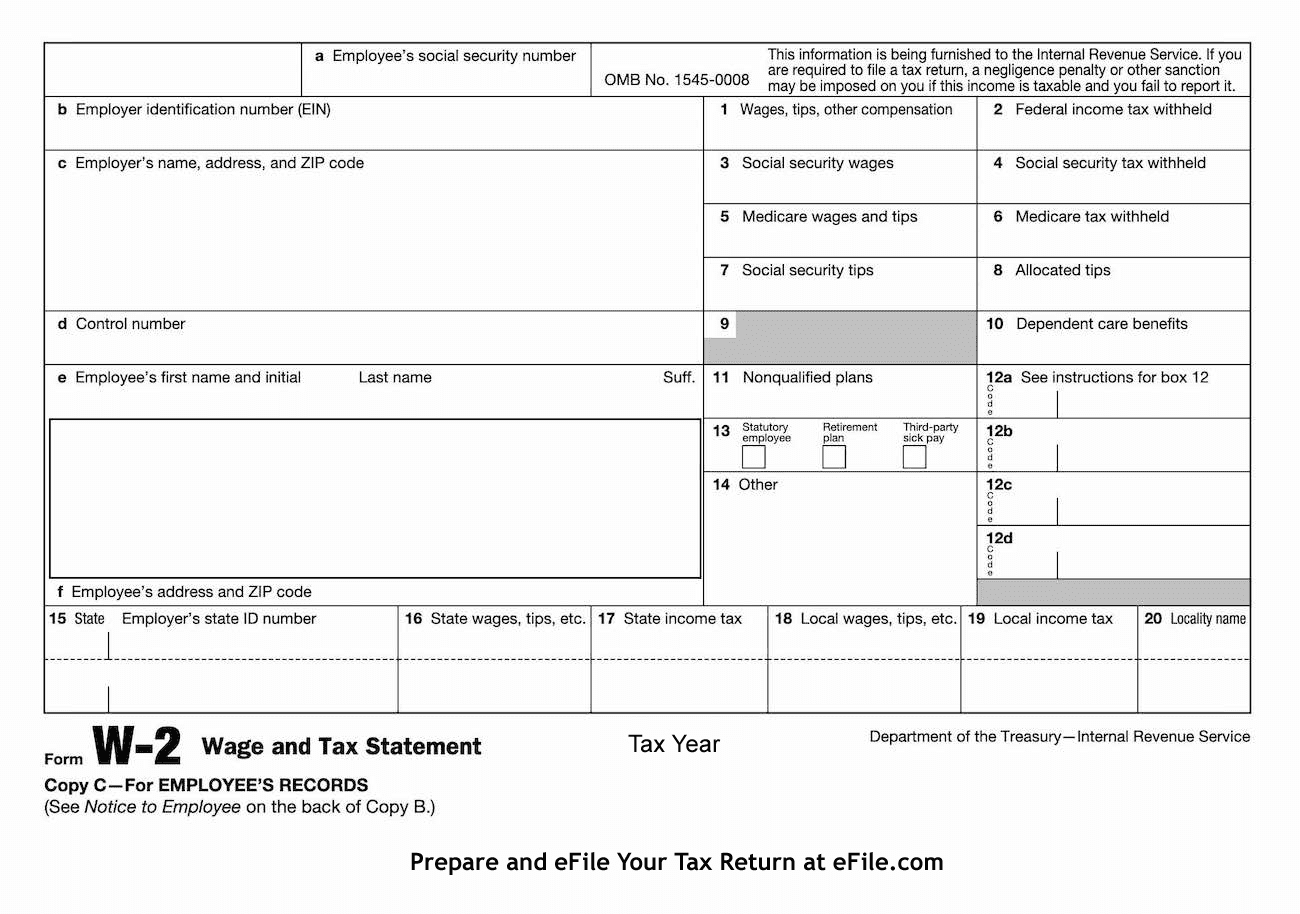

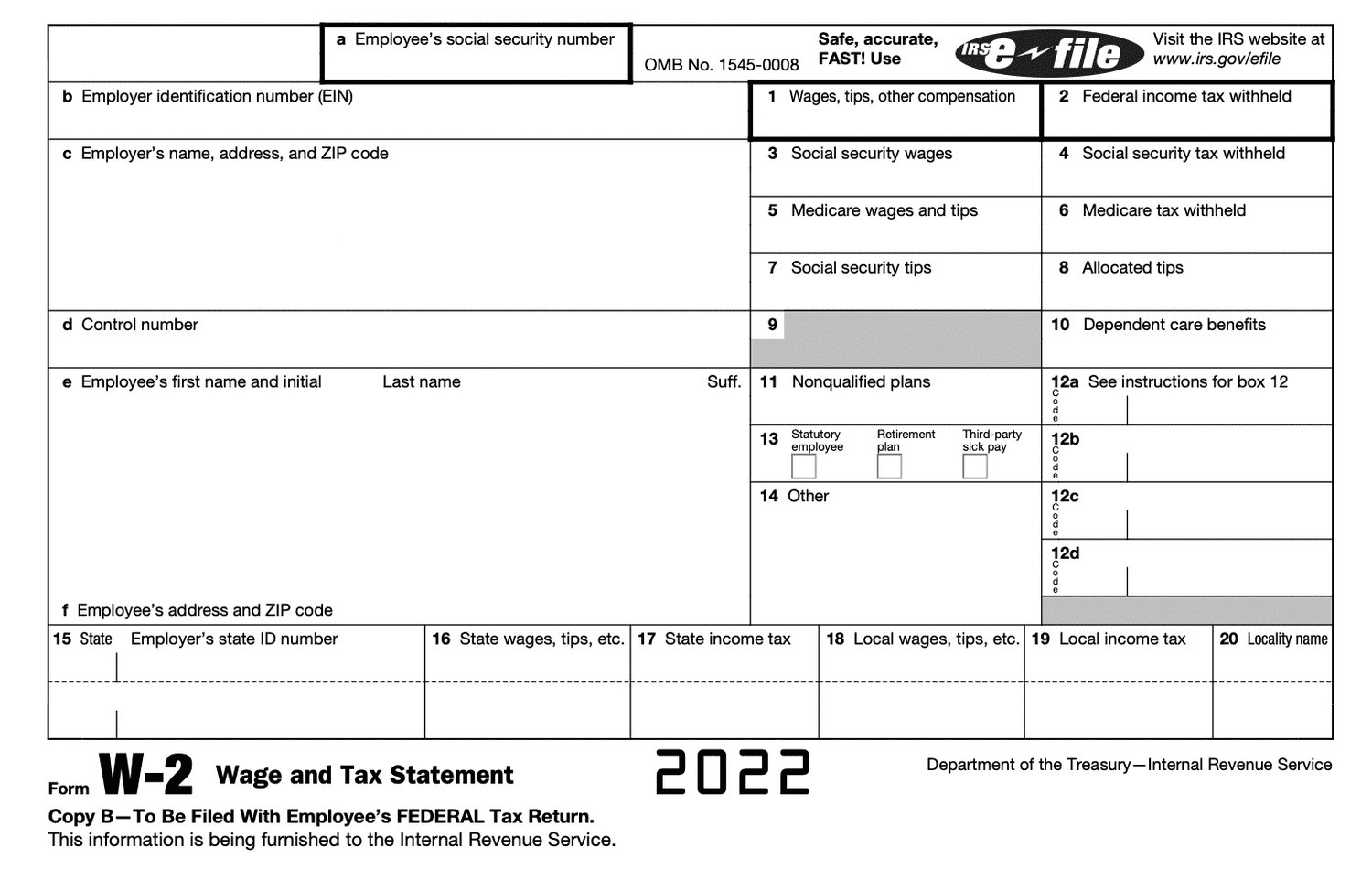

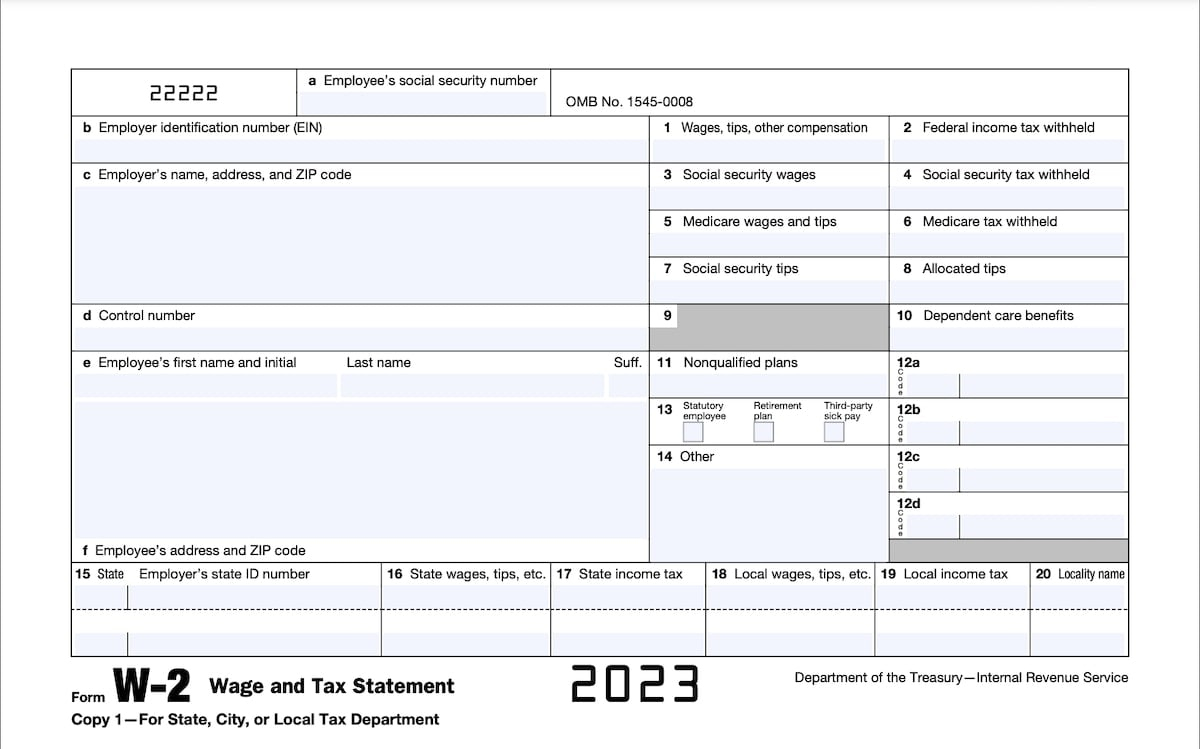

What’s W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unlocking the Mystery of the W2 Form: Your Ticket to Tax Time Fun!

Are you ready to embark on a thrilling adventure into the world of taxes? Look no further than the elusive W2 form, your key to unlocking the mysteries of tax time! This seemingly ordinary document holds the secrets to your financial year, providing you with all the information you need to conquer your taxes with confidence and ease. So buckle up and get ready for a tax time journey like no other!

Decoding the W2 Form: Your Tax Time Adventure Begins!

As you eagerly tear open the envelope containing your W2 form, you may feel a rush of excitement as you prepare to unravel its hidden treasures. The W2 form is a treasure trove of information, detailing your earnings, deductions, and tax withholdings for the year. Armed with this knowledge, you can navigate the often confusing world of tax preparation with ease, ensuring that you maximize your refund and minimize any potential tax liabilities.

But wait, there’s more! The W2 form not only provides you with vital financial information, but it also serves as a roadmap for your tax journey. From box 1 (wages, tips, and other compensation) to box 20 (locally withheld income tax), each section of the W2 form offers valuable insights into your tax situation. By taking the time to decode each box and understand its significance, you can take control of your tax fate and emerge victorious come tax time.

Unraveling the Secrets of the W2: Get Ready for Tax Fun!

With your W2 form in hand, you are now armed and ready to tackle your taxes with confidence and poise. Gone are the days of tax time dread – with the W2 form by your side, you can turn tax preparation into a fun and rewarding experience. So grab your calculator, sharpen your pencils, and get ready to dive headfirst into the world of tax time fun. Who knew taxes could be so thrilling?

In conclusion, the W2 form may seem like a daunting document at first glance, but with a little patience and perseverance, you can unlock its secrets and conquer your taxes with ease. So embrace the adventure that is tax time, and let the W2 form be your guide to financial success. Happy tax season, and may the refunds be ever in your favor!

Below are some images related to What’s W2 Form

what does w2 form look like, what does w2 form mean, what does w2 form show, what does w2 form tell you, what is a w2 form, , What’s W2 Form.

what does w2 form look like, what does w2 form mean, what does w2 form show, what does w2 form tell you, what is a w2 form, , What’s W2 Form.