YMCA W2 Forms – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

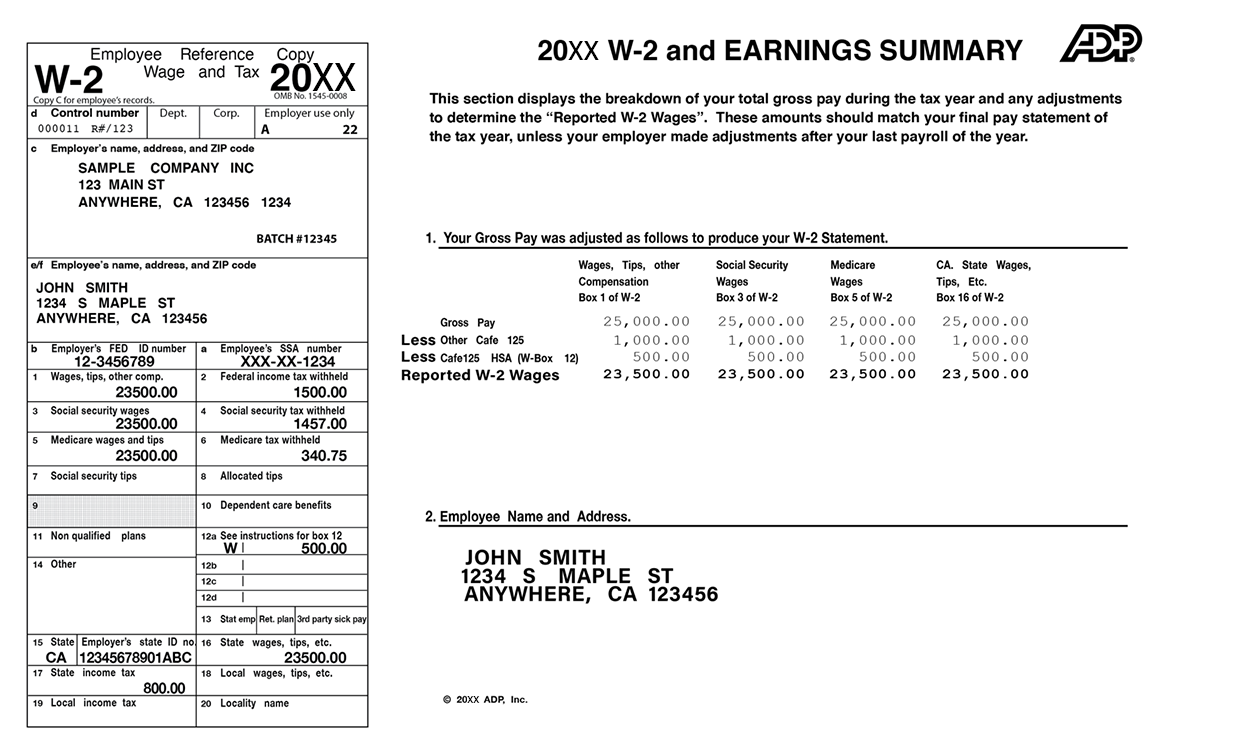

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unwrapping the Joy: Your Guide to YMCA W2 Forms

Have you received your YMCA W2 form and are feeling overwhelmed by all the information on it? Fear not, for we are here to help you unwrap the joy of understanding your YMCA W2 form! In this guide, we will walk you through the magic of YMCA W2 forms and unveil the secrets to understanding them. So grab a cup of hot cocoa, cozy up by the fireplace, and let’s dive into the world of YMCA W2 forms together!

Discover the Magic of YMCA W2 Forms!

As you hold your YMCA W2 form in your hands, you may be wondering what all those numbers and boxes mean. But fret not, for each section of the form holds a piece of the puzzle that is your financial information. The form includes crucial details such as your wages, taxes withheld, and contributions made to retirement plans. By understanding these numbers, you can gain insight into your financial standing and make informed decisions for the future. So take a deep breath, put on your detective hat, and let’s unravel the magic of your YMCA W2 form together!

Unveiling the Secrets to Understanding Your YMCA W2 Form

Now that you have a basic understanding of what information is included in your YMCA W2 form, it’s time to delve deeper into its secrets. Look for Box 1, which shows your total wages for the year, and Box 2, which displays the federal income tax withheld from your pay. Boxes 12 and 14 may include additional information such as retirement plan contributions and other perks provided by your employer. By carefully reviewing each section of the form, you can ensure that your tax return is accurate and maximize any potential refunds. So grab a magnifying glass, sharpen your pencils, and let’s decode the secrets of your YMCA W2 form together!

In conclusion, understanding your YMCA W2 form may seem like a daunting task at first, but with a little patience and guidance, you can unwrap the joy of financial empowerment. By familiarizing yourself with the information on the form and seeking assistance if needed, you can take control of your finances and plan for a brighter future. So don’t let the numbers intimidate you – embrace them as tools to help you achieve your financial goals. Here’s to unlocking the magic of your YMCA W2 form and embarking on a journey to financial success!

Below are some images related to Ymca W2 Forms

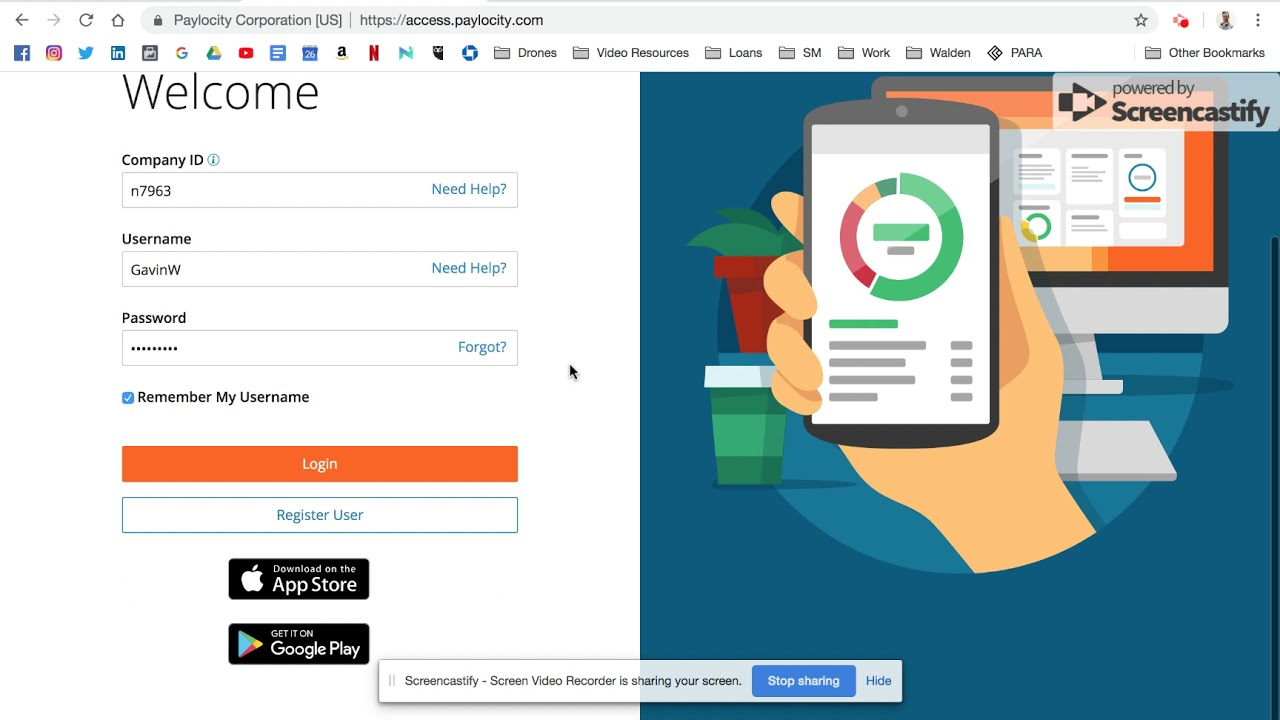

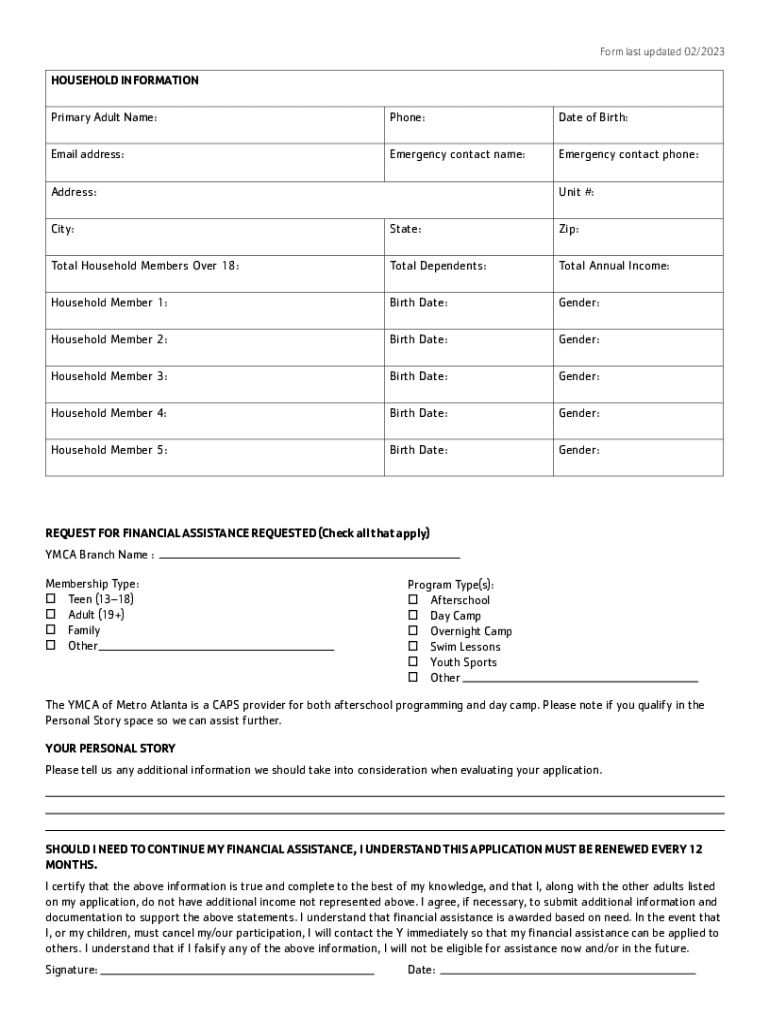

how do i get my w2 from the ymca, how to get w2 from ymca, when should i get my w2 forms, where do i find my w2 forms, where do i get my w2 forms, , Ymca W2 Forms.

how do i get my w2 from the ymca, how to get w2 from ymca, when should i get my w2 forms, where do i find my w2 forms, where do i get my w2 forms, , Ymca W2 Forms.